Market Update: Fed Rate Decision, Trump Tariffs Take Effect, Tech Giants to Report Earnings

23:02 July 27, 2025 EDT

FoolBull Brings You This Week’s Market Highlights

Market Focus

Federal Reserve Rate Decision & News Conference

On July 31, the U.S. will announce the Federal Reserve’s rate decision, and Fed Chair Powell will hold a monetary policy press conference. Markets widely expect the Fed to keep its benchmark rate unchanged, but attention will focus on whether Powell signals a potential rate cut.

Notably, on July 24, President Trump visited the Fed’s Washington headquarters and toured the refurbished facility with Powell. This marked the first formal presidential visit to the Fed in nearly two decades. Trump said he hoped Powell would lower rates—suggesting that if rates were cut by three percentage points to one percent, the U.S. could save over one trillion dollars.

Additionally, the White House has launched an investigation into cost overruns of the Fed building renovation. The Office of Management and Budget is leading an audit and assessment. Republican U.S. Congresswoman Anna Paulina Luna from Florida has written to the Department of Justice alleging Powell gave false testimony during a congressional hearing about the $2.5 billion renovation costs, and she has recommended criminal charges.

Trump Tariff Policy Takes Effect

On August 1, Trump’s so-called “reciprocal tariffs” and a 50% tariff on imported copper are set to take effect. On July 7, Trump signed an executive order delaying the implementation of the reciprocal tariffs from July 9 to August 1, allowing more time for trade negotiations. Trump emphasized the August 1 deadline “will not change,” reaffirming this in social media posts and White House statements.

However, market expectations for the tariffs actually being implemented on August 1 are low. Investors estimate about a 27% probability of high tariffs on Canada and 42% on Brazil. So far, the U.S. has reached preliminary or framework agreements with China, the U.K. and the EU, but many details remain under negotiation.

On July 27, the U.S. and the EU reached a trade agreement in which the EU pledged $600 billion in investment in the U.S., the purchase of $750 billion in U.S. energy, and the opening of EU markets to U.S. goods.

New Round of China–U.S. Trade Talks

From July 27 to 30, a new round of China-U.S. economic and trade talks will be held in Stockholm, Sweden. China’s Politburo member and Vice Premier He Lifeng and U.S. Treasury Secretary Bassent will attend.

Both sides will follow up on key consensus from the bilateral leaders’ June 5 call, using existing consultation mechanisms based on mutual respect, peaceful coexistence, and win-win cooperation to continue discussions on trade issues. Bassent has stated that both sides will strive to reach a “possible” extension of the trade truce, which is set to expire on August 12.

This round follows two prior meetings in Geneva and London. In Geneva, the two sides agreed to suspend some tariffs for 90 days. In London, they reached a framework agreement to implement the leaders’ consensus and consolidate Geneva’s outcomes.

U.S. Tech Giants’ Earnings Reports

This week, several U.S.-listed tech giants—including Microsoft, Meta, Apple, and Amazon—will report earnings. Their performance is expected to influence market confidence in the tech sector.

U.S. Economic Data Releases

July 29: Weekly initial jobless claims through July 26 and June core PCE price index.

July 30: July ADP employment and EIA weekly U.S. crude inventory through July 25.

August 1: July unemployment rate, July seasonally adjusted non-farm payrolls, July ISM Manufacturing PMI, and the July University of Michigan consumer sentiment index.

Hong Kong “Stablecoin Ordinance” Takes Effect

On August 1, Hong Kong’s Stablecoin Ordinance officially takes effect. This is Hong Kong’s first stablecoin licensing regime pegged to fiat currency and represents the world’s first comprehensive regulatory framework for fiat-backed stablecoins.

J.P. Morgan Warns of U.S. Equity Risks

Quantitative strategist team led by J.P. Morgan’s Choudhury warns that global equity markets—especially U.S. equities—are showing signs of complacency. Despite accelerating downgrades in corporate earnings, major equity markets have rallied strongly, potentially setting up cracks and volatility in the U.S. stock market in the second half. Investors are urged to be wary of possible market turbulence.

Market Recap

Over the past week, the three major U.S. stock indexes posted solid gains, with the S&P 500 and Nasdaq repeatedly setting record highs and the Dow Jones Industrial Average also advancing.

The S&P 500 rose approximately 1.5% to close at 6,388.64, a new all-time high. The Dow Jones climbed 1.3% to finish at 44,901.92, approaching record levels. Meanwhile, the Nasdaq jumped 1.98%, breaking above the 21,000 mark for the first time and hitting a new year-to-date high.

source: TradingView

The market rally was driven by two key factors: positive developments in global trade negotiations and better-than-expected corporate earnings.

On July 23, the U.S. and Japan reached a trade agreement that will reduce tariffs on Japanese goods to 15% and draw $550 billion in Japanese investment into the U.S. Simultaneously, U.S.–EU trade talks made significant progress, with the European Union pledging $600 billion in investments and committing to purchase $750 billion worth of U.S. energy products. These breakthroughs eased investor concerns surrounding the looming August 1 reciprocal tariff deadline, offering strong support to risk assets.

The corporate earnings season also got off to a solid start, further boosting market sentiment. Alphabet (Google) rallied on July 23 after posting strong Q2 results. Revenue from its cloud segment rose 32% year over year, becoming the main driver of top-line growth and helping lift the stock significantly.

source: TradingView

GE Vernova surged 14.6% on the week after raising its full-year guidance, citing strong demand for data centers.

source: TradingView

Meanwhile, the VIX volatility index fell to its lowest level in five months, reflecting rising risk appetite in equity markets.

source: TradingView

Despite the broader strength, individual stock performance diverged.

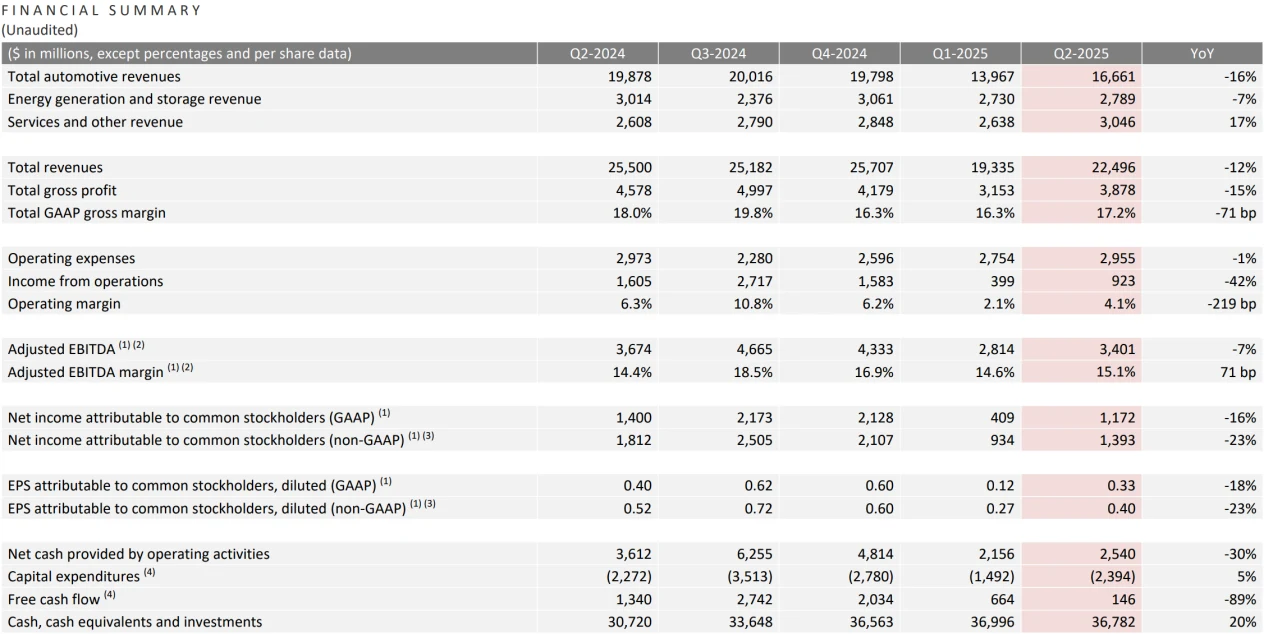

Tesla plunged after disappointing earnings. For Q2, the company reported $22.50 billion in revenue, down 12% year over year, marking the steepest decline in at least a decade and falling short of the $22.6 billion Wall Street forecast. Net income was $1.17 billion, down 20.7%, though slightly above consensus expectations of $1.135 billion. Gross margin came in at 17.2%, down from 18% a year ago but above the expected 16.5%.

source: Tesla

Tesla shares began sliding during the earnings call and ended July 24 down 8.20% at $305.30, making it one of the worst-performing mega-cap tech stocks this earnings season.

source: TradingView

On July 25, Intel also dropped 8.9%, its worst single-day loss since April. Despite beating Q2 revenue expectations and announcing a 15% workforce reduction, the CEO failed to ease investor concerns over the company’s competitive outlook.

source: TradingView

Bottom Line

The combination of trade policy optimism and upbeat earnings was the main driver of this week’s market rally. However, the August 1 tariff deadline and upcoming earnings reports remain critical catalysts that could shape market direction. Wall Street now faces a pivotal and potentially volatile week ahead.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates