A different picture emerges

23:44 July 17, 2025 EDT

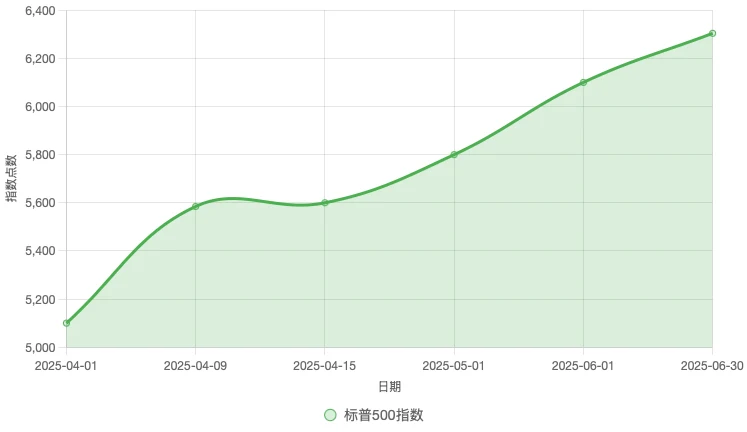

Even with the growing voices that "American exceptionalism is dead," the current trend of the U.S. stock market still suggests that a bull market seems to be coming. Entering 2025, market sentiment has experienced a dramatic reversal. Unpredictable trade policies, rising government debt, and downward pressure on the dollar - this series of macro concerns have shaken the United States' long-standing market leadership. From April to May, the stock market experienced a sharp correction, further fueling the atmosphere of public opinion that "American exceptionalism is declining." This pessimistic view has become more popular as the performance of the seven technology giants lags far behind the market.

On April 2, President Trump announced the "Liberation Day" tariff plan, which became the fuse of this round of selling. Almost all industries were affected, and the market quickly fell nearly 20% from its high point, officially entering the technical retracement range. In the face of violent fluctuations, the media is eager to give explanations, interpreting the correction after the strong rise of US stocks in the past two years as a signal of bubble bursting, and creating a pessimistic market atmosphere. Pinebridge Capital, Standard Chartered Bank and iA Global Asset Management have successively voiced that global capital is accelerating to leave the United States, and the era of "American exceptionalism" may end. Alain Bokobuza of Societe Generale even bluntly stated that if market confidence continues to waver, it is not ruled out that funds will withdraw from US stocks for a long time.

At the same time, due to the depreciation of the US dollar, the downward trend of the US dollar index has caused international investors to face a "double kill": not only the stock price has fallen, but the conversion of the local currency against the US dollar has also reduced returns. The multi-directional negative correlation signal has caused the performance of the US dollar and US assets to soar.

This round of US dollar correction actually occurred on the basis of last year's substantial appreciation. From a medium- and long-term perspective, the bullish trend of the US dollar has not been reversed. This is more like a technical adjustment.

In the European market, it is true that with the rebalancing of global capital allocation, the performance of European stocks this year has temporarily outperformed the United States, but does this constitute evidence of the "end of the US financial market"? Not necessarily. What we need to know is that the cyclical impact of market sentiment and political events cannot be simply equated with the strength of a country's capital markets.

A different picture emerges

Despite concerns about the decline of American exceptionalism, debt and deficits, a weak dollar, and tariffs, the stock market has rebounded from its April lows with unexpected strength. Leading the way are the very stocks that the pessimistic media declared dead.

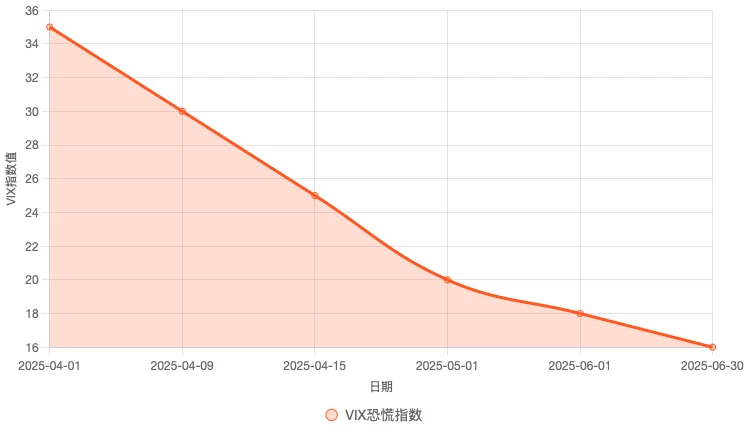

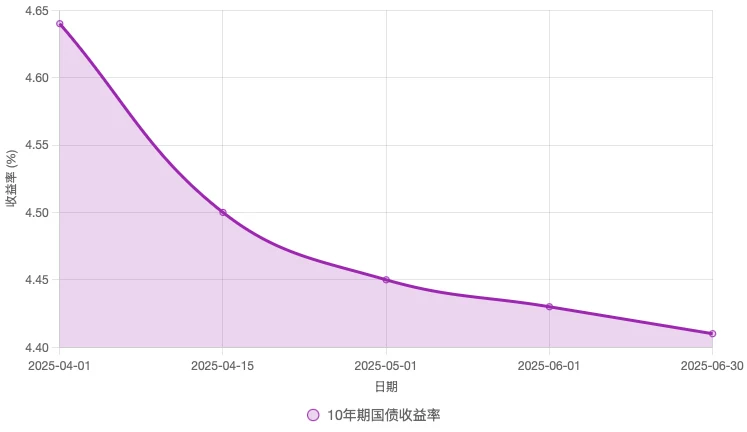

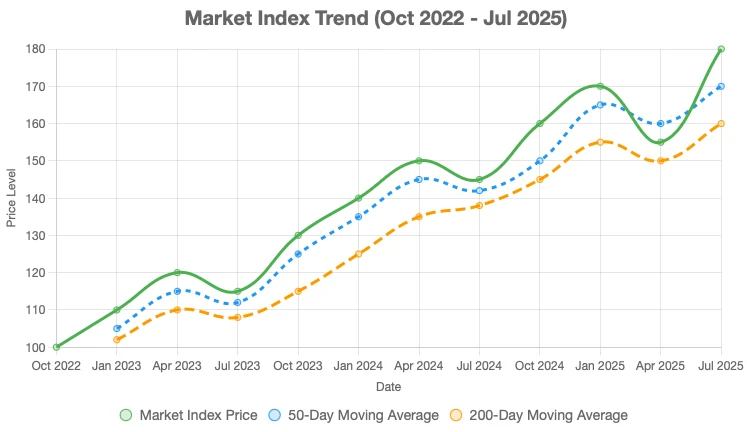

The technical situation of the stock market is in stark contrast to pessimistic expectations. By mid-April, after several days of heavy losses, the market rebounded strongly. The 90-day tariff truce announced on April 9 triggered a 9.5% increase in the S&P 500 index in a single day, the largest single-day gain since 2008. Although inflation remains high and bond yields are as high as 4.5%, the market has held the key support level of the 200-day moving average, indicating that the pullback phase is over.

Most notably, the "double stock pain trade" further supported the stock market's rise. Many institutional investors cut their US holdings in April, leading to a reduction in positions, which stimulated counter-trend inflows, with flows back to quality US assets being the main impact. JPMorgan Chase pointed out that the path of least resistance favors stocks to new highs, and fundamentals reinforce this view. As the latest BullBearReport points out, retail investors have poured into US stocks in large quantities ($515 billion), and another $21 billion has poured into "leveraged" stocks.

The decline has served as a healthy reset. Investor sentiment has shifted from euphoria to skepticism, which is a necessary condition for the bull market to continue.

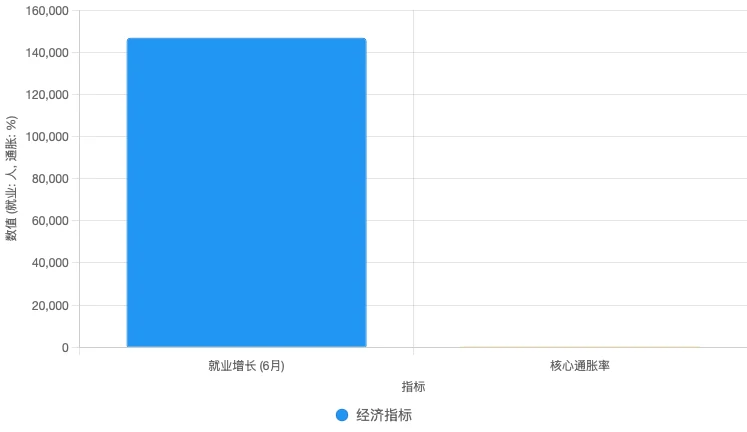

Fundamentals also support the resilience of the market. Employment increased by 147,000 in June, even if job opportunities are still growing amid a weak trend. However, the steady growth of corporate profits in various industries, and the continued strong growth of the "Big Seven" with a high proportion of technology stocks, has largely driven the stock market's rebound. Although there are headlines that Europe is a growth hotspot, the stocks of the "Big Seven" are the main drivers of corporate profits compared with other components of the index and other stocks around the world.

The decline has served as a healthy reset. Investor sentiment has shifted from excitement to skepticism, which is a necessary condition for the bull market to continue.

Fundamentals also support the resilience of the market. Employment increased by 147,000 in June, and job opportunities are still growing in a weak trend. However, corporate earnings in various industries have grown steadily, and the "Big Seven" with a high proportion of technology stocks continue to maintain strong growth, which has largely driven the stock market's rebound. The outperforming growth trend in Europe needs to be attributed to the contribution of the "Big Seven".

From an economic perspective, inflation is easing. The core index hovers around 2.3%, and bond yields are stabilizing. Long-term Treasury yields are around 4.5%, reflecting that the market is no longer panicking because yields have normalized based on the current economic and inflation growth rates.

The "double stock pain trade" also further supported the stock market's rise. Many institutional investors cut their holdings in the United States in April, resulting in a reduction in positions, which stimulated reverse capital inflows, especially back to high-quality US assets. JPMorgan Chase pointed out that the path of least resistance is conducive to new highs in the stock market, and fundamentals also reinforce this view.

From a technical perspective, the bull market is still intact

The most important thing for investors is that the market has long absorbed all the negative media reports. The recent overwhelming negative propaganda around debt, deficits, tariffs, inflation, war, Trump, etc. will only exacerbate your negative bias. However, looking around, investors who stayed away from financial markets in order to "avoid" potential adverse consequences have paid a heavy price and their wealth has shrunk. In other words, there are always "reasons" not to invest. However, current policies will change, but markets will not.

The key for investors is how to stay sober and calm in the media's monotonous negative reports. We know that the resilience of the bull market is built on cold data. Throughout history, the risks we face are familiar: trade policy uncertainty, political turmoil and inflationary pressures. The economic cycle is changing, but the market and risks never change.

These factors are part of a broader pattern that has been reflected in prices. As shown in the figure, the market responded by holding the rising trend line since the low in October 2022, and then accelerating the rise after signs of stabilization appeared. Markets breaking through key moving averages, breaking to new highs, and reversing death crosses are all very bullish moves that show bulls are still in control.

These key resistance levels have been passed, and the current market sentiment has turned bullish, but not yet close to extremes, which suggests that the April "Liberation Day" pullback is behind us and the bull market is still going.

This pullback sets the stage for further gains. The technicals confirm this trend, and the fundamentals from the labor market to corporate profits also reinforce it. Investors who continue to be fooled by this narrative will eventually realize that the data does not support this view. It is true that March and April were indeed turbulent, but they may have reshaped the previous prosperity through a healthy correction, thereby strengthening rather than destroying the core of the bull market.

Whether investing in the "Big Seven", high-quality cyclical stocks, or diversified funds, the road ahead is still full of hope.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates