Key Points:

1. The Q2 2025 earnings season kicks off this week, with key results expected from companies including JPMorgan Chase, Morgan Stanley, and Netflix.

2. Wall Street is focused on three core themes: the durability of economic growth, the impact of Trump’s tariff policy on corporate profits, and whether tech earnings can continue to support stock prices.

This week, the U.S. financial markets will enter the heart of the Q2 2025 earnings season. Major banks such as JPMorgan Chase and Citigroup are set to report results on July 15, marking the official start of this quarter’s reporting cycle.

While the S&P 500 reached a record high of 6,290 on July 9, market sentiment remains mixed. Some sectors—particularly those tied to AI and technology—have rallied sharply, but macroeconomic concerns around tariffs and policy uncertainty continue to weigh on investor confidence.

Analysts are zeroing in on three key issues: the sustainability of economic growth expectations, the potential earnings impact from escalating trade tensions, and whether the tech sector’s strong profits can keep driving the broader market higher.

Source: TradingView

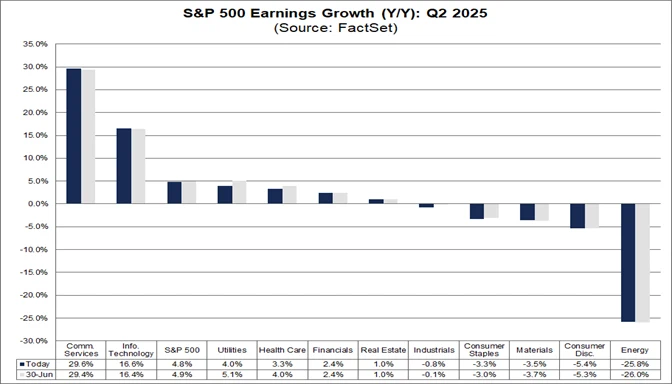

Earnings projections have been sharply lowered

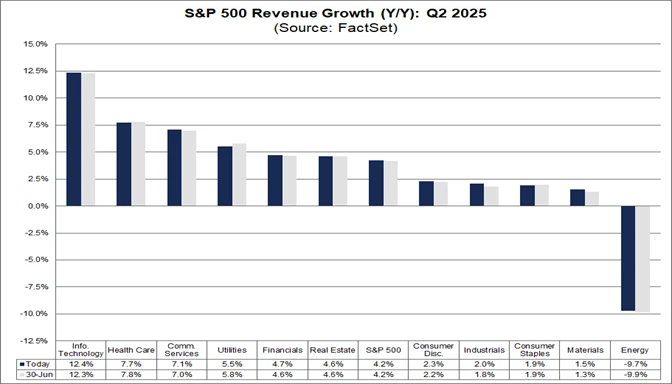

Expectations for economic growth remain intact, as reflected in the modest earnings growth projected for corporate America. According to the latest data from UBS and FactSet, S&P 500 companies are expected to report year-over-year earnings per share growth of approximately 4.1% in Q2 2025, indicating that overall economic activity continues at a moderate pace. In Q1 2025, S&P 500 companies posted their second consecutive quarter of double-digit earnings growth, underscoring the continued strength of corporate profitability.

However, earnings expectations have been notably revised downward heading into the reporting season. FactSet data shows that Q2 earnings estimates have dropped by more than 4% since the end of March—well above the 20-year average—highlighting mounting concerns about the sustainability of growth.

Source: FactSet

History suggests that earnings expectations tend to start high and decline heading into earnings season. Whether companies can beat these lowered expectations will be a key driver of market sentiment.

Escalating Trade Policies Add to Business Strain

In the first half of 2025, the Trump administration continued to revise trade tariff policies, with a new round of tariffs set to take effect on August 1, targeting multiple countries and expanding to key sectors such as semiconductors, pharmaceuticals, and copper. Research from Deutsche Bank suggests that tariffs could trim S&P 500 earnings growth by approximately 2 percentage points year-over-year in Q2—and the impact could intensify going forward.

Corporate strategies for managing trade-related risks have become a key focus for markets. During earnings calls, executives have discussed adjustments to capital expenditures and hiring plans, reflecting their ability to adapt to evolving macroeconomic and trade conditions. In Q1, several tech giants—such as Apple and Amazon—noted that tariffs were pressuring cost structures. Tesla, by contrast, has been relatively insulated due to its highly localized supply chain.

Meanwhile, capital spending among S&P 500 non-financial companies has continued to rise, with tech giants leading the charge in areas like AI. Microsoft expects capital expenditures to exceed $80 billion in fiscal year 2025, while Meta has also raised its capex targets. This increase in investment underscores corporate confidence in future growth, though it may weigh on free cash flow and margins in the near term.

At the same time, shareholder returns through dividends and buybacks remained historically low in Q1 2025, with the S&P 500 dividend yield at 1.34% and buyback yield at 1.99%. These figures suggest companies are taking a more cautious approach to capital return amid ongoing macro uncertainty.

Tech Earnings Remain a Key Pillar of Market Support

In Q1 2025, the technology sector delivered standout performance. Nvidia's market cap surpassed $4 trillion, while tech giants like Microsoft, Google, and Meta all posted strong earnings. Rapid growth in AI and cloud computing businesses served as key drivers.

This quarter, analysts are closely watching whether tech companies can sustain their earnings momentum. Netflix, the first FAANG member to report, expects Q2 FY2025 revenue to reach $11.035 billion, a 15.4% increase from $9.559 billion a year earlier.

Source: Netflix

According to Goldman Sachs trader John Flood, the S&P 500 is likely to surpass its very low earnings bar. However, narrow market breadth—where the top 10% of gainers account for 70% of the S&P’s 52-week performance—suggests elevated risk. Despite macroeconomic uncertainties, the tech sector’s earnings strength remains a key pillar of market support.

Meanwhile, as traditional bellwethers of earnings season, bank stocks will offer early signals on the overall earnings growth trajectory.

Capital markets activity and equity trading revenue are expected to improve, driven by market rebounds and volatility. Net interest income is projected to edge higher quarter-over-quarter. Morgan Stanley analyst Betsy Graseck forecasts stronger-than-expected investment banking revenue in Q2 2025, citing a rebound in North American equity capital markets and a recovery in global M&A volume. Equity market revenues may rise 10% year-over-year.

Investors will also monitor capital return plans from major banks. Following recent stress tests and modest easing in capital requirements, announcements regarding stock buybacks or adjustments to capital buffers could have a material impact on share prices. In addition, the health of loan portfolios and credit quality will remain key indicators of banking sector stability.

Overall, despite earnings downgrades and lingering policy uncertainty, the resilience of the tech sector and large banks may continue to support the broader market. Investors should pay close attention to management commentary on forward guidance to gauge whether further upside potential remains.