June Non-Farm Payrolls Exceed Expectations, Potential Delay in Fed Rate Cut

03:46 July 18, 2025 EDT

Key Points:

1. In June, seasonally adjusted non-farm payrolls increased by 147,000, surpassing the expected 110,000. The unemployment rate fell to 4.1%, lower than the expected 4.3% and May’s 4.2%.

2. Various indicators show that while certain sectors and businesses face pressure from layoffs, the overall resilience of the labor market remains intact.

3. The Federal Reserve is unlikely to make an immediate policy response to the slowdown in employment growth and will await further evidence. Currently, market traders have almost entirely abandoned bets on a rate cut at the July meeting.

Following the release of the June non-farm payroll data, expectations for a rate cut at the Fed’s July meeting have cooled significantly. This stronger-than-expected report signals continued resilience in the U.S. labor market. Despite uncertainties stemming from the trade and immigration policies of the Trump administration, business hiring activity has not yet shown signs of systemic decline. This provides the Fed with more time to remain on the sidelines and assess the delayed effects of policy actions on the economy.

Unemployment Rate Drops

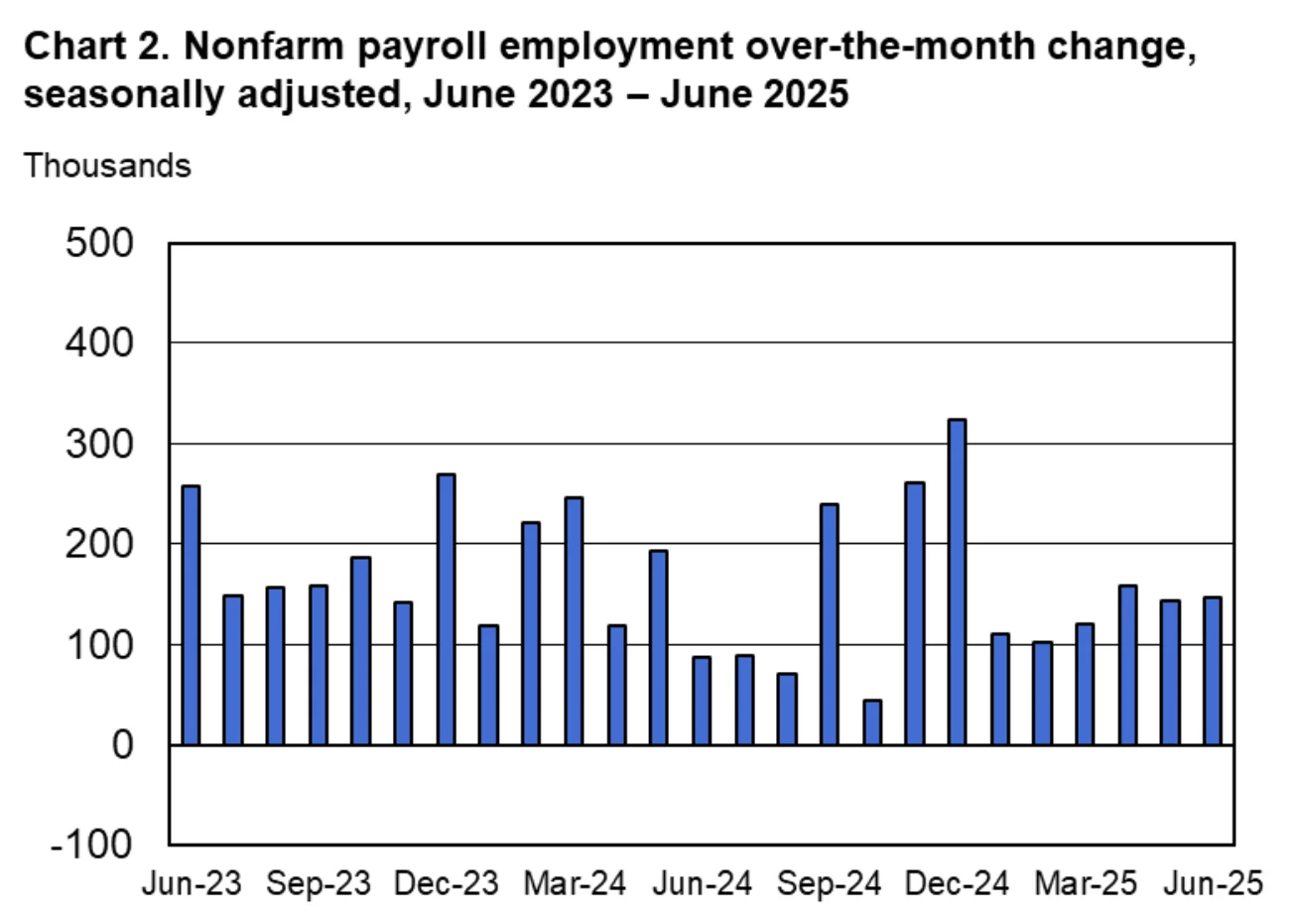

According to the U.S. Bureau of Labor Statistics, non-farm payrolls increased by 147,000 in June, significantly higher than the expected 110,000, and above the revised May figure of 144,000.

Source: U.S. Bureau of Labor Statistics

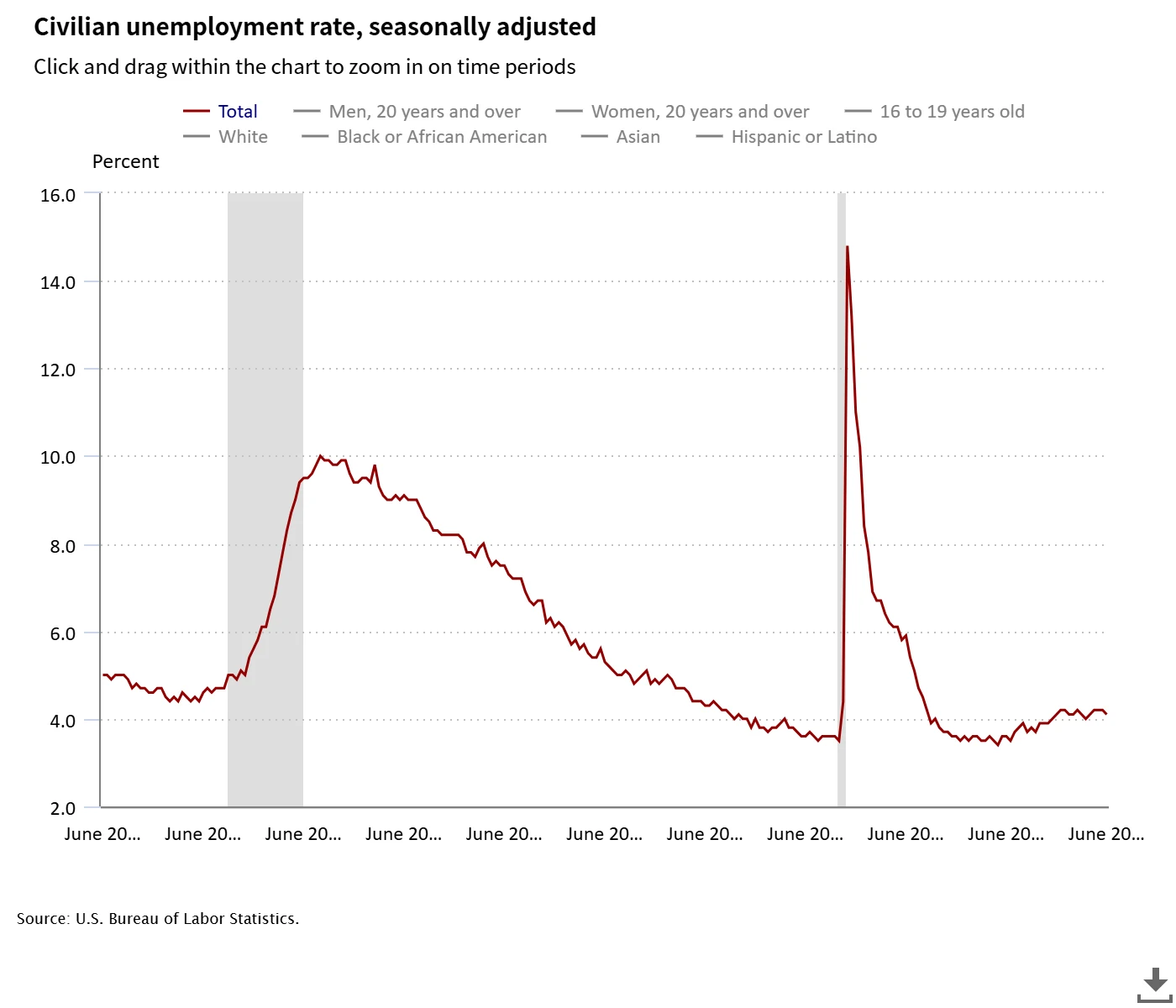

Meanwhile, the unemployment rate dropped to 4.1% in June, below the expected 4.3%, marking the lowest level since February. This indicates that the labor market has not shown significant signs of weakness.

Source: U.S. Bureau of Labor Statistics

Average hourly earnings rose by 0.2% month-over-month, with a year-over-year increase of 3.7%, showing moderate growth that helps ease concerns about persistent inflation.

By sector, government employment saw strong growth, adding 73,000 jobs, with notable contributions from state and local education positions. The healthcare industry added 39,000 jobs, and social assistance roles grew by 19,000. In contrast, the private sector added only 74,000 jobs, the lowest since October 2023, with most of the gains concentrated in healthcare. Federal government employment fell by 7,000 due to layoffs.

This disparity suggests that while overall job creation remains positive, momentum in private sector hiring is weakening, possibly reflecting businesses' caution amid policy uncertainties.

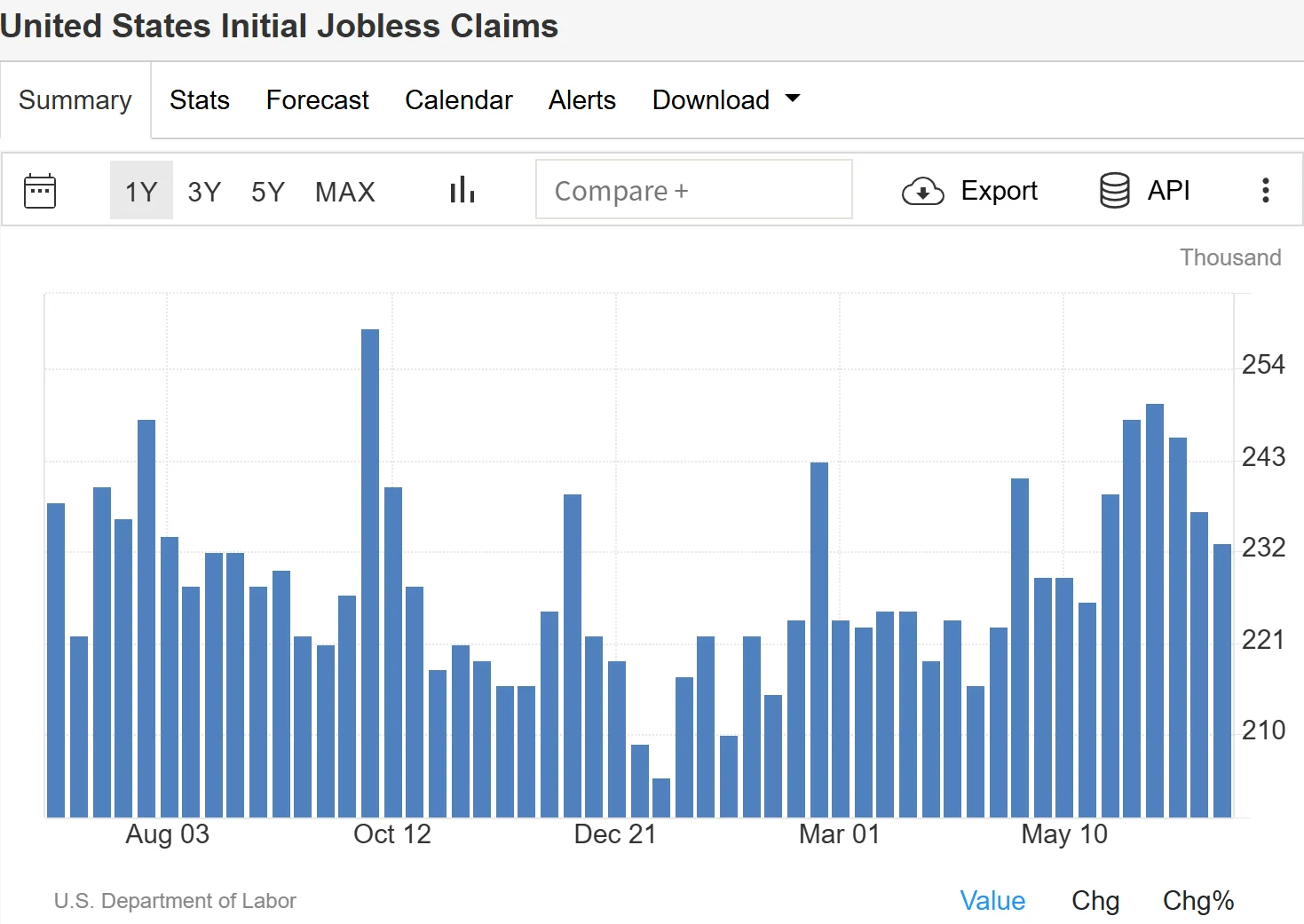

The U.S. Department of Labor also reported on Thursday that initial jobless claims for the week ending June 28 fell to 233,000, a decrease of 4,000 from the previous week and lower than the expected 240,000. This marks the second consecutive week of declining claims, signaling that while economic growth is slowing, overall layoffs remain moderate, and the labor market retains significant resilience.

Source: Trading Economics

Initial jobless claims, as a high-frequency indicator, typically provide a quick snapshot of how businesses are adjusting labor in response to macroeconomic changes. The current figure is still far below levels seen during the 2008 financial crisis or the 2020 pandemic, suggesting that businesses have not yet begun large-scale workforce reductions.

Labor Market Indicators Split

Despite the strong June non-farm payroll data, other labor market indicators show some signs of weakness. On Wednesday, the ADP report revealed that private sector employers unexpectedly cut 33,000 jobs in June, marking the first private sector layoffs since March 2023.

Source: ADP

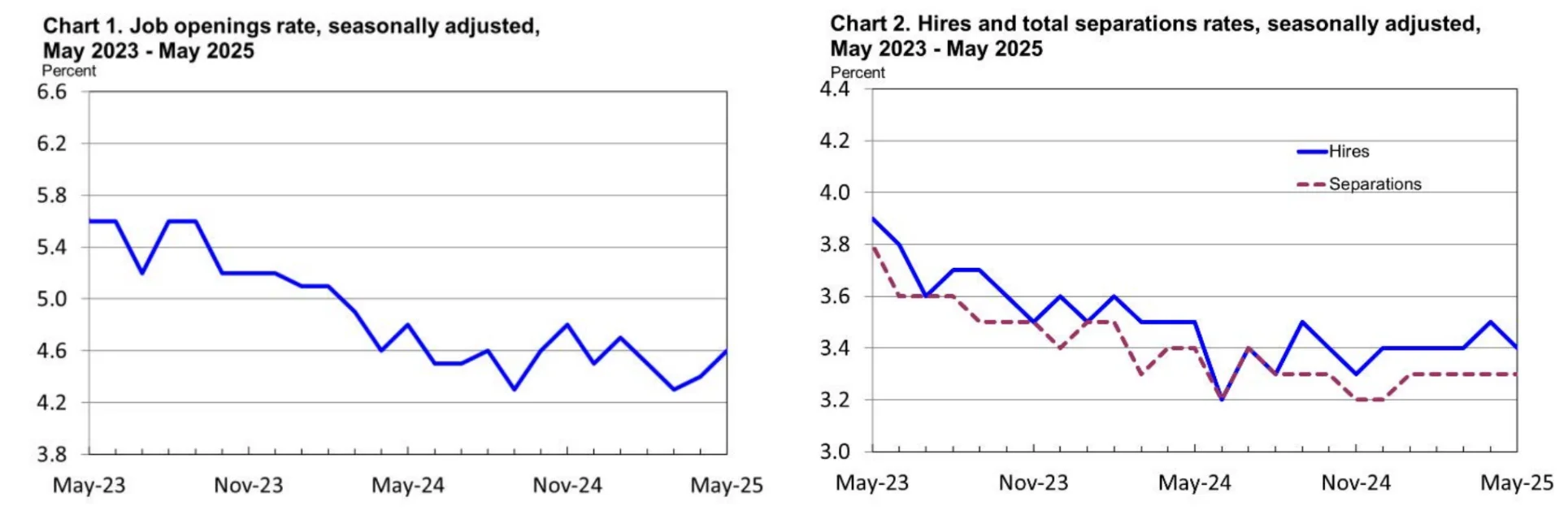

However, despite signs of layoffs and an increase in unemployment claims, the data does not point to a broad slowdown in the labor market. The U.S. Department of Labor’s May Job Openings and Labor Turnover Survey (JOLTS) showed that, as of the end of May, job openings remained at their highest level since November 2024. Additionally, the quit rate and hiring rate are near their lowest levels in a decade, indicating that there is still a degree of tightness and demand in the labor market.

Source: BLS

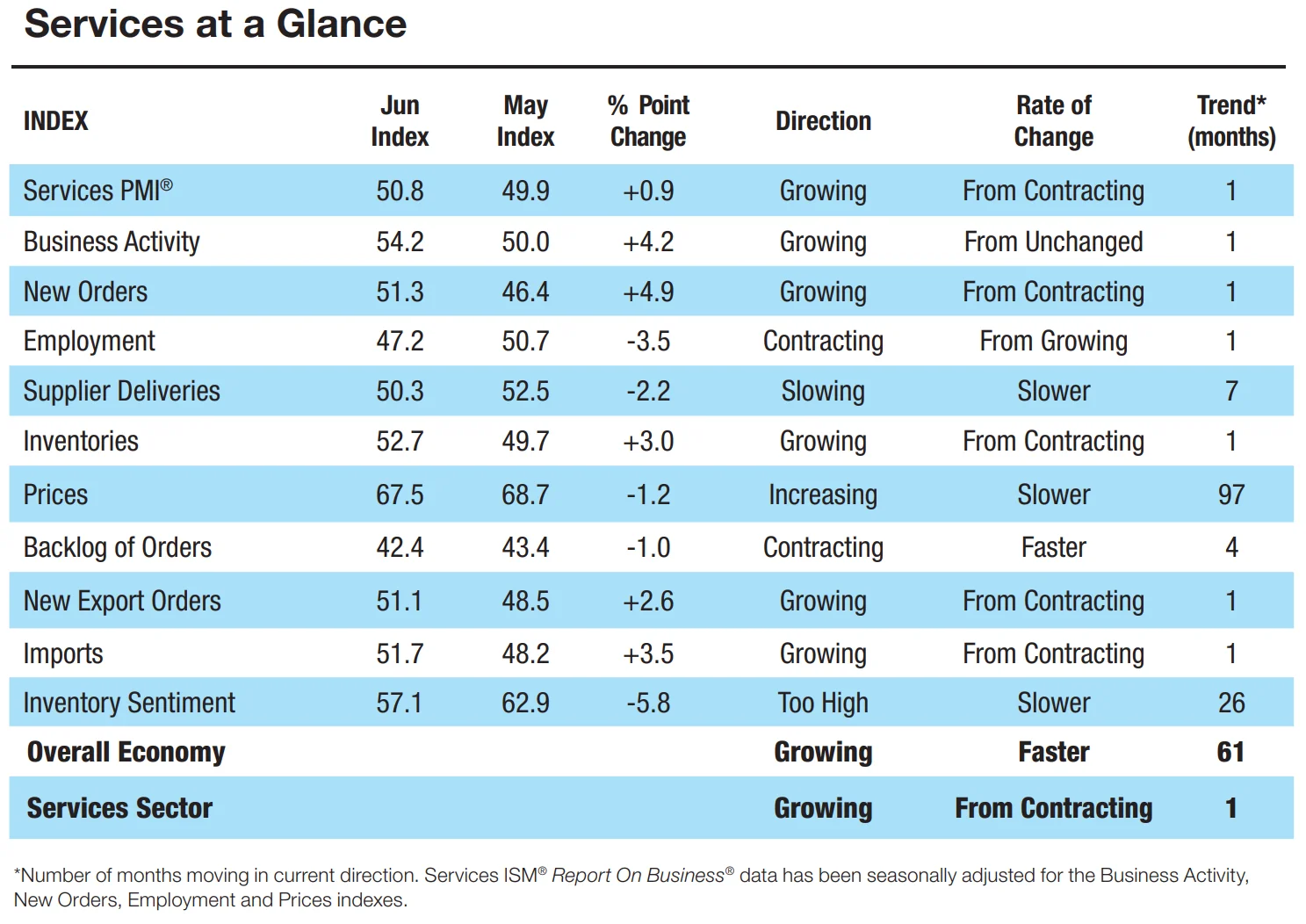

Furthermore, the June ISM Non-Manufacturing Index came in at 50.8, slightly above the expected 50.5, indicating a slow expansion in the services sector. However, the employment component contracted, aligning with the weaker private sector results from the ADP report.

Source: ISM

These data points show that, while certain sectors and businesses are facing layoffs, the overall resilience of the labor market remains, especially in high-demand areas such as healthcare and government sectors. This localized slowdown suggests that the Federal Reserve may face a more complex decision-making environment, requiring close monitoring of various data and policy impacts.

Fed Not Rushing to Ease Policy

Nick Timiraos, a reporter from The Wall Street Journal, often referred to as the "New Federal Reserve Press Secretary," pointed out that Federal Reserve officials are closely monitoring structural changes in the labor market, particularly the unemployment rate, rather than just focusing on the pace of job growth. Due to tighter border policies, which may technically limit job growth, changes in the unemployment rate are seen as a more accurate reflection of real labor demand.

Timiraos believes that when job growth slows but the unemployment rate remains stable, it may indicate that the supply of labor is declining faster than demand is falling. The current situation appears to align with this pattern. Therefore, the Fed is unlikely to respond immediately to the slowing pace of job growth and will wait for more evidence.

Federal Reserve Chairman Jerome Powell emphasized this week that the economy is "gradually cooling," but has not yet experienced "unexpected weakness." He stated that officials would continue to monitor economic data over the summer, particularly in relation to inflation and employment performance.

Recently, other Federal Reserve officials have also adopted a more cautious stance. Atlanta Federal Reserve President Raphael Bostic noted that the U.S. may be entering a period where high inflation could permeate consumers’ and businesses' psychology. He believes that companies will need a considerable amount of time to adapt to trade and policy changes and should not rush to loosen monetary policy.

He further emphasized that the adjustments from changes in trade and geopolitical developments will be slow and complex, rather than a one-off short-term shock as described in textbook models. This process may take a year or longer.

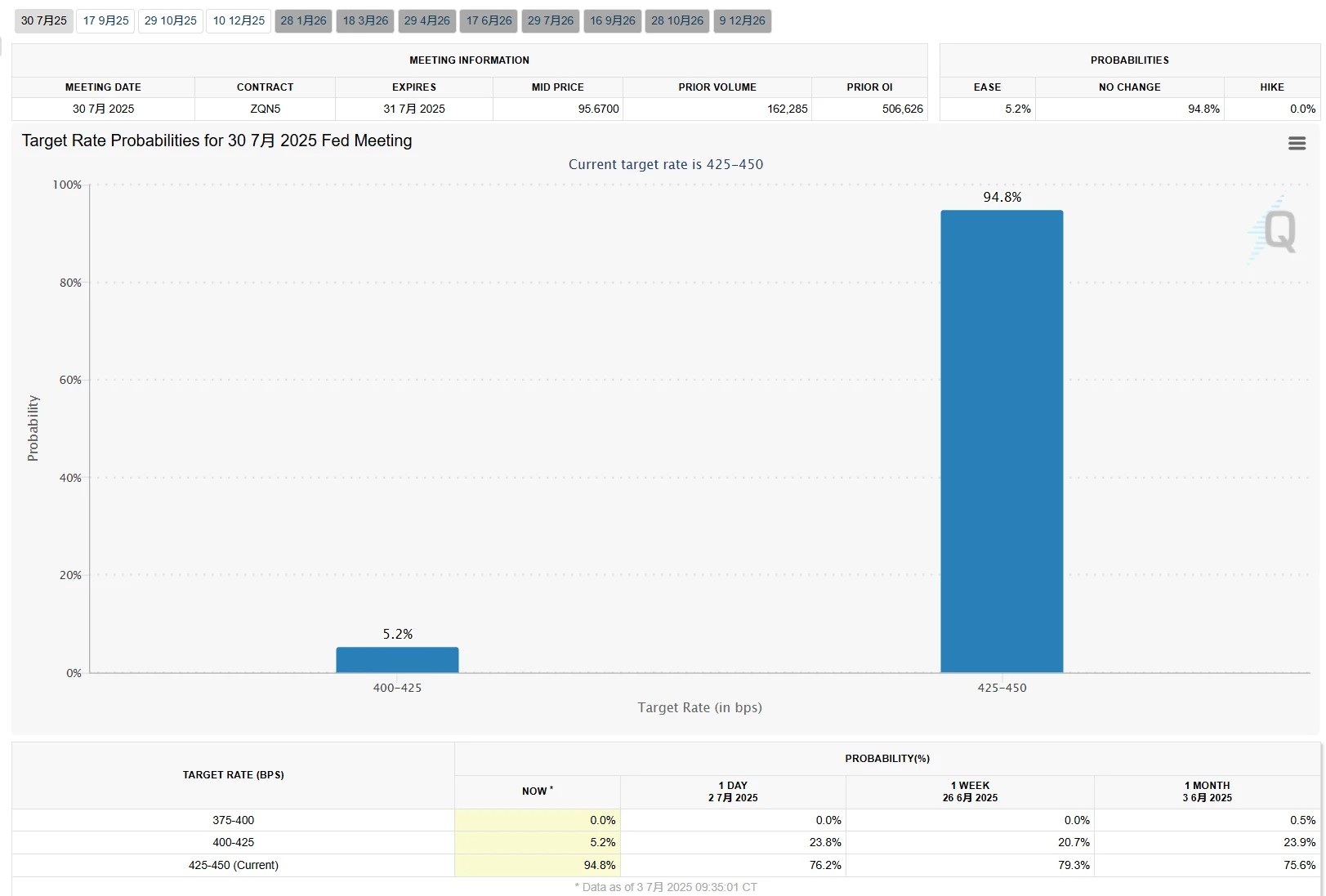

Market Cuts Rate Cut Expectations

Following the release of the employment data, market expectations for a rate cut in July were significantly reduced. According to the CME FedWatch Tool, the probability of maintaining the current interest rate in July has risen to 94.8%, with the likelihood of a rate cut now only 5.2%. Just a day prior, the probability of a cut stood at 23.8%. Traders have nearly completely abandoned bets on easing during the July meeting.

Source: CME

Gregory Faranello, Head of Interest Rate Strategy at AmeriVet Securities, noted that this employment report gives Powell more room for policy patience. The Fed is expected to experience a quiet summer.

While a rate cut in July now seems highly unlikely, the market still anticipates a rate cut in September as part of its baseline scenario. Currently, Federal Funds futures show a 70% probability of a rate cut in September, down from 98% before the report. The interest rate swaps market is pricing in a 50 basis point rate cut by the end of the year, aligning with the median of the FOMC’s dot plot. Prior to the non-farm payroll data release, the market had priced in a near 70 basis point rate cut for the year.

In the coming months, the market will be increasingly sensitive to every employment and inflation report. The Federal Reserve is likely to initiate a new round of easing only if there is clear evidence of a significant slowdown in economic activity, a sustained rise in unemployment, or inflation falling substantially below the target. For now, the Fed remains in a "data-driven" mode, exercising patience and waiting for more evidence.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates