Fed Expected to Stay on Hold This Week — Real Shift May Arrive in September

02:46 July 28, 2025 EDT

Key points:

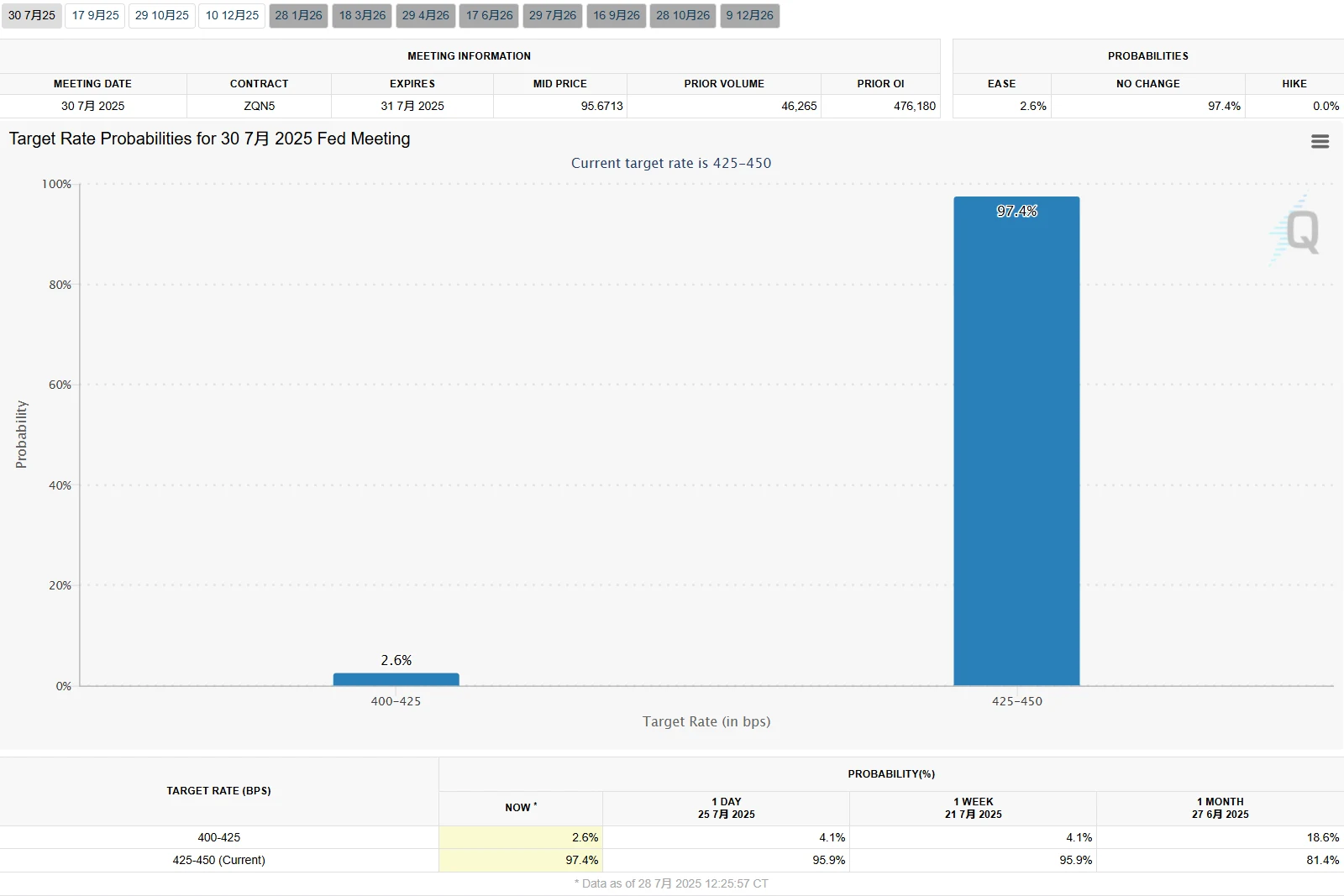

1. Markets widely expect the Federal Reserve to hold rates steady at the 4.25% to 4.5% range.

2. Economic data supports the Fed’s wait-and-see stance but also leaves the door open for a potential rate cut in September. If the economy slows meaningfully, the Fed may move to ease more quickly.

Following months of mixed signals—persistent inflation flare-ups and signs of cooling economic growth—the Federal Open Market Committee (FOMC) is set to convene its policy meeting to decide the next step for the federal funds rate.

Markets are nearly unanimous in expecting the Fed to keep its benchmark rate unchanged at 4.25% to 4.5%, with the probability of a July rate cut priced at just 2.6%. Although the Fed has already cut rates by 100 basis points since September 2024, it has held steady for four consecutive meetings in 2025, signaling a continued balancing act between inflation pressures and growth concerns, and a reluctance to act prematurely in the near term.

Source: CME Group

Attention is now turning to any shifts in language in the policy statement and Chair Powell’s tone during the press conference, as markets look for signs the Fed may be preparing to kick off a rate-cutting cycle in September.

Internal and External Pressures

This rate decision comes against a particularly charged political backdrop. In recent weeks, the Trump administration has stepped up its pressure on the Federal Reserve, raising fresh concerns about the central bank’s independence. Former President Donald Trump has repeatedly criticized Fed Chair Jerome Powell, accusing him of holding back economic growth with high interest rates.

On July 24, Trump visited the Fed’s headquarters, leveraging the $2.5 billion renovation project to publicly pressure Powell. He argued that slashing rates by 300 basis points could save “trillions of dollars.” Earlier, on July 19, Republican Congresswoman Anna Paulina Luna sent a letter to the Department of Justice, accusing Powell of withholding details about the renovation during congressional testimony—a move she claims could amount to perjury. Although Trump has said he doesn’t currently plan to fire Powell, his ambiguous statements leave room for future political pressure.

Adding to the pressure, on July 24, Azoria Capital—led by Trump ally James Fishback—filed a lawsuit in U.S. District Court in Washington, D.C., alleging that the FOMC’s closed-door meetings violate the 1976 Government in the Sunshine Act. The lawsuit argues that the Fed’s opaque policy deliberations limit the market’s ability to forecast decisions and may be politically motivated to undermine Trump’s economic agenda.

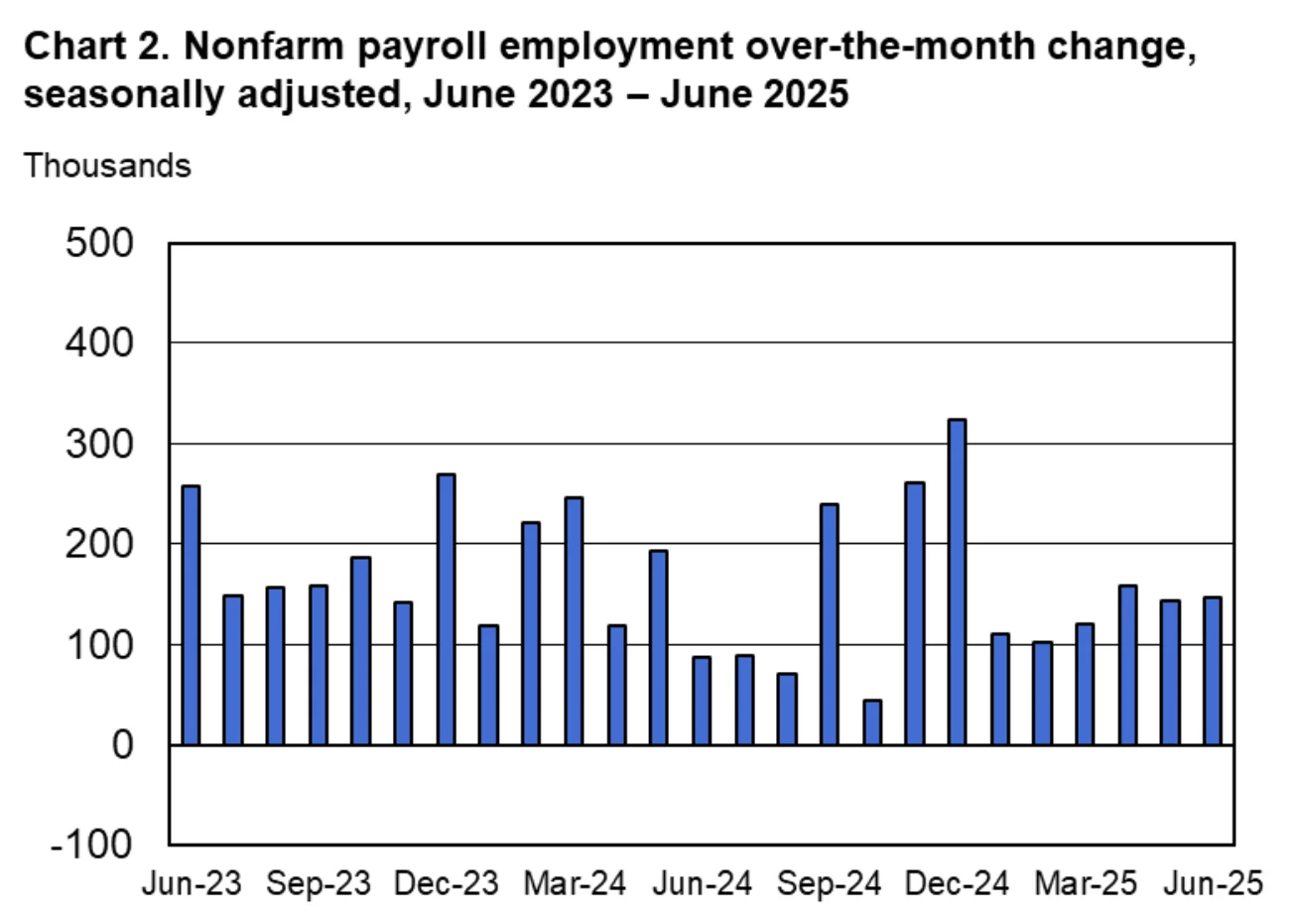

Within the FOMC, divisions over the timing of rate cuts further complicate the decision-making process. Fed Governors Christopher Waller and Michelle Bowman have signaled support for earlier easing. In July, Waller noted that private sector job growth is “nearly stalled,” citing signs of economic weakness and arguing that rate cuts could lower borrowing costs and shield the economy from further deterioration. He also downplayed Trump’s proposed tariffs, calling them a “one-off price adjustment” unlikely to delay rate cuts.

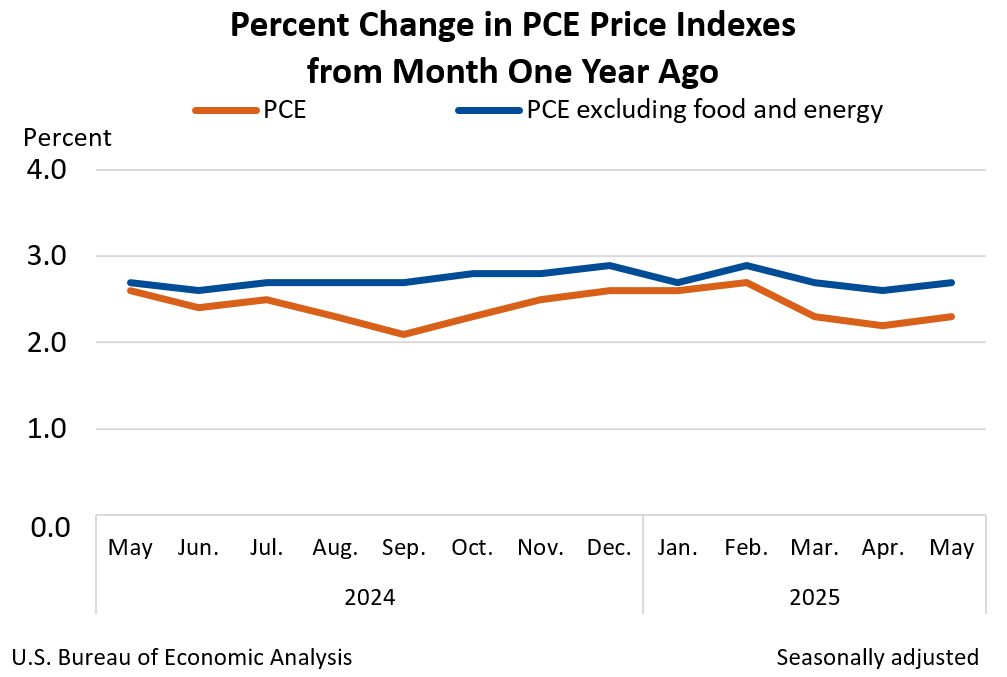

In contrast, Atlanta Fed President Raphael Bostic remains cautious, warning that tariffs could take more than a year to fully feed through to inflation and might disrupt inflation expectations. While core PCE inflation came in at 2.7% in May—down from its post-pandemic peak of 5.5% but still above the Fed’s 2% target—uncertainty around the inflationary impact of trade policy has made the timing of any rate move even more contentious.

Source: BEA

Economic Realities

Economic data has justified the Fed’s wait-and-see stance—but also kept the door open for a potential rate cut in September.

In June, the U.S. economy added 147,000 nonfarm payroll jobs, surpassing expectations of 110,000, while the unemployment rate dipped to 4.1%, reflecting a resilient labor market. However, Fed Governor Christopher Waller warned of a slowdown in private sector hiring—a subcomponent that may signal underlying labor market risks.

Source: U.S. Bureau of Labor Statistics

Retail sales data came in stronger than expected, suggesting steady consumer demand and reinforcing expectations of a soft landing. On the inflation front, core PCE inflation registered 2.7% in May. Trump’s “reciprocal tariffs,” set to begin on August 1, could raise consumer goods prices. During a June 18 congressional hearing, Fed Chair Jerome Powell noted that the new tariffs could add to inflationary pressure over the summer.

Michael Gapen, Chief U.S. Economist at Morgan Stanley, said the uncertainty surrounding tariffs has pushed the Fed to remain patient and wait for clearer evidence on inflation pass-through effects. Atlanta Fed President Raphael Bostic echoed a cautious tone, arguing that companies may delay price increases until the tariffs actually take effect, meaning inflation risks could surface in the coming months.

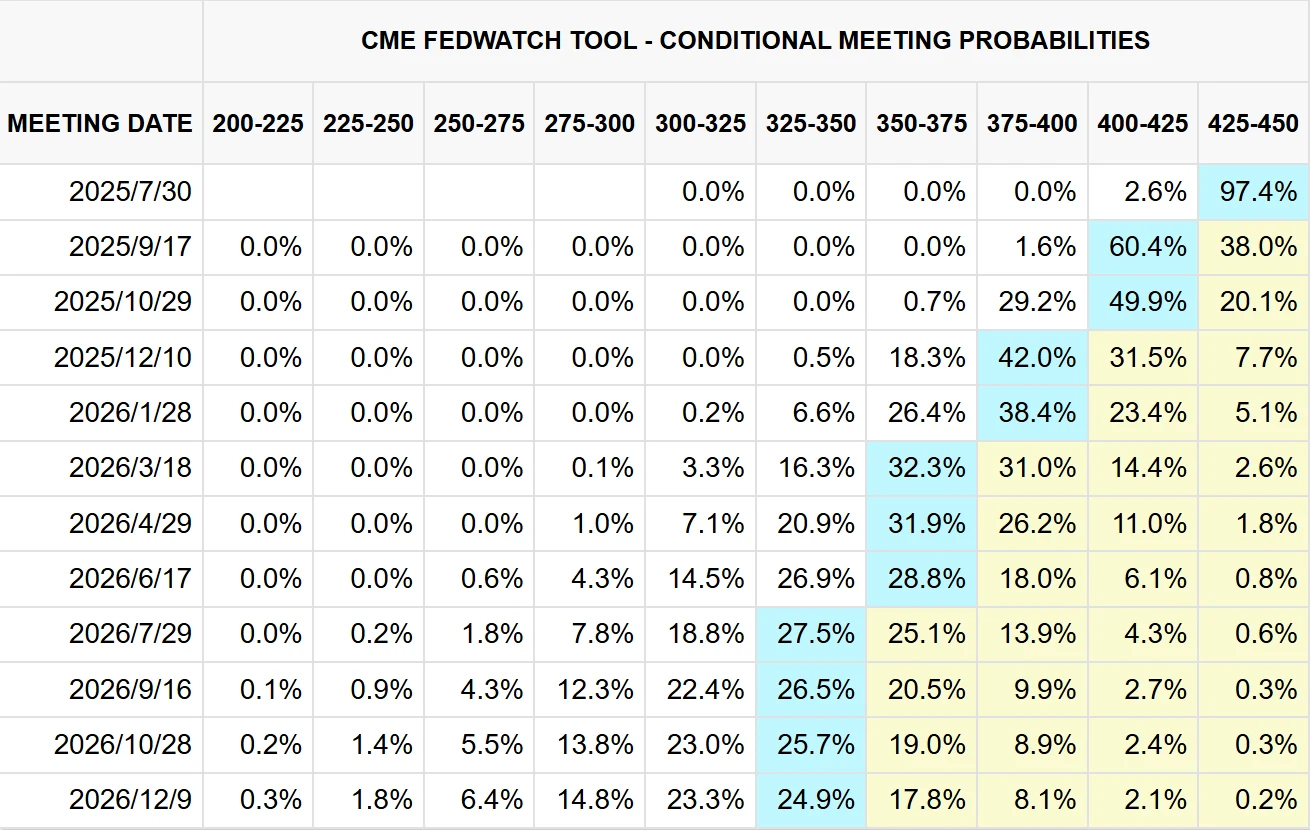

Market expectations for rate cuts are centered around September. According to the CME FedWatch Tool, the probability of a 25-basis-point cut in September stands at 60.4%, while the likelihood for October is 49.9%.

Source: CME

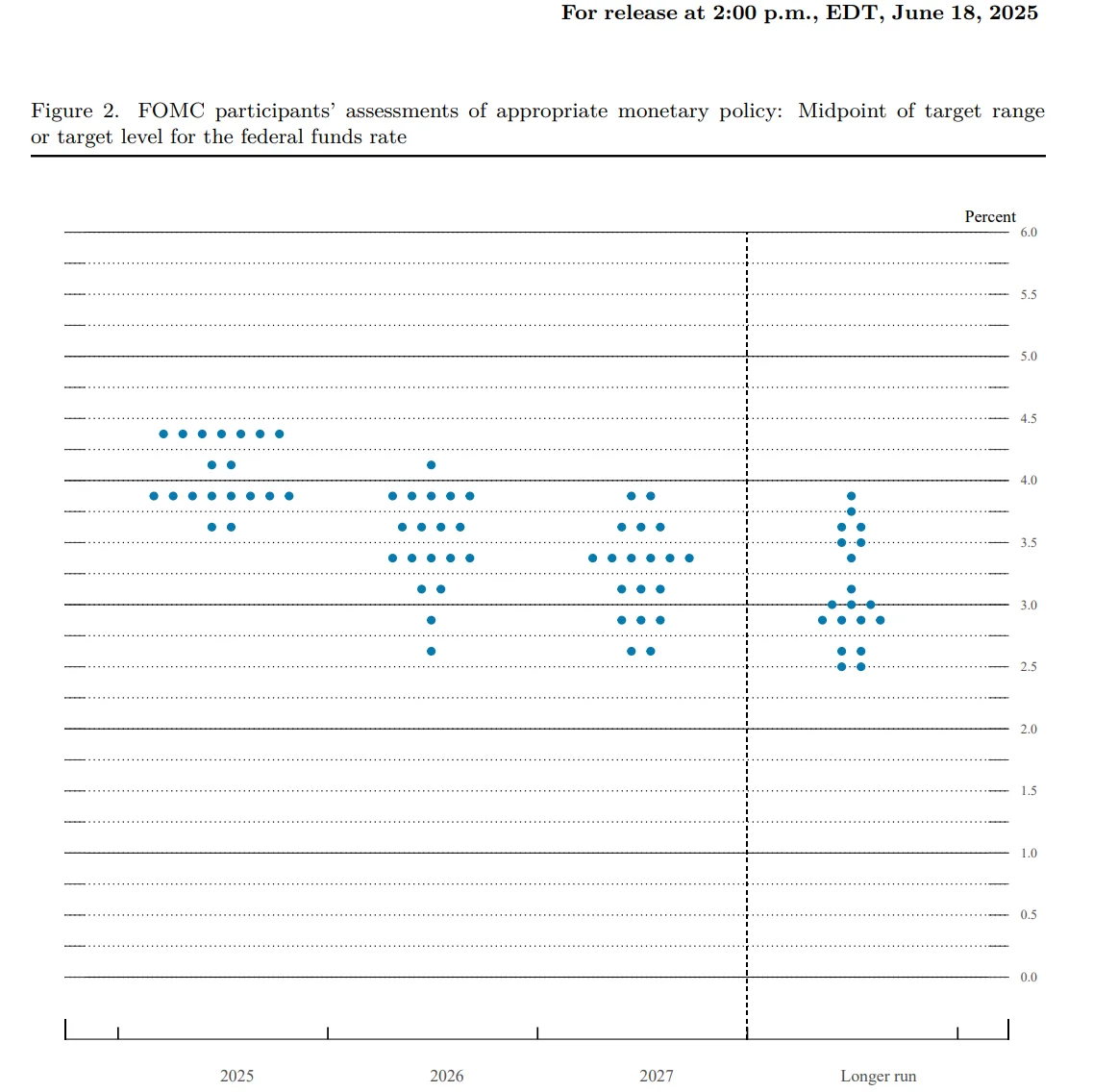

The FOMC’s June dot plot projected the median federal funds rate at 3.75%–4.00% by the end of 2025, implying two cuts remain possible this year.

Source: Federal Reserve

This week’s policy statement, Powell’s press conference, and any updates to the dot plot will be critical for market participants trying to assess the Fed’s path forward. Ian Lyngen, Head of U.S. Rates Strategy at BMO Capital Markets, emphasized that the strength of the real economy will ultimately dictate the timing of rate cuts, as the Fed remains committed to its data-dependent framework.

Rate Cut Outlook

The Federal Reserve currently faces a threefold dilemma. First, political pressure from former President Trump and a lawsuit by Azoria Capital pose a threat to the Fed’s independence, potentially undermining market confidence in monetary policy. Second, internal divisions within the FOMC could break the tradition of unanimous voting. Analysts at Bank of America warned that such divisions may lead to “a more frequent pattern of dissent,” increasing policy uncertainty. Third, the uncertainty surrounding tariff policy has complicated the inflation outlook, forcing the Fed to weigh the economic benefits of rate cuts against the risk of reigniting inflation. If tariffs keep inflation persistently above the 2% target, the pace of easing may slow. However, if the labor market shows significant weakness, the Fed may accelerate rate cuts.

The July FOMC meeting is widely expected to result in no change to the federal funds rate. Powell is likely to reiterate the Fed’s “data-dependent” stance, emphasizing the need to further monitor developments in employment, inflation, and tariff impacts. The September 17 FOMC meeting will be a critical inflection point. If job data for July and August reveal labor market softness, the likelihood of a 25-basis-point cut will rise significantly. Over the medium term, tariff-driven inflation could persist into late 2025 or early 2026, potentially forcing the Fed to keep rates higher for longer. On the other hand, if the economy weakens materially, the Fed may respond with faster monetary easing.

In addition, Trump’s ongoing efforts to influence the Fed’s independence—especially ahead of Chair Powell’s term expiration in 2026—could trigger market volatility. Speculation over his successor may further intensify uncertainty.

Over the coming months, the Fed’s central task will likely be to strike a delicate balance between inflation control and economic growth, while withstanding external political pressure to safeguard policy independence and forward guidance.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates