In July 2025, U.S. President Donald Trump intensified his criticism of Federal Reserve Chairman Jerome Powell, particularly regarding the delayed actions on interest rate cuts. Trump publicly called for Powell's resignation and hinted at nominating a candidate with a more dovish monetary policy stance to replace him.

However, due to the Federal Reserve's collective decision-making process, its tradition of independence, and various external market factors, the likelihood of a rapid interest rate cut remains low, even if Powell were to step down as Chairman.

The Constraints on the Fed's Policy Decision-Making

We need to understand that the Federal Reserve's monetary policy is determined by the Federal Open Market Committee (FOMC), which consists of 12 members, including 7 members of the Federal Reserve System Board of Governors, the President of the New York Federal Reserve, and 4 rotating regional Federal Reserve Bank Presidents.

As one of the governors, the Chairman of the Federal Reserve has one permanent vote, which carries the same weight as the votes of other governors and the New York Fed President. Any interest rate adjustment requires the support of a majority of FOMC members, meaning that even if Trump successfully nominates a new chairman who supports rate cuts, any policy shift would still need to persuade other members.

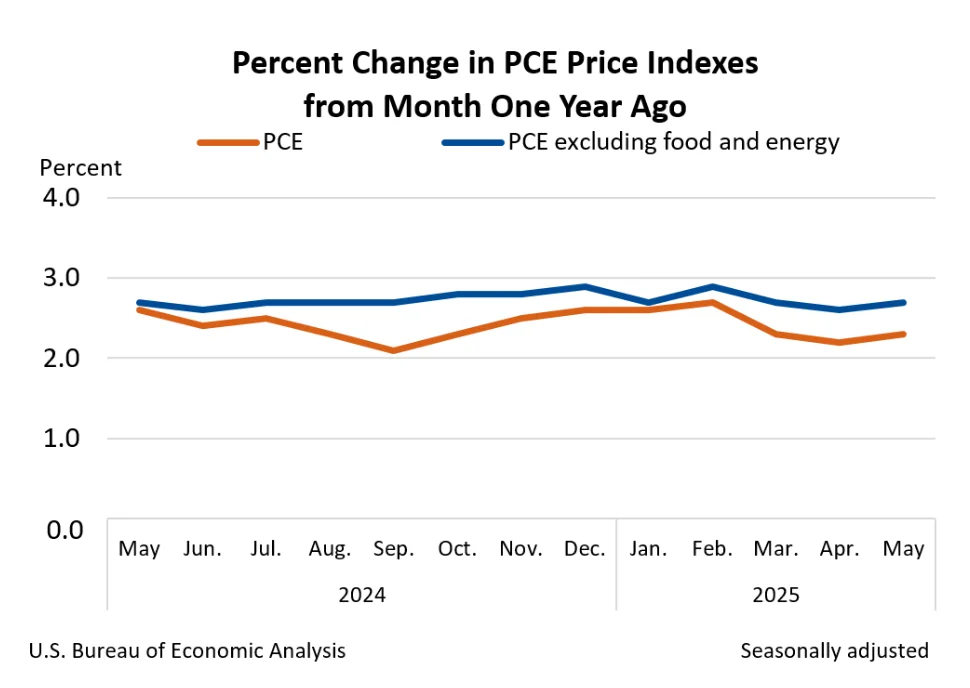

The Federal Reserve's Congressional mandate is to promote maximum employment and price stability, targeting a 2% long-term PCE inflation rate, while also maintaining low unemployment. In May 2025, the U.S. CPI annual growth rate rose from 2.3% in April to 2.4%, and the core PCE inflation rate climbed to 2.7%, still above the Fed’s 2% target, indicating that inflationary pressures have not fully dissipated.

Source: BEA

Although inflation has come down from its 2022 peak, it remains high, partly due to rising import costs driven by Trump's tariff policies.

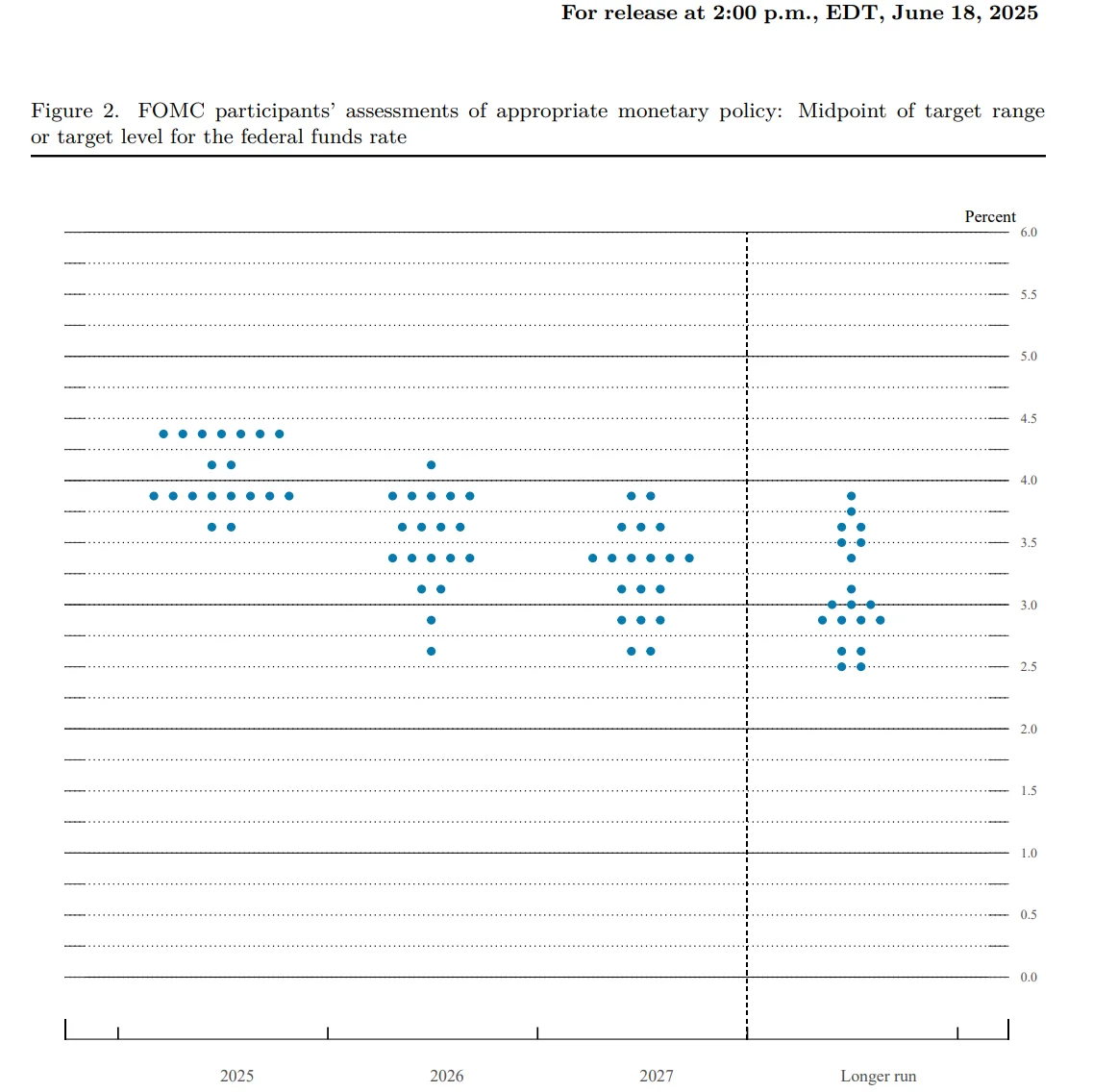

In response, most FOMC members have taken a cautious stance on rate cuts in the short term. The minutes from the June meeting revealed that the FOMC unanimously agreed to keep the federal funds rate at 4.25% to 4.5%, reflecting a judgment of economic stability and a cautious approach to inflation risks.

The minutes noted that economic activity has been expanding steadily, the unemployment rate remains low, and the labor market is strong, though inflation is still somewhat elevated. Economic uncertainty has lessened but remains significant. The FOMC emphasized that it would assess the timing and extent of rate adjustments based on incoming data, evolving outlooks, and a balance of risks. If any risks emerge that could hinder its goals (maximum employment and 2% inflation), the committee is prepared to adjust its policy stance.

Source: Federal Reserve June Dot Plot

In 2025, inflationary pressures have been exacerbated by Trump's trade policies (such as tariffs), and members of the FOMC are inclined to wait for more economic data to assess the inflation trend. Some Fed officials believe that cutting rates prematurely might fuel inflation expectations, weakening the effectiveness of monetary policy. Harvard economist Jason Furman has pointed out that the collective decision-making mechanism of the FOMC limits the influence of any single chairman, particularly when policy proposals are clearly politically motivated.

The Federal Reserve's Tradition of Independence

Since the 1950s, when the Federal Reserve freed itself from direct control by the Treasury, it has been committed to maintaining its independence. Officials emphasize that monetary policy should be based on economic data rather than political pressure. Powell's term as chairman runs until May 2026, and he has made it clear that he will not resign early. Even if Powell is replaced, the new chairman would have to contend with an institution culture that places a high premium on independence. If rate cuts are seen as political interference, FOMC members may resist such proposals to preserve the Federal Reserve’s credibility.

Historically, it is rare for a Federal Reserve chairman to continue serving as a governor after stepping down, though it has occurred. For example, in 1948, Marriner Eccles resigned from the chairmanship under pressure from President Truman but remained on the Board of Governors for three more years, continuing to influence policy discussions. If Powell chooses to remain on the Board (his term as a governor runs until 2028), he could challenge the policy agenda of the new chairman, further complicating Trump’s goal of rate cuts.

Additionally, the Federal Reserve Board of Governors consists of 7 members, each serving a 14-year term, with staggered appointments to limit the power of any single president to influence the board. During the remainder of Trump’s term, only one governor—Adriana Kugler’s term—will expire in 2026. The other three governors, appointed by the Democrats, will have terms extending into the 2030s, limiting Trump’s ability to reshape the board. Therefore, even with a new chairman, the composition of the FOMC will remain diverse, making a swift shift toward dovish policies unlikely.

The Indirect Impact of Rate Changes and Market Response

The Federal Reserve indirectly influences borrowing costs, such as mortgage rates, credit card rates, and auto loan rates, by adjusting the federal funds rate (a short-term interbank rate). However, the relationship between short-term and long-term rates is not direct. For example, after the Federal Reserve significantly lowered the federal funds rate from 2023 to 2024, the 30-year fixed mortgage rate remained high at 6.67%, reflecting market expectations of inflation and economic outlook.

Long-term rates are driven by inflation expectations and market confidence. If investors believe that the new chairman's rate-cut decisions are driven by political pressure rather than economic necessity, it could raise inflation expectations, causing U.S. Treasury or mortgage rates to rise.

Stephen Stanley, Chief Economist at Santander Capital Markets, stated that if the market loses confidence in the Federal Reserve's commitment to fighting inflation, long-term yields could rise, offsetting the effects of rate cuts. This market dynamic would further limit Trump’s ability to quickly reduce borrowing costs through appointing a new chairman.

The economic environment in 2025 also adds complexity to the Federal Reserve’s policy decisions. Trump's tariff policies could push up import costs, exacerbating inflationary pressures. According to Bloomberg, economists have downgraded global GDP growth forecasts due to the trade war, affecting demand across industries from consumer electronics to automobiles. As a result, FOMC members are inclined to maintain higher rates to curb inflation rather than rapidly cutting rates to stimulate the economy.

Additionally, the Federal Reserve must balance economic growth with financial stability. Investor concerns about inflation and geopolitical risks could lead to market volatility. If the new chairman pushes for aggressive rate cuts, it may raise doubts on Wall Street about the Federal Reserve’s independence, further pushing up long-term rates and increasing borrowing costs for businesses and consumers.

Closing Remarks

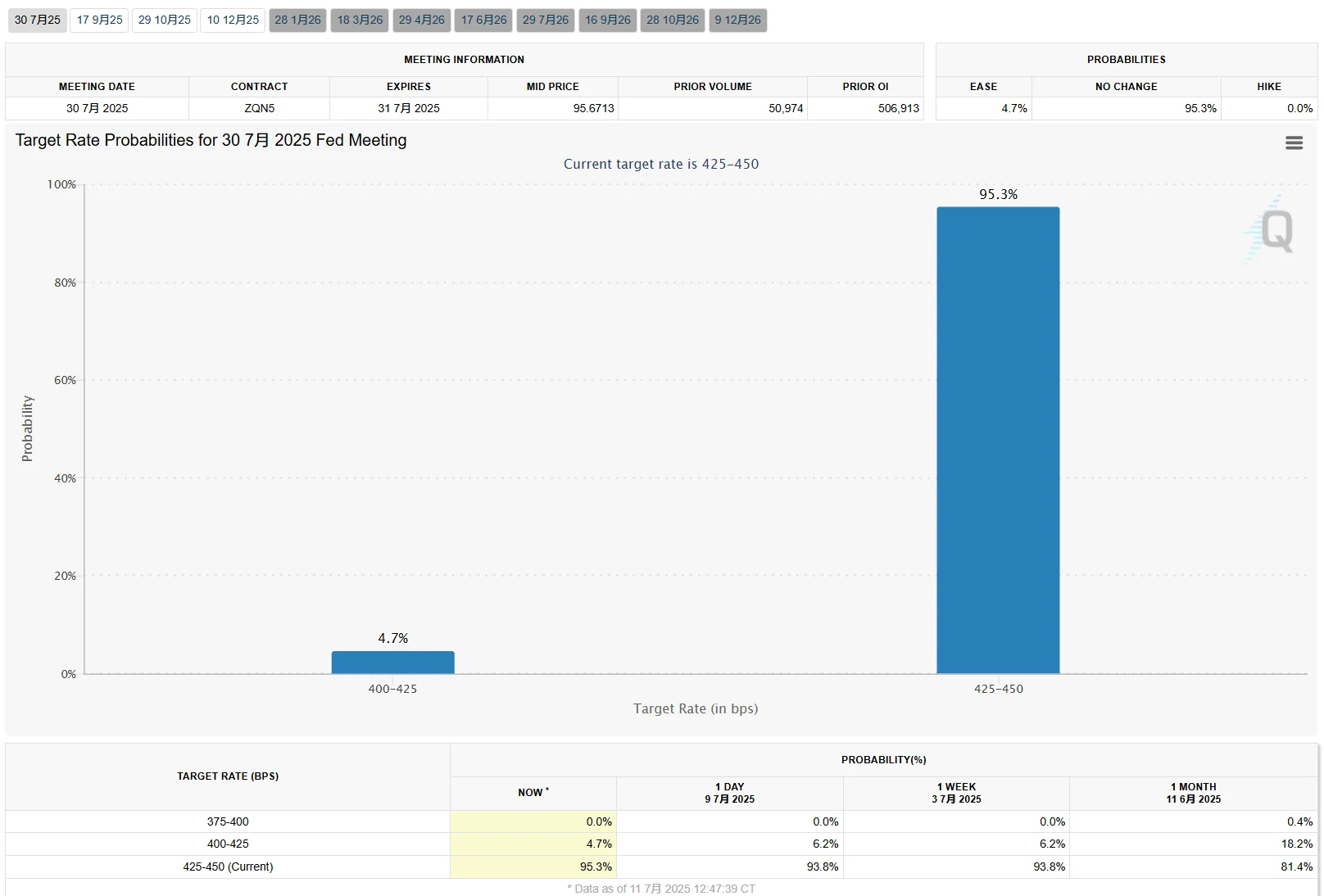

In conclusion, Trump’s criticism of Powell's pace of rate cuts and his intention to replace the chairman are unlikely to quickly change the direction of monetary policy. The June FOMC meeting minutes and May inflation data (CPI at 2.4%, Core PCE at 2.7%) indicate that inflationary pressures and the collective decision-making process limit the possibility of rapid rate cuts. According to the CME FedWatch Tool, the probability of the Fed keeping rates unchanged in July is as high as 95.3%, while the probability of a 25 basis point rate cut is only 4.7%. The market generally believes that the Fed will maintain its current monetary policy stance in the short term.

Source: CME

Morgan Stanley's research report states that due to tariffs pushing inflation higher this summer and immigration control policies keeping the labor market tight, the Fed is unlikely to cut rates in 2025. They expect rate cuts to begin in March 2026. However, the report also notes that if the private sector bears more tariff costs, leading to a weaker labor market, rate cuts may come sooner.

The Fed’s independence, board structure, and market sensitivity to inflation further diminish the White House's direct influence. In the long run, the White House may influence the board through gradual appointments, but this would take years. The market’s response to inflation and tariff risks could, in fact, push up long-term rates, thereby offsetting the effects of rate cuts.