What You Need to Watch Regarding the Latest Trump Tariff Updates

02:46 July 16, 2025 EDT

Key Points:

1. On July 7, Trump announced the tariff implementation date would be extended to August 1, 2025.

2. So far, Trump has sent formal letters to more than 20 countries, notifying them of specific tariff rates.

3. On May 28, the U.S. Court of International Trade ruled that Trump had abused his authority, leading to a suspension of certain tariffs. The federal appeals court temporarily upheld the tariffs and scheduled a hearing for July 31.

On July 9, 2025, the 90-day grace period for Trump’s "reciprocal tariffs" officially expired, during which markets were rattled by fears over potential policy fallout. However, just two days before the original deadline, President Trump unexpectedly announced a new extension of the tariff enforcement date to August 1, 2025, granting countries an additional three-week “negotiation window.”

While the decision gave markets a brief reprieve, it also sent a strong signal: if negotiations fail, the U.S. may be headed for another round of trade wars. Global markets continue to fluctuate amid persistent uncertainty.

Latest Tariff Developments

Since declaring “Liberation Day” on April 2, former President Trump has sought to reshape America’s trade relationships through high tariffs and aggressive negotiation tactics, aiming to narrow the trade deficit and boost domestic manufacturing. To soften market impact, he announced a 90-day grace period on April 9, lowering most tariffs to 10%, originally set to expire on July 9. This move gave foreign governments additional time to negotiate tariff relief or strike trade deals with the U.S.

By the end of the initial grace period, the U.S. had only reached formal trade agreements with the United Kingdom and Vietnam, and signed a framework cooperation agreement with China. While the European Union and India had yet to sign official deals, ongoing negotiations suggested that some tariffs might still be lifted. Overall, the grace period failed to deliver a meaningful wave of new trade agreements.

Following the announcement of a second grace period, Trump sent formal letters to more than 20 countries outlining specific tariff rates. These included plans to impose import duties ranging from 25% to 40% on goods from 14 countries—including Japan, South Korea, Malaysia, Tunisia, and Kazakhstan—starting August 1.

Subsequently, Trump issued notices to seven additional countries, including the Philippines, Sri Lanka, Iraq, and Algeria, imposing tariffs ranging from 20% to 30%. Brazil, however, faced the steepest penalties, with tariffs reaching as high as 50%, making it one of the most heavily targeted nations. The move drew sharp opposition from Brazilian President Lula, whose government invoked the Economic Reciprocity Act and signaled plans to impose retaliatory tariffs on U.S. goods—raising the prospect of a trade war between the two largest economies in the Americas.

Taken together, these actions suggest that while the “90-day Reciprocal Tariff Suspension” has technically been extended, it may in practice serve as a pressure tactic to accelerate negotiations. Trump has made it clear: if countries fail to reduce their trade barriers by August 1, the U.S. will proceed with full tariff implementation as planned. That said, tariff exemptions will be granted to companies that manufacture locally or establish production facilities within the United States.

Risks Are Rising

Analysts broadly believe that Trump’s latest tariff strategy mirrors the pattern seen during the large-scale tariff rollout on “Liberation Day” in April. Research indicates that when the U.S. imposed tariffs of up to 40% on goods from more than a dozen countries at the time, it already exerted upward price pressure on certain imports—particularly in sectors such as industrial metals, textiles, and electronic components.

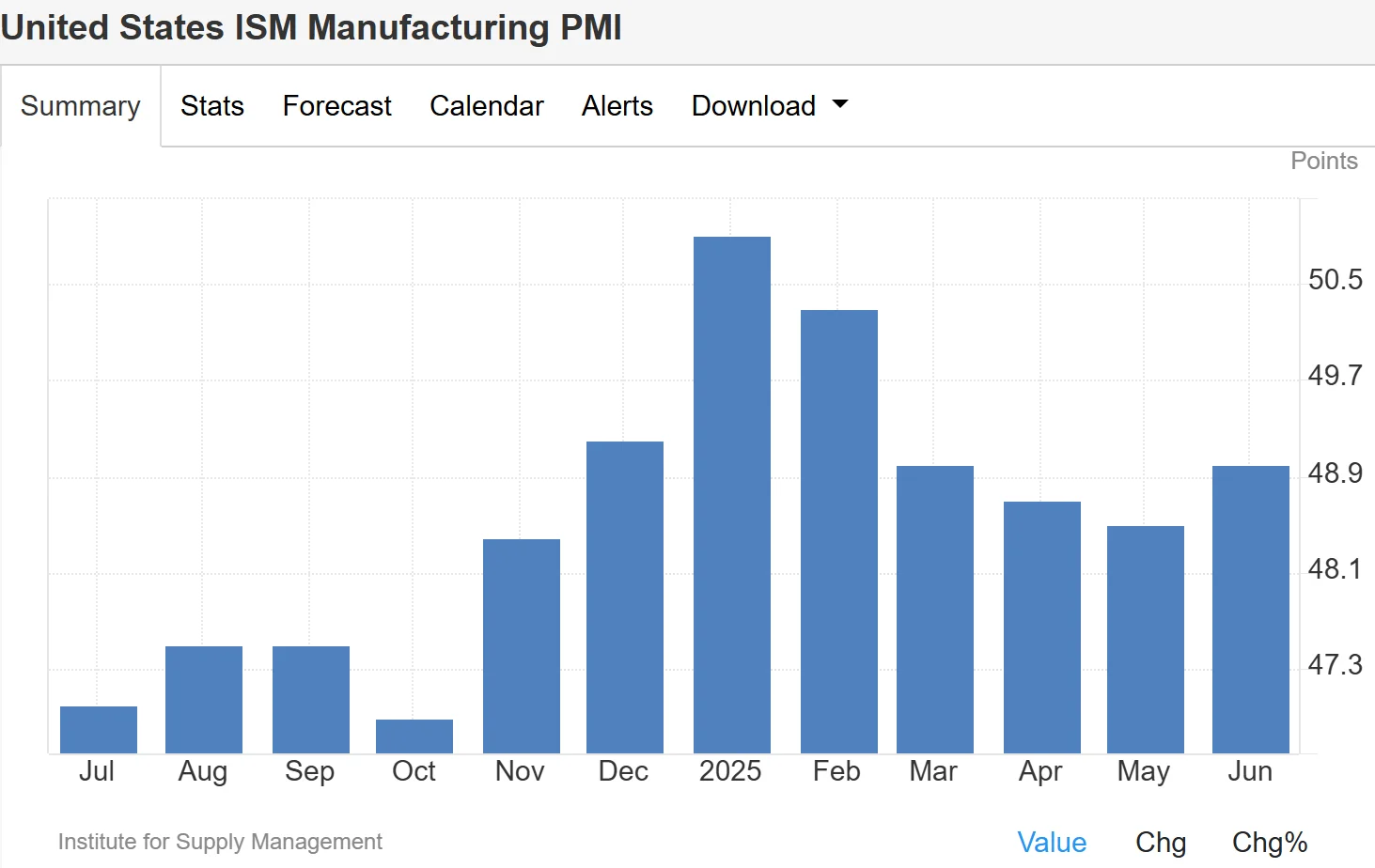

The U.S. manufacturing sector is already showing signs of strain. The Institute for Supply Management’s Manufacturing PMI for June came in at 49, marking the fourth consecutive month below the 50 threshold. New orders dropped to 46.4 and have now declined for five straight months. Combined with the potential cost pressure from tariffs, these figures suggest that a manufacturing rebound faces mounting headwinds. In this environment, new tariffs could further dampen business appetite for inventory restocking and capacity expansion.

Source: Trading Economics

Several economists have warned that tariffs could push U.S. inflation above 3% in 2025, cut economic growth in half, and even trigger a recession. The Tax Foundation estimates that the tariffs are equivalent to a $1,200 annual tax increase per household. A report from Goldman Sachs projects that businesses will pass on 60% of the tariff burden to consumers. The uncertainty driven by tariff threats appears to be slowing corporate investment and hiring, dragging on overall economic momentum.

The Organisation for Economic Co-operation and Development (OECD) has also revised down its global growth forecast for 2025, citing tariffs as a drag on the world economy. The U.S. economy already contracted in the first quarter, and continued tariff pressure could worsen the risk of a recession. Rising consumer prices are likely to weaken demand further.

What Will Happen Next

Absent new agreements, more than 20 countries face tariffs ranging from 25% to 50%, raising the risk of a full-blown global trade war. Negotiation progress with the EU and India suggests some exemptions may still be granted, but hardline positions from countries like Brazil could trigger a retaliatory spiral. Trump’s “letter equals agreement” strategy has streamlined negotiations, yet the execution details of framework deals—with countries such as Vietnam and the UK—remain unclear, suggesting continued short-term market volatility.

In the long run, Trump’s tariff policy could reshape the global trade landscape by incentivizing manufacturing to return to the U.S. However, the elevated costs and retaliatory measures may ultimately erode American competitiveness. The World Trade Organization (WTO) and the European Union have both called for multilateral coordination to counter unilateralism, but Trump’s “America First” stance continues to complicate talks.

Trump has invoked the International Emergency Economic Powers Act (IEEPA) to justify the tariffs. However, on May 28, the U.S. Court of International Trade ruled that he had overstepped his emergency powers, suspending portions of the tariffs. The Federal Appeals Court temporarily upheld the tariffs and scheduled a hearing for July 31. Should the IEEPA challenge result in a final ruling against the legality of the tariffs, the policy could face constraints. Even then, Trump may pivot to other legal frameworks—such as the Trade Act of 1974—to maintain pressure.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates