Google’s Earnings Crush Expectations, But Challenges Persist—Is Now the Time to Buy?

03:51 July 24, 2025 EDT

Key Points:

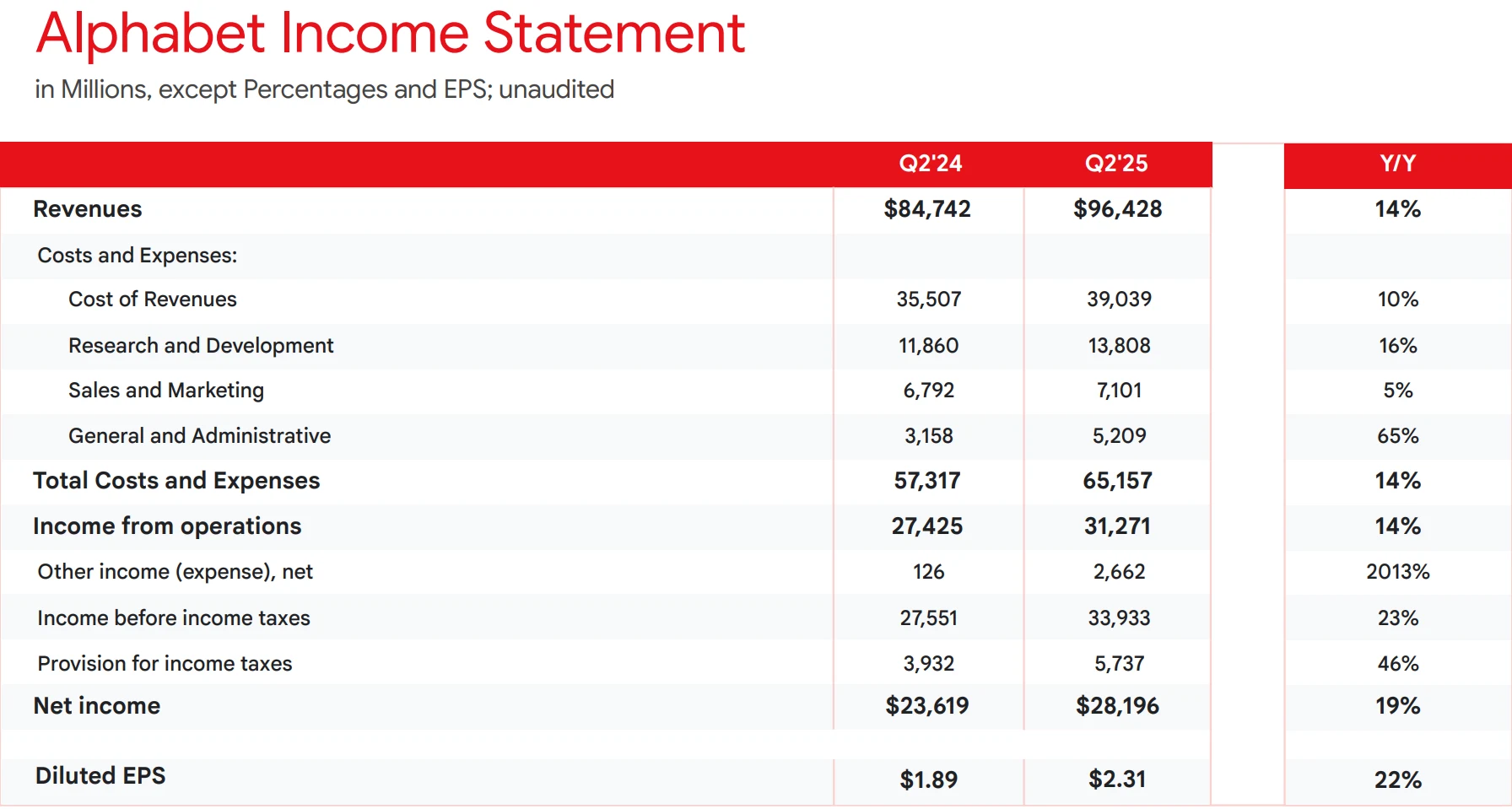

1. Alphabet’s Q2 total revenue reached $96.43 billion, a 14% increase from $84.74 billion in the prior year, or 13% growth excluding currency fluctuations.

2. The company announced an increase in its 2025 full-year capital expenditure to $85 billion, $10 billion above prior estimates, with further increases expected in 2026.

3. Amid aggressive AI investments and sustained double-digit revenue growth, Alphabet’s current valuation does not fully reflect its potential.

Alphabet, Google’s parent company, reported second-quarter earnings that showcased continued revenue and profit growth driven by its core search advertising and cloud computing businesses. As Microsoft and Amazon accelerate monetization of AI opportunities, Google is leveraging its Gemini model to make significant strides, signaling the arrival of its “Gemini moment.”

The company also raised its 2025 full-year capital expenditure (CapEx) forecast from $75 billion to $85 billion, reflecting aggressive investment in AI infrastructure. While the earnings exceeded Wall Street expectations, the increased CapEx raised concerns about profitability and the sustainability of AI-driven growth.

Earnings Strongly Outperform Estimates

Alphabet's second-quarter total revenue reached $96.43 billion, surpassing analyst expectations of $93.97 billion. Net income grew 19% to $28.2 billion, with diluted earnings per share (EPS) of $2.31, a 22% year-over-year increase, exceeding market forecasts of $2.18.

Source: Alphabet

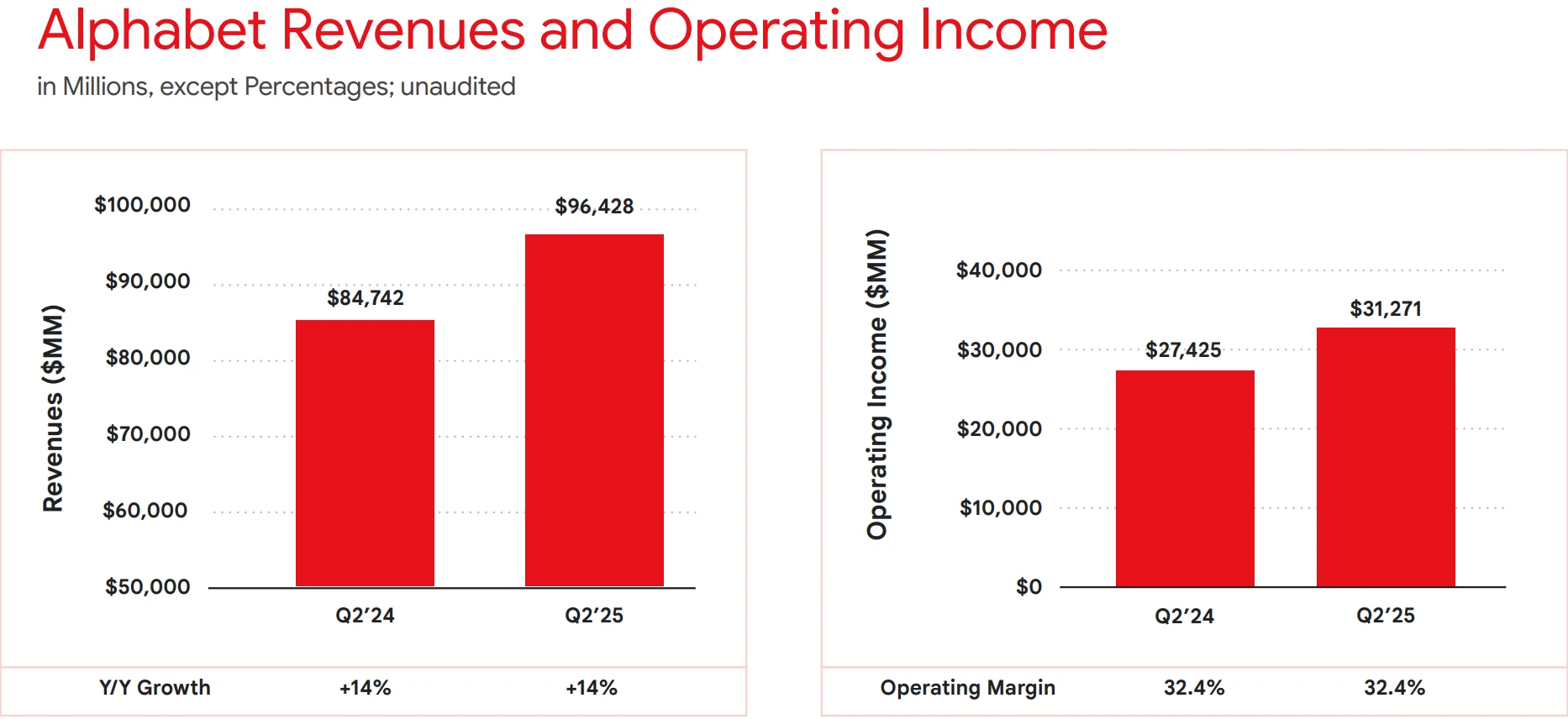

Operating income rose 14% to $31.27 billion, with an operating margin steady at 32.4%, reflecting Alphabet's ability to balance revenue growth with cost management.

Source: Alphabet

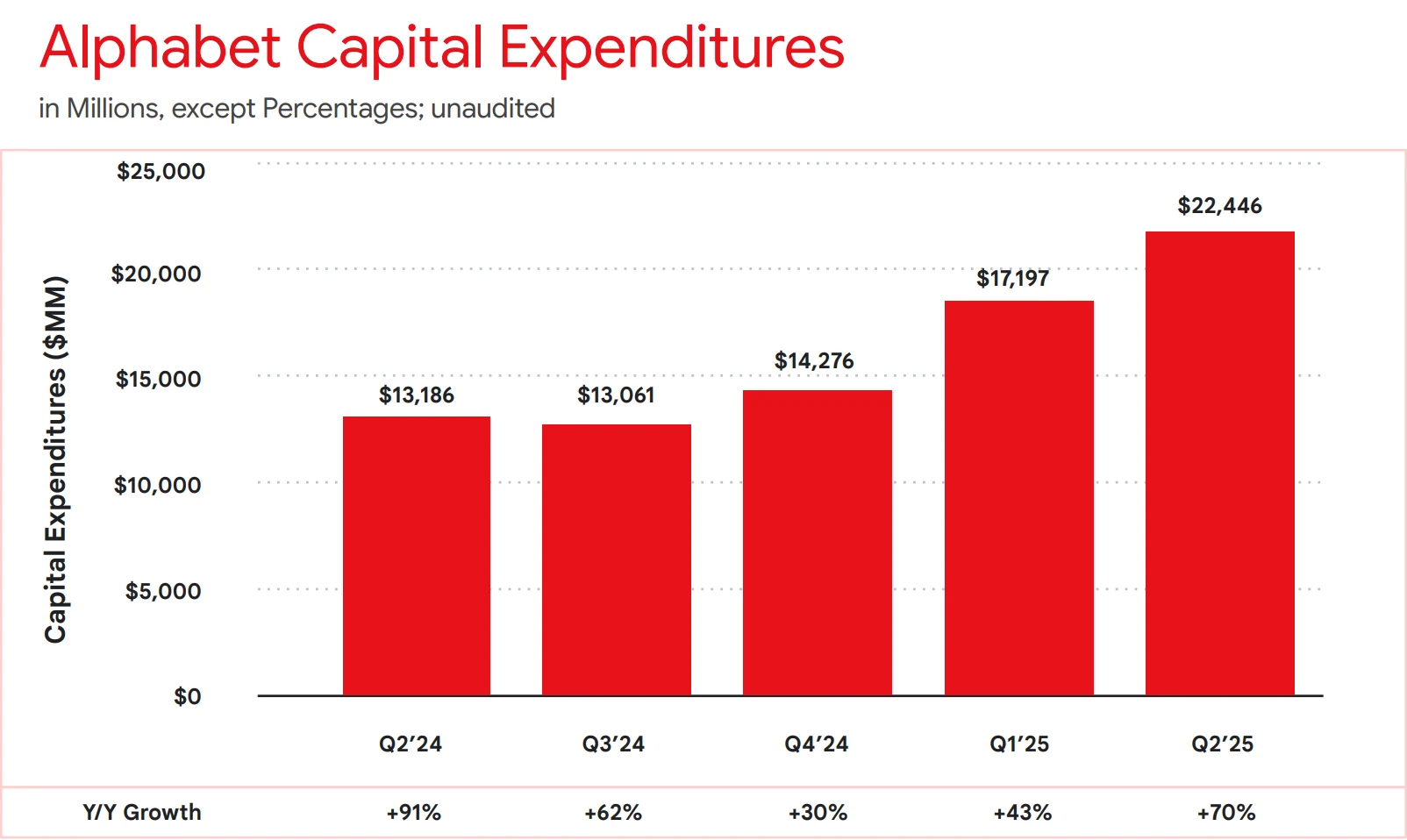

Adjusted revenue, excluding partner payouts, was $81.7 billion, beating analyst estimates of $79.6 billion. However, capital expenditure surged 70% year-over-year to $22.45 billion, driven by investments in AI infrastructure and cloud services, leading to a 61% decline in free cash flow to $5.3 billion. Despite this, trailing twelve-month free cash flow grew 10% to $66.73 billion, indicating robust long-term cash generation.

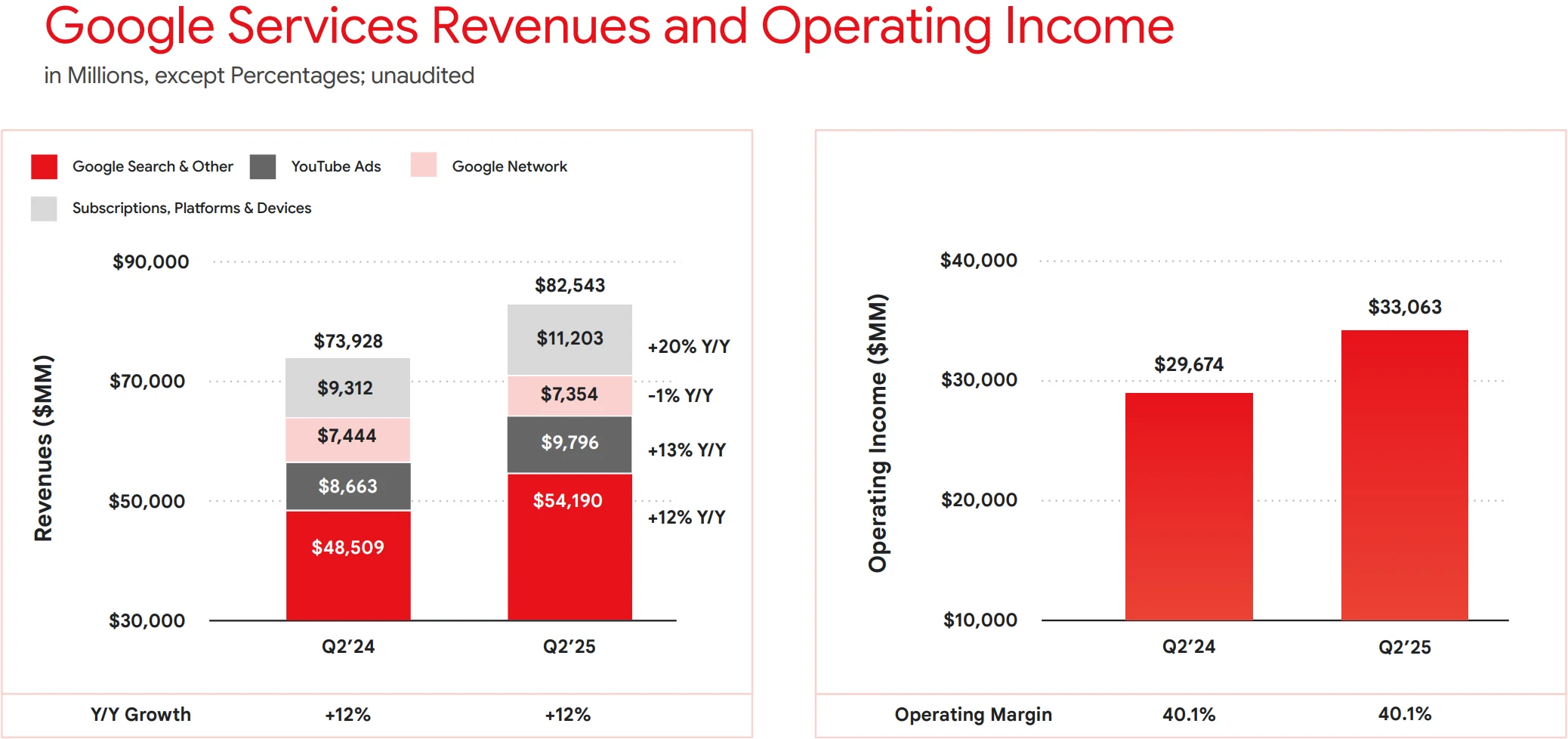

By segment, Google Services remained the primary revenue driver, generating $82.54 billion in Q2 2025, up 12% year-over-year. Search business revenue was $54.19 billion, up 11.7%, slightly above expectations of $54 billion. AI-driven features like AI Overviews, now serving 1.5 billion monthly users, enhanced user engagement and ad monetization. Chief Business Officer Philipp Schindler noted that AI Overviews' monetization rate matches traditional search ads, signaling successful AI integration into the core search business.

Source: Alphabet

Advertising, Alphabet’s revenue backbone, totaled $71.3 billion, up 10.4% year-over-year. Search advertising revenue reached $54.1 billion, up 11.7%, maintaining steady growth, while YouTube ad revenue was $9.8 billion, slightly above expectations.

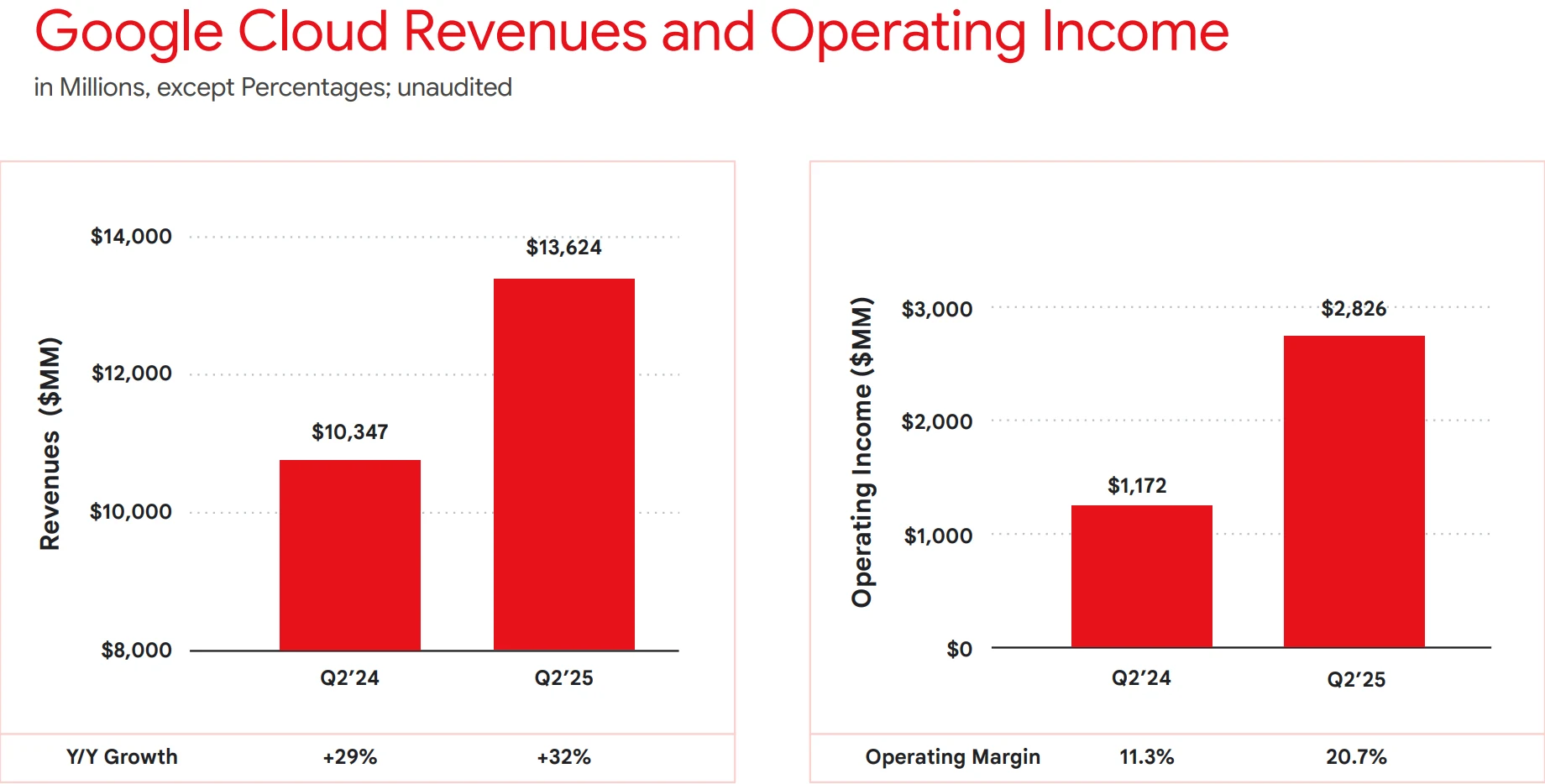

Cloud computing performed strongly, with revenue up 32% to $13.6 billion and operating profit reaching $2.8 billion, exceeding expectations and underscoring Google Cloud’s potential in the AI era.

Source: Alphabet

Aggressive AI Spending

Despite strong earnings, another market focus is Google’s aggressive investment in AI infrastructure. In Q2 2025, Alphabet’s capital expenditure reached $12.5 billion, a 56% increase from $8 billion in the prior year, marking a record single-quarter high. CFO Anat Ashkenazi stated during the earnings call that spending was primarily allocated to data center expansion and AI chip (TPU) deployment, with full-year 2025 capital expenditure expected to “significantly exceed 2024’s $70 billion,” reaching $85 billion, with further increases planned for 2026, underscoring the company’s long-term commitment to AI infrastructure.

Source: Alphabet

However, unlike Microsoft’s rapid AI commercialization through its Copilot product line, Google’s AI product monetization remains in exploration. While the Gemini model has been released in multiple versions, scalable paid subscriptions in workplace settings and deep enterprise integration are not yet mature. Markets are concerned about whether, under the cost pressures of high-compute investments and equipment depreciation, Alphabet can effectively translate its substantial capital outlays into measurable revenue growth, with profit elasticity still requiring time to validate.

Additionally, Alphabet’s core search business faces challenges. The company is contending with a 2020 U.S. Department of Justice antitrust lawsuit, with a federal judge expected to rule in August 2025 on remedies that could include divesting Chrome, prohibiting payments to Apple for default search engine status, or mandating data sharing with competitors. Daniel Newman, CEO of The Futurum Group, noted that antitrust uncertainty and AI disruption concerns are weighing on Alphabet’s stock. A punitive ruling could limit Alphabet’s ability to leverage its search dominance, impacting ad revenue.

While AI Overviews have begun incorporating ads for monetization, their efficiency remains below that of traditional search link ads. CFRA Research analyst Angelo Zino predicts that over the next two to three years, Alphabet may lose ad market share due to competition from social media platforms and emerging AI tools. If AI-native search fails to seamlessly transition ad monetization capabilities, Google’s long-term profit model, heavily reliant on search advertising, could face revaluation pressure.

Macroeconomic uncertainties and policy changes also pose headwinds. President Donald Trump’s decision to end the “de minimis trade loophole” is expected to impact Asia-Pacific retailers, potentially creating a slight drag on ad revenue in 2025.

Alphabet’s “Other Bets” segment merits attention. Including Waymo and Verily, the segment saw revenue grow 2.2% year-over-year but reported an operating loss of $1.25 billion. Waymo, the autonomous driving unit, plans to launch services in Tokyo in 2025 and partner with Uber in Austin and Atlanta. Alphabet’s $5 billion multi-year investment in Waymo reflects confidence in autonomous driving, though profitability remains a long-term goal.

Market Performance

Following the earnings release, Alphabet’s stock (GOOGL) initially fell 2.8% in after-hours trading on July 23, 2025, due to concerns over increased capital expenditure but later rebounded, closing with a 2% gain. As of this writing, the stock’s year-to-date return is only 0.73%, underperforming the S&P 500’s 8% gain, as shown in the finance card above.

Source: TradingView

From a valuation perspective, after the after-hours rally, Alphabet’s forward price-to-earnings (P/E) ratio stands at approximately 20x, lower than Microsoft’s 30x and Amazon’s 25x, with its price-to-earnings growth (PEG) ratio among the lowest for large-cap tech stocks. Given its aggressive AI investments and sustained double-digit revenue growth, the current valuation does not fully reflect its potential.

From a technical perspective, following the significant after-hours gain, Alphabet’s stock may break out of its three-month consolidation range. If the stock sustains above $200 with increased trading volume, it could signal a medium-term bullish trend, as indicated in the finance card above.

Source: TradingView

Some analysts remain optimistic about Alphabet’s long-term prospects. Oppenheimer raised its price target from $220 to $235, citing strong search and cloud performance. Citigroup maintained a “Buy” rating with a $203 target, based on a 20x multiple of projected 2026 GAAP EPS of $10.24, highlighting Alphabet’s diversified revenue streams and AI leadership.

At current valuation levels, if market sentiment stabilizes, Alphabet may gradually address its “undervalued” status, presenting increasing mid-to-long-term allocation value for investors.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates