FoolBull Brings You This Week’s Market Highlights

Market Focus

Powell to Deliver Unusual Pre-Meeting Remarks

Federal Reserve Chair Jerome Powell is scheduled to speak publicly on Tuesday, July 22, before the U.S. market opens—an uncommon occurrence during the Fed’s typical “blackout period.” The speech comes amid escalating pressure from President Donald Trump, who has repeatedly criticized Powell and urged the Fed to “cut rates now.” Markets will closely monitor Powell’s comments for any signals on the Fed’s independence.

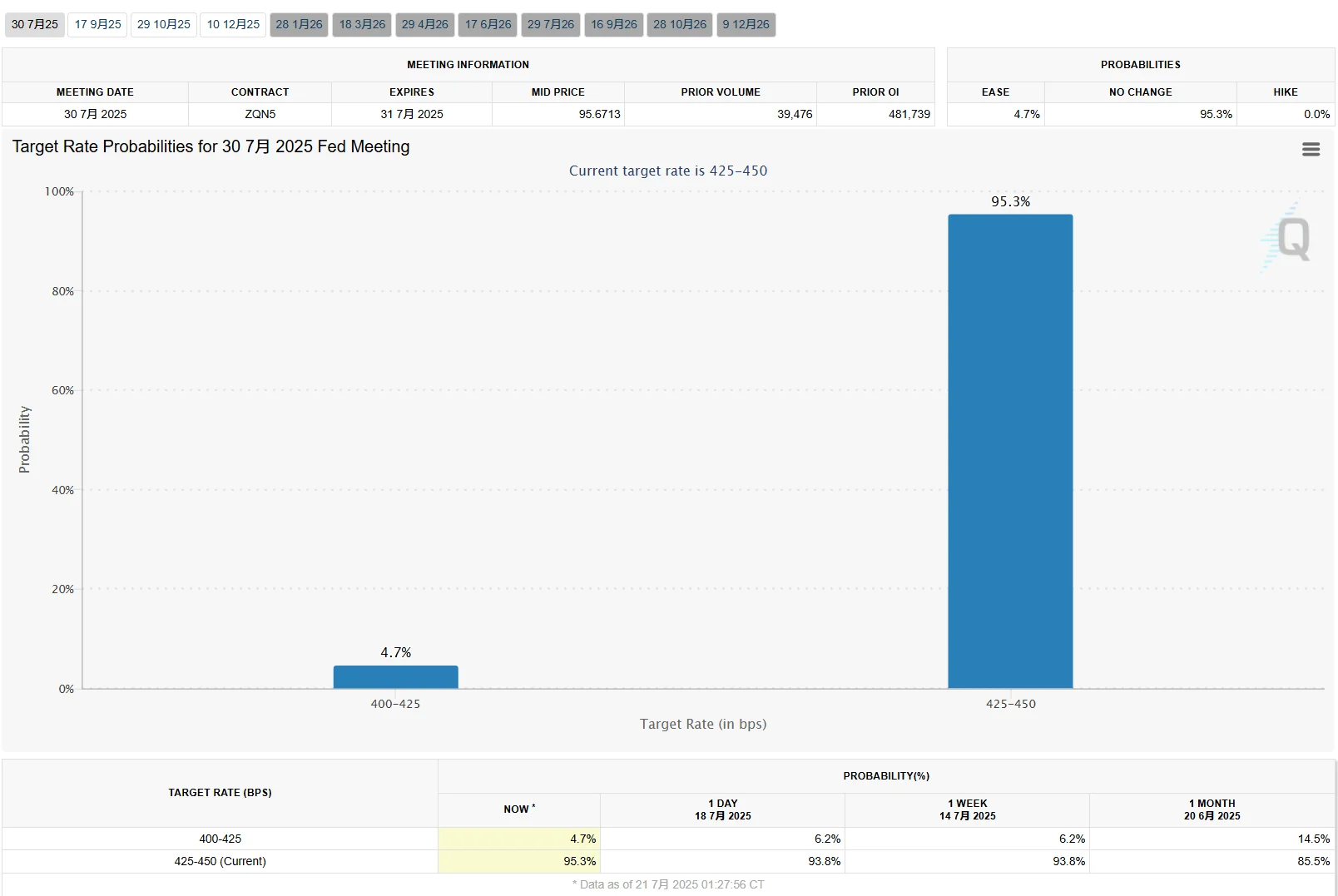

Currently, markets have largely priced out the chance of a rate cut at the Fed’s July meeting. According to the CME FedWatch Tool, there is a 95.3% probability the Fed will hold rates steady, with just a 4.7% chance of a cut. However, the outlook for the September meeting remains uncertain, with markets assigning a 57.8% probability of a 25-basis-point rate cut.

Source: CME

Earnings from the ‘Magnificent Seven’ to Drive Stock Action

Q2 earnings season hits full stride this week, with over 100 S&P 500 companies set to report. All eyes will be on Alphabet (Google) and Tesla, whose results will directly sway tech sentiment. Comments from Elon Musk during the earnings call are expected to impact market views on AI, autonomous driving, and humanoid robotics. Reports from companies like Coca-Cola and General Motors will also shed light on how U.S. corporations are handling tariff pressures.

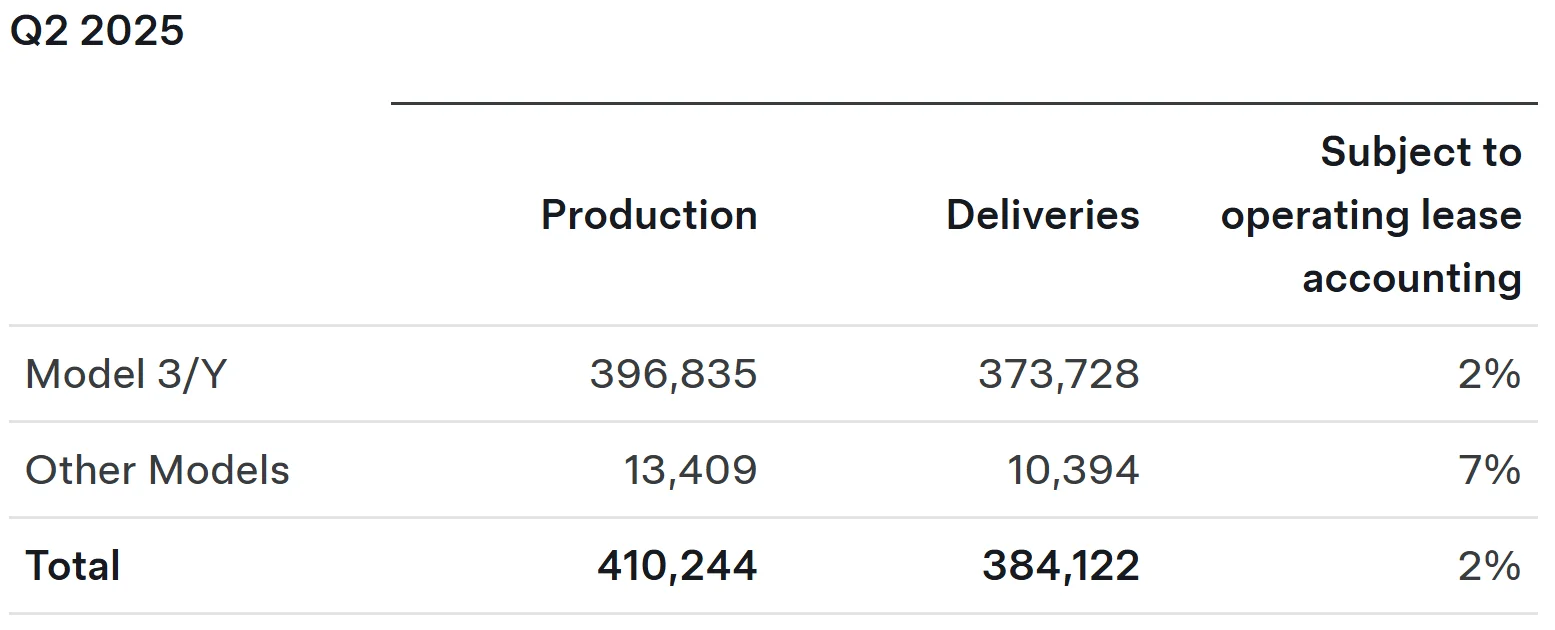

For Tesla, Wall Street estimates Q2 revenue to come in at $22.9 billion, with net income of $1.5 billion. If revenue meets expectations, it would mark a sequential increase from Q1’s $19.335 billion, but a year-over-year decline from Q2 2024’s $25.5 billion.

Source: Tesla

That said, analysts and investors are more focused on Tesla’s forward guidance and any new strategic updates from Musk—particularly on autonomous driving and robotics. Markets will be listening for updates on the Robotaxi and Optimus humanoid robot, both of which Tesla previewed in recent months. Tesla is also set to announce its Optimus mass production plan on July 25, a development that has already fueled a 15% weekly rally in the stock. The specifics of that production roadmap will be closely scrutinized.

Source: TradingView

Trump to Outline AI Vision in Key Policy Speech

On July 23, former President Trump is expected to deliver a major address titled "Winning the AI Race," outlining his vision for maintaining U.S. leadership in artificial intelligence.

According to media reports, the Trump administration is finalizing an AI action plan that originated from an executive order signed just days after Trump’s return to office in January. Sources say Trump may also sign multiple executive orders during the speech to formalize key parts of the plan.

Separately, on July 22, Fed Vice Chair for Supervision Michelle Bowman will join OpenAI CEO Sam Altman for a fireside chat on the impact of AI on banks, businesses, and consumers—discussing how innovation can be fostered within the financial system.

Macro Data and International Talks to Influence Markets

Several key economic indicators are due this week, including the June Conference Board Leading Economic Index (LEI), weekly jobless claims (through July 19), and June durable goods orders. These releases will shape investor sentiment around the U.S. economic outlook.

On the trade front, uncertainty lingers over the U.S.-Japan negotiations, with auto tariffs still a sticking point. Despite optimistic comments from Treasury Secretary Bessent following his visit to Japan, markets remain on edge as the August 1 tariff hike deadline approaches.

Meanwhile, geopolitical risks remain in focus. Iran has agreed to resume nuclear talks with the UK, France, and Germany on July 25 in Istanbul, aiming to avoid the reimposition of international sanctions—a development that could move global markets.

Market Recap

Over the past week, U.S. markets saw choppy action as tariff concerns, inflation data, and the early stages of earnings season intertwined. Despite ending the week with modest gains, the major indexes failed to sustain fresh record highs. Several trading sessions were marked by heightened volatility due to policy uncertainty and mixed corporate earnings.

The S&P 500 Index (SPY) closed at 6,296.79 on July 18, posting a weekly gain of approximately 0.59%. The index hit a high of 6,315.67 and a low of 6,201.59 during the week. While tariff concerns weighed on the market earlier in the week, sentiment improved midweek following benign inflation data and strength in select tech stocks, allowing the S&P 500 to post moderate gains on Wednesday and Thursday before hitting a fresh high on Friday.

Source: TradingView

The Dow Jones Industrial Average closed at 44,342.19, ending the week slightly lower by about 0.07%. It reached a weekly high of 44,571.68 and a low of 43,758.98. The Dow traded relatively flat, gaining 0.53% on Wednesday after producer price index (PPI) data came in cooler than expected. However, losses in bank stocks and ongoing tariff worries led to minor declines earlier in the week.

Source: TradingView

The Nasdaq outperformed, closing at 20,895.56 with a strong weekly gain of about 1.51%. The tech-heavy index posted multiple record closes, particularly on Wednesday and Thursday, driven by resilient performances from chipmakers and major tech names.

Source: TradingView

Stock performance diverged sharply this week. The biggest gainer was Circle, which surged 19.3% on July 16, fueled by investor enthusiasm over its stablecoin business and the upcoming launch of U.S.-style perpetual contracts—spurring interest in crypto-related equities.

Source: TradingView

Tesla rose 3.5% the same day, benefiting from renewed optimism around EVs and AI integration, which drove significant capital inflows. Meanwhile, TSMC ADR climbed over 3% the following day after reporting a 61% jump in Q2 net income and raising its 2025 sales forecast, underpinned by robust AI chip demand.

Source: TradingView

On the downside, several heavyweight tech stocks struggled. ASML tumbled over 8% on July 16 after its CEO expressed caution about 2026 growth, triggering a sharp reevaluation of the company’s outlook. Micron Technology dropped more than 4% on July 15, dragged down by weakness in the broader semiconductor sector.

This week’s market activity was shaped by a mix of catalysts. First, renewed fears over the Trump administration’s proposed “reciprocal tariffs 2.0” raised concerns about trade policy uncertainty—particularly for industries like technology and autos that are heavily reliant on global supply chains. All three major indexes opened the week on a weaker note.

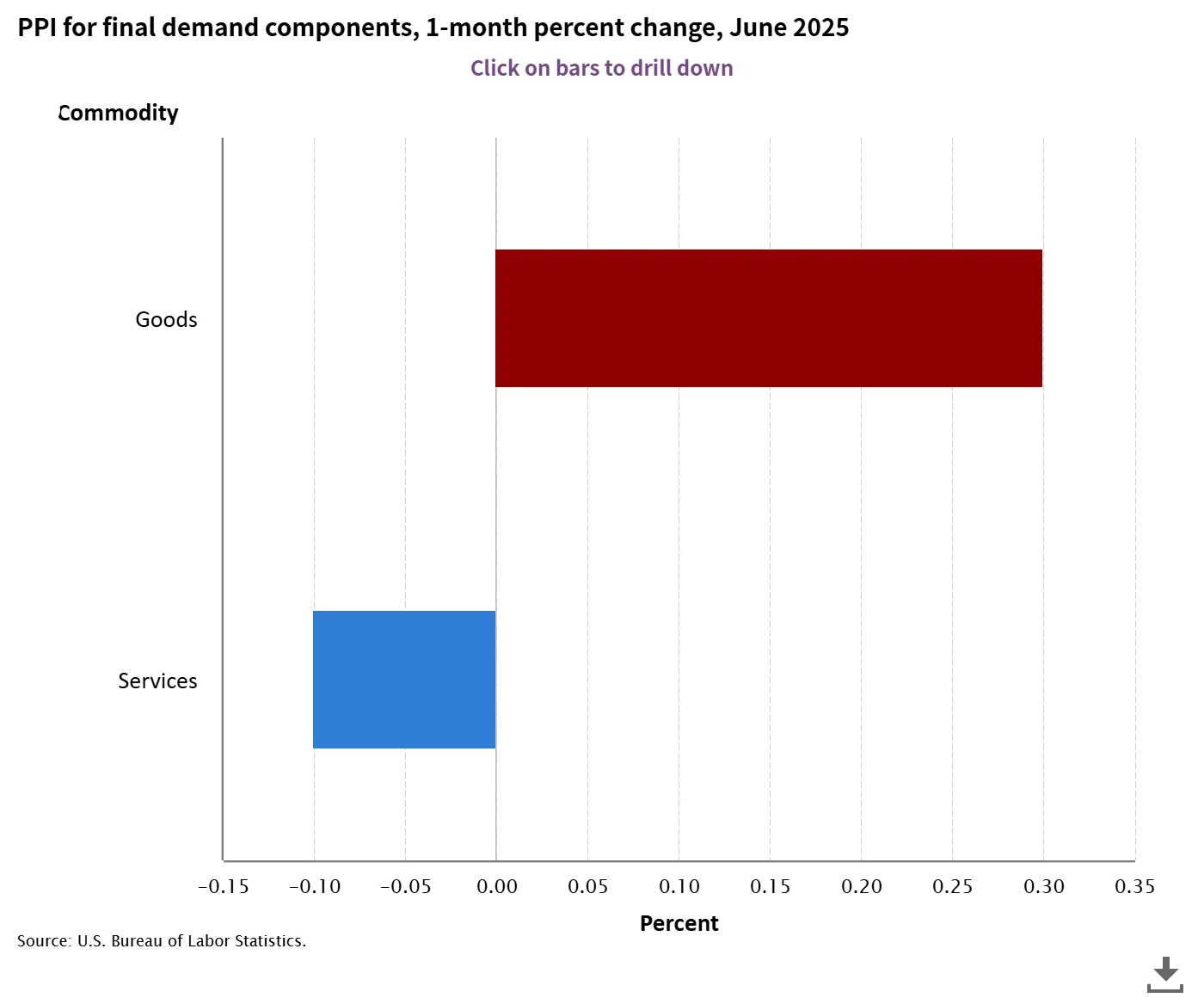

On the macro front, the June PPI came in nearly flat, below expectations, helping to ease inflation fears and lift investor sentiment midweek. However, signs of accelerating consumer inflation pushed Treasury yields higher and limited risk appetite later in the week.

Source: U.S. Bureau of Labor Statistics

Corporate earnings offered a mixed bag, reinforcing stock-specific divergences. Netflix posted a more than 40% surge in Q2 profits but fell after-hours due to valuation concerns. In contrast, TSMC’s solid results and upbeat AI outlook helped spark a rebound in the semiconductor space.

Source: TradingView

From a policy perspective, Trump dialed back comments about potentially firing Fed Chair Jerome Powell, which helped calm concerns about the Fed’s independence. Meanwhile, geopolitical risks remained elevated. Ongoing tensions in the Middle East and global trade friction pushed up market volatility, as reflected in the VIX.

The tech and semiconductor sectors continued to split. AI leaders like Nvidia held up relatively well, while ASML sold off sharply on conservative 2026 guidance. The Philadelphia Semiconductor Index fell nearly 2% during the week, underscoring market uncertainty around the industry’s growth trajectory.

Key Focus This Week

This week, U.S. equity markets are expected to face significant volatility, with several critical drivers warranting close attention.

The second-quarter earnings season enters a dense phase, with results from Alphabet, Tesla, and Intel potentially setting the tone for the tech sector. Tesla, in particular, is highly anticipated due to its exposure to both AI and electric vehicles; however, if earnings disappoint, a sharp pullback could follow.

Ongoing uncertainty surrounding tariff policy continues to weigh on the market. The Trump administration’s tough stance on trade may further fuel investor concerns over sectors such as autos and semiconductors.

Comments from Federal Reserve officials will also influence expectations for the future rate path, especially as inflation trends diverge and bond market volatility persists. Policy continuity will remain crucial under current macro conditions.

Technology and AI remain core market drivers. Following Nvidia’s recent AI-led rally, investors are looking to this week’s tech earnings for confirmation of continued momentum. In addition, new developments in crypto regulation could trigger structural moves in related stocks.

Geopolitical uncertainty also lingers. Tensions in the Middle East and the Russia-Ukraine conflict may elevate market risk aversion and drive the VIX volatility index higher.