TSMC Q2 Revenue Beats Expectations on Strong AI Chip Demand

21:53 July 15, 2025 EDT

Key Points:

1. TSMC’s Q2 revenue reached NT$933.8 billion (approximately US$31.95 billion), a 38.6% year-over-year increase, surpassing market expectations.

2. The rapid growth of the AI chip market is the main driver of TSMC's performance.

3. Despite facing tariff and supply chain risks, TSMC's outlook remains optimistic.

TSMC (Taiwan Semiconductor Manufacturing Company) reported that its revenue for Q2 reached NT$933.8 billion (around US$31.95 billion), a 38.6% year-over-year increase, exceeding market expectations. TSMC will release its complete Q2 earnings report on July 17, including its outlook for the current quarter and the full year.

The revenue growth was primarily driven by the strong demand for AI chips, with significant orders from major customers like NVIDIA. As the world’s largest semiconductor foundry, TSMC continues to play a pivotal role in advanced process technologies and the global semiconductor industry.

Following the data release, TSMC’s stock closed down slightly by 0.9% to US$229.76 on Thursday. This could be attributed to the 37% surge in its stock price over the second quarter, prompting some investors to lock in profits. TSMC's market capitalization remains solid at approximately US$1.191 trillion, ranking it as the 9th largest company globally.

Source: TradingView

AI Demand Drives Revenue Growth

TSMC’s Q2 2025 Revenue Reaches NT$933.8 Billion (US$31.95 Billion), Up 38.6% YoY, Significantly Exceeding Market Expectations

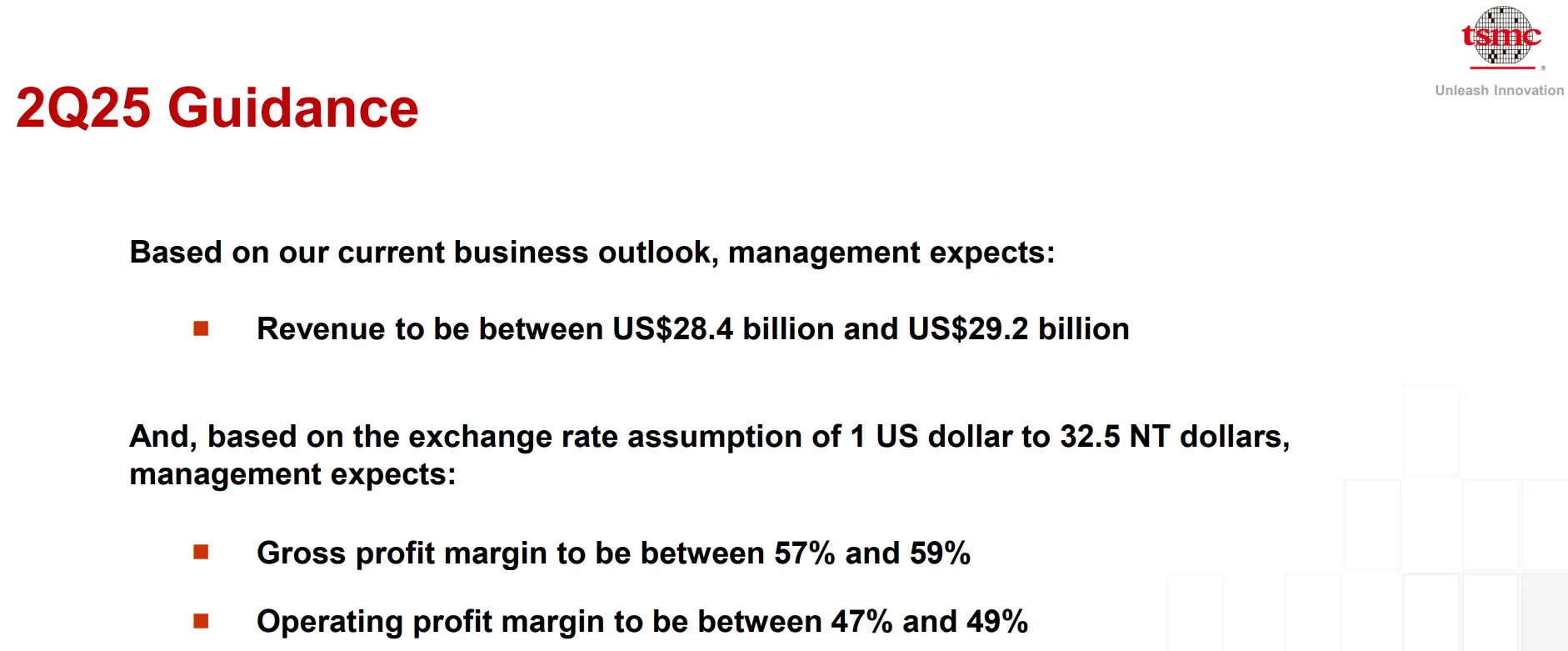

TSMC (Taiwan Semiconductor Manufacturing Company) reported Q2 2025 revenue of NT$933.8 billion (approximately US$31.95 billion), reflecting a 38.6% year-over-year increase, significantly surpassing market expectations of NT$927.83 billion and the company’s guidance range of US$28.4–29.2 billion. This growth was primarily driven by strong demand for AI chips.

Source: TSMC

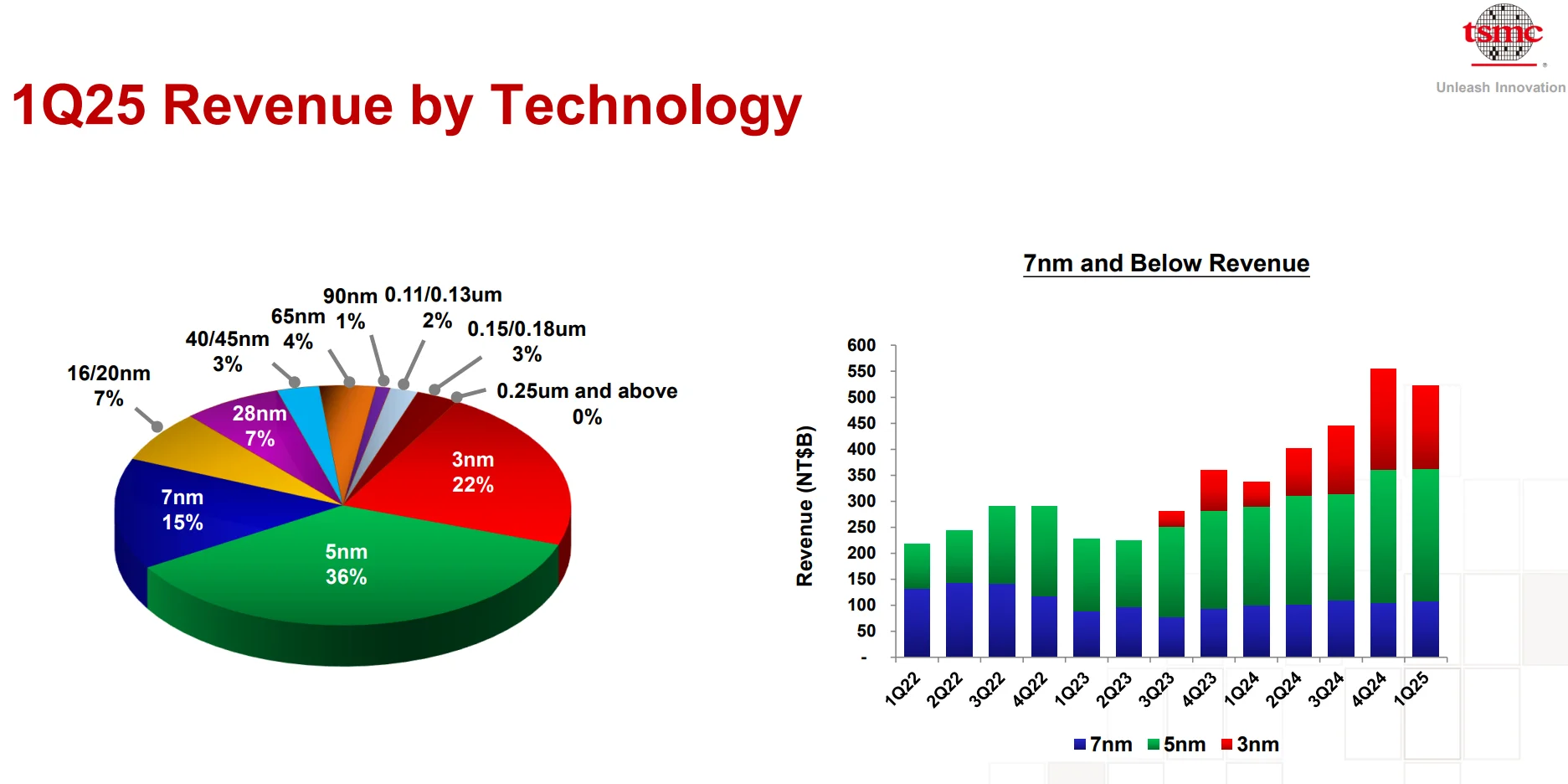

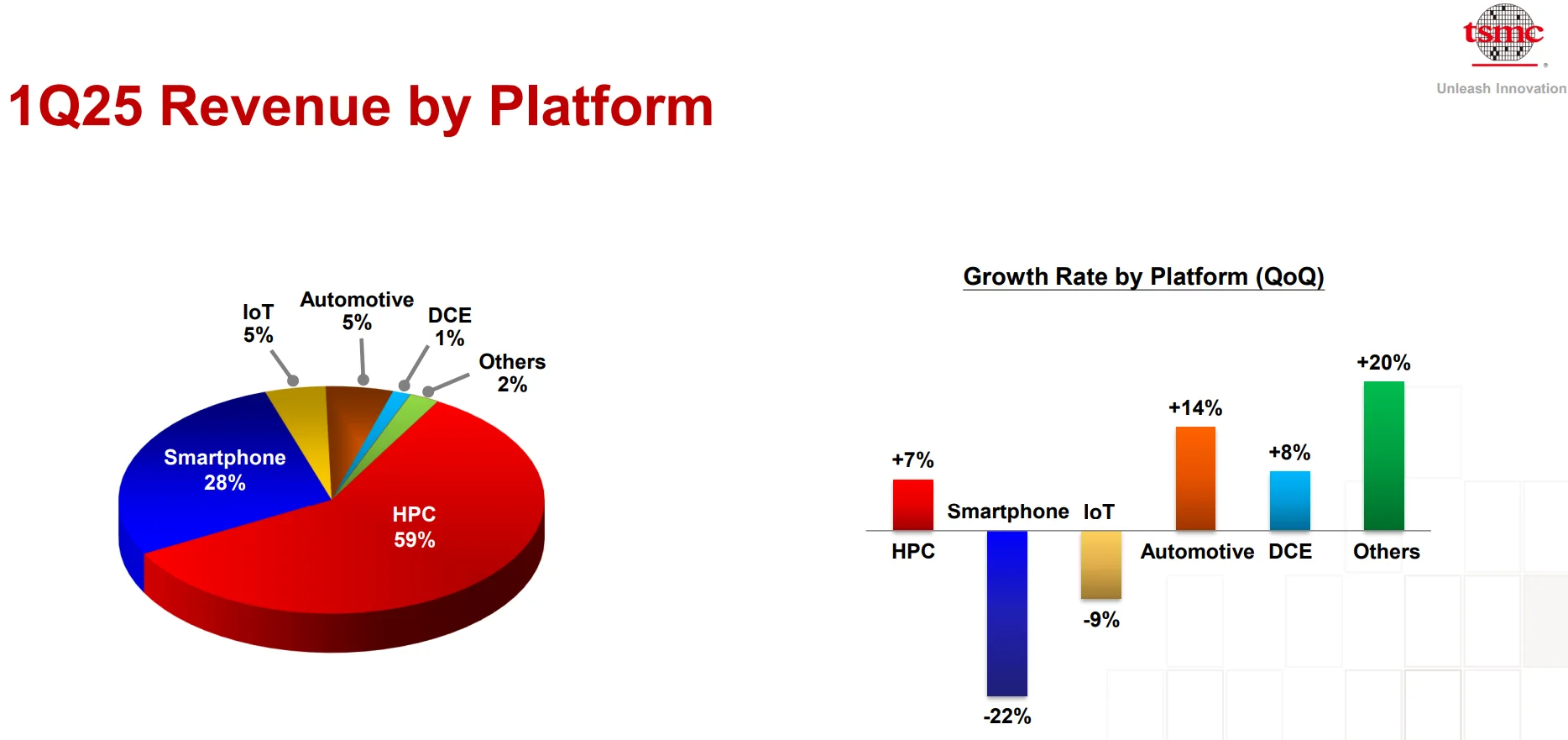

According to the data, TSMC’s high-performance computing (HPC)-related revenue grew by over 70% YoY, accounting for nearly 60% of total revenue, underscoring the rapid expansion in the AI sector. The company’s 3nm and 5nm process technologies played a critical role in this AI boom, meeting the high-performance and low-power requirements of AI chips.

Source: TSMC

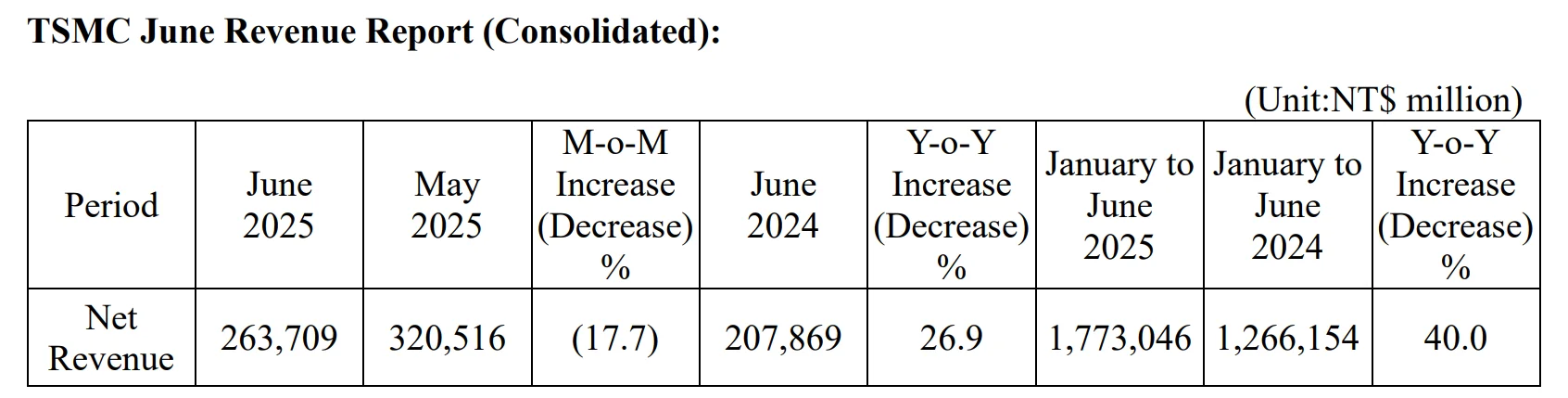

Quarter-over-quarter, Q2 revenue grew by 13.5%, ending the seasonal decline observed in Q1. Although June’s revenue fell by 17.7% month-over-month (impacted by customer inventory adjustments), it still showed a 26.9% year-over-year growth, indicating resilient demand. For the first half of 2025, cumulative revenue totaled NT$1,773.05 billion, a 40% YoY increase, supporting the feasibility of the company’s guidance for a 24%-26% growth in US dollar revenue for the full year.

Source: TSMC

In terms of capital expenditures, Q1 2025 spending totaled US$10.06 billion, with the full-year budget for 2025 maintained at US$38-42 billion. About 70% of this budget is allocated to advanced process technologies, 10%-20% for special processes, and the remainder for advanced packaging. This reflects TSMC’s ongoing investment in technology R&D and capacity expansion.

Near-Monopolistic Market Position

The Rapid Growth of the AI Chip Market is the Main Driver Behind TSMC's Performance

In 2024, generative AI chip revenue surpassed $125 billion, and it is expected to exceed $150 billion in 2025, with projections reaching $500 billion by 2028. This growth is driven by the increasing demand for high-performance computing resources in data centers. TSMC, with its 3nm and 5nm process technologies, has been able to meet the high-performance and low-power requirements of AI chips. Revenue from high-performance computing (HPC) grew by more than 70% YoY in 2025, accounting for nearly 60% of total revenue. AI-related revenue is expected to make up over 30% of total revenue for the year.

Source: TSMC

Within the competitive landscape, TSMC maintains its technological leadership. Samsung's 3nm process faces yield and efficiency issues, causing some customers to shift towards TSMC. Intel’s 18A node has been delayed until 2026, with its Ohio wafer fab expected to begin production in 2030-2031, making it unlikely to challenge TSMC’s market position in the short term. TSMC's advantage in advanced packaging technology is also notable, with CoWoS (Chip on Wafer on Substrate) capacity expected to reach 660,000 wafers per year by Q4 2025, doubling compared to 2024, to meet the demand for high-bandwidth memory (HBM) in AI chips.

TSMC's collaborations with major chip design companies like NVIDIA and AMD further cement its position. NVIDIA’s AI accelerators (such as the Blackwell GPU) and AMD’s growing share in the PC and server markets both rely on TSMC’s manufacturing capabilities. In Q1 2025, TSMC held 35% of the global foundry 2.0 market, highlighting its leadership in cutting-edge process technologies and packaging capabilities.

Tariff and Supply Chain Risks

Despite TSMC's strengthened leadership in AI chip manufacturing, the company still faces certain market challenges.

U.S. tariffs on semiconductor materials and equipment may lead to higher costs for TSMC's Arizona wafer fab, putting pressure on its profit margins. In addition, supply chain bottlenecks in mature process nodes have emerged as potential risks to market stability, particularly in the automotive and industrial sectors.

Furthermore, the global copper supply shortage could impact semiconductor manufacturing. PwC predicts that by 2035, climate change-induced disruptions to copper supply will affect 32% of global semiconductor capacity.

Outlook Remains Positive

Despite this, TSMC's future outlook remains optimistic.

The company plans to ramp up mass production of its 2nm (N2) process by the end of 2025 and achieve 1.6nm (A16) technology by 2028, further widening the technological gap with its competitors. Global capacity expansion is also underway, with investments in the U.S., Japan, and Germany totaling over $100 billion. CEO C.C. Wei stated that AI chip demand will continue to outpace supply, and this supply-demand imbalance is expected to persist for a long time, providing strong support for TSMC to maintain high revenue and profit levels.

Sales (in USD) for 2025 are expected to grow by about 20%, with AI-related chip business revenue likely to double. The compound annual growth rate (CAGR) for the next five years is estimated to be around 45%. Non-AI sectors, such as the gaming cycle and the recovery of traditional applications, will also contribute to the company's performance.

Analysts predict that by 2028, TSMC's market share in the 5nm and below wafer foundry market will exceed 90%, with AI-related revenue potentially surpassing 50%.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates