Outside the Magnificent-7, These Two Tech Stocks Deserve Attention

03:36 July 25, 2025 EDT

Key Points:

1. Uber’s leadership in ride-sharing and delivery services makes it a promising tech stock.

2. Roblox operates a virtual platform that connects players and developers, benefiting from the growing trends of the metaverse and user-generated content (UGC).

As of July 2025, tech stocks are performing strongly, with the Nasdaq Composite up 28% over the past three months. Mega-cap tech companies—such as Alphabet and NVIDIA—continue to lead the market, fueling a notable rebound in investor sentiment.

However, beyond the “Magnificent Seven” names like Microsoft, NVIDIA, and Apple, are there other quality tech stocks worth watching? This article focuses on two companies with long-term growth potential: Uber Technologies (UBER) and Roblox Corporation (RBLX).

Uber: Autonomous Driving Shift Brings Profit Flexibility

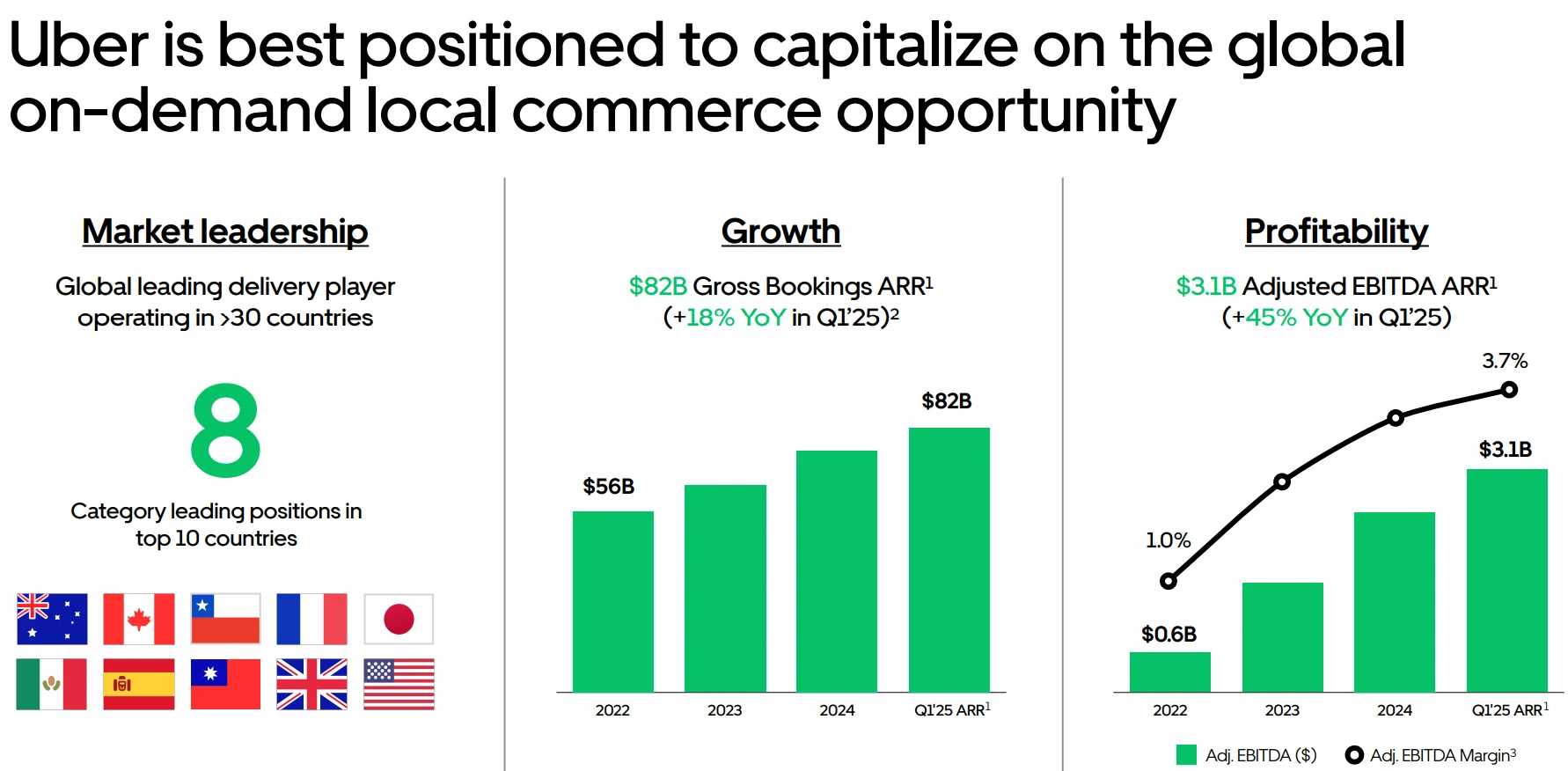

Uber’s leadership in ride-sharing and delivery services positions it as a high-potential tech stock.

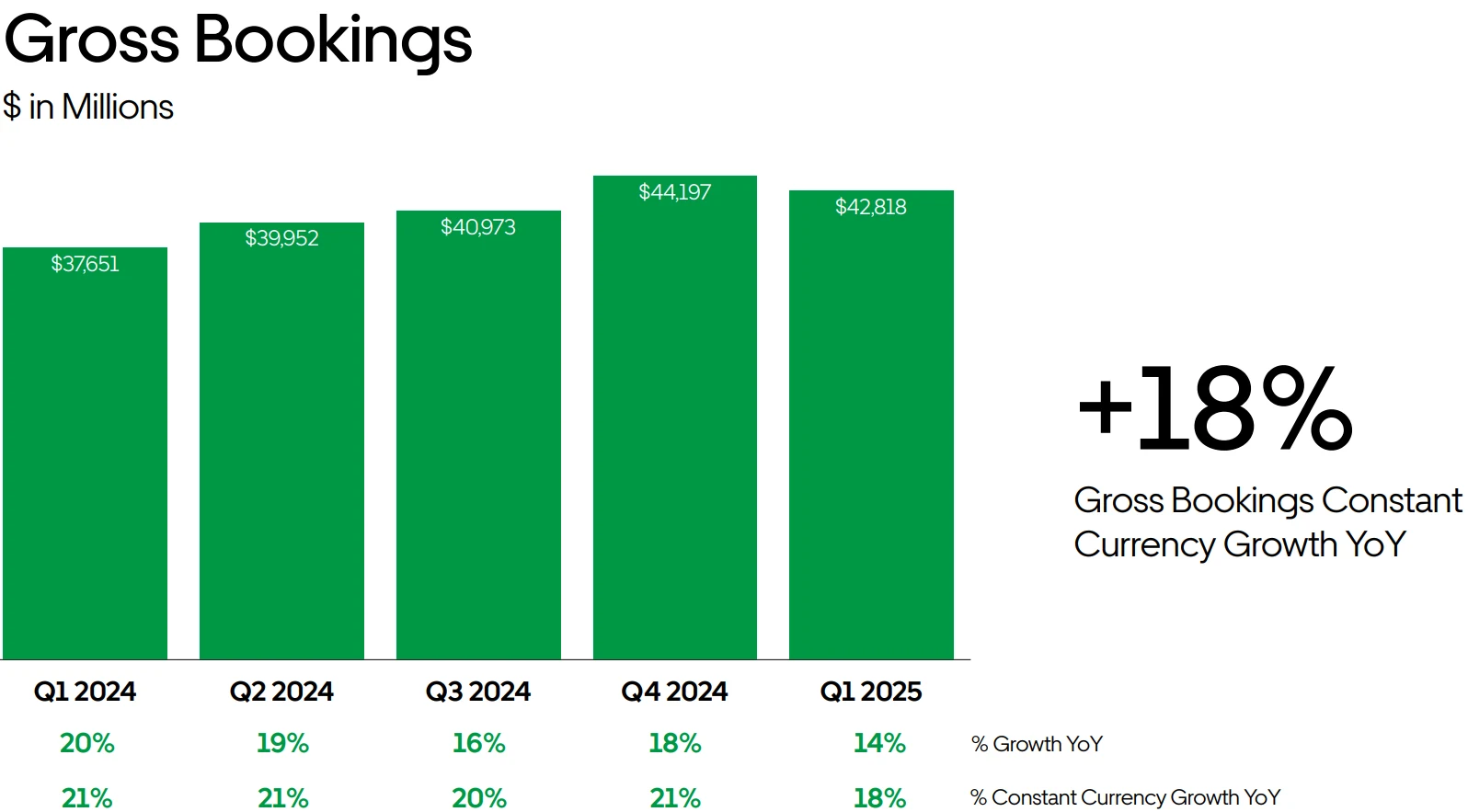

In Q1 2025, Uber’s revenue rose 14% year-over-year to $11.5 billion, or 17% on a constant currency basis. Adjusted EBITDA jumped 35% to $1.9 billion. Adjusted EBITDA margin—as a percentage of gross bookings—was 4.4%, up from 3.7% in Q1 2024.

Source: Uber

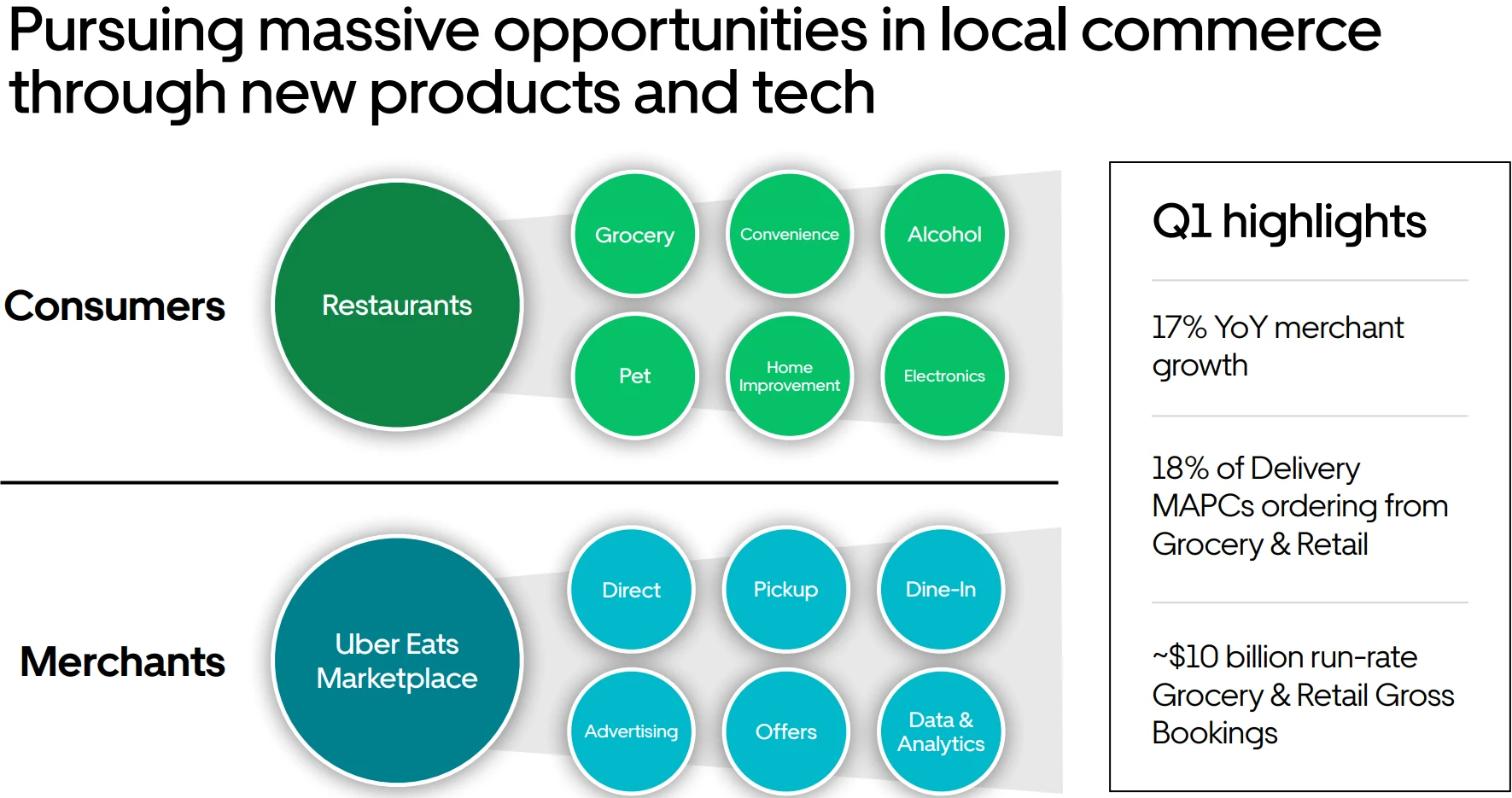

This improvement reflects enhanced operational efficiency and growth across diversified business lines, including freight and food delivery. As of June 2025, Uber’s Monthly Active Platform Consumers (MAPCs) reached 170 million, up 14% from the prior year.

Source: Uber

While autonomous ride-hailing is gaining traction—Tesla and Waymo (owned by Alphabet) are already testing and deploying services in multiple cities—it doesn't necessarily mean that traditional mobility platforms will be displaced. In fact, Uber appears well positioned to benefit from this trend.

Uber has already partnered with Waymo to test AV ride-hailing services in cities like Phoenix, with plans to integrate AV technology to lower driver-related costs. In 2024, driver compensation accounted for roughly 40% of Uber’s total cost base. Gradual AV integration could significantly reduce operating expenses, improve profit margins, and attract more price-sensitive riders.

Billionaire investor Bill Ackman has noted that Uber’s stock trades at a discount to its intrinsic value. As of July 25, 2025, Uber shares are trading at $90.87, with a trailing P/E ratio of around 15.91—below the average for tech stocks.

Source: TradingView

That said, widespread adoption of AVs will take time. Near-term cost reductions will likely remain constrained by Uber’s continued reliance on human drivers. In addition, regulatory uncertainty and macroeconomic headwinds could weigh on consumer spending. Nevertheless, Uber’s diversified operations and AV strategy support its long-term growth potential within the tech sector.

Bloomberg analysts project that Uber will benefit from AV adoption and diversified business lines, with full-year 2025 revenue expected to grow between 12% and 15%. For Q2 2025, Uber has guided for gross bookings between $45.75 billion and $47.25 billion—up 16% to 20% year-over-year on a constant currency basis.

Source: Uber

Autonomous driving is also expected to accelerate Uber’s expansion into adjacent segments like food delivery and freight, further diversifying its revenue base. In sum, continued technological advancement and improved cost structure should unlock new growth drivers for Uber—making it a stock worth watching in 2025 and beyond.

Roblox: Hit Game Fuels Platform Surge

Roblox is another tech stock worth watching.

The company operates a virtual gaming platform that connects players and developers, benefiting from the metaverse trend and user-generated content (UGC). Most games are free to play, while Roblox primarily generates revenue through sales of its virtual currency, “Robux.” Players use Robux to purchase in-game items, forming the core of the platform’s business model.

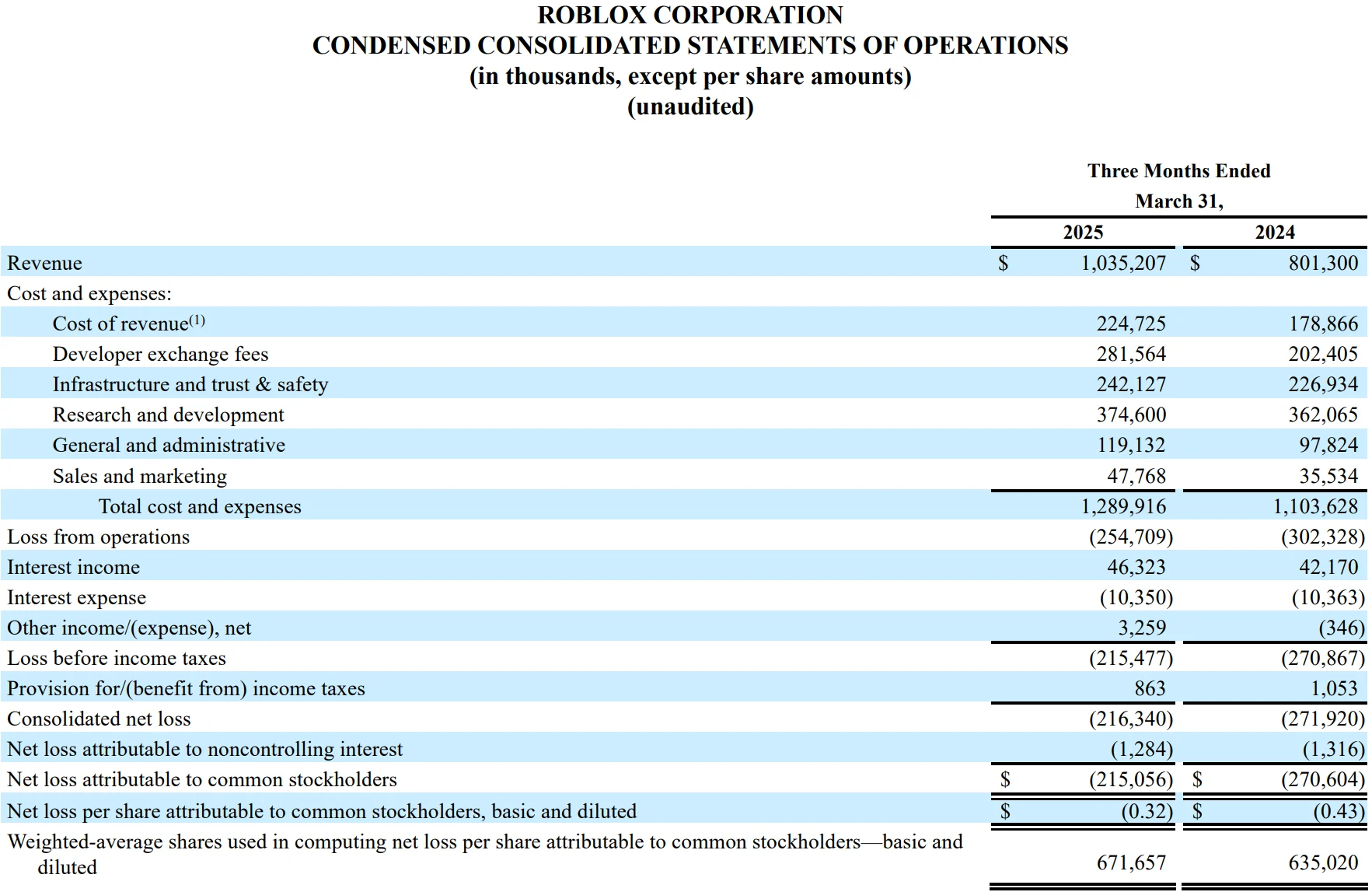

In Q1 2025, Roblox’s revenue grew 29% year-over-year to $1.035 billion, with daily active users (DAUs) reaching 97.8 million, up 26% year-over-year. Growth by region included 27% in the U.S. and Canada, 32% in Europe, 22% in Asia-Pacific, and 19% in other global markets.

Source: Roblox

As of July 2025, Roblox’s stock price has surged 104% year-to-date, reaching approximately $118. This rally was largely driven by the breakout success of a new platform game, Grow a Garden.

Source: TradingView

Grow a Garden, launched in March 2025, attracted 21.3 million monthly active players by June, surpassing the Fortnite record of 14.3 million. This success has boosted user engagement and Robux spending, which is expected to be reflected as continued revenue growth in the Q2 earnings report due July 31. Roblox’s UGC model allows for ongoing content innovation, maintaining strong user stickiness.

Source: Roblox

Roblox’s long-term growth potential is underpinned by its predominantly young user base (around 90% under age 18) and the expanding metaverse ecosystem. However, the stock’s sharp run-up has pushed its forward P/E ratio to about 50x, well above the S&P 500 average. The popularity of any single game (like Grow a Garden) could fade, potentially impacting short-term revenue growth. Additionally, an economic slowdown may reduce consumer spending on virtual goods.

That said, even if the current game’s momentum tapers off, Roblox’s stable user base and robust developer ecosystem provide a foundation for sustained growth. Analysts project revenue growth of 25% to 30% for 2025. For investors looking to gain exposure to the interactive entertainment sector, Roblox offers a high-growth, sticky investment opportunity.

Final Thoughts

As the tech sector regains strength, market attention often focuses on the “Seven Giants.” However, Uber and Roblox demonstrate unique advantages and growth potential within their respective niches, making them attractive potential “dark horses” given their current valuations.

Against a backdrop of heightened policy and market volatility, selecting platform-based tech stocks with genuine earnings improvement and solid user bases may offer a more balanced strategy that combines both defensive and offensive qualities.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates