Key Points:

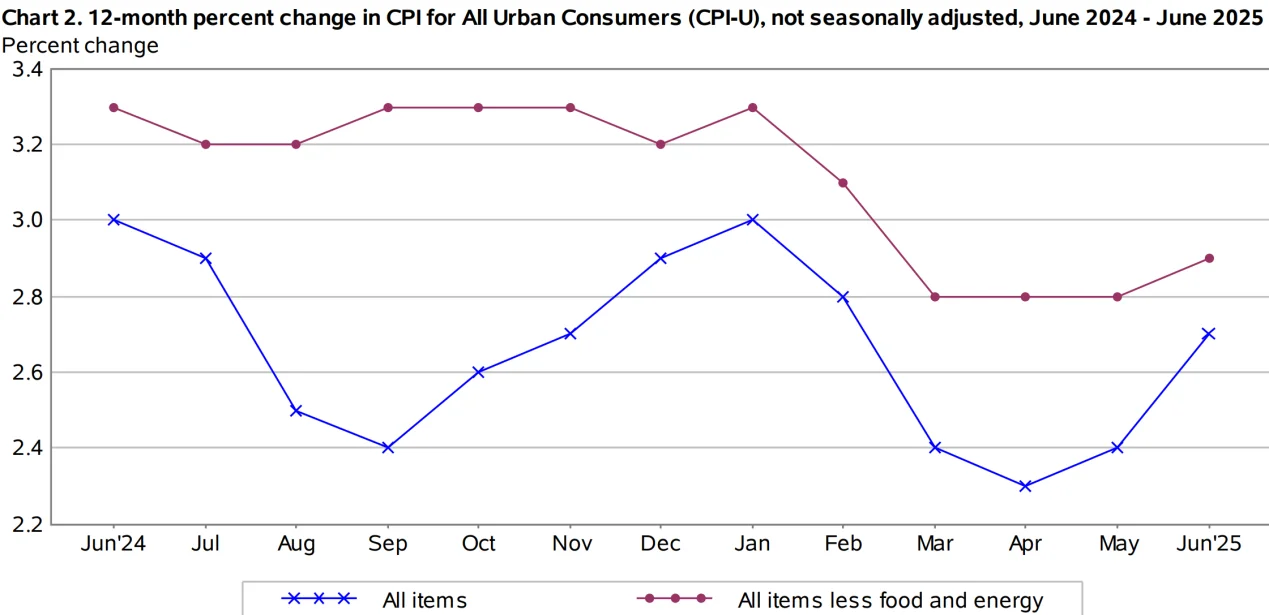

1. The Consumer Price Index (CPI) rose 2.7% year-over-year in June, slightly above the expected 2.6%, while the month-over-month increase of 0.3% was in line with expectations.

2. Tariffs are gradually driving prices higher, and Fed Chair Powell’s cautious stance aligns with current economic data.

The U.S. Consumer Price Index (CPI) for June 2025 has been released. While both the headline and core inflation figures came in below expectations on the surface, suggesting some room for Fed easing, a rebound in energy and certain goods prices driven by the latest round of tariffs has complicated the inflation outlook.

Following the data release, President Donald Trump renewed pressure on the Federal Reserve, calling for an “immediate and substantial” rate cut. However, markets and institutions widely expect Chair Jerome Powell to maintain a cautious approach and refrain from shifting toward easing in the near term.

Data Overview

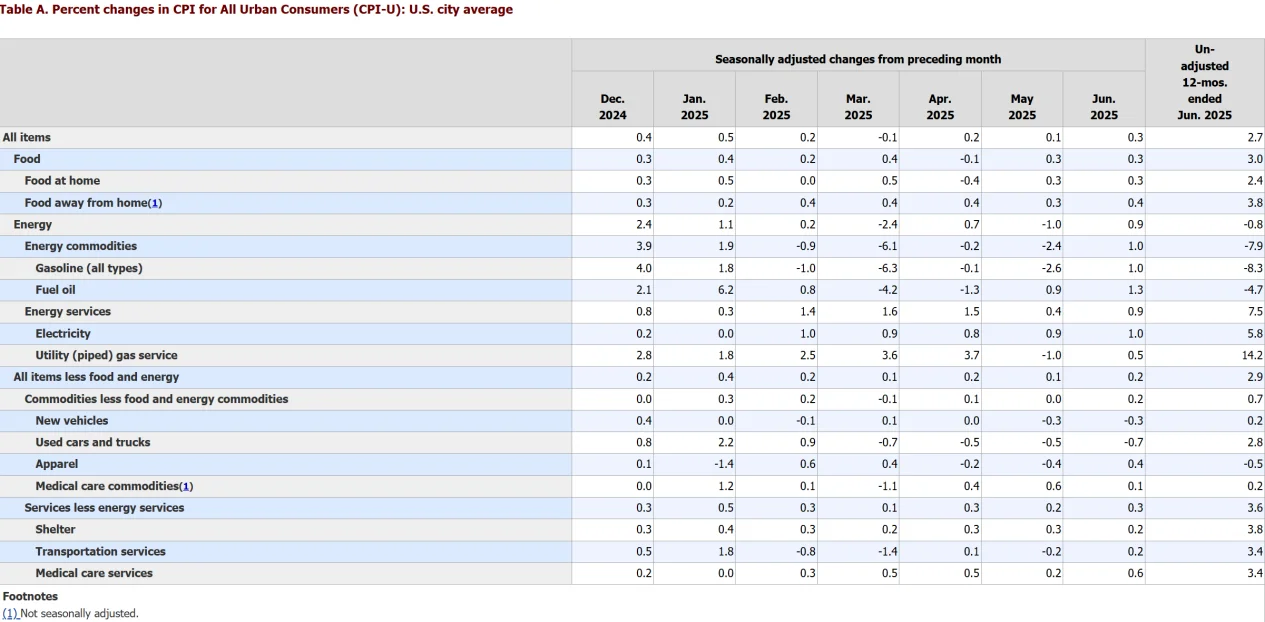

According to data from the U.S. Bureau of Labor Statistics, headline CPI rose 2.7% year-over-year in June, up from 2.4% in May. On a month-over-month basis, CPI increased 0.3%, also higher than May’s 0.1%. Core CPI, which excludes food and energy, rose 2.9% year-over-year, slightly above May’s 2.8%. On a monthly basis, core CPI increased 0.2%, up from 0.1% in May but below the market expectation of 0.3%. This marks the fifth consecutive month that core CPI’s monthly gain has come in below consensus estimates.

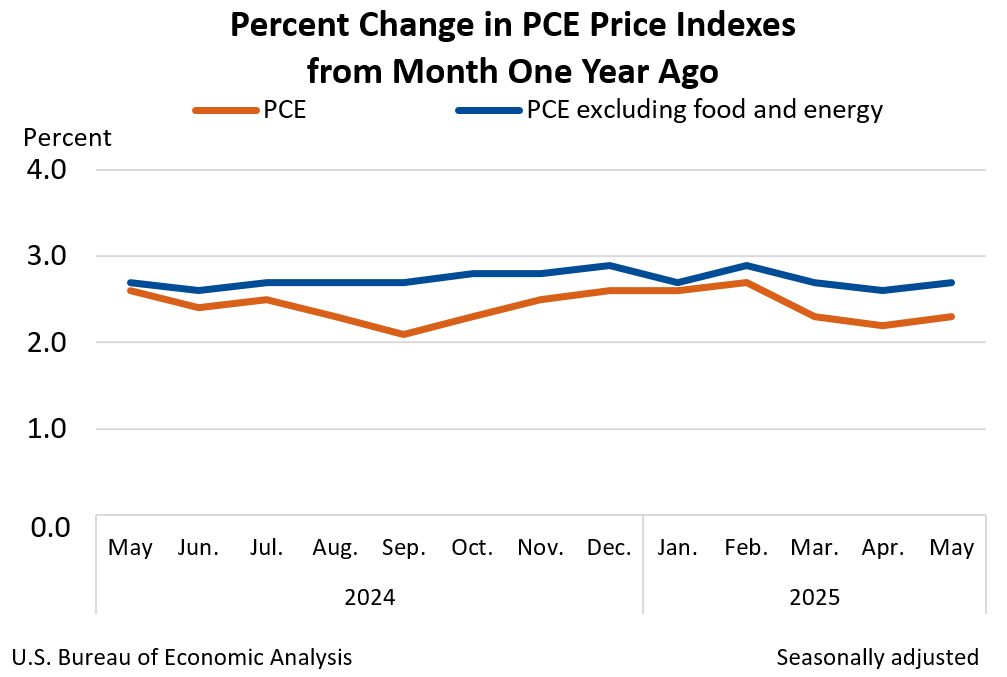

Source: BEA

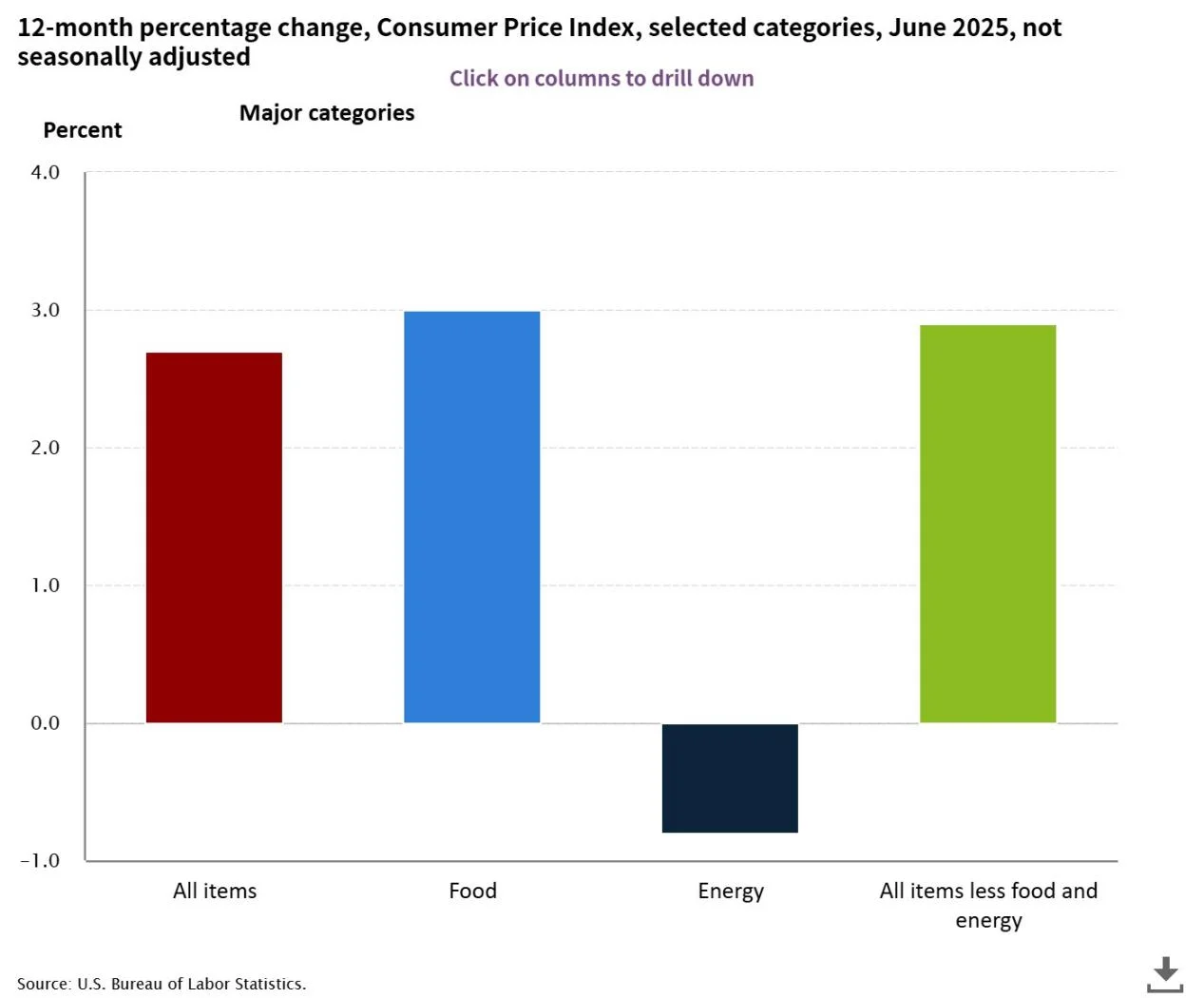

Breaking down the components, inflation remains moderate overall, despite divergent trends in energy and food prices. While energy prices are still down year-over-year, a recent month-over-month uptick reflects the early impact of rebounding oil prices. Food prices continued their trend of modest increases.

Source: BEA

In core goods and services, housing costs remain the primary driver. Meanwhile, prices for tariff-sensitive categories such as appliances and apparel have shown noticeable increases, indicating that cost pressures are gradually being passed on to end consumers. Overall, while inflation is slightly below expectations, structural price increases in certain categories warrant attention.

Source: BEA

Tariff Inflation

Although overall inflation data did not show a significant overshoot, the detailed breakdown reveals undeniable signs of “tariff-driven price pressures.” The recent tariff policies implemented by the Trump administration, including tariffs ranging from 10% to 145% on imported goods, have led to price increases in certain categories.

In June, prices for core goods with high import exposure—such as apparel, footwear, furniture, and appliances—generally rose. For example, furniture and bedding prices increased 0.4% month-over-month, reversing a 0.8% decline from the previous month. Apparel and footwear prices also rose by 0.4% and 0.7%, respectively.

This is the key market concern: the tariff effect is gradually becoming visible. Seema Shah, Chief Global Strategist at Principal Asset Management, noted that these data indicate the new round of tariffs pushed by the Trump administration has begun to seep into inflation through core goods prices.

Omair Sharif, President of Inflation Insights, added that excluding autos, core goods prices rose 0.55% in June—the largest monthly increase since November 2021—demonstrating that rising import costs are starting to impact end-consumer prices.

Cautious Stance

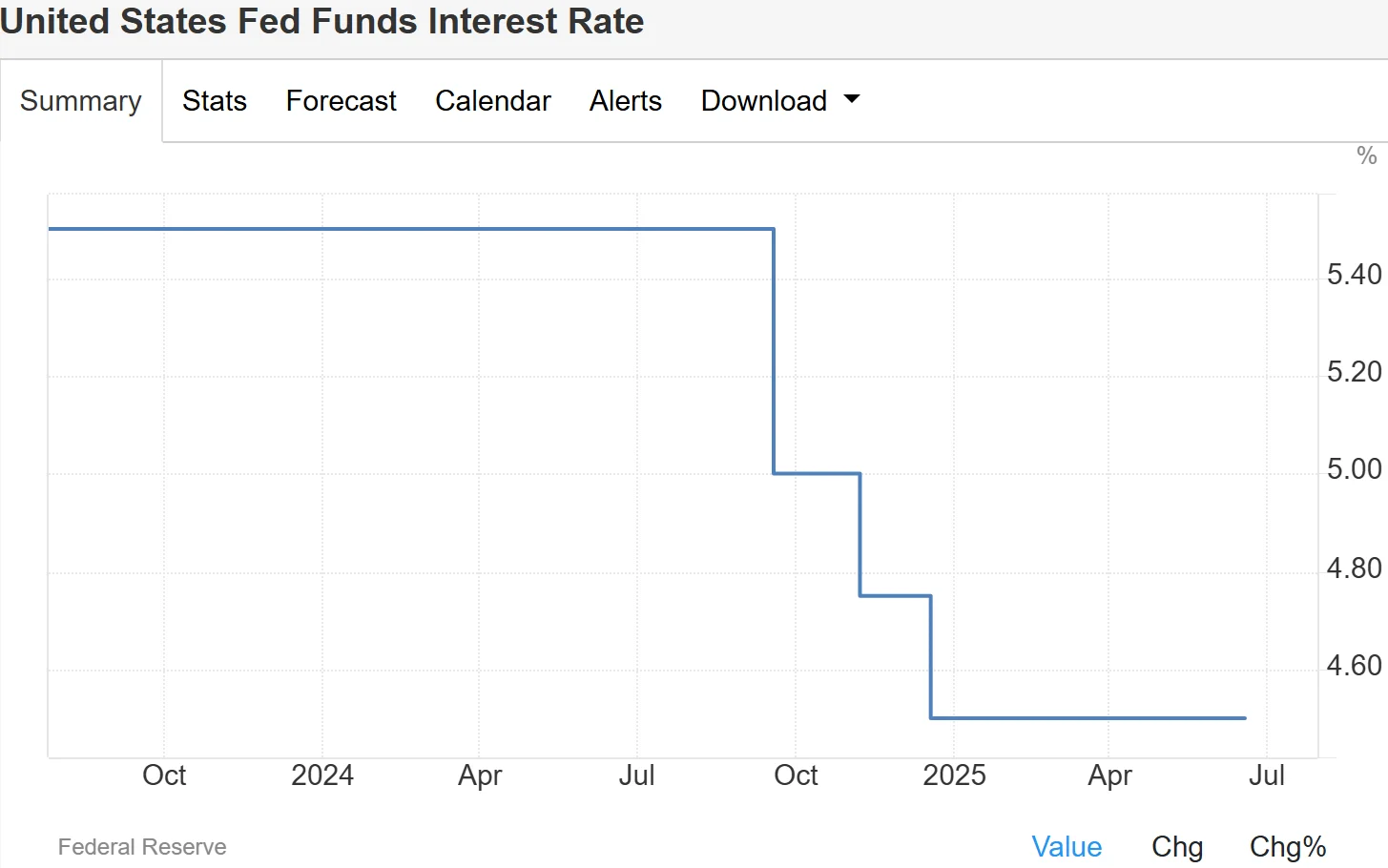

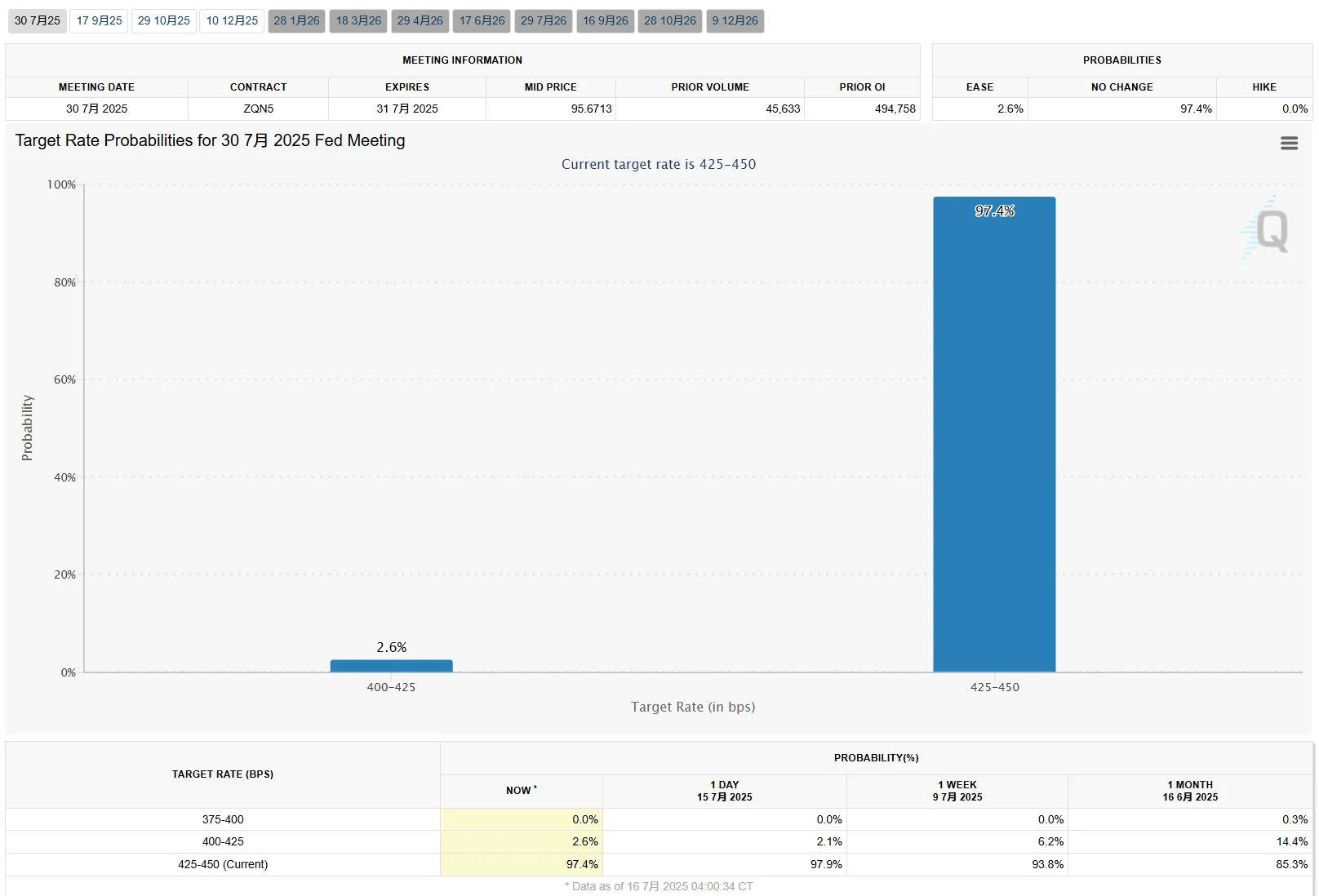

Since December 2024, the Federal Reserve has maintained the federal funds rate at 4.25%–4.50%. Fed Chair Powell emphasized that uncertainty around tariff policies requires the Fed to remain cautious until inflation trends become clearer.

Source: TradingEconomics

Dallas Fed President Lorie Logan stated that tariffs have not yet significantly pushed inflation higher, but data in the coming months will be critical. She believes the current moderately restrictive monetary policy supports achieving the 2% inflation target while maintaining stable employment. Boston Fed President Susan Collins also noted that economic uncertainty does not support an immediate rate cut, though the inflationary impact of tariffs may be lower than expected.

Core PCE is expected to be between 2.7% and 2.8% in June, continuing the upward trend from April (2.2%) and May (2.3%). This trend reinforces the Fed’s internal view that “more data is needed,” likely delaying rate cuts until late 2025.

Source: BEA

Notably, following the release of below-expectation CPI data, former President Trump called for a 300 basis-point rate cut via Truth Social, arguing that low inflation justifies rate cuts to save on debt interest payments. He claimed tariffs have not significantly raised inflation and criticized the Fed for being slow to act.

However, markets and analysts generally agree tariffs are gradually pushing prices higher, and Powell’s cautious stance aligns better with current economic data. For example, Seema Shah from Principal Asset Management highlighted that rising apparel and appliance prices indicate tariff costs are being passed through, while Omair Sharif of Inflation Insights LLC emphasized the upward trend in core goods prices.

According to the CME FedWatch Tool, after the CPI report release, investors’ probability of the Fed holding rates steady at the July meeting rose to 97.4%, up from 93% on Monday. Meanwhile, the likelihood of a rate cut in September dropped sharply after the report, falling below 60% immediately and continuing down to near 50%.

Source: CME

Bottom Line

The June CPI data indicates that inflationary pressures are building but have not yet reached a broad-based inflation level. The Federal Reserve is likely to keep interest rates unchanged over the coming months to monitor the impact of tariffs and core PCE trends. Ryan Sweet from Oxford Economics predicts that rate cuts could be delayed until December 2025, unless the labor market significantly deteriorates.

For businesses and consumers, the pass-through of tariff costs may lead to higher living expenses, particularly in the imported goods sector.

The inflationary impact of tariff policies is becoming evident, but the full effect will require more time to assess. The Fed’s decisions will be data-driven rather than politically influenced, making the likelihood of maintaining higher rates in the near term relatively high.