Market update this week: Trump announces new tariff policy, multiple economic data will be released, and the second quarter earnings season of US stocks begins

05:33 July 16, 2025 EDT

FoolBull Brings You This Week’s Market Highlights

Market Focus

Trump Announces New Tariff Policy

On July 12, U.S. President Donald Trump posted letters addressed to Mexico and the European Union on his social media platform, Truth Social, announcing that the United States will impose a 30% tariff on goods imported from Mexico and the EU starting August 1, 2025. Previously, Trump also stated that starting August 1, the U.S. would levy a 35% tariff on Canadian imports and a 50% tariff on Brazilian goods, with plans to impose a uniform 15% or 20% tariff on nearly all trade partners.

Earlier that day, European Commission President Ursula von der Leyen announced that the EU would extend the suspension of retaliatory trade measures against the U.S. until August 1 to allow for continued negotiations. These measures were originally enacted to counter the Trump administration’s steel and aluminum tariffs. Von der Leyen said the EU would continue preparing additional countermeasures to ensure full readiness while reiterating that the EU prefers to resolve trade issues through negotiation.

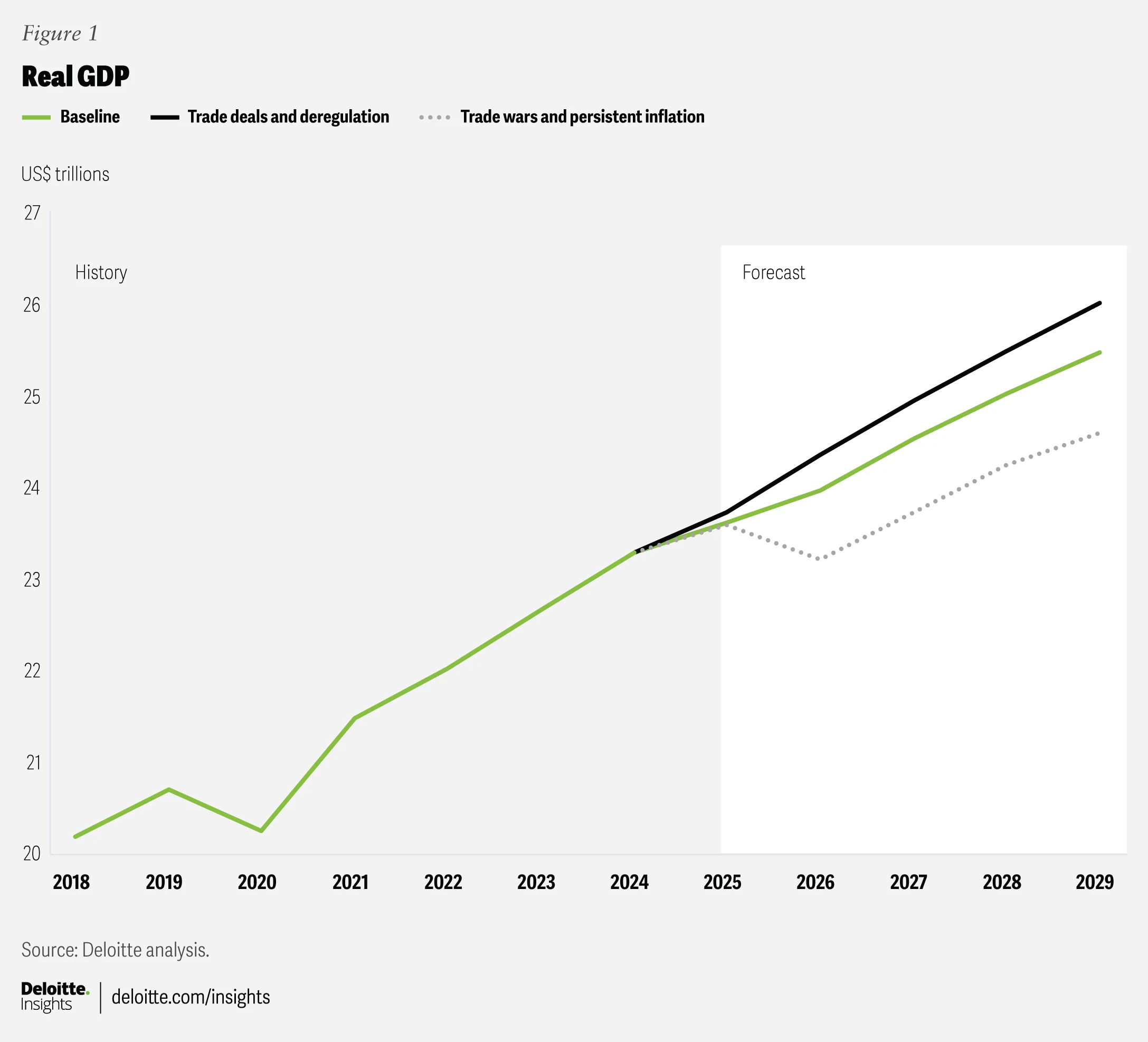

According to Deloitte’s latest forecast, the U.S. real GDP growth rate in 2025 is expected to be 1.4%, down from the levels of the previous two years. A report by the Yale Budget Lab pointed out that this year’s U.S. tariff policy will reduce GDP growth by 0.7 percentage points and could shrink the economy by about $110 billion annually in the long term.

Source: Deloitte Insights

First China-U.S. Foreign Ministers Meeting Since Trump’s Return to White House

On July 11, during the ASEAN Foreign Ministers’ Meeting in Kuala Lumpur, Chinese Foreign Minister Wang Yi, also a member of the CCP Politburo, met with U.S. Secretary of State Marco Rubio. This marked the first high-level face-to-face meeting between the two countries since Trump returned to the White House in January.

Following the meeting, Rubio stated that the possibility of a Trump visit to China and a meeting with Chinese leadership is “very high.” While no specific date was discussed, both sides expressed strong interest, and plans for the meeting are already underway. Bloomberg and other media outlets reported that the positive dialogue between the foreign ministers increases the likelihood of a leaders’ summit, which could help ease trade tensions.

Key U.S. Economic Data to Be Released This Week

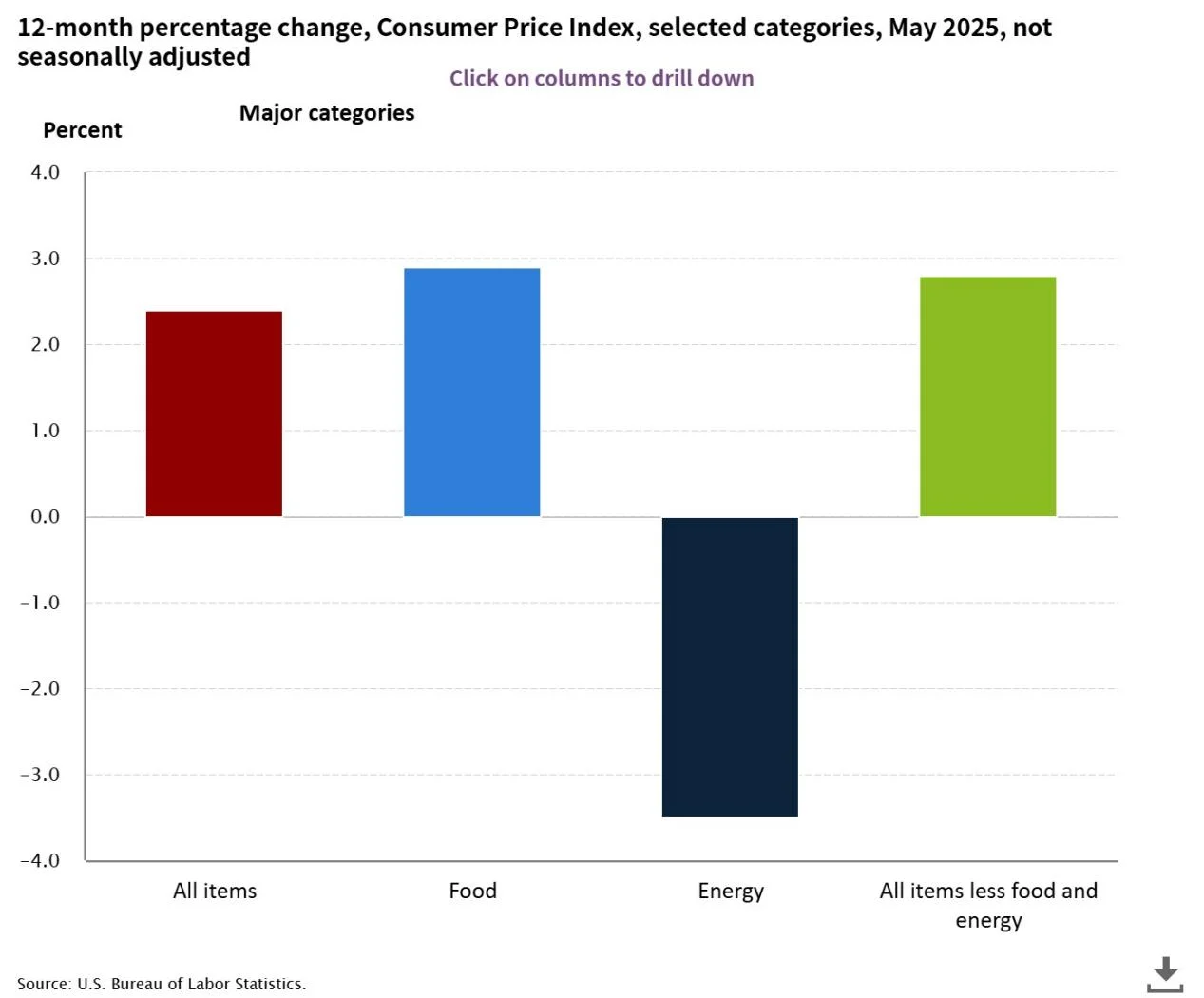

This week, the U.S. will release several critical economic indicators. On Tuesday (July 15), the June year-over-year unadjusted CPI will be released. Markets expect CPI to rise from 2.4% in May to 2.7% in June, with core CPI rebounding from 2.8% to 3%.

Source: BEA

On Wednesday (July 16), the June PPI year-over-year data will be published, providing insights into upstream cost trends.

On Thursday (July 17), June retail sales data will be released, offering new information on U.S. inflation and growth momentum.

U.S. Q2 Earnings Season Begins

The second-quarter earnings season for U.S. equities kicks off this week, with financials leading the way. JPMorgan, Citigroup, Wells Fargo, and BlackRock are all scheduled to report earnings before the bell on Tuesday. Later in the week, ASML and TSMC will also release their results on Wednesday and Thursday, respectively.

Federal Reserve Officials to Deliver Speeches

Several Federal Reserve officials are scheduled to speak this week, including Fed Governors Michelle Bowman and Michael Barr, as well as New York Fed President John Williams. Their remarks on the economy and monetary policy will be closely watched by investors looking for clues on the Fed’s potential rate cuts.

On July 18, the Fed will release its Beige Book on current economic conditions, with markets focused on how it characterizes growth and whether it signals any shift in rate expectations.

Trump Renews Pressure on Powell to Resign

On July 13, Trump once again called for Federal Reserve Chair Jerome Powell to resign, stating, “He should step down because he’s very bad for the country.” Trump has repeatedly criticized Powell, pressuring the Fed to slash interest rates to support his fiscal agenda.

That same day, White House economic adviser Kevin Hassett said in an interview that Trump could remove Powell if there were a valid legal reason. However, House Financial Services Committee Chairman French Hill emphasized that the president does not have the authority to fire the Fed Chair, though Congress will continue strengthening oversight of the central bank.

This week, the Trump administration is seizing on the Fed’s costly headquarters renovation as a potential justification to push Powell out early. Office of Management and Budget Director Russell Vought blamed the Fed for “significant cost overruns” and demanded Powell respond to 11 questions about the renovation project within seven business days. Powell has previously defended the project, saying the headquarters is “unsafe and not waterproof,” underscoring the need for renovation.

Deutsche Bank strategists issued a warning this week, saying markets are underestimating the risk of Trump forcing Powell to resign. If that happens, it could trigger a sharp selloff in the dollar and U.S. Treasuries, shaking global financial markets. ING strategists also noted that Powell’s premature departure would likely cause the Treasury yield curve to steepen dramatically, with safe-haven currencies like the euro, yen, and Swiss franc emerging as key beneficiaries.

Trump to Make ‘Major Statement’ on Russia

Trump announced he will deliver a “major statement” on Russia on July 14. Moscow is reportedly awaiting the announcement to understand its implications.

NVIDIA CEO Jensen Huang to Hold Media Briefing in Beijing

According to a July 13 report from Reuters, NVIDIA CEO Jensen Huang is scheduled to hold a media briefing in Beijing on July 16. The event coincides with the opening of the third China International Supply Chain Expo, which NVIDIA is attending for the first time.

China contributed $17 billion in revenue to NVIDIA for the fiscal year ending January 26, accounting for 13% of the company’s total sales. Huang has repeatedly emphasized China’s importance to NVIDIA’s growth. However, on July 11, two U.S. senators sent a letter to Huang urging him not to meet with companies suspected of violating U.S. chip export controls, and to avoid contact with any entities on the U.S. export restriction list. Reports also indicate that NVIDIA is preparing to launch a new AI chip specifically designed for the Chinese market as early as September.

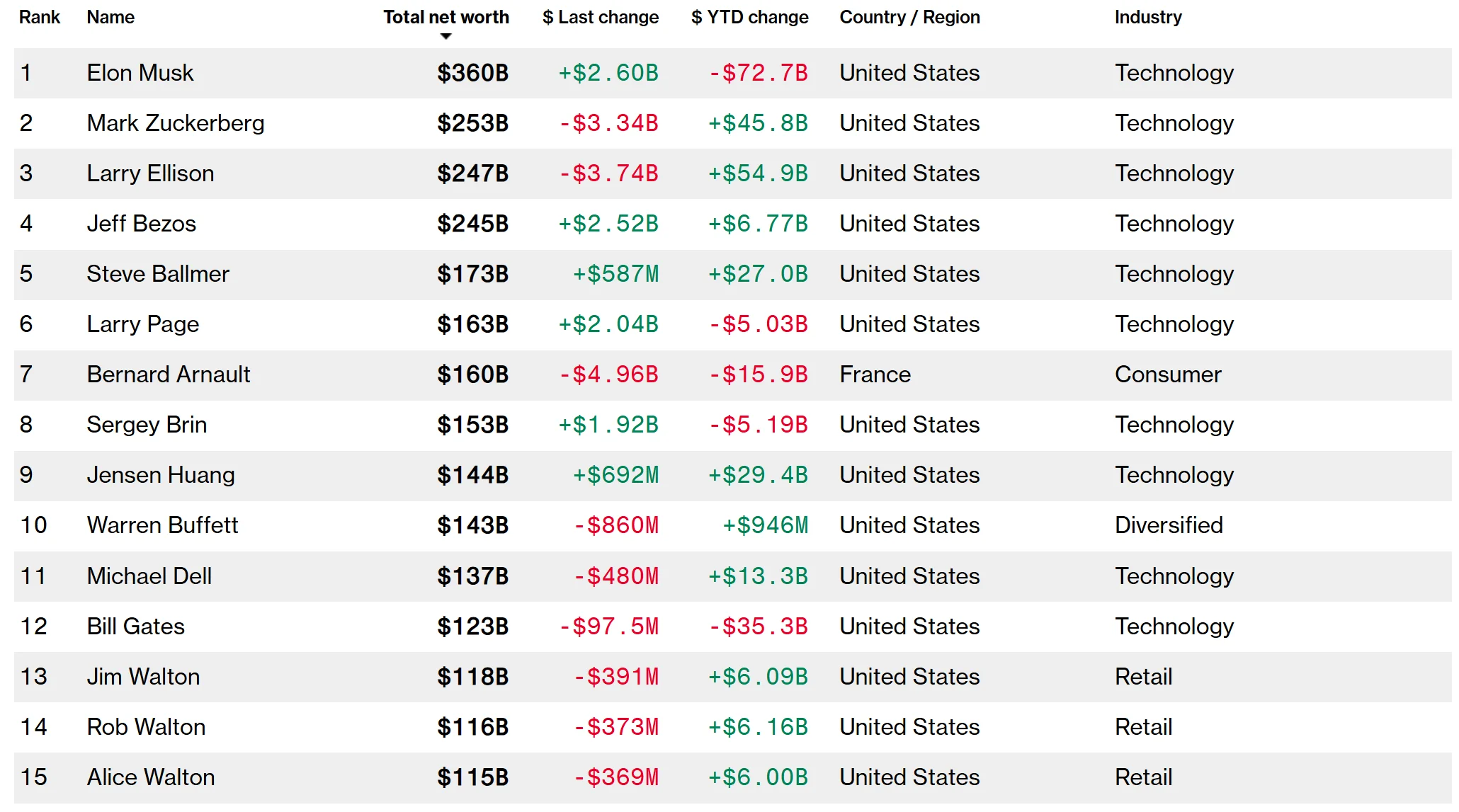

Notably, according to Bloomberg’s Billionaires Index, Jensen Huang’s net worth has reached $144 billion, surpassing Warren Buffett’s $143 billion and ranking him ninth globally. The surge in Huang’s wealth is driven by investor confidence in NVIDIA’s dominance in AI. So far this year, NVIDIA’s stock has gained more than 20%, with Huang’s personal wealth increasing by $29 billion during the period.

Source: Bloomberg

Market Recap

Last week, all three major U.S. stock indexes posted modest declines. The Nasdaq Composite slipped 0.08%, the Dow Jones Industrial Average fell 1.02%, and the S&P 500 Index declined 0.31%. Market sentiment showed signs of volatility, with investor confidence notably affected by the latest tariff policy developments.

Source: TradingView

Tech stocks stood out. Nvidia continued its historic rally, gaining 3.5% for the week and pushing its market capitalization above $4 trillion, solidifying its position as the most valuable publicly traded company in the world. Other tech giants including Microsoft, Alphabet (Google’s parent company), and Amazon also posted small gains. However, Apple dropped more than 1%, while Tesla and Meta ended the week slightly lower.

Source: TradingView

Oil prices stabilized and rebounded. The front-month contract for WTI crude rose 2.16% to $68 per barrel, while Brent crude gained 3.02% to $70 per barrel.

Source: TradingView

Gold prices also rose, driven by increased safe-haven demand. COMEX gold futures for July delivery climbed 0.73% to $3,359 per ounce.

Source: TradingVie

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates