Key Points:

1. ASML’s Q2 2025 earnings beat expectations, but the stock plunged more than 8% following the report.

2. ASML withdrew its explicit revenue growth outlook for 2026, citing increasing macroeconomic and geopolitical uncertainty, with tariff risks particularly pronounced.

As a global leader in semiconductor lithography equipment, ASML released its Q2 2025 earnings on July 16, 2025, delivering results that exceeded market expectations. However, amid weak macroeconomic conditions, heightened geopolitical tensions, and escalating tariff risks, the company warned that it may face flat revenue growth in 2026. This cautious guidance triggered a sharp sell-off, with the stock dropping more than 8% after the earnings announcement.

Source: TradingView

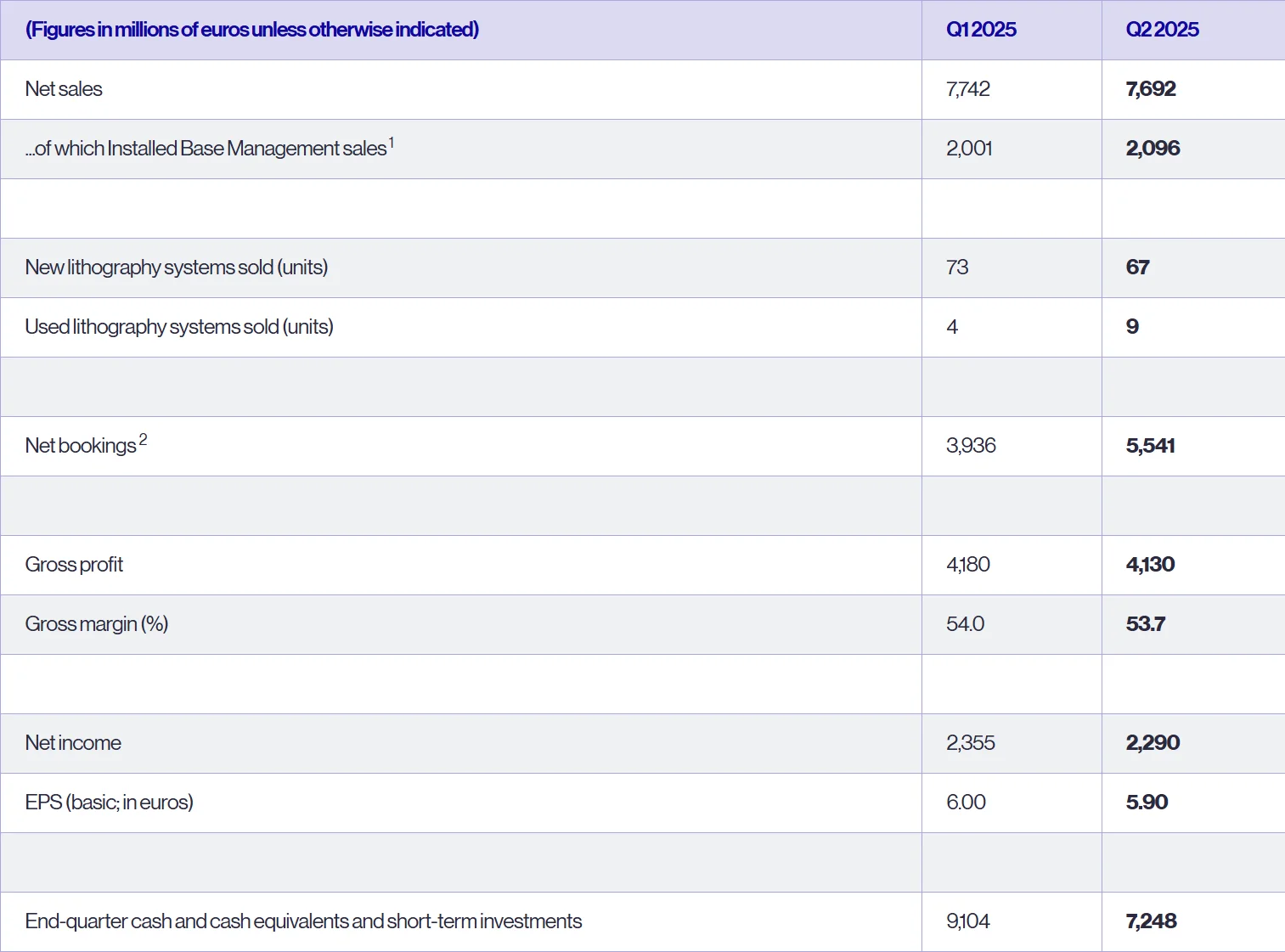

Q2 Financial Highlights

ASML delivered a strong financial performance in the second quarter, with key metrics across the board surpassing market expectations. The company reported net sales of €7.7 billion, exceeding the market consensus of €7.52 billion and reaching the upper end of its guidance range, reflecting significant year-over-year growth. This was mainly driven by increased sales of EUV lithography machines and strong demand for equipment upgrade services.

Net profit came in at €2.3 billion, above the expected €2.04 billion. The gross margin was 53.7%, higher than the anticipated 51.6%, benefiting primarily from the high-margin EUV systems and upgrade service revenues. New orders totaled €5.5 billion, up 41% quarter-over-quarter and well above the market forecast of €4.19 billion. EUV machine orders alone reached €2.3 billion, highlighting robust demand for advanced process equipment.

Source: ASML

Growth in the company’s performance was mainly driven by demand for logic chips, which accounted for 69% of system sales, and memory chips at 31%. Artificial intelligence (AI) applications have become the core growth driver. Geographically, Taiwan accounted for 35% of system sales, mainland China 27%, and South Korea 19%, indicating ASML’s continued heavy reliance on the Chinese market amid geopolitical risks.

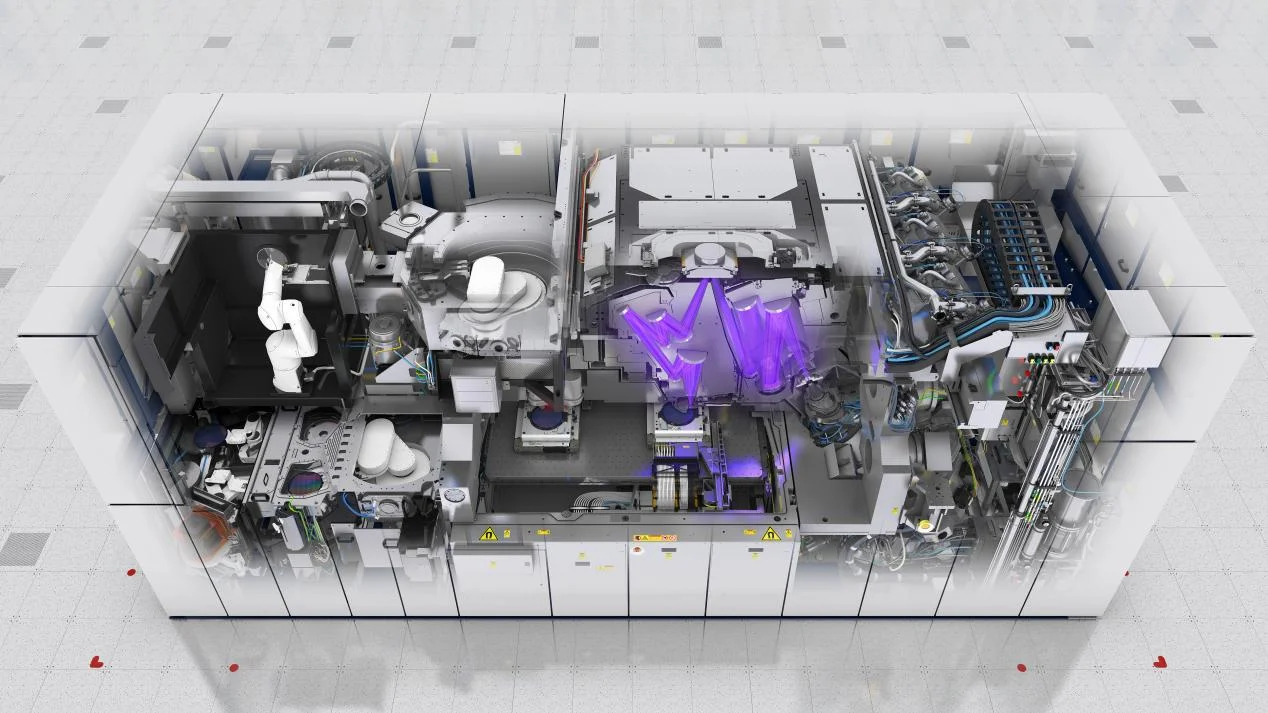

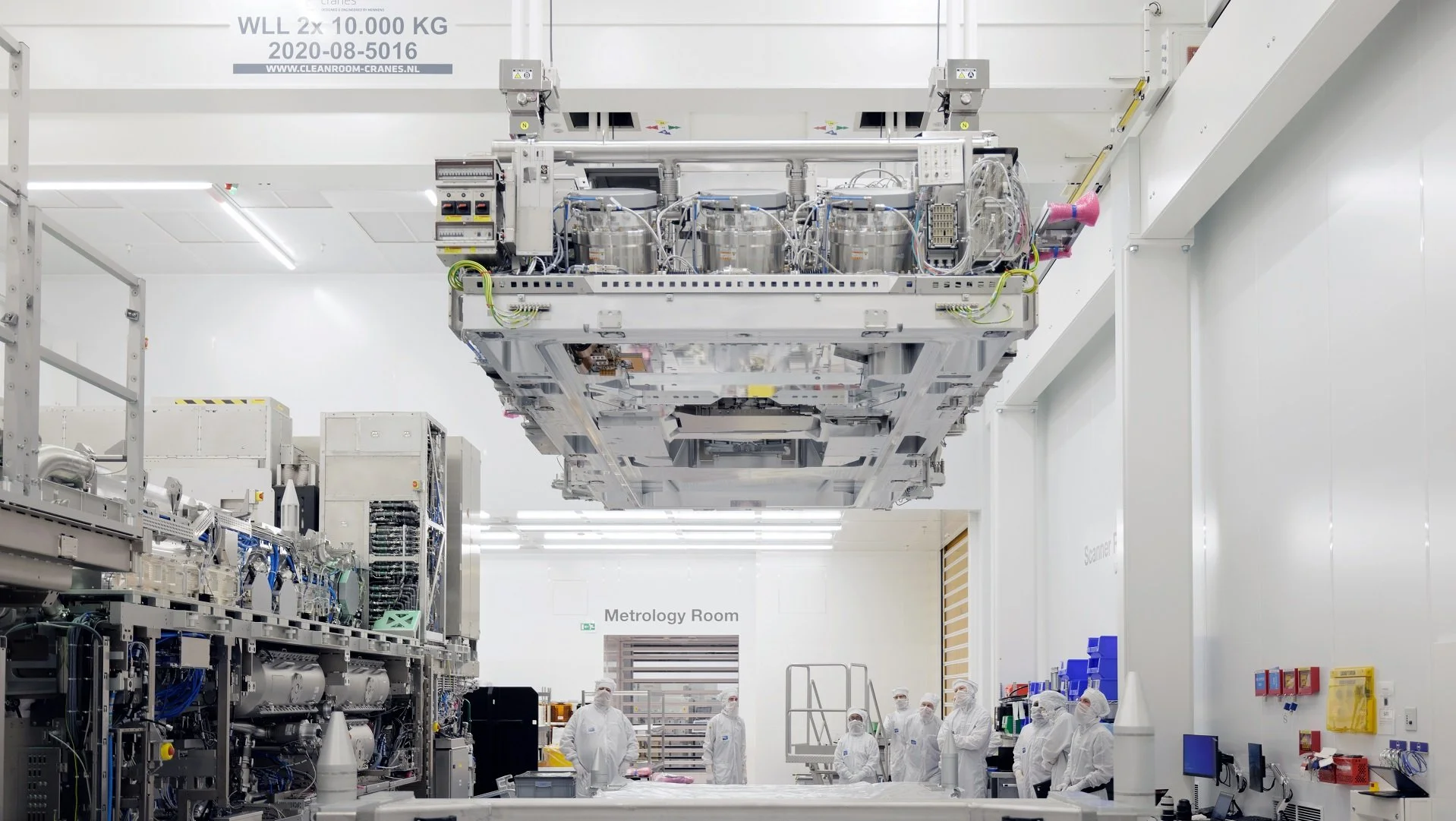

Notably, ASML delivered its first High Numerical Aperture (High NA) EUV system (TWINSCAN EXE:5200B) this quarter, reinforcing its leading position in sub-2nm process technology.

Cautious Optimism Ahead

ASML maintained its full-year 2025 guidance, expecting revenue to grow approximately 15% year-over-year to €32.5 billion, with a gross margin around 52%. The company anticipates stronger performance in the second half of the year, particularly in Q4, driven by:

EUV business projected to grow about 30% year-over-year, mainly fueled by AI chip demand.

DUV and application businesses expected to remain flat compared to 2024.

Installed base and aftermarket services forecasted to increase around 20%, with net sales of approximately €2 billion in Q3.

For Q3 2025, ASML expects net sales between €7.4 billion and €7.9 billion, with a gross margin of 50%-52%, slightly lower than Q2 due to product mix changes and increased R&D (€1.2 billion) and administrative expenses (€310 million).

However, despite the strong Q2 results, ASML withdrew its clear revenue growth outlook for 2026. CEO Christophe Fouquet stated that although fundamentals with AI customers remain strong, “macroeconomic and geopolitical uncertainties are intensifying, with tariff issues particularly prominent.”

This marks a sharp contrast to the management’s optimistic tone over previous quarters. The market had expected around 7% revenue growth in 2026, reaching €34.7 billion. This baseline has now been broken, forcing analysts to reassess their valuation models and earnings outlooks.

ASML currently faces multiple challenges. First is tariff risk. Fouquet highlighted the possibility of the U.S. imposing tariffs on new systems and components, with other countries potentially retaliating. This could impact ASML’s equipment and parts shipments to the U.S., as well as the supply chain from the U.S. to Europe. Tariffs may also compress the company’s gross margin.

Source: ASML

Furthermore, export controls imposed by the U.S. and Dutch governments on China, especially concerning EUV equipment, add uncertainty. Although mainland China accounted for 27% of system sales this quarter (mainly DUV systems), its share may decline to around 20% in 2025.

Additionally, major customers like Intel and Samsung are cutting capital expenditures. Intel plans to reduce its 2025 spend to $21.5 billion, down 17% year-over-year, while Samsung has scaled back purchases of High NA EUV systems. These cuts reflect caution in the non-AI market. The slow recovery of non-AI semiconductor markets such as PCs and smartphones also limits customers’ capacity expansion plans.

Analysts Cut Price Targets

Due to the uncertainty surrounding its 2026 outlook, ASML’s stock plunged 8.33% on July 16, 2025, closing at $754.45.

Meanwhile, several Wall Street banks, including Morgan Stanley, Deutsche Bank, and Citigroup, lowered their price targets for the stock. Morgan Stanley cut its target from €660 to €600, maintaining a “hold” rating, citing a slowdown in EUV node expansion that limits growth momentum.

ASML’s Q2 results demonstrated its strong position in the semiconductor equipment market, but the cautious 2026 outlook exposed vulnerabilities in its growth trajectory. While AI demand provides some cushion, geopolitical tensions and tariff risks could pose long-term threats to its supply chain and profitability. Investors need to weigh ASML’s technological moat against external uncertainties. The semiconductor industry’s cyclical nature, combined with policy uncertainties under the Trump administration, may further amplify market volatility.

Source: ASML

Additionally, the ongoing discussions around tariffs and export controls merit deeper analysis. Despite tightening U.S. and Dutch restrictions on China, the Chinese market still accounted for 27% of system sales this quarter, indicating persistent demand for legacy technology (DUV) and potential policy loopholes. However, if restrictions escalate further, ASML may need to accelerate shifts to other markets or rely on innovation to sustain its margins.

The Bottom Line

From a long-term perspective, ASML’s technological moat and market position remain irreplaceable. As AI chip manufacturing advances toward 3nm and even 2nm process nodes, EUV and the upcoming High-NA EUV systems will continue to be key growth drivers. The company is also intensifying R&D on next-generation lithography systems and expects second-half 2025 revenues to surpass the first half, with the fourth quarter contributing the most.

However, in the short term, the path to realizing this technological dividend will no longer be smooth. The combination of political interference, cautious customers, and rising costs introduces greater volatility to ASML’s revenue trajectory. This means that its quarterly performance will increasingly depend on project progress in specific regions or clients, as well as favorable policy windows.