Recently, U.S. President Donald Trump once again announced plans to impose new tariffs on multiple countries, targeting key trade partners including Mexico, Canada, and the European Union with tariffs as high as 30%. At the same time, the U.S. has issued formal letters pressuring these nations to either accept the proposed tariff terms or face consequences.

On the surface, these measures might be expected to spark market concerns—especially given that similar tariff announcements triggered sharp volatility just a few months ago. However, markets have responded with relative calm. As of the close on Monday, July 14, the S&P 500 edged up 0.14%, remaining within 0.5% of its all-time high.

S&P 500 Index — Source: TradingView

Tariff Developments

Earlier this week, former President Donald Trump sent letters to the leaders of more than 20 countries, stating that the U.S. will begin imposing new tariffs starting August 1. These include a 30% tariff on goods imported from Mexico and the European Union, a 35% tariff on Canadian imports, and a 50% tariff on all goods from Brazil. Additional tariffs include 30% on products from Sri Lanka, 25% on goods from Brunei and Moldova, 30% on imports from Algeria, Iraq, and Libya, and 20% on goods from the Philippines. Trump also announced a 50% tariff on all copper imported into the United States, effective the same day.

In addition, on July 14, Trump stated that if no agreement is reached to end the Russia-Ukraine conflict within 50 days, the U.S. will impose "very severe" tariffs of approximately 100% on Russia. Countries that conduct arms-related transactions with Russia could also be targeted, and nations purchasing Russian oil may face secondary tariffs of up to 500%.

At the same time, Trump’s team indicated a willingness to engage in negotiations on tariffs, suggesting a more diplomatic approach despite the escalating rhetoric. U.S. officials claimed that several trade agreements have already been reached and that the administration remains open to talks, including with European partners.

In response, multiple countries have announced plans to implement retaliatory measures. The Brazilian federal government is expected to issue a reciprocal tariff decree by July 15, countering the proposed 50% U.S. tariff on Brazilian goods. Meanwhile, European Commission Vice President Maroš Šefčovič warned that if U.S.-EU trade negotiations fail, the bloc is prepared to impose additional tariffs on up to €72 billion (approximately $84 billion) worth of American imports.

Markets Are Growing Immune

However, despite the clear escalation in trade tensions, market reactions have been surprisingly calm. Since the beginning of the year, the S&P 500 has steadily approached its all-time high, with the latest closing price less than 0.5% below that peak. The current VIX index stands at 16.88, near its lowest level this year.

VIX Index data — Source: TradingView

The yield on the U.S. 10-year Treasury note remains steady at 4.4%, sitting near the midpoint of its recent range, indicating that investor risk appetite remains relatively strong.

10-Year U.S. Treasury Yield data — Source: TradingView

This contrasts sharply with the “triple threat” sell-off in equities, bonds, and currencies triggered by tariff fears in April 2025. The current market calm can be attributed to several factors.

First, market sensitivity to tariff threats has diminished. Similar tariff headlines have emerged repeatedly over the past months but mostly failed to materialize or were seen as negotiation tactics. As is often noted on Wall Street, markets tend not to overreact to recurring news. Unless tariffs are actually implemented, negative adjustments are unlikely.

Second, rising tariff revenues have softened the negative expectations around tariffs. On July 13, Trump announced that the U.S. collected $25 billion in tariff revenue last month, primarily from automobiles, aluminum, steel, and lumber, and emphasized that “this is just the beginning,” predicting tariff income will reach “robust levels” in the coming month.

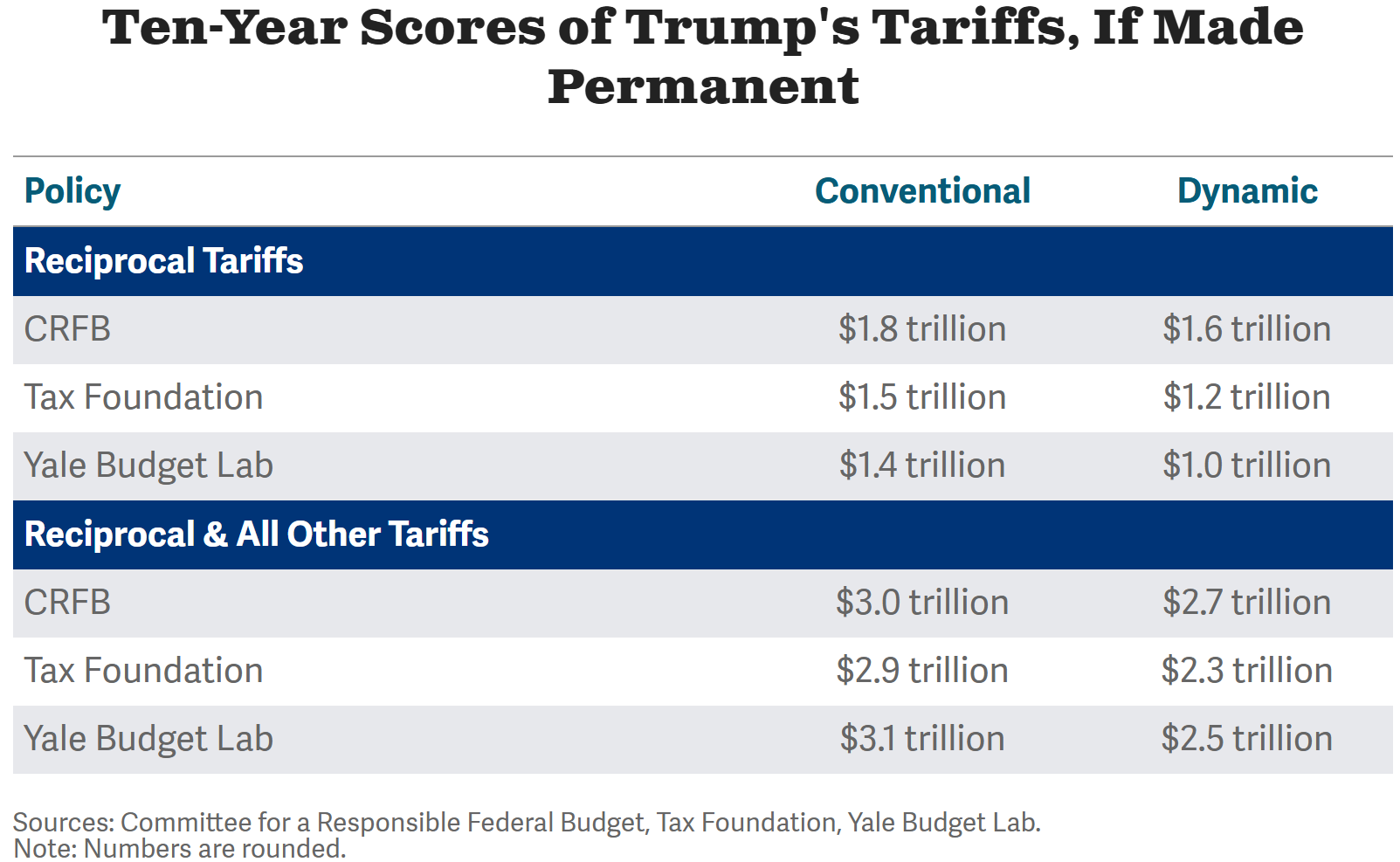

The Congressional Budget Office (CBO) estimates total tariff revenue could reach approximately $2.8 trillion over the next decade. Meanwhile, Yale University’s Budget Experiment predicts that all tariffs announced by the Trump administration so far could generate nearly $2.49 trillion in revenue over ten years, although these figures will be partially offset by economic losses. Tariff revenues provide a fiscal supplement that helps ease budget pressures and indirectly support the market.

Source: Committee for a Responsible Federal Budget

Furthermore, the macroeconomic fundamentals remain solid, underpinning investor optimism. Recent employment data have been strong, inflation, while not fully subdued, shows signs of stabilization. Corporate earnings remain near historic highs and are expected to maintain double-digit growth in the coming years. Innovations in artificial intelligence and other technologies continue to fuel long-term economic growth, attracting considerable attention from capital markets.

NVIDIA’s market capitalization surpasses $4 trillion, directly boosting the index — Source: TradingView

Markets have already digested much of the uncertainty surrounding trade policies over the past few months. Although new tariff threats have emerged, the increased transparency around details and the government’s expressed willingness to negotiate have actually clarified the outlook, reducing the likelihood of extreme panic.

Additionally, while geopolitical risks remain unresolved, markets have developed a more mature understanding and response strategy regarding potential conflicts. Tensions in Ukraine and the Middle East have not yet caused material damage to the U.S. economic fundamentals or corporate earnings, helping markets maintain relative composure.

Risks Remain

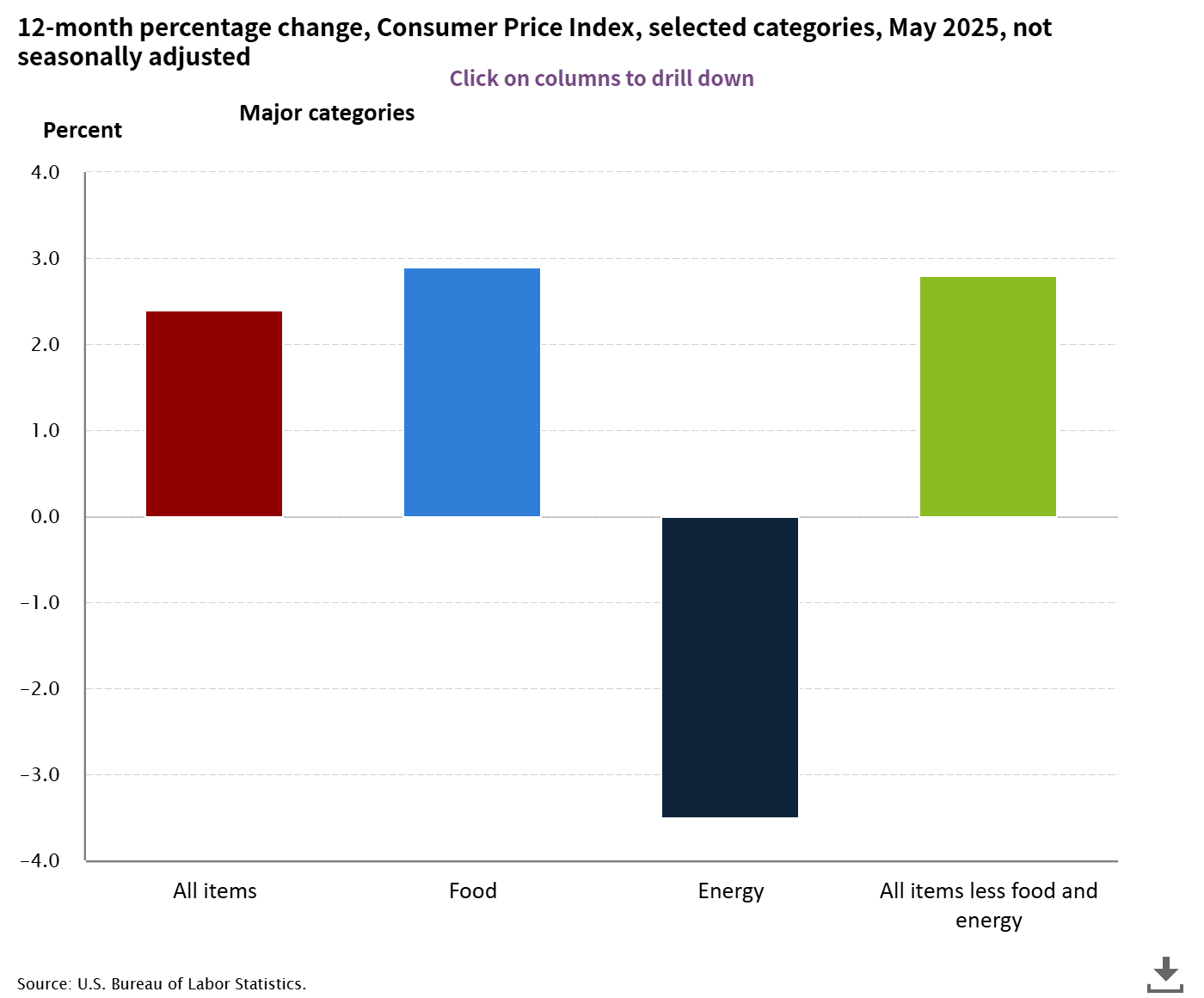

Despite the recent market resilience, underlying risks should not be overlooked. If President Trump's tariff plans are fully implemented, inflationary pressures could rise significantly. Some analysts estimate that this round of tariffs could push the U.S. CPI higher by 0.5% to 1% in Q4 2025, potentially delaying the Federal Reserve’s rate cut cycle, constraining market expectations for liquidity easing, and suppressing valuations in an already richly priced equity market.

U.S. May CPI Data — Source: BLS

Meanwhile, trading partners have issued clear signals of retaliatory measures. The EU and Brazil are preparing equivalent countermeasures that, if enacted, would introduce new disruptions to global supply chains. According to the World Trade Organization, if trade tensions persist, global trade volume could contract by 2% in 2026. This would affect multinational companies’ operational efficiency, potentially drag down global consumer demand, and ultimately pressure corporate earnings.

Given that the S&P 500’s forward price-to-earnings ratio has risen to around 22x, well above the 10-year average of 18x, the market’s tolerance for negative shocks is increasingly limited. Should economic data or corporate earnings signal weakness, market volatility is likely to intensify. Overall, while market resilience remains strong, the tension between elevated valuations and macroeconomic risks is mounting.