Two High-Quality Stocks Worth Holding Long-Term That Could Help You Build Wealth

03:20 July 29, 2025 EDT

Key Points:

1.While traditional tobacco operations face regulatory headwinds and structural decline, Altria’s strategic push into smoke-free alternatives is gradually starting to show tangible results.

2.Mastercard has begun integrating AI technologies into its risk management and payment security architecture, laying the groundwork for future efficiency gains and margin expansion.

Against a backdrop of elevated macroeconomic uncertainty, companies with sustainable profitability, solid financial structures, and reasonable valuation levels have become priority targets for medium- to long-term capital allocation. Investors are increasingly focused on identifying fundamentally stable businesses with predictable cash flows and valuation safety margins to support long-term capital accumulation.

Under this framework, Altria Group (NYSE: MO) and Mastercard Inc. (NYSE: MA) stand out as representative cases in the U.S. equity market. Both companies maintain high profitability metrics within their respective industries and demonstrate strong capital return capabilities. At the same time, market expectations for valuation normalization are steadily rising for both names, making them worthy of close investor attention.

Altria: High Dividend and Undervalued Opportunity

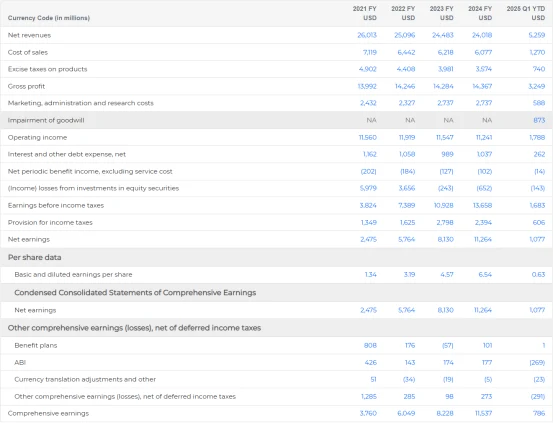

Altria Group has long focused on tobacco and smoke-free alternatives, with its core competitive edge rooted in high industry entry barriers, stable market share, and strong cash flow generation. As of year-end 2024, the company reported a return on invested capital (ROIC) of 42.8%, well above the S&P 500 median range of approximately 10–12%. This figure underscores Altria’s superior capital efficiency and profitability.

Source: Altria

While traditional tobacco faces increasing regulatory pressures and structural decline, Altria’s strategy in the smoke-free segment is beginning to deliver results. Its 2024 acquisition of the e-cigarette brand NJOY is helping shift its product mix toward modern formats such as heated tobacco and vaping. According to company filings, NJOY products are now distributed in over 30,000 U.S. retail outlets, and management expects the brand’s contribution to total revenue to grow from the current 5% to over 15% within the next three years—positioning it as a key growth pillar.

Source: Altria

Altria currently offers a dividend yield of 6.9%, significantly above the S&P 500 average of approximately 1.4% and the 10-year U.S. Treasury yield (around 4.4%). Historically, Altria's dividend yield has averaged around 4.5% over the past decade, suggesting that current valuations may be in discounted territory. If the market re-rates the stock based on its stability and income appeal, there is room for price recovery.

Altria trades at a price-to-earnings (P/E) ratio of approximately 10.2, well below the S&P 500 average of 22.4, indicating potential undervaluation. Although the company carries a negative price-to-book (P/B) ratio—largely due to aggressive buybacks and high leverage—this is not uncommon in mature industries. Its enterprise value to EBITDA (EV/EBITDA) stands at 8.7, compared to the tobacco industry median of 11.2, reinforcing the view that the stock is priced at a discount. Year-to-date, Altria shares have gained 16.3%, outperforming the S&P 500.

Source: TradingView

Additionally, according to FactSet data as of mid-July 2025, Altria’s forward P/E stands at approximately 8.6x—near the lower bound of its five-year valuation range. Short interest has declined by 8.1% over the past month, suggesting bearish sentiment is beginning to fade and the downside outlook is narrowing.

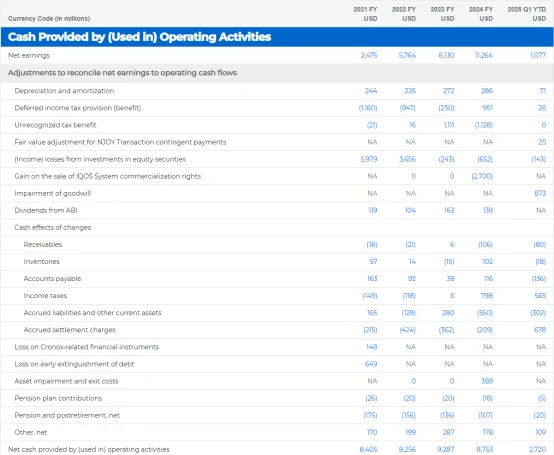

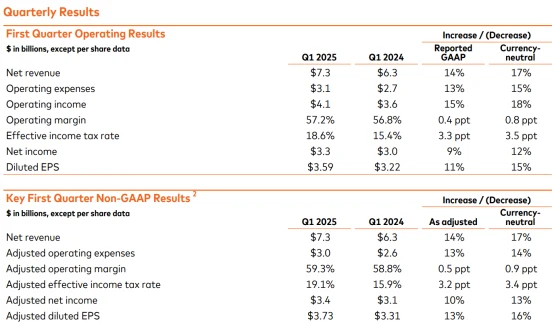

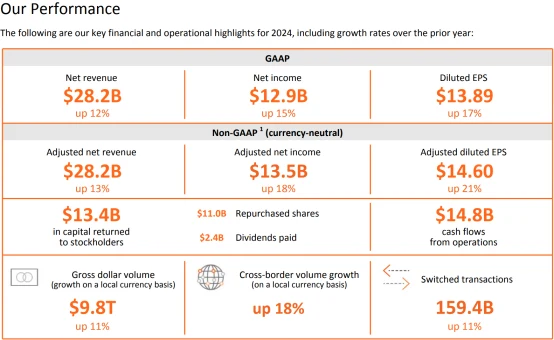

Mastercard: Consumer-Driven Steady Growth

Mastercard has been a long-term beneficiary of the global shift toward digital payments. Its business model is built on charging fees for payment authorization, clearing, and transaction data processing. Because the company does not assume credit risk, its financial leverage remains moderate, and it maintains a strong, resilient balance sheet.

The company is scheduled to report Q2 2025 earnings before the U.S. market opens on July 31. Street consensus expects revenue of $7.983 billion, up 14.68% year-over-year, with earnings per share (EPS) forecast at $4.030, representing a 15.14% increase (on a US-GAAP basis). If results meet expectations, this would mark Mastercard’s eighth consecutive quarter of double-digit revenue growth—driven by ongoing strength in global consumer spending and cross-border transaction volume.

Source: Mastercard

One of Mastercard’s core financial strengths lies in its capital return profile. As of year-end 2024, the company posted a return on invested capital (ROIC) of 56.6%—more than twice the median for S&P 500 constituents—demonstrating superior capital efficiency. Globally, Mastercard continues to have significant room for expansion, particularly in Latin America, Southeast Asia, and Africa, where cashless payment adoption remains relatively low. These markets represent key long-term growth opportunities.

Source: Mastercard

From a valuation standpoint, UBS analyst Timothy Chiodo recently reiterated a “Buy” rating on Mastercard, with a price target of $670—implying roughly 18% upside from current levels. Given Mastercard’s strong free cash flow generation and consistent share repurchase strategy, the stock is well-positioned to deliver sustainable returns over the medium to long term.

Source: TradingView

In addition, Mastercard is incorporating generative AI into its risk management and payment security frameworks. The company is applying AI to enhance fraud detection and transaction data processing—laying the groundwork for improved operational efficiency and future margin expansion.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates