Key Points:

1. Netflix posted double-digit growth in both revenue and profit for Q2, and raised its full-year sales and earnings guidance. 2. Former President Trump has suggested potential tariffs on entertainment products from outside the U.S., posing a policy risk for Netflix.

Netflix recently reported its fiscal Q2 2025 earnings, significantly outperforming market expectations. The company continued to deliver strong revenue and profit growth and raised its full-year outlook, with particularly positive momentum in advertising revenue and international subscriber growth. Still, expectations around forward guidance were not fully met, leaving some investors mildly disappointed.

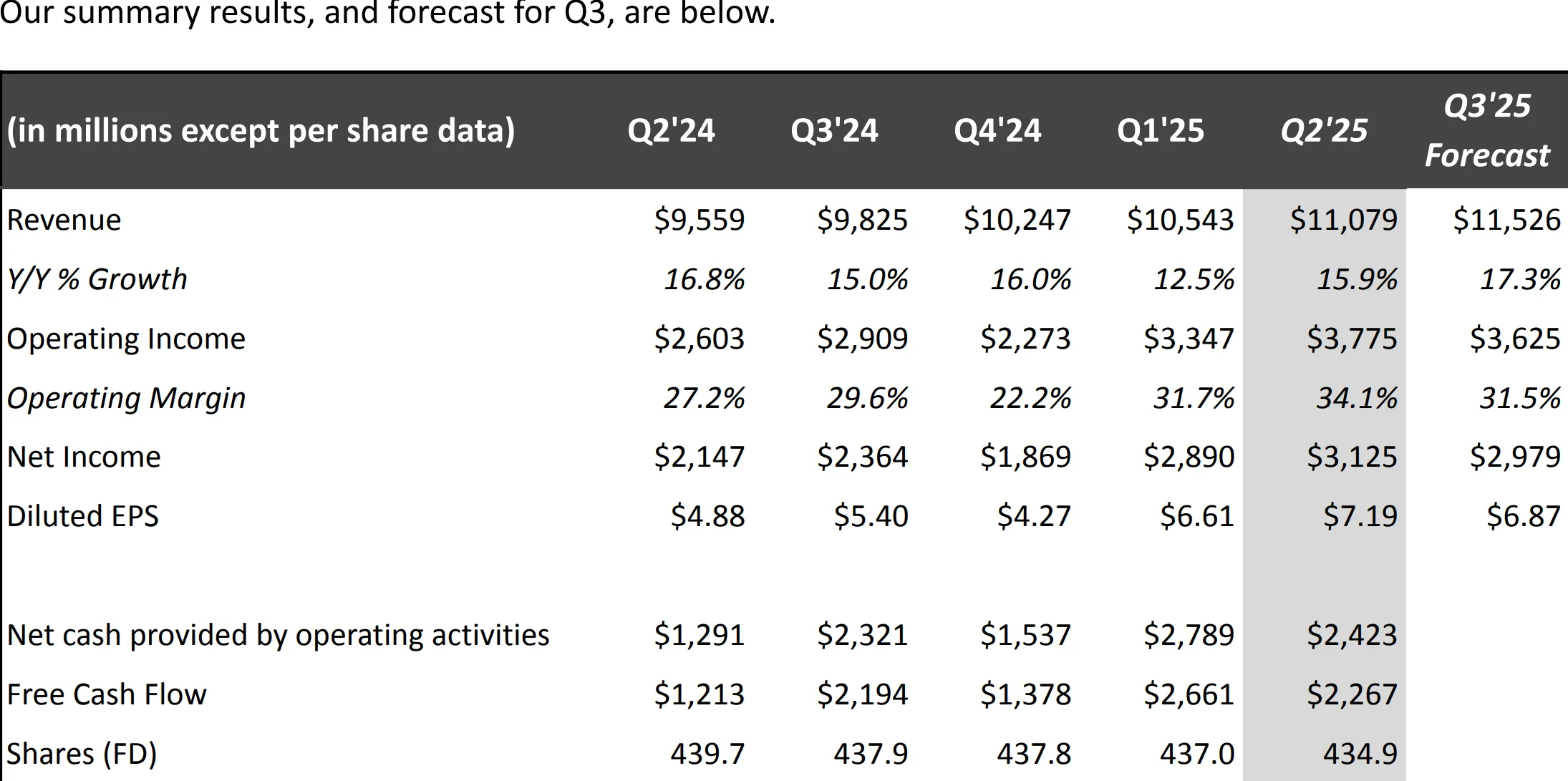

Financial Performance

Netflix generated $11.08 billion in revenue for Q2, up 15.9% year over year, slightly above analysts’ estimate of $11.06 billion. This compares favorably to the 12.5% year-over-year growth in Q1, signaling continued momentum. Despite Q2 typically being a seasonally softer quarter, Netflix delivered an operating margin of 34.1%, beating analysts’ expectations of 33.3% and improving from 31.7% in Q1 and 27.2% in Q2 2024.

Net income came in at $3.13 billion, or $7.19 per diluted share—up 45.6% from $2.15 billion ($4.88 per share) a year earlier—topping analysts’ forecast of $7.08 per share. Free cash flow rose 86.9% year over year to $2.27 billion, underscoring the company’s strong cash generation.

Source: Netflix

Netflix stopped disclosing quarterly subscriber numbers starting in 2025, but the steady growth in revenue suggests the user base has continued to expand from the 302 million reported at the end of 2024. In January 2025, the company raised subscription prices: the ad-supported plan increased from $6.99 to $7.99 per month, the standard ad-free tier from $15.49 to $17.99, and the premium tier from $22.99 to $24.99. These adjustments drove revenue growth without triggering significant subscriber churn, reflecting strong user stickiness.

While Netflix did not break out specific advertising revenue figures, management said ad revenue is on track to double in 2025 versus 2024. The company completed the global rollout of its ad tech platform in Q2, following earlier launches in the U.S. and Canada. This expanded its appeal among price-sensitive users and diversified its revenue streams.

Following its strong earnings beat, Netflix raised full-year revenue guidance to $44.8–$45.2 billion, up from the prior range of $43.5–$44.5 billion and above the Street consensus of $44.6 billion. For Q3, Netflix guided for $11.53 billion in revenue, beating Wall Street’s $11.28 billion estimate, and expects operating income of $3.63 billion, also ahead of the $3.47 billion consensus. Full-year operating margin is expected to remain at 29.5%, while free cash flow guidance was slightly narrowed to $8.0–$8.5 billion from the previous range of $8.0–$8.91 billion.

These outlooks reflect management’s confidence in second-half content demand, driven by a strong slate of original series and live programming—including weekly WWE events, boxing matches, and NFL games.

Strategic Developments

Netflix’s content slate remains a core driver of its growth. In Q2, hit shows like Sirens, Ginny & Georgia, and The Four Seasons delivered strong viewership, while the company earned 120 Emmy nominations—second only to HBO Max. The addition of live sports and entertainment, including WWE and NFL programming, has enhanced platform appeal and supported subscriber retention.

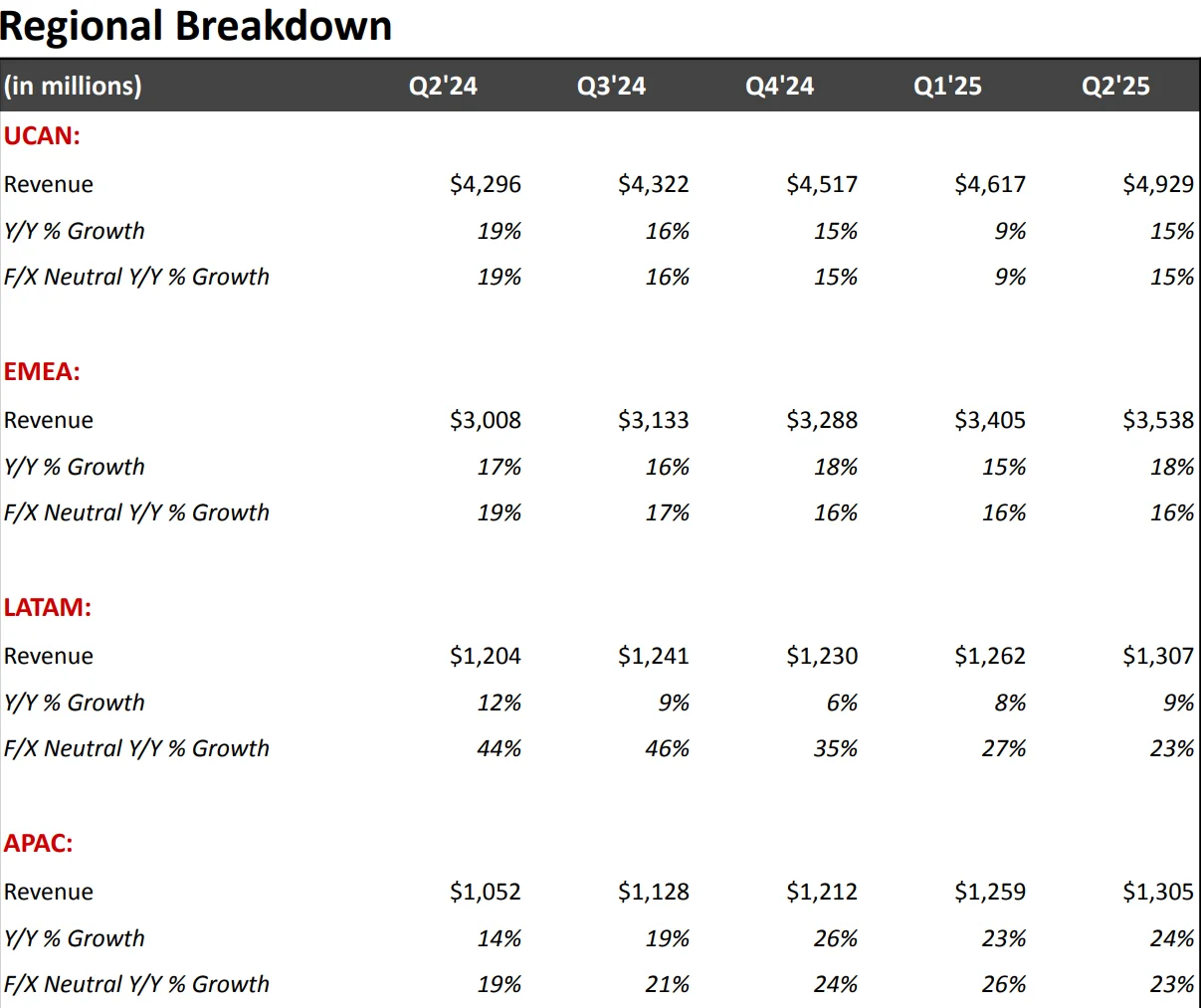

From a global standpoint, more than two-thirds of Netflix’s user base is located outside the U.S., providing a structural competitive edge. A weaker U.S. dollar in Q2 further boosted international revenue contributions. At the same time, investments in states like New Mexico and New Jersey are helping the company deepen its domestic footprint while hedging against potential regulatory risks, such as proposed tariffs on foreign entertainment content.

In addition, the global rollout of Netflix’s ad tech platform has strengthened its position in the digital advertising space. Growth in the ad-supported tier aligns with broader industry trends, as rivals like Disney+ and Hulu also expand their ad-based offerings. Netflix’s goal of doubling ad revenue in 2025 will hinge on effective monetization and advertiser adoption.

External Risks

Recently, former President Trump indicated that the U.S. may consider imposing tariffs on entertainment products originating outside the country—a potential policy threat for Netflix. Over two-thirds of Netflix’s revenue comes from international markets, particularly in Europe, Asia, and Latin America. If tariffs were to target the production, distribution, or cross-border data transmission of streaming content, they could directly increase Netflix’s operating costs. For instance, such tariffs might raise content acquisition expenses in foreign markets or force Netflix to revise its pricing strategy to preserve margins—potentially weighing on subscriber growth, especially in price-sensitive emerging markets.

Source: Netflix

Moreover, Netflix’s global content production model relies heavily on filming and post-production in multiple countries. Tariffs could significantly raise costs across these stages. In 2024, roughly 60% of Netflix’s content spending was directed toward non-U.S. markets, reflecting its global investment strategy. Should tariffs inflate production costs, Netflix may be compelled to reallocate more content creation to the U.S., potentially weakening its ability to deliver localized content and compete effectively abroad.

To mitigate this risk, Netflix highlighted its domestic investments in its shareholder letter. Between 2020 and 2024, the company invested approximately $125 billion in the U.S., including studio and infrastructure development in states like New Mexico and New Jersey. These investments not only bolster Netflix’s domestic production capabilities but may also serve as a goodwill gesture to U.S. policymakers, aiming to ease regulatory pressure. Still, if tariffs are implemented, Netflix could be forced to reconfigure its global supply chain and production strategies—raising costs and pressuring margins. Additionally, retaliatory measures from international markets could further complicate its global operations.

While Netflix has not yet been directly impacted by trade tensions, its business model remains vulnerable to shifts in trade policy due to its heavy reliance on international markets.

At the same time, Netflix continues to face competition from traditional media giants such as Disney+, Amazon Prime Video, and HBO Max. Although Netflix maintains an edge in scale and content diversity, ongoing cost-cutting efforts by rivals could intensify price competition in the ad-supported streaming space. To stay ahead, Netflix must continue to innovate its content offerings and optimize its advertising technology.

Stock Performance

Despite Netflix’s strong earnings performance, its stock price initially dropped nearly 3% in after-hours trading before narrowing losses to less than 0.5%, only to widen again to nearly a 2% decline during the overnight session. This volatility reflects investor disappointment over the relatively modest upward revision to the full-year revenue guidance. Some analysts believe Netflix’s shares have already risen to a high level, with much of the market’s expectations for future performance priced in. Notably, Netflix’s stock nearly doubled over the past year, pushing its price-to-earnings ratio to 43x—significantly above the Nasdaq 100’s 27x—raising concerns among investors about limited downside protection going forward.

Source:TradingView

Netflix’s elevated valuation reflects strong market confidence in its growth potential but also makes the stock more sensitive to any earnings shortfalls. Historical data shows Netflix achieved steady revenue growth in 2024 and 2025 through ongoing content investment and pricing strategies; however, a high P/E ratio means that any slowdown in growth or external shocks could trigger share price volatility.

According to Tipranks, the 12-month average price target from 36 Wall Street analysts stands at $1345.47, with the highest target at $1600 and the lowest at $950. While analysts remain optimistic about Netflix’s long-term prospects, the stock price may face near-term pressure from market sentiment.