Microsoft's business growth drives its stock price up

22:07 July 17, 2025 EDT

As the earnings season approaches, many investors habitually focus on the changes in analyst ratings after the release of corporate earnings reports, believing that this is the key node for the market to re-evaluate the company's value. But in fact, keen investors have long realized that analysts' behavior before the release of earnings reports has quietly revealed their predictions and tendencies about the company's future fundamental performance. And these signals ahead of the market deserve further attention.

Microsoft is a typical example. The technology giant is expected to release its latest quarterly earnings report on July 29, which has changed the market's direction. Since entering July, Wall Street analysts have raised Microsoft's ratings, and many institutions have simultaneously raised their target prices to $600. Compared with the current market consensus price of $534.14, there is more than 12% upside, which is a very strong optimistic expectation.

Image source: TradingView

The main reason for Wall Street institutions and analysts to upgrade their ratings is their recognition of Microsoft's continued growth capabilities in core business areas such as artificial intelligence, cloud computing and enterprise software. It can also be understood that the market has further indicated the possibility of Microsoft's revenue and profit exceeding expectations in its financial report. In the context of the current macroeconomic variables still existing and the valuation volatility of the technology industry intensifying, analysts dare to raise their ratings and target prices before the financial report, which shows that they see more certain positive factors in the company's fundamentals.

This has a reminder value for short-term traders and also provides important clues for long-term investors: Even if the specific financial report data has not yet been seen, Microsoft may still hand in a satisfactory report card.

Microsoft's business growth is the key

Microsoft's leadership in the field of artificial intelligence is the driving force behind its long-term bullishness. As AI accelerates its popularity, many young and flexible companies are springing up. However, Microsoft's ability to evolve remains a key factor in its high valuation and maintaining its position among tech giants.

Azure has become a leader in traditional cloud workloads and a cornerstone of global AI development, providing support for everything from enterprise applications to advanced language models. At the same time, Microsoft 365 now integrates AI-driven Copilot tools, so Windows and Office software are becoming more and more popular. This was not available before Microsoft AI came out.

Such an evolution is also reflected in Microsoft's entry into cybersecurity. As companies prioritize digital defense, the cybersecurity field is experiencing double-digit growth. The company's expansion of its Game Pass subscription service and integration with Activision Blizzard show that gaming has become another diversified revenue source for Microsoft, and these businesses have allowed Microsoft's revenue to grow steadily.

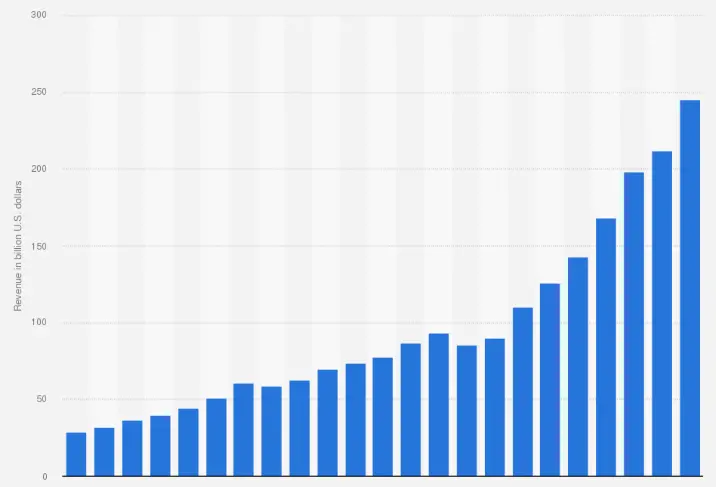

image source:Statista

The theme of continuous innovation runs through the stocks of the seven major tech giants. NVIDIA Corp has transformed from a GPU maker to a backbone of AI infrastructure.

Alphabet Inc is embedding its Gemini AI into search and cloud products. Amazon.com Inc is expanding generative AI tools and automation across its logistics network, while Meta Platforms Inc is integrating AI into advertising and content recommendations.

The Next $4 Trillion Company

Nvidia surpassed Microsoft and other tech stocks with a market value of $4 trillion. Microsoft is currently close behind at $3.75 trillion. In fact, Dan Ives of Wedbush Securities predicts that the company's market value will reach $5 trillion within the next 18 months.

Anyone who has been following Microsoft's growth over the past year knows that it's thanks to growth in artificial intelligence and cloud computing (via the company's Azure platform).

Strong demand for AI solutions prompted Microsoft to announce layoffs. The layoffs are part of the company's move to replace some of its traditional sales staff with solution engineers. The move is in response to customer demand for technical answers earlier in the sales process.

Stock Price

Microsoft shares continue to move higher in an established uptrend and continue to find support above the 50-day simple moving average (SMA). This, coupled with positive (albeit relatively flat) momentum in the MACD indicator, suggests that bullish sentiment will continue in the short term.

Image source: TradingView

If you're a long-term investor, this chart won't worry you about the earnings outlook. Analyst sentiment suggests that the company is likely to beat revenue and profit estimates, which is bullish for its stock price.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates