Mag 7 Q2 Earnings in Focus — Can Big Tech Keep Driving the Bull Market

05:11 July 28, 2025 EDT

As the Q2 2025 earnings season reaches its peak, investor attention is squarely focused on four tech giants—Microsoft (MSFT), Meta (META), Apple (AAPL), and Amazon (AMZN)—all set to report this week.

As core members of the Mag 7 mega-cap group, these companies will release their earnings between July 30 and 31. Together, they account for approximately 23.9% of total S&P 500 earnings, meaning their results will have a direct impact on the broader index direction and could prove decisive for the trajectory of the tech sector.

Against the backdrop of former President Trump’s “reciprocal tariffs” policy and ongoing enthusiasm for artificial intelligence (AI) investments, markets are eager to see whether the Mag 7 can maintain their growth momentum—and whether they still have the power to drive the index higher.

Recent Performance

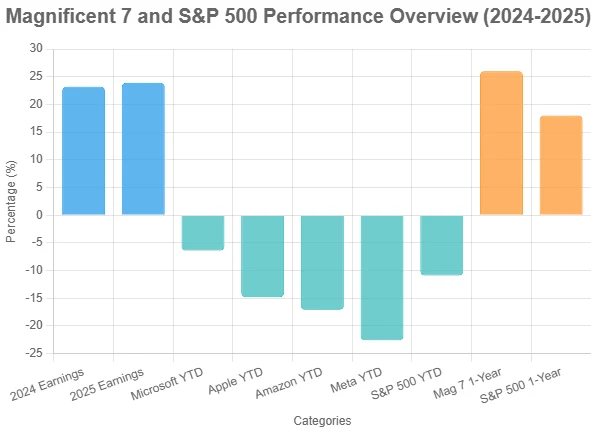

The Mag 7 has consistently been the primary driver of gains in the S&P 500, and in 2025, the group is projected to contribute 23.9% of the index’s total earnings—up slightly from 23.2% in 2024. However, individual stock performance has diverged notably this year. Since February 19, Microsoft (-6.4%) has outperformed the S&P 500 (-10.9%), while Apple (-14.8%), Amazon (-17.1%), and Meta (-22.6%) have lagged behind. On a 12-month basis, the Mag 7 has gained about 26%, outperforming the S&P 500’s 18% increase.

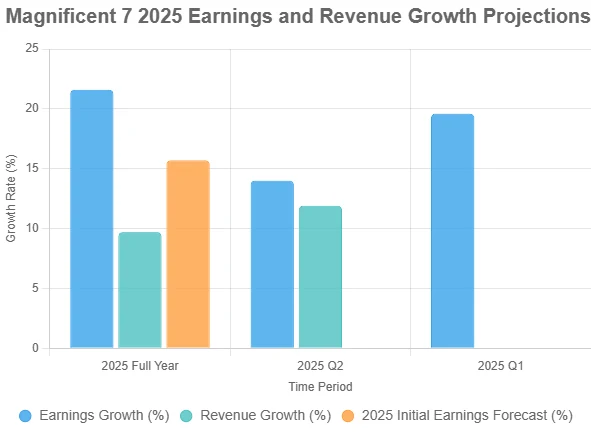

According to Bloomberg data, the Mag 7’s earnings are expected to grow 21.6% in 2025, with revenue rising 9.7%. However, this marks a downward revision from the 15.7% earnings growth projected at the start of the year. For Q2 2025, earnings growth is forecast at 14% and revenue growth at 11.9%, both down from Q1’s 19.6% earnings growth rate.

The recent downward revisions in earnings expectations—particularly the negative adjustment for Meta—have raised concerns about whether these companies can sustain high growth. Investors are currently cautious about potential earnings disappointments from Apple and Meta, while Microsoft and Amazon are viewed more optimistically and seen as likely candidates to beat expectations.

Drivers and Headwinds

AI infrastructure spending remains a key focus in this earnings season.

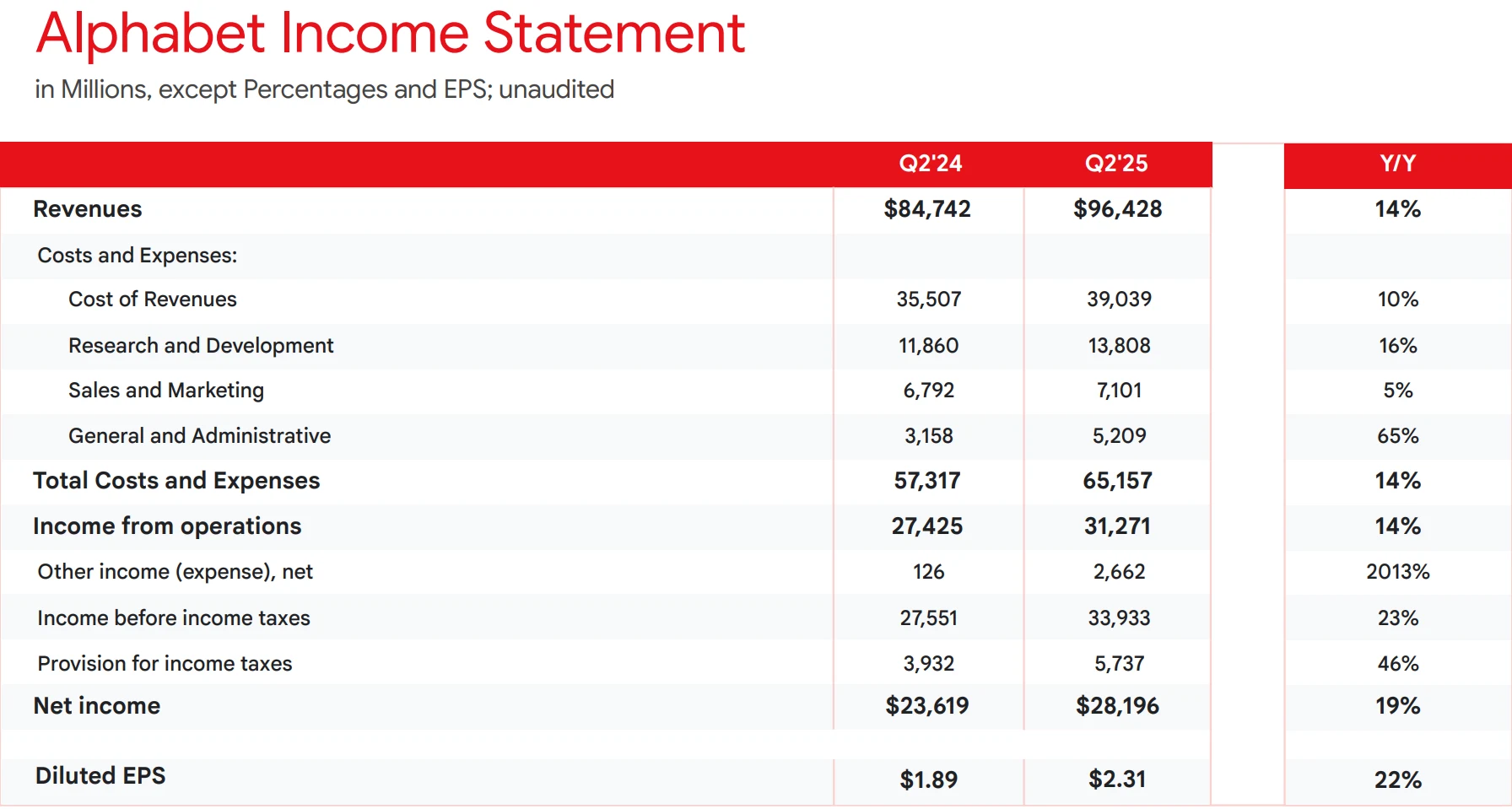

Alphabet posted a strong Q2 last week, with Google Cloud revenue rising 32% year-over-year, up from 28% in Q1. The company also raised its 2025 capital expenditure guidance by $10 billion to $85 billion, signaling robust AI-driven demand.

Source: Alphabet

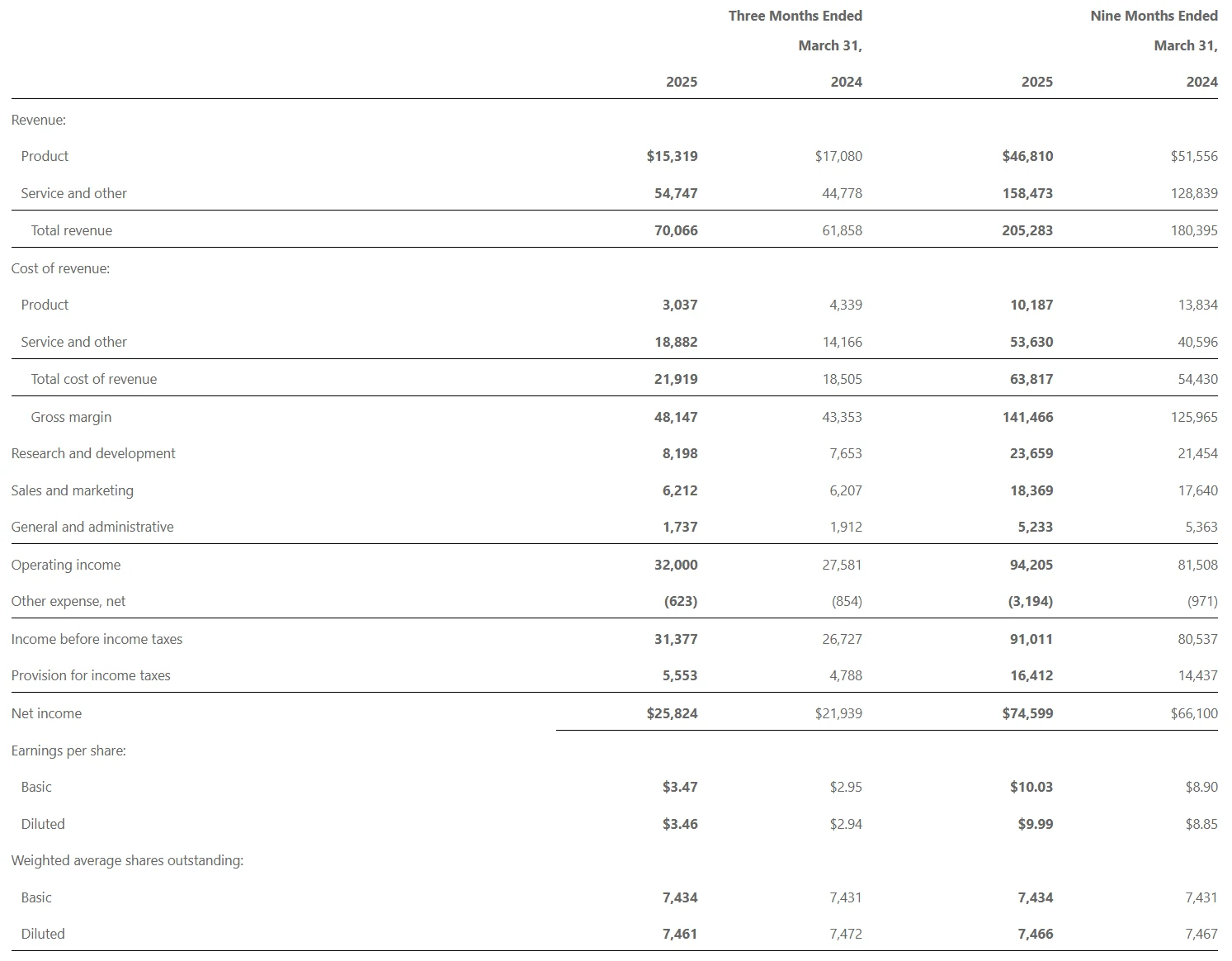

The market expects Microsoft, Amazon, and Meta to also raise their capex to support cloud and AI expansion. However, investors are questioning the return on these elevated investments, particularly Microsoft’s execution in Azure. In Q3 FY2025, Azure delivered solid performance, with cloud revenue up 33% YoY, beating the 29.7% consensus estimate. AI workloads were a key driver, processing over 100 trillion AI tokens during the quarter, reflecting strong momentum.

Source: Microsoft

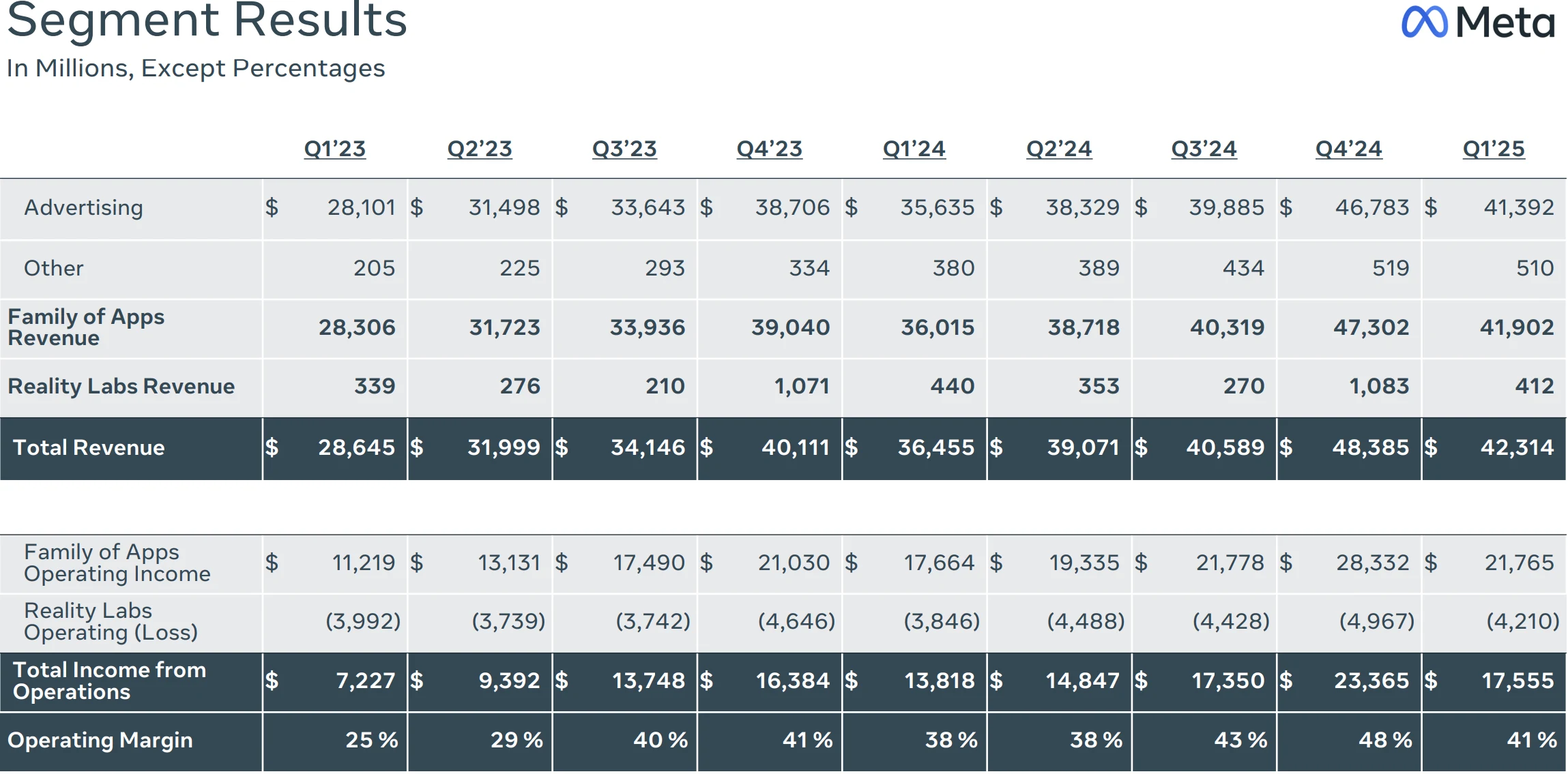

Amazon Web Services (AWS), despite facing capacity constraints, is also expected to deliver strong growth, potentially matching Alphabet’s cloud results. Meta posted Q1 revenue of $42.314 billion, up 16.07% YoY, with net income of $16.644 billion, a 34.56% increase. Analysts forecast Q2 revenue could reach $44.55 billion (up ~14%), with EPS rising to $5.84, indicating 10% growth.

Source: Meta

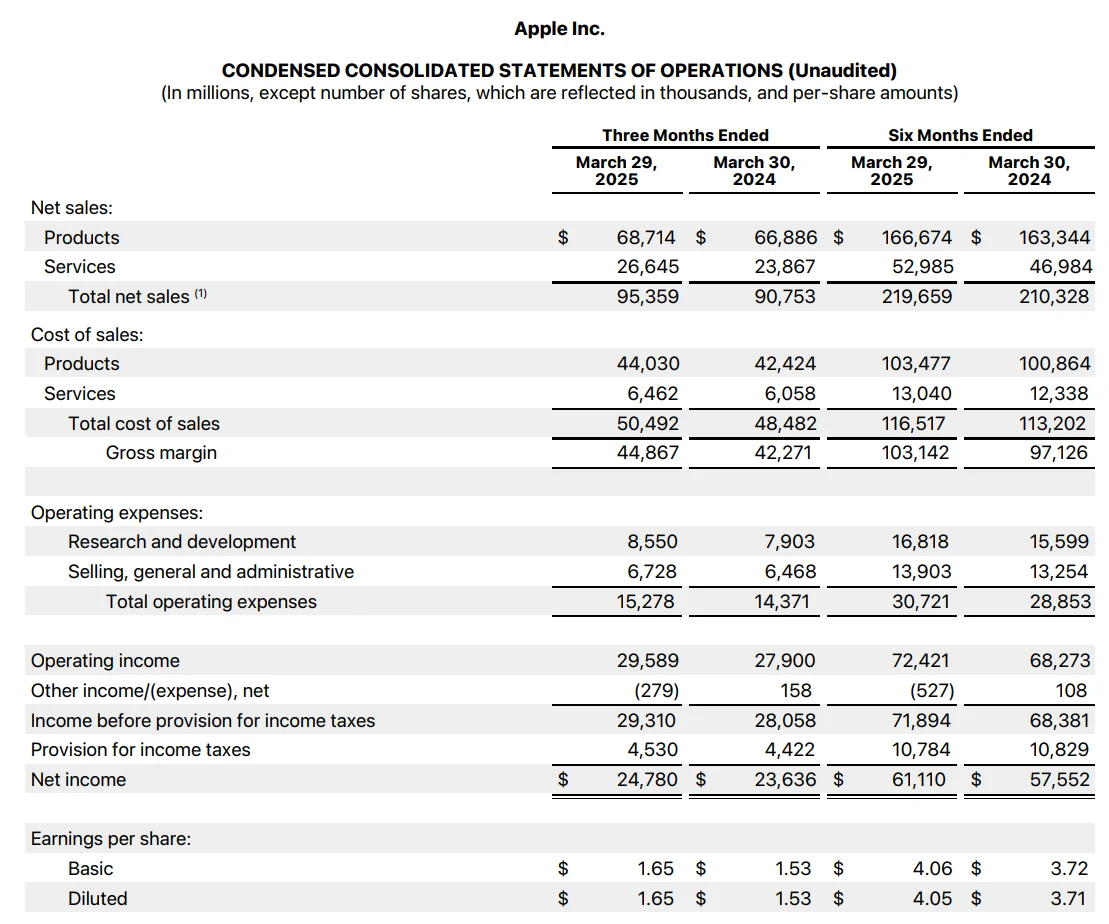

Apple’s AI investments remain conservative. For Q2 FY2025, earnings grew just 4.8%, revenue rose 5.1%, and gross margin improved by one percentage point to 46.9%. Tariff impacts were limited during the quarter.

Source: Apple

Critically, the proposed “reciprocal tariffs” by Trump, set to begin August 1, pose a direct threat to both Apple and Amazon. Apple’s reliance on China for iPhone production exposes it to rising costs. Analysts estimate that if tariffs escalate, gross margin could decline another 100–150 basis points. Amazon’s global supply chain also faces pressure, though diversified revenue streams such as AWS offer some buffer. Management commentary on tariff risks will be closely watched. Some analysts note that if the dollar strengthened during Q2, tariffs may further compress revenue growth.

In terms of valuation, the Mag 7 trades at a forward P/E of 28.3x, above the S&P 500’s 21.8x (or 19.7x excluding the Mag 7). Meta appears most attractive at 22.8x, followed by Amazon, while Microsoft (30x) and Apple (29x) are on the higher end. The group’s net profit margin in 2025 is expected to reach 25.3%, nearly double the S&P 500’s 13.4%.

High valuations demand strong earnings delivery. Uncertainty around tariffs and the risk of downward guidance revisions could further temper investor sentiment.

Stabilizing Force

The S&P 500 provides a broader context for the Mag 7 earnings.

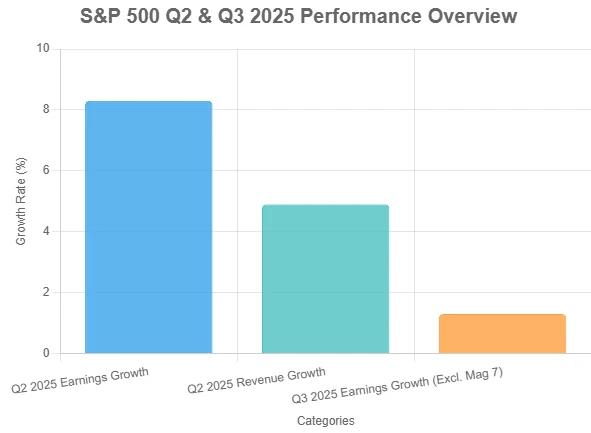

As of July 25, 168 S&P 500 companies (accounting for 33.6% of the index) have reported Q2 results, with earnings up 8.3% year-over-year and revenue up 4.9%. Of these, 83.3% beat earnings per share (EPS) estimates and 80.4% exceeded revenue expectations, both above historical averages. Excluding the Mag 7, S&P 500 Q2 earnings growth drops to just 1.3%.

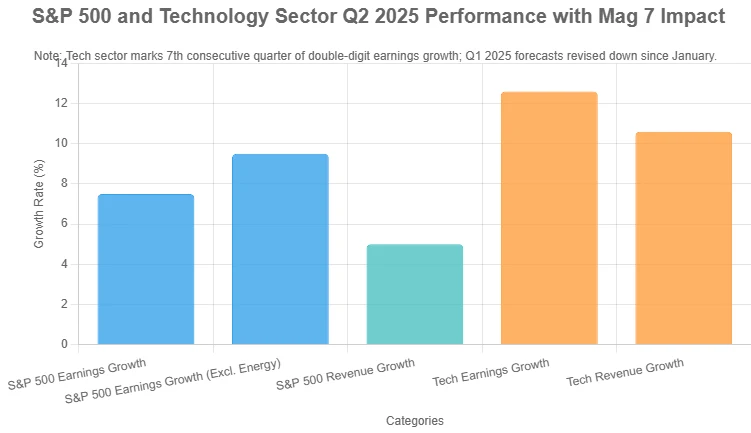

Q2 S&P 500 earnings are expected to grow 7.5% overall (9.5% excluding the energy sector), with revenue growth of 5%. The tech sector is forecasted to see earnings growth of 12.6% and revenue growth of 10.6%, marking the seventh consecutive quarter of double-digit earnings growth. However, since January, Wall Street analysts have been revising down Q1 2025 earnings estimates, particularly in the tech sector. The strong performance of the Mag 7 is critical to maintaining momentum in the tech space.

Currently, the Mag 7 face risks including tariff-driven cost increases that could compress Apple and Amazon’s gross margins; potential downward revisions in earnings guidance or unclear returns on AI investments could weaken confidence; and high valuations make the group more sensitive to negative news. On the opportunity side, Microsoft and Amazon stand to benefit from robust demand for cloud and AI services, Meta’s AI-powered ad optimization shows growth potential, and recent share price pullbacks offer buying opportunities for long-term investors. The Q2 earnings season will be key to testing the Mag 7’s ability to manage tariff risks, deliver on AI investments, and sustain growth. The overall 14% earnings growth expectation remains solid, but the slowdown in growth and elevated valuations require strong execution.

The S&P 500’s heavy earnings reliance on the Mag 7 makes this week’s earnings reports especially important. With U.S. equities back near historical highs, future market direction will depend more on corporate earnings delivery and sustained growth in AI-related businesses, rather than solely on expectations of monetary easing.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates