Amazon's next wave of growth

21:13 July 18, 2025 EDT

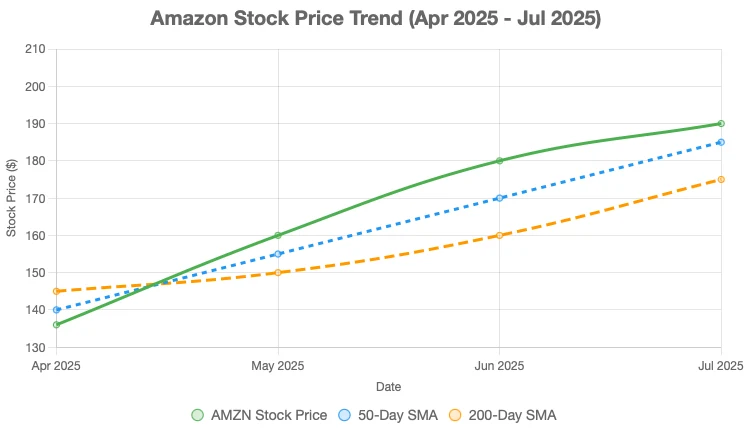

Amazon has shown a strong breakthrough trend since the low point in April, with a cumulative increase of nearly 40%, and is now approaching the historical high set in February this year. Judging from the current technical chart, this rebound has not yet peaked, but is accumulating new momentum.

For investors, this sends a positive signal: Amazon still has a lot of room for upside, especially for long-term funds, it is still one of the few technology blue chips worth holding firmly.

The core of this trend is the fundamentals that continue to exceed market expectations. The company has achieved earnings exceeding expectations for several consecutive quarters. The latest financial report in May shows that both AWS cloud business and overall operating profit have maintained strong growth. Although the performance guidance mentioned in the financial report is slightly conservative, the market did not over-interpret it, but quickly repaired the sentiment, and mainstream institutions are generally optimistic about its future trend.

Now, the market is focusing on the next financial report to be released at the end of July. On the basis of previous high growth, Amazon faces considerable pressure to realize profits, and investors expect it to deliver an answer sheet that exceeds expectations again to further consolidate the current valuation.

Amazon's next round of growth

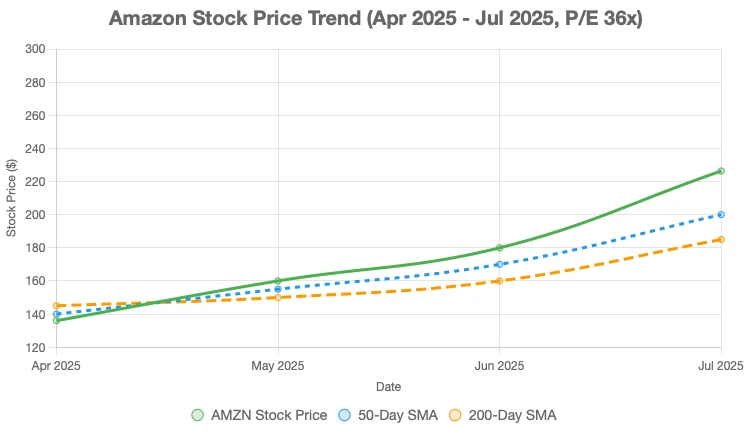

Amazon's current valuation level may be the most easily overlooked but most noteworthy trump card in its long-term bull market.

Currently, the stock's price-to-earnings ratio is only 36 times, far below the average level of the past few years. In contrast, Amazon's price-to-earnings ratio was around 46 times last year, and two years ago, this figure was even as high as three digits. The continued compression of valuations has provided a more cost-effective entry window for long-term investors who are currently interested in layout.

It is worth mentioning that this valuation decline is not due to a slowdown in growth. On the contrary, Amazon is still maintaining healthy expansion in multiple high-profit margin tracks, and AWS business is still the key engine of the company's profitability. Against the backdrop of continued improvement in earnings and steady increase in profit margins, the current valuation level is not only not expensive, but rather quite reasonable.

Compared with other large-cap tech stocks with slowing growth, Amazon's valuation is no longer out of reach, but has returned to rationality after its performance has been realized. For medium- and long-term funds, this is a typical scenario of "buying high-quality assets at a reasonable price."

Wall Street's bullish reasons

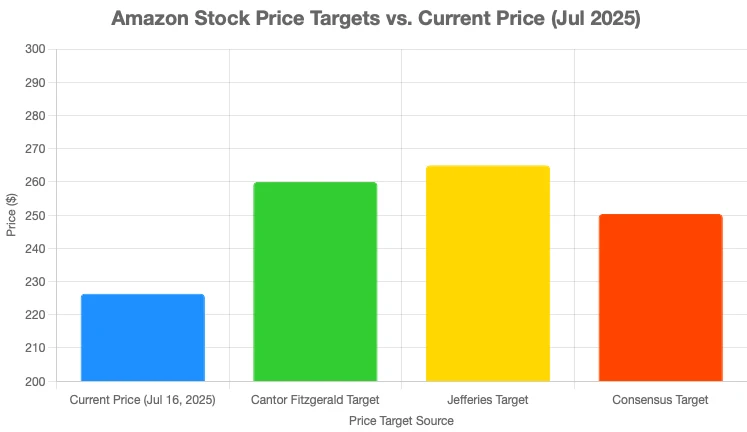

The reasons for being bullish on Amazon are not only fundamentals, but also the strong optimism of analysts behind it, adding fuel to its long-term potential.

This week, two heavyweight Wall Street institutions - Cantor Fitzgerald and Jefferies - both reiterated their "buy" ratings on Amazon and raised their target price to $265. This price represents a nearly 20% upside compared to Wednesday's closing price. For a super giant with a market value of $2.4 trillion, such upward expectations are unusual.

Once this target price is achieved, Amazon's stock price will not only surpass its historical highs, but also strengthen its image as "one of the few technology leaders that is still breaking through and whose valuation has not yet been overdrawn." In other words, when most large-cap tech stocks have entered a phase of value consolidation, Amazon still maintains growth momentum and valuation flexibility, becoming a rare "offensive and defensive" target favored by institutions.

Strong fundamentals

Currently, market sentiment is high and Amazon's stock price is rising, but the next financial report to be released at the end of July will undoubtedly be a key node. After several months of strong gains, investor sentiment has become sensitive, and any negative signals in the financial report, involving AWS business or uncertainty in forward guidance, may cause sharp fluctuations.

AWS remains the core pillar of Amazon's profit structure. It is this business that drove the company's overall earnings and operating profits to exceed expectations in May. However, if its growth rate slows or management's statement on the outlook for corporate spending appears conservative, the market attitude may instantly turn from optimism to caution.

Even so, Amazon has not been without challenging quarters. With its huge business volume, high stickiness of products and services, and global influence, the company still has strong resilience. For long-term investors, these characteristics constitute a solid fundamental moat, which is enough to provide sufficient downside buffer in the face of short-term fluctuations.

Technical aspect

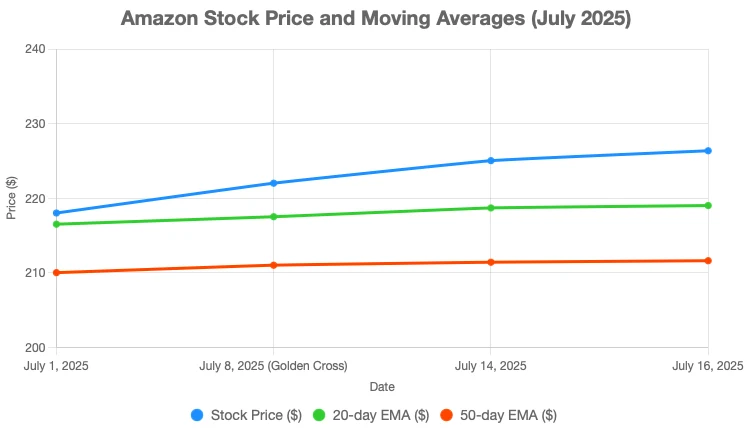

In technical analysis, the "golden cross" is considered to be one of the important signals for judging the mid-term trend of stocks. Specifically, when the short-term moving average (such as the 20-day moving average) crosses the long-term moving average (such as the 50-day moving average), it usually means that market sentiment is undergoing a positive shift. Especially in the current situation where the cross is accelerating, it often indicates that the bullish trend may continue to expand in the coming weeks or even months, driving the stock price further up.

Take Amazon as an example. Although the market response to this year's Prime Day promotion was mediocre, it did not curb the upward trend of the stock price at all. At present, its stock price is close to 91% of its 52-week high. The technical pattern of "golden cross" strengthens the expectation of rising, and it is even expected to challenge the historical high.

For this reason, some institutional investors regard the recent small correction as a good opportunity to increase their positions. Truist Financial analyst Youssef Squali firmly reiterated his "buy" rating on Amazon and set the target price at $250. This means that from the current stock price, the stock still has more than 14% room for growth.

This bullish atmosphere in the market is also reflected in short-selling behavior. Data shows that in the past quarter, Amazon's short position has dropped from $18 billion in the first quarter to the current $13 billion. This covering trend means that many bears have chosen to withdraw from the battlefield, clearing important obstacles for the stock price to continue to rise.

From the perspective of technical signals, fundamental support, or changes in the market's capital structure, Amazon's current upward momentum has solid support. Even in the face of short-term disturbances such as tariff pressure and weak promotions, Amazon still demonstrates strong resilience and market appeal, and remains worthy of investment for mid- and long-term investors.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates