In the first quarter of 2025, Berkshire Hathaway, led by Warren Buffett, once again demonstrated its hallmark investment approach: amid elevated valuations and an unpredictable market environment, the company actively reduced its risk exposure, concentrated holdings in core assets, and maintained ample liquidity.

According to the latest 13F filing, Berkshire adjusted its holdings in the financial sector while making marginal optimizations in consumer stocks, alongside retaining a newly initiated position that has not yet been disclosed. Overall, the portfolio strategy continues to reflect the company’s long-standing focus on steady returns and capital preservation.

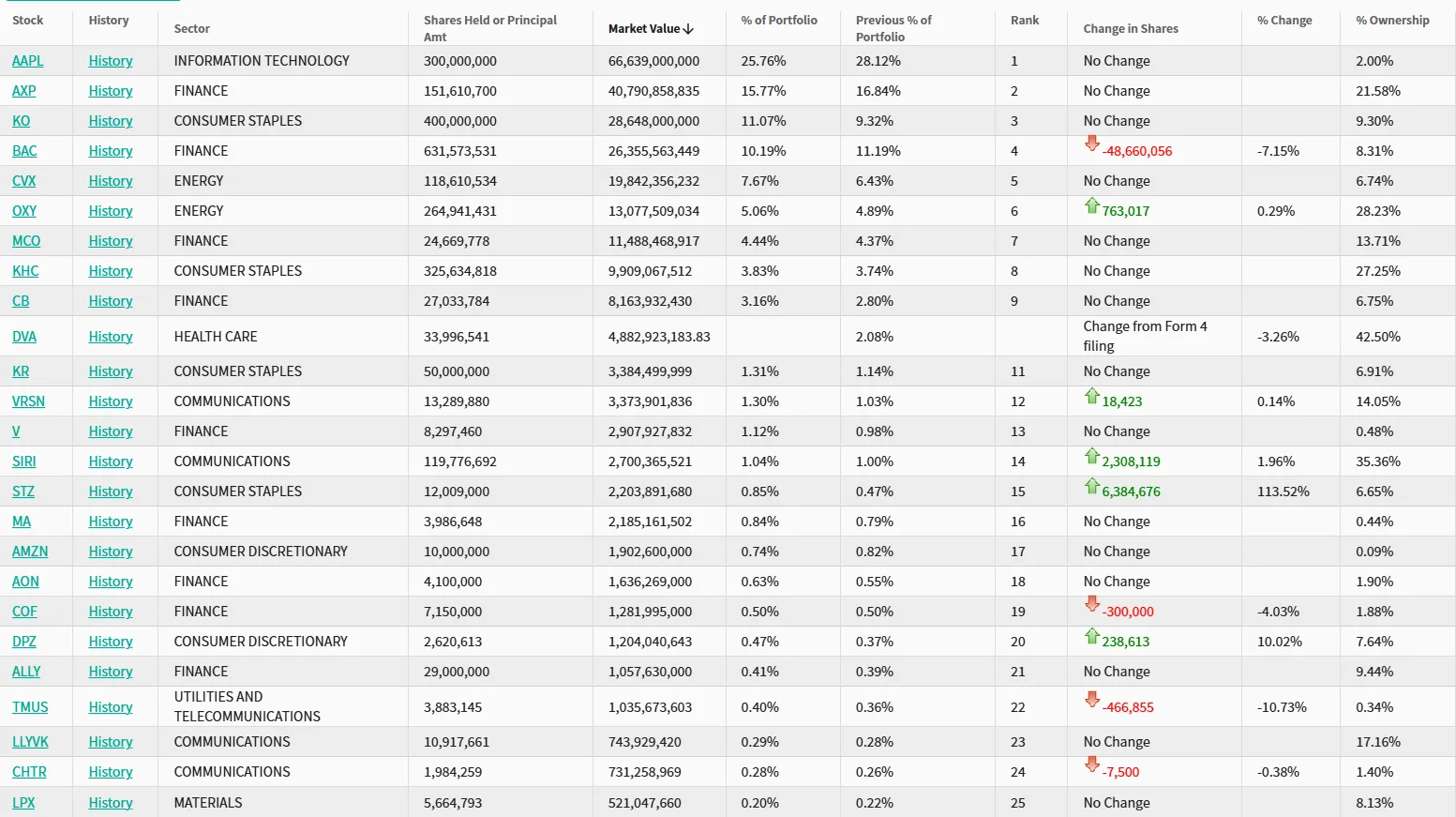

Source: WhaleWisdom

Cuts Bank Holdings

As of March 31, 2025, Berkshire Hathaway’s top 10 holdings accounted for nearly 90% of its total portfolio value, reflecting a stable structure with no significant style shifts. Apple remained the largest single position, with a steady holding of 300 million shares valued at $66.6 billion, representing nearly one-quarter of the total portfolio. Traditional core holdings such as American Express, Coca-Cola, and Chevron also saw no substantial changes, underscoring Buffett’s long-term confidence in brand value and consumer resilience.

In contrast, adjustments in the financial sector were more pronounced. Berkshire trimmed its Bank of America stake by 48.66 million shares, a reduction of 7.15%. This move stands in subtle contrast to Bank of America’s Q1 earnings report — while revenue exceeded expectations, investment banking income fell by 3%, and credit card charge-offs rose to 4.05%, highlighting the vulnerability of traditional banking amid interest rate fluctuations and consumer weakness.

At the same time, Berkshire reduced its position in Capital One Financial by about 4% and completely exited holdings in Citigroup and Brazil’s digital bank Nubank.

This is not the first time Berkshire has systematically reduced exposure to financials. Over the past decade, Buffett has repeatedly cut bank holdings during cyclical peaks or when the sector faced structural challenges. The current reduction signals a cautious view on banks’ profitability and risk amid a high interest rate environment.

Facing regulatory pressures, interest rate volatility, and credit risks, the banking sector’s valuations have pulled back but still lack clear margin of safety.

Boosts Consumer Stocks

This quarter, Berkshire Hathaway made modest increases in its consumer sector holdings. Its stake in Constellation Brands rose by 113%, while the position in Pool Corp., a supplier of pool equipment, grew by 144%. Although these additions represent a relatively small portion of the overall portfolio, they signal Berkshire’s continued focus on structural opportunities within the consumer space.

Constellation Brands holds a strong brand presence in the premium alcoholic beverages market, with well-known names such as Corona and Modelo enjoying widespread global recognition and positive reputation. Amid high inflation and demand polarization, the company’s brand strength and consumer recognition of its premium products provide pricing power that helps maintain competitiveness through changing market conditions.

Pool Corp. benefits from trends in U.S. household asset upgrades and home renovations, sustaining steady growth within its niche. These incremental additions reflect Berkshire’s preference for companies with strong brand moats, stable cash flow, and exposure to structural consumer upgrade trends. In an environment marked by escalating global trade tensions and supply chain cost fluctuations, businesses with stable cash flow and high customer stickiness align with Buffett’s classic principle of seeking “economic moats.”

It is important to note that these increases represent marginal portfolio optimizations rather than aggressive bets on the consumer sector. They more so reflect Berkshire’s strategic consideration for diversification amid macroeconomic uncertainties.

Undisclosed Positions Are in Place

Beyond the visible portfolio changes, Berkshire Hathaway once again filed with the U.S. Securities and Exchange Commission (SEC) for temporary confidential treatment of certain holdings in the first quarter.

Based on past experience, such confidentiality requests are often linked to strategic investments in the process of being gradually built, where the full purchase plan has yet to be completed. This approach allows Berkshire to quietly increase stakes in certain stocks without attracting market attention or driving up share prices. As one of the world’s greatest investors, Buffett’s moves often trigger market follow-on buying. When he favors a stock and intends to accumulate it gradually, confidentiality helps avoid heightened market reactions that could raise the investment cost.

By extrapolating from data disclosed in Berkshire’s Q1 2025 10-Q report, if the confidential holding involves a single stock, the build-up could be valued between $1 billion and $2 billion. Some analysts speculate that the target may belong to non-cyclical industrials, infrastructure, or manufacturing sectors—consistent with Buffett’s preference for “understandable business models” and companies with durable economic moats.

Previously, during Buffett’s accumulation of shares in insurance company Chubb, Berkshire also requested similar confidential treatment, with the holding publicly disclosed in 2024. Before that, similar requests were made when purchasing Chevron and Verizon Communications in 2020.

Cash Reserves Rise

Berkshire Hathaway maintained a high cash reserve strategy throughout the first quarter of 2025. By the end of the quarter, its cash holdings reached $347.7 billion. In an environment characterized by tightening global liquidity and elevated U.S. dollar SOFR rates, such a substantial cash reserve empowers Berkshire to capitalize on market sell-offs, while the increasing cash allocation underscores its defensive stance against potential downside risks.

At the 2025 Berkshire Hathaway Annual Meeting, Warren Buffett remarked that the reason for his substantial profits is that he has never been fully invested. Thus, holding cash is not necessarily a conservative move but rather an active strategic choice. Historically, Berkshire leveraged its cash reserves to execute large-scale acquisitions during market crises — notably during the 2008 financial crisis and the 2020 pandemic sell-off — targeting sectors such as energy and financials, ultimately generating outsized returns.

BRK.A data - Source: TradingView

Over the long term, Berkshire views cash not as a passive hedge but as a key tool to achieve excess returns amid systemic market corrections. This flexible allocation enables the firm to exploit valuation dislocations in extreme environments, patiently waiting for the moment to “be greedy when others are fearful.”

Final Thoughts

Amid rising global market uncertainties, sustained high interest rates, and escalating trade tensions, Warren Buffett and Berkshire Hathaway have refrained from aggressive moves. Instead, they have focused on optimizing portfolio structure, reducing risk exposure, and maintaining flexibility.

For market participants, where noise is frequent and short-term trends volatile, Buffett’s approach serves as a timely reminder: in complex market cycles, the essence of investing remains rooted in rationality, patience, and discipline.