The Market Signals Behind Large Bank Buybacks

03:50 July 18, 2025 EDT

In recent years, stock buybacks have become a key tool in corporate capital allocation, especially in the financial sector. Buyback programs from major banks often reflect a company's strategy to enhance its value while also signaling key market information. In 2024, the total buybacks for companies in the S&P 500 surpassed $942.5 billion, with stock repurchase becoming a core method for shareholder returns, particularly in the current economic climate. Stock buybacks not only reflect a company’s financial health but also signal its expectations for future market trends.

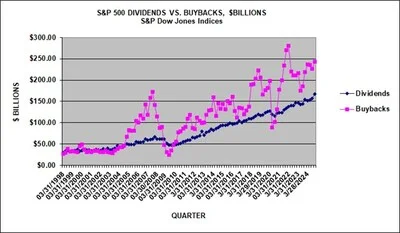

S&P 500 Dividend and Buyback Data Source: S&P Global

In 2025, as interest rates adjust, economic growth slows, and structural changes unfold in the banking sector, large banks like Morgan Stanley, Wells Fargo, and Citigroup have launched significant buyback programs. These buybacks are both a strategy for capital returns and a response to changing market conditions.

So, does this wave of buybacks signal a revaluation of the financial sector, or is it merely aimed at boosting short-term stock prices?

What is Stock Buyback

Stock buybacks refer to a company repurchasing its own shares from the secondary market, with the intention of either canceling the shares or holding them as treasury stock. Since the Trump administration’s corporate tax cuts in 2017, businesses have seen an increase in cash flow, which has fueled the popularity of buybacks. Compared to cash dividends, buybacks reduce the number of outstanding shares, indirectly boosting earnings per share (EPS) and return on equity (ROE). Additionally, buybacks offer a tax advantage since capital gains tax rates are typically lower than dividend tax rates. Moreover, buybacks are more flexible than dividends, as they can be paused at any time and typically cause less market negative reaction when adjusted.

By reducing the number of outstanding shares, buybacks increase the ownership percentage of existing shareholders, with no additional capital expenditures required, potentially boosting future EPS. In theory, large-scale buybacks reduce share supply, which may drive up the stock price in the short term, creating a cycle of “buyback – stock price increase – options exercise – repurchase.”

Recent Buyback Plans

Stock buybacks often directly reflect the market's confidence in the future prospects of a stock or sector. In July 2025, major banks such as Morgan Stanley, Wells Fargo, and Citigroup announced large-scale buyback programs.

Morgan Stanley’s buyback plan is valued at $20 billion, approximately 10% of its market capitalization. This plan signals Morgan Stanley’s optimistic outlook on future market conditions. Currently, investment banking activities, particularly mergers and acquisitions (M&A) and sales transactions, are thriving, and market rotations combined with interest rate fluctuations may further boost trading commissions and financing activities. With interest rates potentially dropping to lower levels by the end of 2025, Morgan Stanley anticipates more M&A opportunities.

Wells Fargo announced a buyback plan of up to $40 billion in Q2 2025. Wells Fargo, which focuses on commercial banking with primary revenue sources including mortgages and credit card products, expects the low point of the credit cycle to be nearing its end. With anticipated interest rate cuts, Wells Fargo’s profitability is expected to improve.

Wells Fargo’s buyback plan reflects management’s recognition of the bank’s stock value, and the increase in buyback scale is expected to further enhance shareholder value, potentially driving up stock prices.

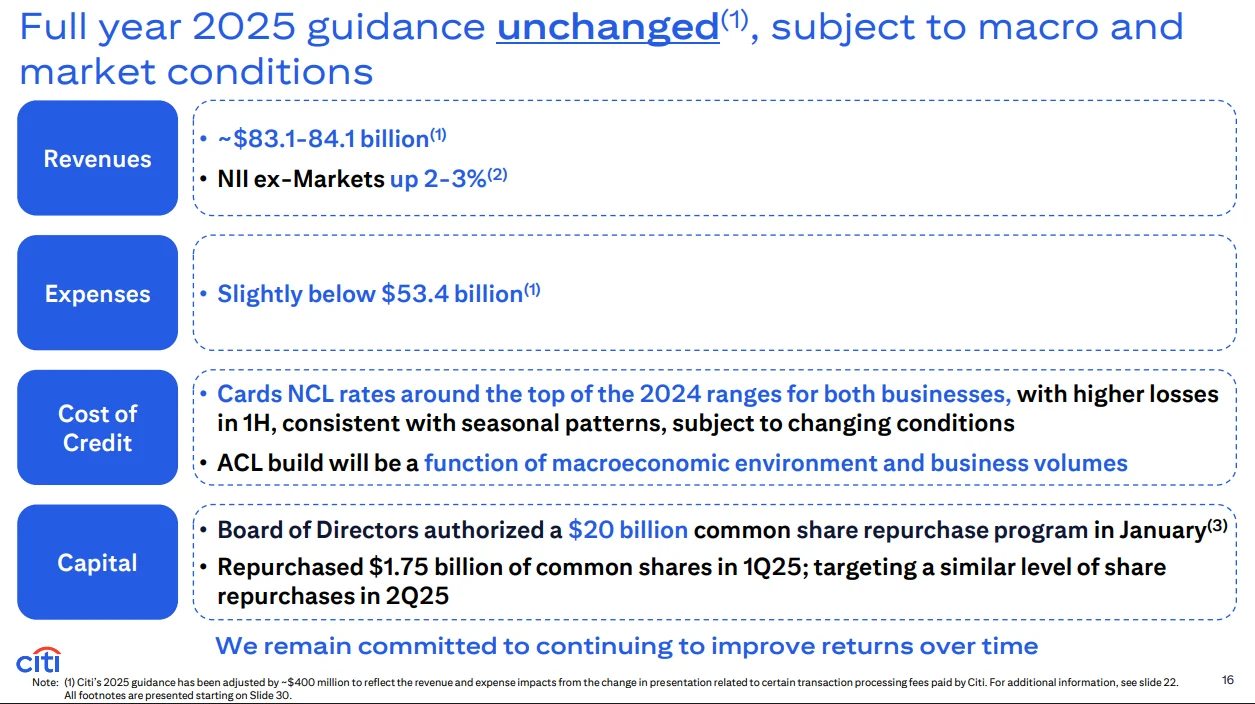

Citigroup’s buyback plan, valued at $20 billion, aligns with the strong momentum of its stock price. As a large bank combining both investment banking and commercial banking businesses, Citigroup benefits from diversified revenue sources, enabling it to perform well in the current complex market environment.

Source: Citigroup

These plans are in line with the Federal Reserve's stress test results in July 2025, which showed that banks’ average Common Equity Tier 1 (CET1) capital ratio was 11.6%, well above the 4.5% minimum requirement, reflecting strong risk resilience.

Can Buybacks Serve as a Pricing Signal?

Buybacks can reflect management's confidence in the stock's undervaluation and future earnings growth. In Q1 2025, S&P 500 companies repurchased $283 billion worth of shares, a 24% year-over-year increase, with the financial sector contributing $200 billion. Historical examples show that the $200 billion buyback in 2023 boosted the S&P 500 banking index by 15% over three months; in Q2 2024, Citigroup's $5 billion buyback increased its price-to-book (PB) ratio from 0.8x to 1.0x. Additionally, the 2025 stress tests and the U.S. loan growth forecast of 5%-6% further support the revaluation of the industry.

However, concerns have emerged due to a disconnect between buyback growth and profit growth. From 2010 to 2020, S&P 500 buybacks grew from $298 billion to $519 billion, while profit growth lagged behind. In 2017-2018, EPS and buyback growth were 40% and 37%, respectively, while net income growth was just 6%.

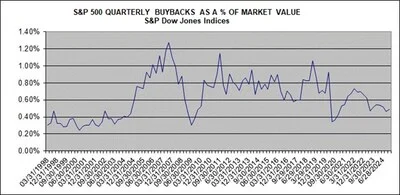

S&P 500 Quarterly Buybacks as Percentage of Market Cap Source: S&P Global

This indicates that buybacks may be masking underlying weakness, especially when capital expenditures and R&D are reduced. Over-reliance on buybacks may undermine long-term competitiveness, as funds are diverted from innovation or acquisitions to repurchases. While it may provide short-term stock price support, it lacks fundamental backing and presents risks to long-term investors.

Executive compensation linked to EPS or stock prices may incentivize companies to buy back shares at certain times to boost short-term financial performance, but this could overshadow the need for long-term business development and innovation. For example, after the Silicon Valley Bank crisis in 2023, buybacks helped stabilize valuations, but aggressive buybacks before the crisis left some banks with insufficient cash reserves, requiring government bailouts. Similarly, Citi's buyback at the onset of the pandemic still saw its stock drop by 20%, as the market focused on the potential impact of economic recession on asset quality.

Moreover, buybacks, as net buying activity, can stabilize market sentiment during periods of monetary tightening or foreign capital outflows, helping to alleviate downward pressure. However, if buybacks are driven by weak fundamentals rather than earnings growth, they may create valuation bubbles and distort the market's price discovery function.

Industry-Specific Dynamics

The recent surge in stock buybacks within the financial sector aligns with the steepening of the yield curve and the stability of credit quality. A January 2025 report by Angel Oak Capital Advisors notes that lower interest rates toward the end of the year could improve net interest margins. However, trade tariffs and the final implementation of Basel III regulations may raise capital costs, limiting the sustainability of buybacks.

J.P. Morgan's 2025 outlook highlights increasing sectoral differentiation, with the financial industry benefiting from buybacks and mergers and acquisitions (M&A) activity. However, competition in non-bank loans and challenges in commercial real estate lending may pose risks for regional banks. In 2025, the S&P 500 has authorized $750 billion in buybacks, with around $200 billion allocated to the financial sector. But, as AI investments in the technology sector are expected to absorb funds by the end of the year, this could impact the sustainability of buyback activities.

Large buybacks by major banks in 2025 may serve as a strong signal of sectoral repricing, supported by solid capital ratios, stress-test results, and expected profit growth. However, investors should assess the alignment between buybacks and underlying fundamentals, as excessive reliance on them could signal short-termism.

Moreover, investors should pay close attention to the progress of Q2 2025 earnings season. JPMorgan is scheduled to release its earnings on July 15, marking the official start of the earnings season. This will provide more detailed data on industry earnings performance and the sustainability of buyback activity, which is crucial for evaluating the investment outlook for the financial sector.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates