Is the Market's Concern Over Trump Tariffs Fading?

21:24 July 22, 2025 EDT

In July 2025, despite the Trump administration’s continued push for aggressive trade policies and threats to impose tariffs on goods from multiple countries as early as August 1, concerns among consumers and businesses about the impact of tariffs are gradually easing. Recent economic data indicate that U.S. manufacturing and retail sectors are slightly less pessimistic about supply chain prospects, while consumer confidence indices have also shown a rebound, suggesting that the marginal impact of trade policy disruptions on the market is diminishing.

Multiple surveys reveal that, although businesses remain cautious about the cost pressures from future tariffs, adjustments in current inventories and domestic supply chain alternatives have mitigated some risks associated with reliance on external inputs. Meanwhile, consumer concerns about rising prices have not significantly intensified, indicating that the short-term pass-through of tariffs to end-user consumption remains limited.

However, the market has not entirely ruled out the possibility of policy-driven shocks. If the White House initiates a new round of tariffs around August, particularly targeting critical manufacturing components or automobiles, it could trigger renewed fluctuations in inflation expectations, potentially influencing the Federal Reserve’s policy path and market risk appetite.

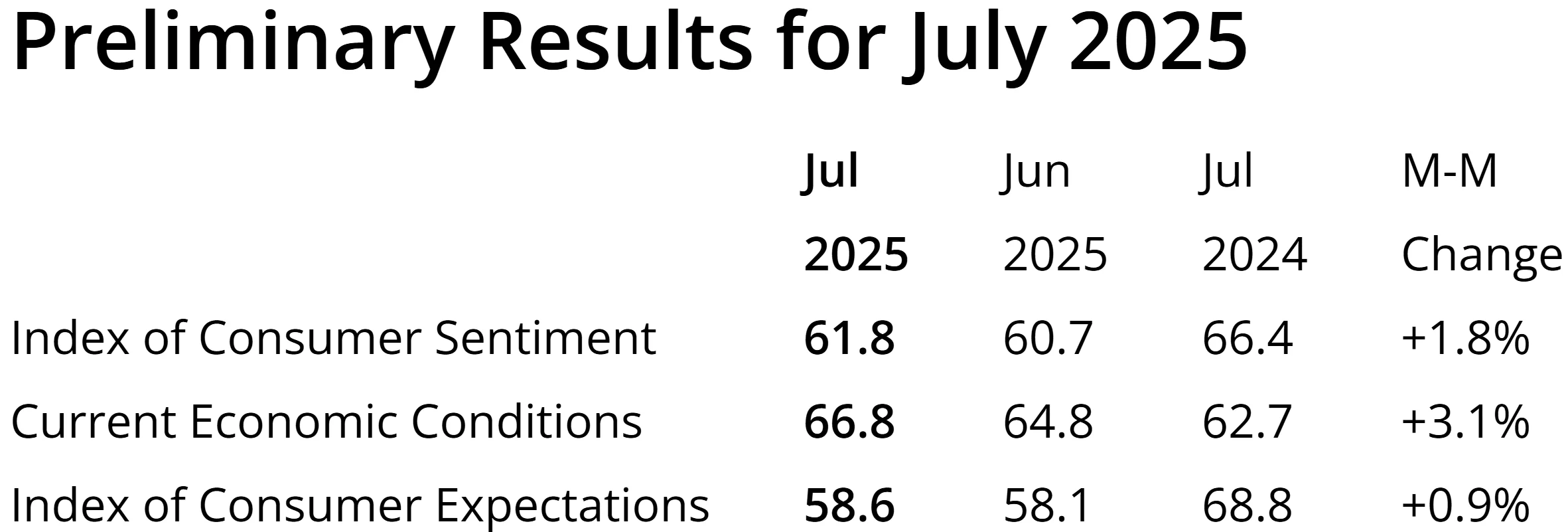

Consumer Confidence Rebounds

Consumer confidence is on the rise. In July 2025, the University of Michigan’s preliminary Consumer Sentiment Index rose to 61.8, the highest level since February, with both the current conditions and expectations indices beating forecasts. A key driver was the decline in one-year inflation expectations—from 6.6% in June to 4.4%—suggesting that consumers see tariff-driven price increases as likely to be short-lived.

Source: University of Michigan

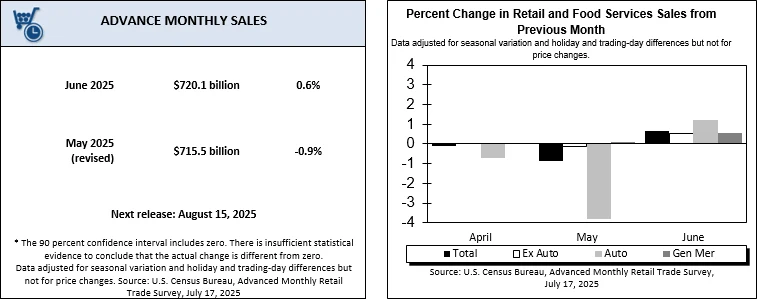

The improvement is partly driven by a resilient labor market. Initial jobless claims for the week ending July 12 fell to 221,000, down 7,000 from the previous week, signaling continued labor market strength. Additionally, retail spending in June rebounded unexpectedly, reinforcing consumers’ perception of economic resilience. Heather Long, Chief Economist at Navy Federal Credit Union, noted that this “helps explain the link between improving retail sales and rising confidence.”

Source: U.S. Department of Commerce

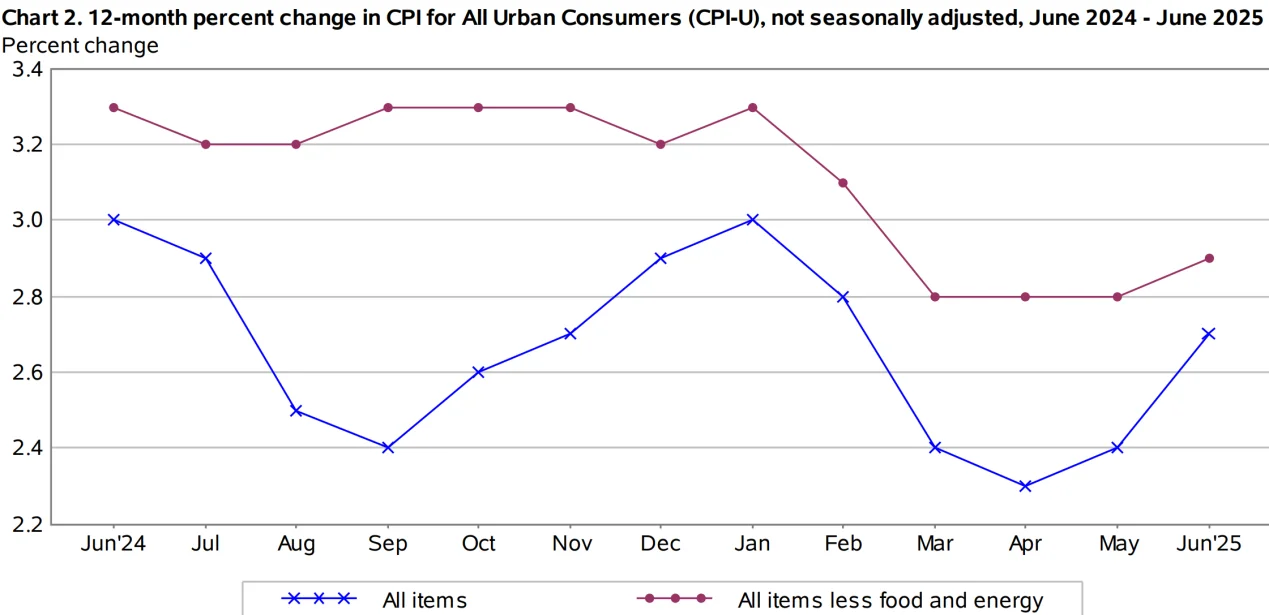

However, real inflation pressures may be building. According to data from the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose 2.7% year-over-year in June—the largest increase since February 2023. Prices for tariff-sensitive imported goods such as appliances, clothing, and furniture posted notable gains.

Source: BEA

A Bloomberg poll showed that more than half of respondents believe current tariff policies are negatively impacting their financial situation, and 69% expect prices for everyday goods to rise due to tariffs.

While the short-term rebound in consumer confidence may support retail spending, tariff policy uncertainty remains a longer-term risk. With the August 1 deadline for new tariff decisions approaching, market sentiment could come under renewed pressure, and consumer momentum may face a fresh round of tests.

Business Sentiment Improves

Business confidence in the economic outlook is improving, according to recent manufacturing surveys. The New York Fed’s Empire State Manufacturing Index rose by 22 points in July, while a similar survey by the Philadelphia Fed also reflected a pickup in business activity and future sentiment. Nationwide economist Oren Klachkin noted that easing inflation concerns and solid economic data have contributed to the rebound in corporate sentiment.

Still, the pressure from tariffs driving up business costs has not gone away. KPMG’s Tariff Pulse Survey shows that more than half of U.S. companies report margin compression due to tariffs. From January to May, average import prices for steel and aluminum rose nearly 30%, while input costs for textiles, leather, rubber, and plastic products also surged—leading to a pullback in business investment. JPMorgan’s Q2 earnings came in below last year’s levels, with CEO Jamie Dimon citing policy uncertainty around tariffs as a key reason for rising corporate caution.

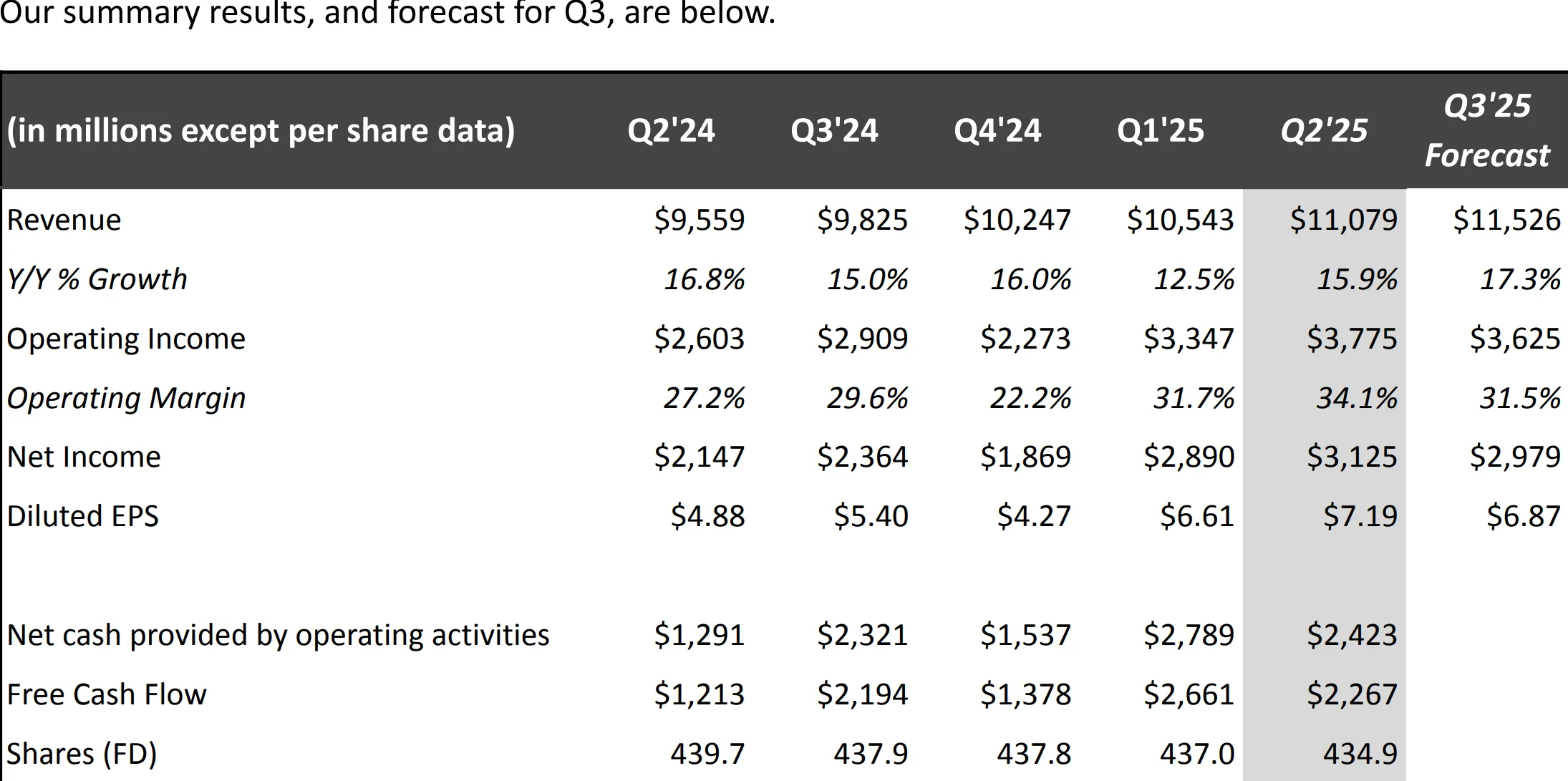

This pressure is particularly acute in the tech and entertainment sectors. ASML CEO Peter Wennink said clients are delaying orders due to tariff-related uncertainty, making it difficult for the company to confirm its 2026 growth outlook. Netflix has so far avoided direct impacts, but President Trump’s threat to impose tariffs on foreign entertainment products could reduce the company’s earnings per share by as much as 20%.

Q2 2025 Financials Source: Netflix

Improving manufacturing sentiment is helping to support production activity, but rising costs and reduced capital investment tied to tariffs may limit profitability—especially in trade-sensitive industries.

Tariff Updates

The White House is planning to raise tariffs on key trade partners—including Mexico, Canada, and the European Union—starting August 1, adding a fresh layer of uncertainty to markets. The United Nations and the WTO have warned that U.S. tariff policy has already led to a projected 0.2% decline in global goods trade volume for 2025; if the measures escalate further, that drop could widen to as much as 1.5%, with the least-developed countries likely to bear the brunt.

Meanwhile, domestic policy flip-flops are compounding the challenge for businesses. The “reciprocal tariffs” enacted in April intensified trade tensions with China. Although both sides reached a temporary agreement in May, the threat of new tariffs in August has reignited market volatility.

This uncertainty is also triggering ripple effects globally. The EU is seeking to finalize a framework trade deal with the U.S. before August 1, but key disagreements remain over reciprocal tariffs and supply chain roles. Emerging economies such as Brazil and South Africa are responding with countermeasures and are turning to multilateral cooperation frameworks to push back against U.S. pressure. The global trade landscape is undergoing a profound shift.

The ongoing recalibration of Trump’s tariff policies—often referred to as the “TACO” phenomenon—may offer businesses brief reprieves. In the short term, resilient economic data continues to support consumption and production, but longer-term uncertainty is clearly discouraging investment.

The policy developments leading up to August 1 will be pivotal. If new tariffs are implemented, they could drive inflation expectations higher and weigh heavily on business and consumer confidence.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates