Behind the Record Run of U.S. Stocks

23:39 July 24, 2025 EDT

In July 2025, the S&P 500 Index repeatedly hit new record highs, demonstrating resilience and momentum that exceeded market expectations. As of the close on July 24, the S&P 500 stood at 6,363.35, edging up 0.07% from the previous day. During the session, it reached an intraday high of 6,381. Since mid-July, the index has posted multiple intraday and closing record highs, with market sentiment remaining broadly bullish.

Source: TradingView

This latest rally has unfolded against a backdrop of multiple uncertainties facing the U.S. economy. Trade policy tensions, geopolitical risks in the Middle East, and pockets of weakness in economic data all theoretically pose headwinds for the market. Yet, equity prices have continued to trend higher. According to several Wall Street analysts, the current strength in U.S. equities is no coincidence—it is the result of several key factors working together.

Solid economic fundamentals

Despite ongoing concerns about the potential economic impact of the Trump administration's tariff policies, recent economic data has been robust, easing some investor fears of a U.S. recession.

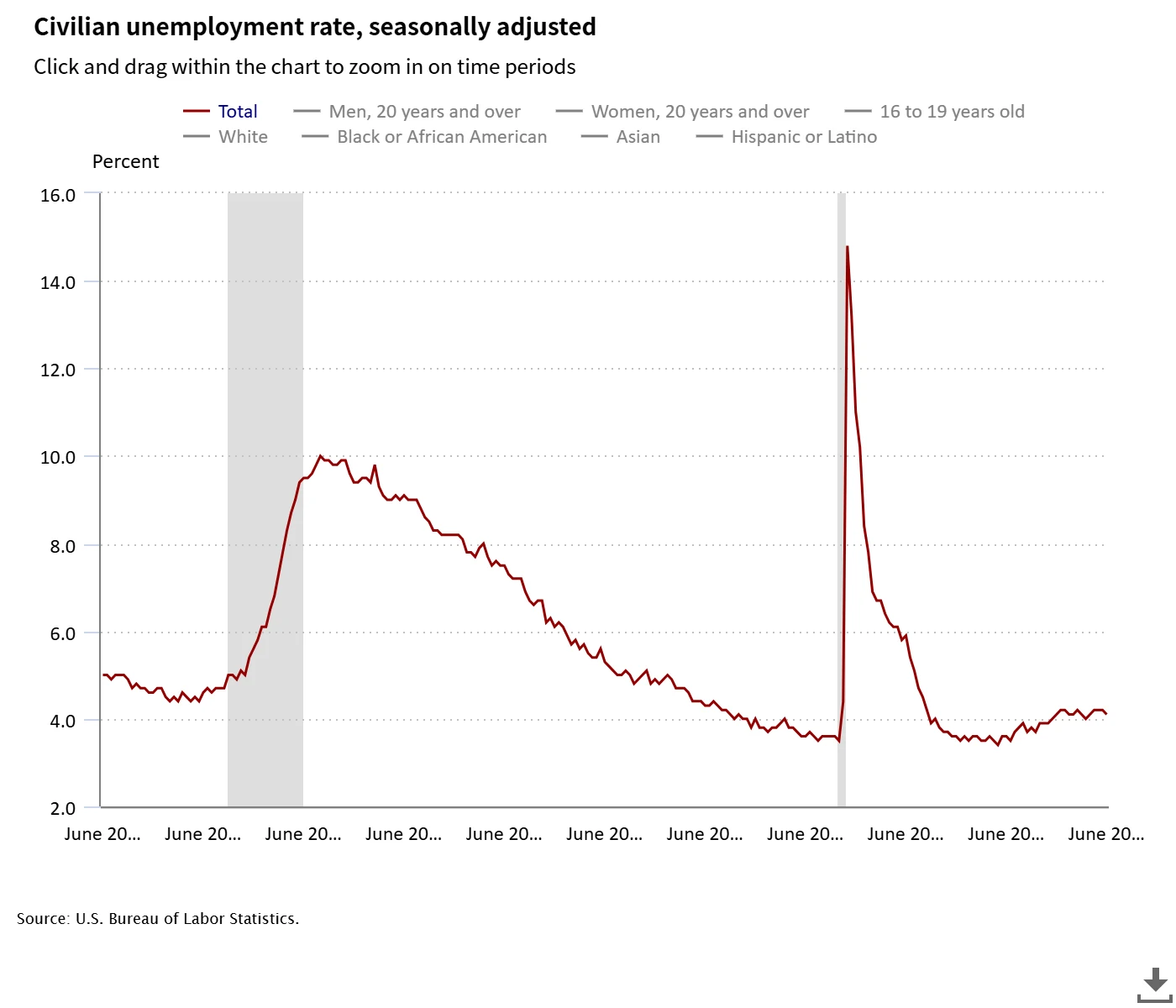

First and foremost, the resilience of the economy has provided a foundation for the index's rise. In June 2025, U.S. nonfarm payrolls increased by 147,000, significantly surpassing the market's expectation of 106,000. The unemployment rate dipped slightly from 4.2% to 4.1%. These figures have alleviated recession concerns and bolstered market confidence.

Source: U.S. Bureau of Labor Statistics

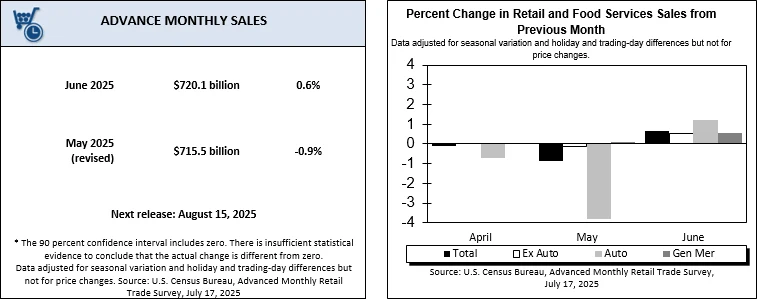

Retail sales data further reinforced the optimistic sentiment. June retail sales rose 0.6% month-over-month, well above the expected 0.1%. Growth was particularly strong in the automotive, building materials, and food and beverage sectors, signaling a recovery in consumer activity. This rebound is also seen by Wall Street as a sign of improved consumer expectations for the economic outlook.

Source: U.S. Department of Commerce

Importantly, large corporations reported second-quarter earnings that exceeded expectations. Alphabet's revenue grew 14% year-over-year, with cloud revenue surging 32%, continuing to be a key performance driver. PepsiCo and United Airlines also posted stronger-than-expected results, indicating stability in the consumer and services sectors. Meanwhile, Netflix's adjusted earnings per share reached $7.19, up 22% from the previous year, further boosting market confidence in the earnings outlook for tech stocks.

The financial sector has seen active trading as well. JPMorgan Chase reported a net profit of $15 billion for Q2 2025, surpassing analyst estimates, with stock trading revenues hitting record highs. JPMorgan's CFO, Jeremy Barnum, remarked on the earnings call that "overall, consumer conditions remain fairly strong," and noted that, as several CEOs have recently stated, even with rising inflation, U.S. consumers are "somewhat numb" to tariffs but remain "very resilient."

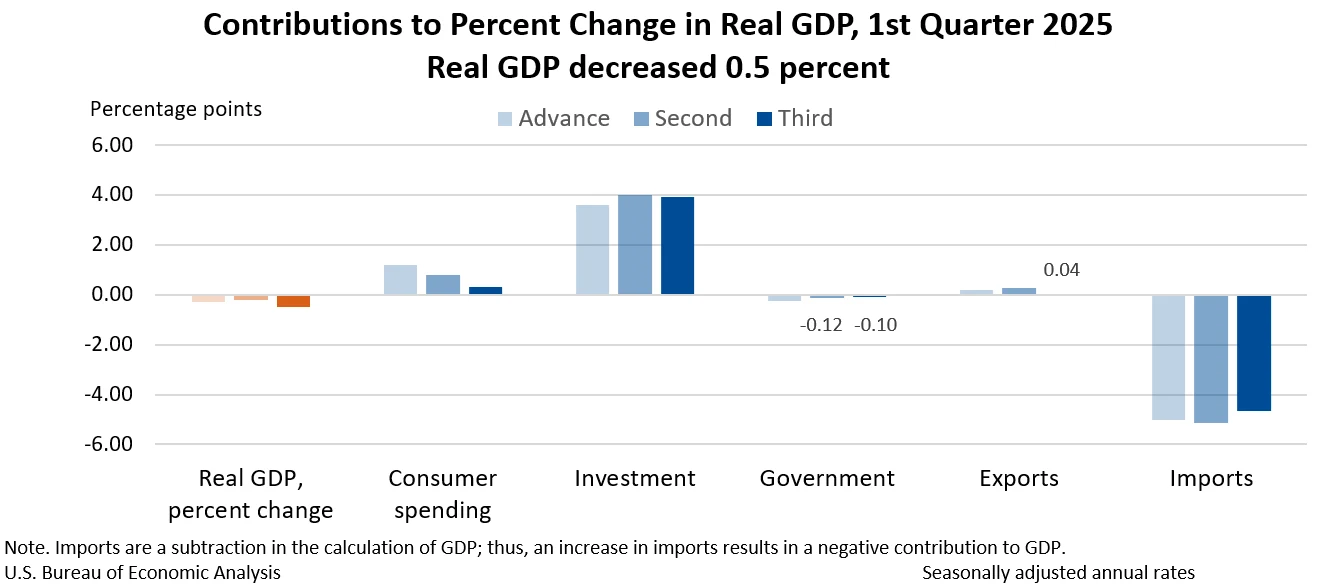

Moreover, the macroeconomic foundation supporting the market remains intact. While U.S. GDP contracted by 0.5% quarter-over-quarter in Q1 2025, and some consumer spending indicators showed signs of slowing, the dual support from employment and consumption has provided stability to the market. Analysts point out that as long as core macroeconomic indicators do not deteriorate systematically, the U.S. equity market could continue its upward trajectory amid volatility.

Source: U.S. Bureau of Economic Analysis

Policy Outlook and the "TACO Trade"

Market sentiment has been significantly influenced by expectations surrounding trade policies. In April 2025, U.S. President Donald Trump introduced the "reciprocal tariffs" plan, which caused market volatility. However, investors have gradually come to anticipate that the tariff threat may not be fully realized, leading to the emergence of the "TACO trade" (Trump Always Chickens Out). The so-called "TACO trade" refers to the widespread market expectation that Trump’s aggressive trade policies are more of a negotiating tactic, with limited follow-through on actual implementation.

Davide Oneglia, the head of macroeconomic research at GlobalData.TS Lombard, pointed out that Trump may adjust or compromise on his tariff stance before August 1, which would ease market tensions. Daniela Sabin Hathorn, a senior analyst at Capital.com, also believes that the tariff statements are more about strategic maneuvering, with a low likelihood of actual implementation. This expectation has led investors to lower their risk assessments of supply chain disruptions and input-driven inflation, thereby creating more room for the stock market to rise.

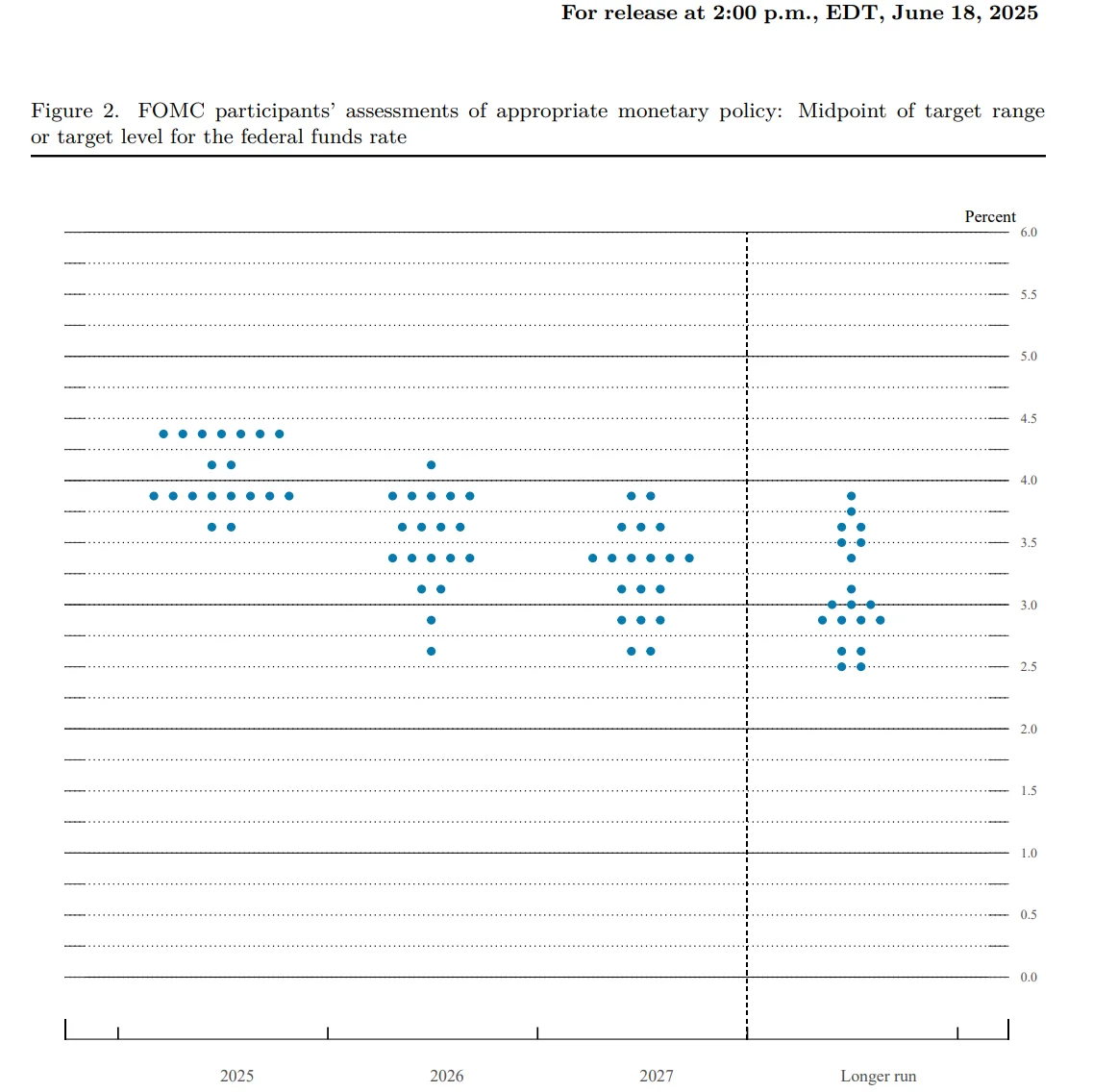

Federal Reserve policy expectations have also supported the market. The Fed has hinted at the possibility of two rate cuts in 2025, which would lower borrowing costs and enhance the attractiveness of the stock market. However, the June CPI rose 2.7% year-over-year, up from 2.4% in May, complicating the rate-cutting path. The uptick in inflation has put the Fed in a difficult position regarding its decision-making.

Source: Federal Reserve

JPMorgan CEO Jamie Dimon warned in early July that if inflation remains elevated, the Fed may need to raise interest rates, with a probability of 40%-50%.

Market Trends and Investor Behavior

The market rally is also driven by both "FOMO" (Fear of Missing Out) and "MOMO" (Momentum Trading) sentiments. As the S&P 500 continues to hit new highs, traders and retail investors are accelerating their entry, creating a positive feedback loop of technical buying. Steve Sosnick, Chief Strategist at Interactive Brokers, noted that unless there is a significant external shock, the market momentum is likely to persist. This dynamic forms a self-reinforcing cycle, driving the S&P 500 index higher.

While these sentiment-driven factors can push the market upward in the short term, they also mean that if the macroeconomic environment faces a shock, the market could experience a more rapid correction.

The AI boom has also become a major driver of the market, particularly for large tech stocks. Companies like Alphabet and NVIDIA are benefiting from AI-driven productivity gains. A global fund manager survey by Bank of America revealed that 40% of respondents believe AI has already boosted productivity, with 21% expecting to see results within the next year. Andrew Pease from Russell Investments pointed out that AI is the dominant theme in the market but warned that valuations may be too high.

Risks Remain

Despite the S&P 500 continuing to set new highs, there remains a degree of divergence within the market. Andrew Pease from Russell Investments pointed out that the current rally lacks broad-based confidence, with investor sentiment remaining neutral or even cautious.

The outlook for tariff policies remains uncertain, and tensions in the Middle East could escalate at any time. Additionally, corporate earnings are showing a clear bifurcation, with some cyclical sectors under pressure. Daniela Sabin Hathorn from Capital.com warned that if geopolitical or policy shocks occur, the market could face a rapid correction.

Moreover, while employment and retail data support the short-term rally, GDP contraction and a slowdown in consumer spending suggest that the economy is not universally strong. Sectoral divergence (strong performance in tech and consumer goods, weak in manufacturing) means the market is increasingly reliant on specific sectors, which raises volatility risks.

The "TACO trade" and expectations of rate cuts have boosted the market, but tariff negotiations and inflationary pressures may disrupt these optimistic assumptions. If negotiations break down before August 1 or inflation remains persistently high, the market could adjust quickly.

From a valuation perspective, the S&P 500’s forward P/E ratio is currently around 22.8, higher than the historical average of 18.5, indicating that optimistic sentiment is already priced in.

Historical experience has shown that high-valuation markets are sensitive to negative news. The 2018 U.S.-China trade war provides a reference for the current high-valuation market. At that time, the S&P 500 performed strongly, driven by global economic recovery and corporate earnings growth, with a forward P/E ratio of around 17, near the historical average upper limit.

However, when the U.S. announced tariffs on China in March 2018, it triggered concerns about global supply chains and economic growth. The S&P 500 experienced two significant corrections in 2018: a more than 10% drop over two weeks in early February, entering a technical correction zone, and a sharp decline from October to December, falling 13.97% in the quarter, hitting its lowest point of the year on December 24, down around 20% from the year’s high, entering a bear market zone.

Source: TradingView

Given this, volatility is expected to increase in the second half of 2025, especially with inflation and interest rate paths uncertain. The S&P 500 could face resistance around the 6,500-point level unless economic data or policy outcomes deliver an unexpected positive surprise.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates