June CPI Coming Up: Will the Fed Still Cut Rates?

05:43 July 15, 2025 EDT

Key Points:

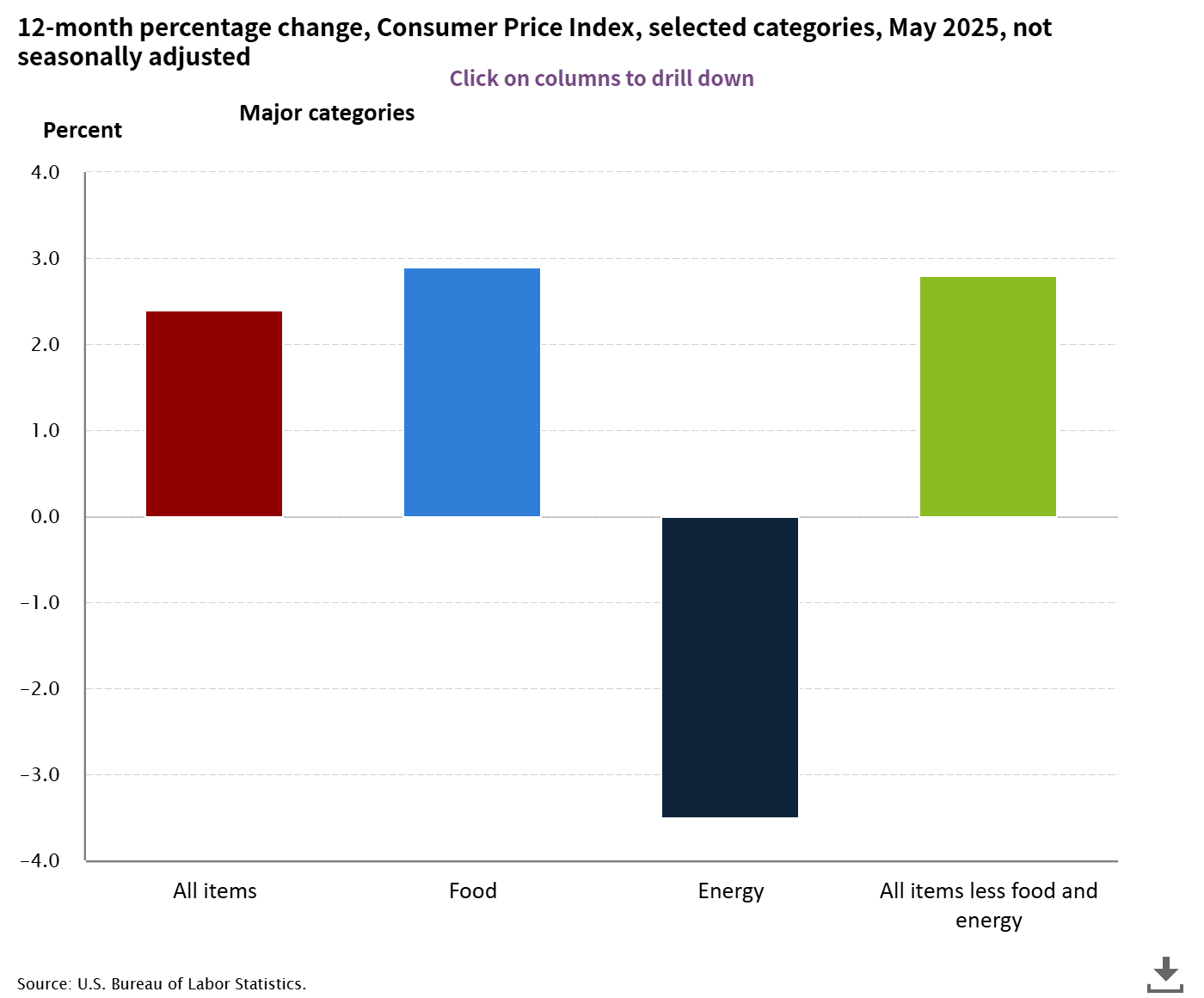

1. The market expects June CPI (YoY) to rise to 2.7% from 2.4% in May, while core CPI (excluding food and energy) is projected to climb to 3.0% from 2.8%. Both headline and core CPI are expected to increase 0.3% month-over-month.

2. The Federal Reserve is expected to keep interest rates unchanged at 4.25%–4.5% during its July 29–30 policy meeting.

3. If core inflation remains elevated, the window for rate cuts this year could narrow further.

On July 15, the U.S. Bureau of Labor Statistics will release the June Consumer Price Index (CPI) report. Markets broadly anticipate that headline CPI will rise to 2.7% year-over-year from 2.4% in May, while core CPI is expected to increase to 3.0% from 2.8%. On a month-over-month basis, both measures are projected to rise by 0.3%.

Source: BLS

If the data comes in as expected, it would serve as another clear signal that former President Trump’s renewed tariff measures are starting to impact inflation. It would also reignite debate over the Fed’s policy path in the months ahead.

Tariff Costs Are Gradually Being Passed Through

The market’s expectation of rising inflation is largely driven by the transmission effect of the Trump administration’s tariff policies gradually materializing. Since 2025, the U.S. has imposed a 10% tariff on most imported goods, a 25% tariff on automobiles, and tariffs on products from key trading partners including China. After a supply chain buffering period, companies have begun passing these increased costs onto end consumers.

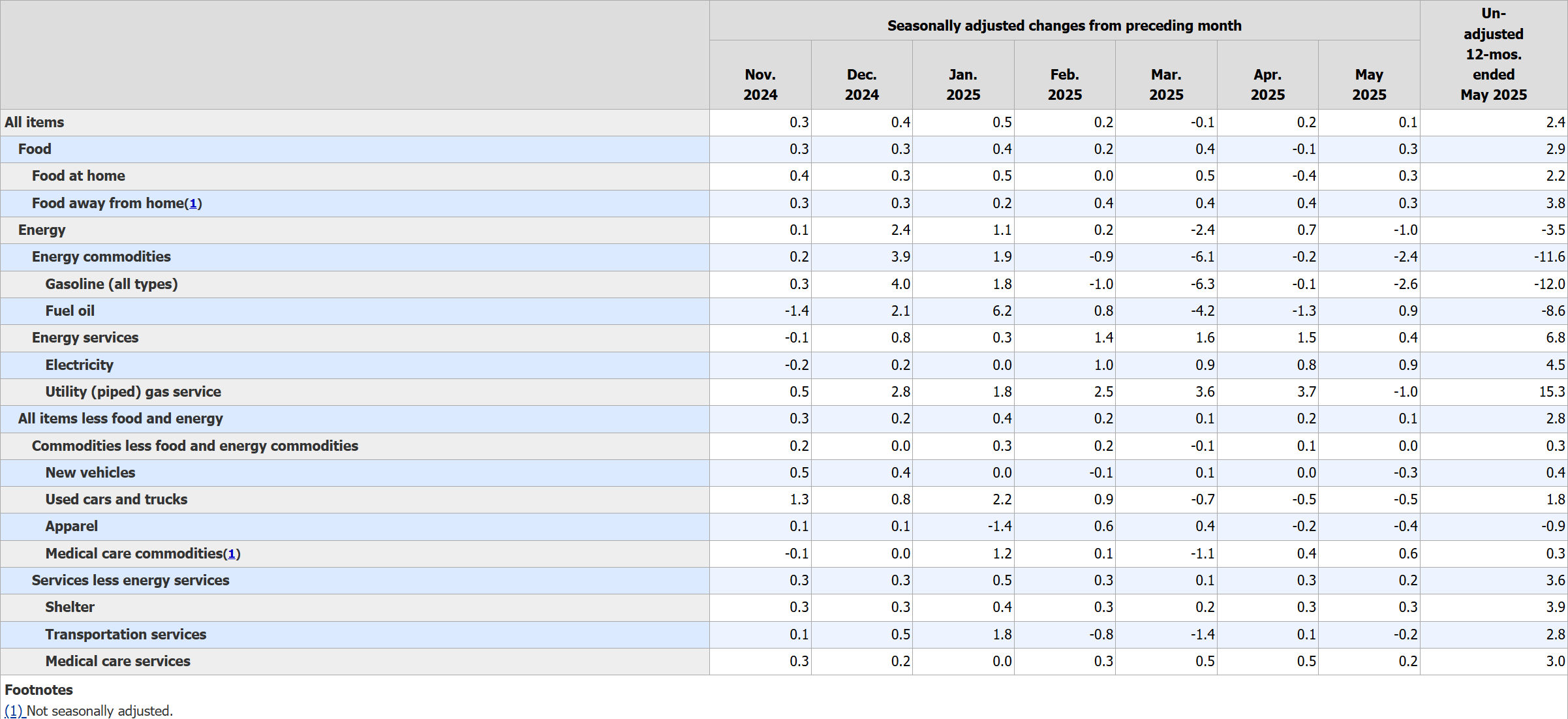

For example, prices for tariff-sensitive categories such as home appliances and furniture have shown structural increases. Used car prices are expected to rise month-over-month due to a rebound in wholesale auction markets, while clothing prices, after two consecutive months of weakness, are also likely to recover. These price changes, combined with tariff effects, are the direct drivers behind the rebound in core goods prices, amplifying overall inflationary pressure.

Core services inflation, which slowed to 0.1% in March, is expected to pick up again in June. Following a six-month low in rent growth, a modest rebound is anticipated. The pace of deflation in airfares and hotel prices is expected to slow, while moderate increases in medical and entertainment costs further push core CPI higher.

Source: BLS

However, economists differ significantly in their assessment of tariffs’ inflationary impact. Pantheon Macroeconomics believes June CPI data will clearly reflect tariff-driven price increases, arguing that supply chains have little room left to absorb costs. In contrast, Nomura Securities suggests the tariff impact will be limited in the short term, with price rises in some categories but more pronounced inflationary pressures possibly delayed until late 2025.

This divergence is also mirrored within the Federal Reserve. The June meeting minutes indicate most officials view tariffs as a source of persistent inflationary pressure, while a minority consider it a one-off shock that can be largely ignored.

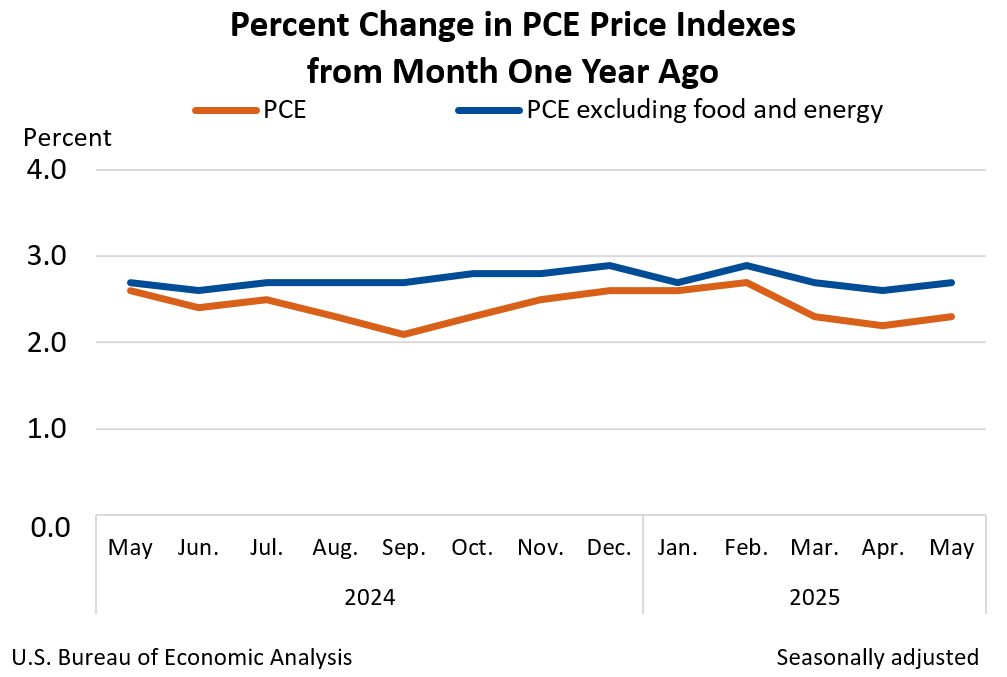

Notably, the core PCE price index rose 2.7% year-over-year in May, hitting its highest level since February 2025, underscoring inflation’s stickiness. While companies may delay price hikes by compressing profit margins or optimizing supply chains, low base effects and ongoing cost pressures could accelerate inflation in the coming months.

Source: BEA

More broadly, tariff policies risk triggering retaliatory measures from trading partners. The United Nations’ May 2025 report warns that trade tensions may drive up production costs, disrupt supply chains, and intensify financial market volatility. Against the backdrop of fluctuating global energy prices, these external risks could further amplify inflationary pressures, raising concerns about inflation overshooting expectations.

Labor Market Conditions

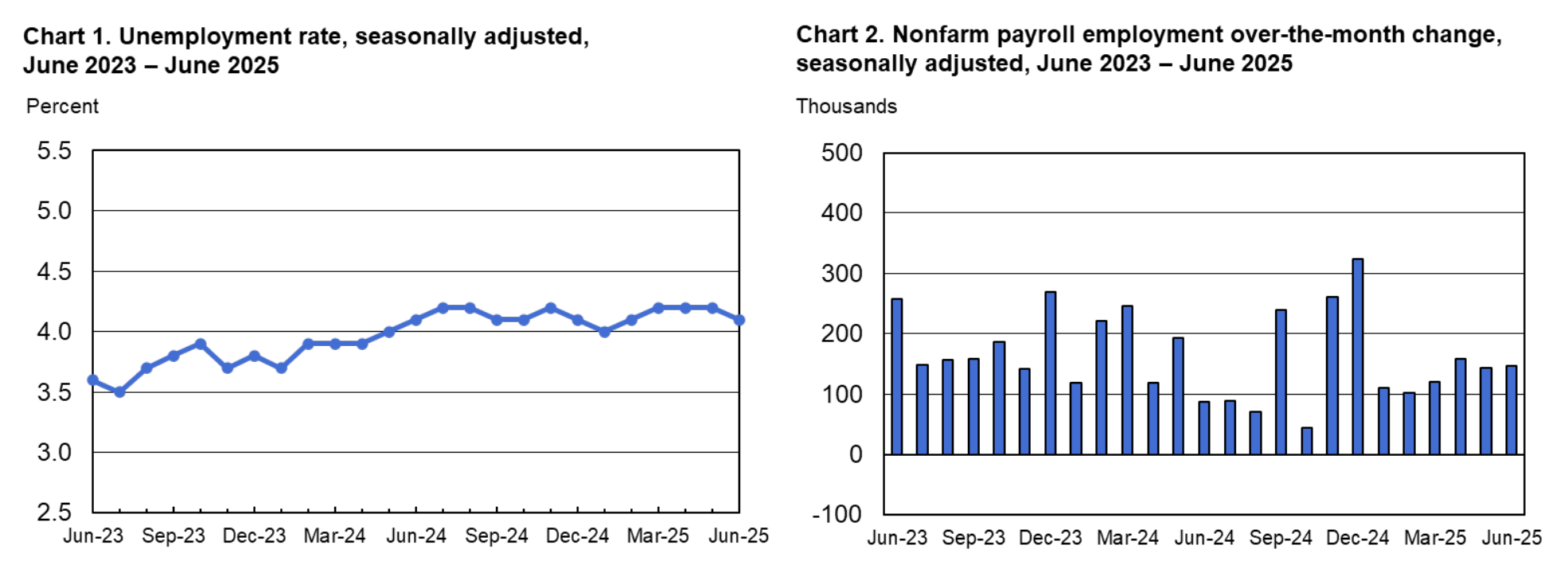

Beyond inflation, the Federal Reserve’s monetary policy adjustments also heavily depend on employment data. In June, nonfarm payrolls increased by 147,000 jobs, roughly in line with the 12-month average of 146,000, indicating that the overall labor market remains resilient. The unemployment rate held steady at 4.1%, below expectations.

Source: BEA

However, the ADP private sector employment report showed a rare decline of 33,000 jobs in June. Although initial jobless claims have retreated, they remain elevated, suggesting the labor market may be entering a phase of “high-level stagnation.” This implies that even if the Fed remains vigilant on inflation, it cannot fully dismiss the risk of a downturn in employment.

Source: ADP

If the labor market cools further, it could ease wage pressures and partially offset some tariff effects. Conversely, continued tightness may exacerbate inflation.

The Fed’s Choices

The June minutes revealed a “historic-level” split among Federal Reserve officials on the path to rate cuts: among 12 voting members, six maintained a neutral stance, two were clearly hawkish, and only a few, including Waller, supported a rate cut in July. On July 1, Chair Powell explicitly stated that absent tariff policies, the Fed would have already begun easing. However, current inflation forecasts have been significantly revised upward due to tariffs, forcing a wait-and-see approach. This view aligns with Chicago Fed President Goolsbee, who noted that recent tariff measures may delay rate cuts and more definitive data is needed.

Meanwhile, Cleveland Fed President Mester emphasized that the labor market shows no “clear signs of weakness” and that current rates are near neutral, requiring restrictive policy to ensure inflation returns to the 2% target.

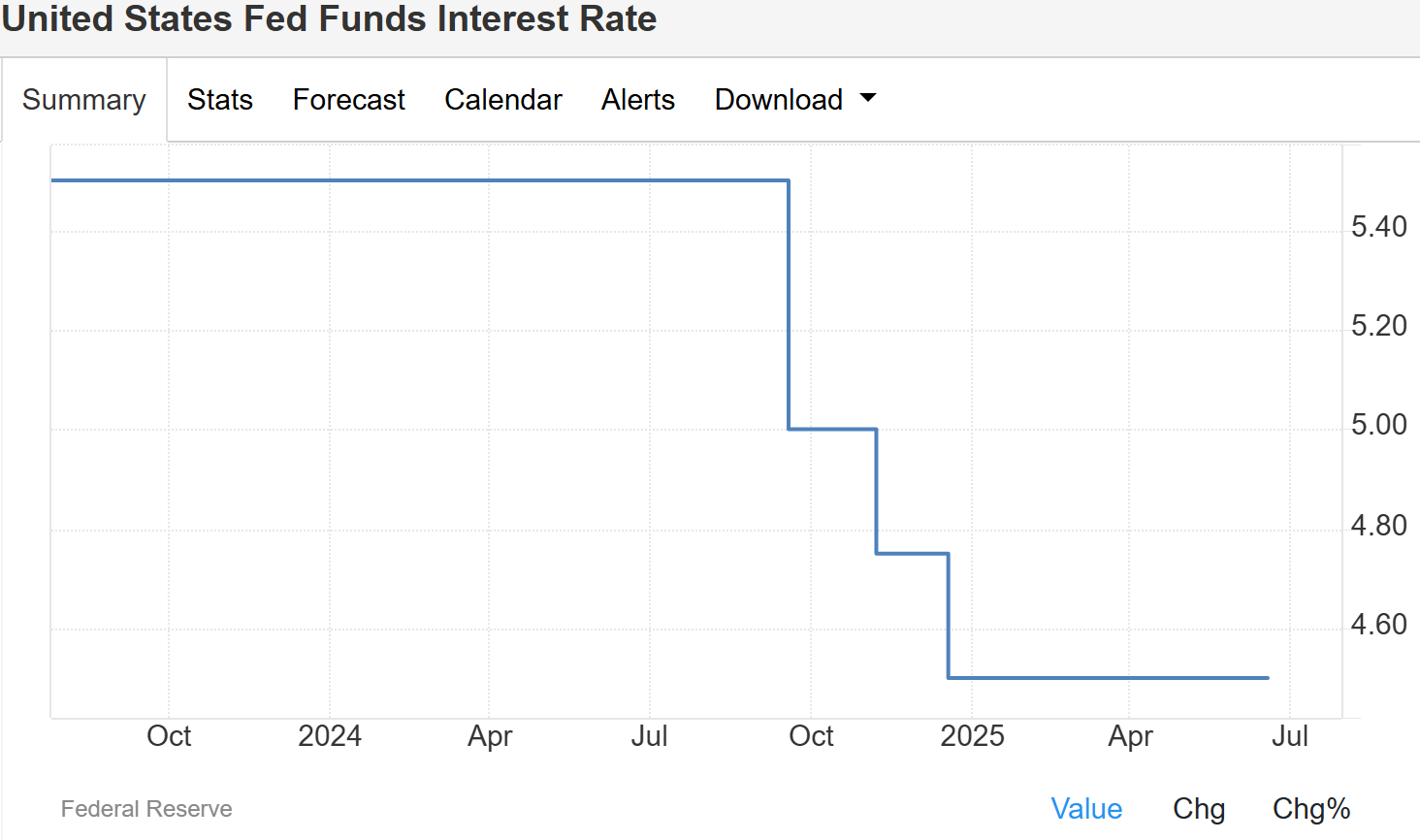

At the same time, the White House continues to pressure for rate cuts. Trump recently renewed criticism of Powell’s “poor performance,” but the Fed remains data-driven and stresses its independence. The market widely expects the Fed to hold rates steady at 4.25%–4.5% during the July 29–30 meeting.

Source: TradingEconomics

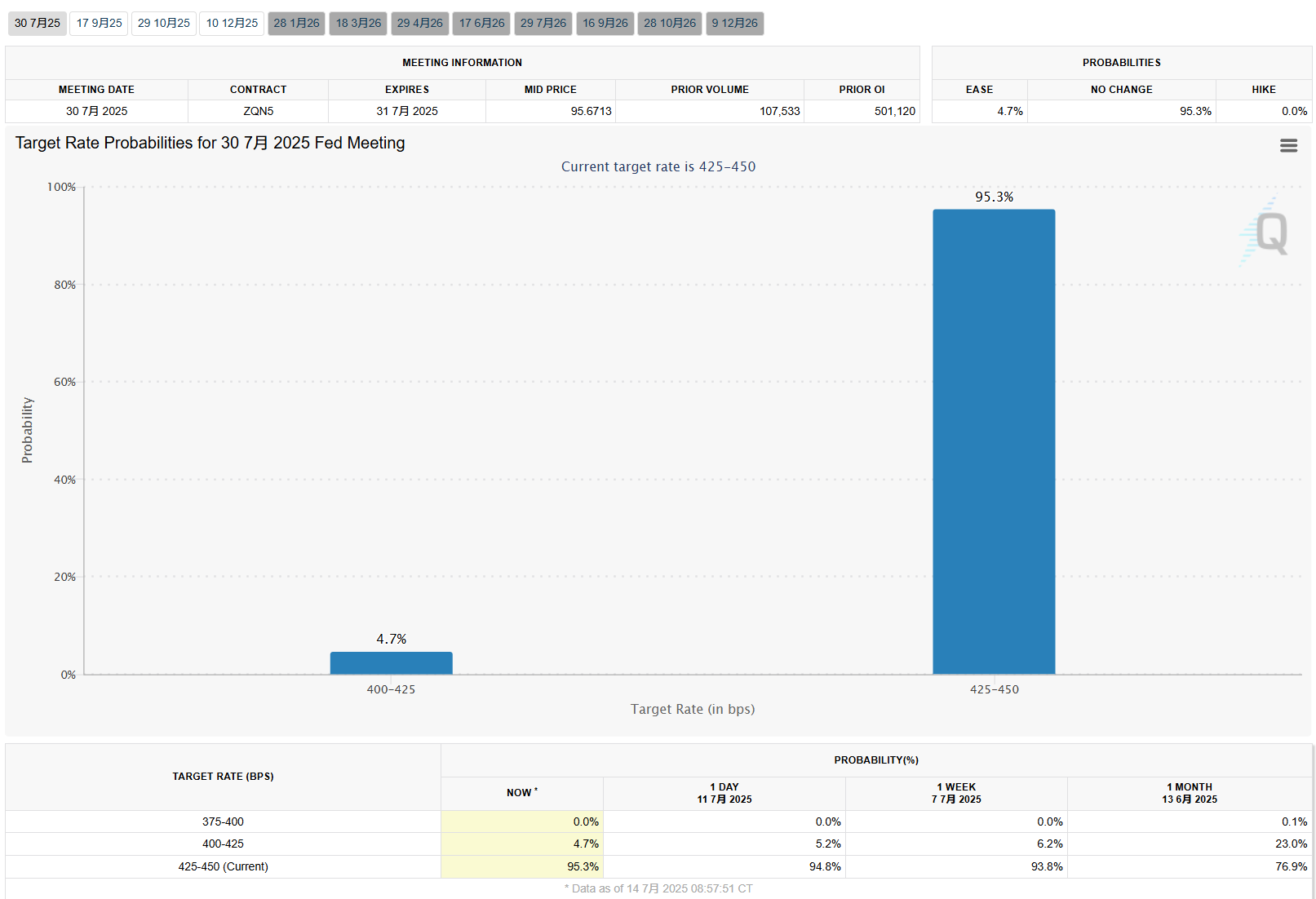

However, market pricing shows the probability of a 25-basis-point cut in September rising to 60.2%. Yet, institutions like Morgan Stanley still forecast no rate cuts for 2025, citing tariffs that may push summer inflation to 3.0%–3.3%. If inflation spikes again and employment weakens, a policy shift could come sooner than expected.

Source: CME

Final Thoughts

Overall, the June CPI data is highly likely to mark the first “quantifiable” impact of Trump’s new tariff policies on inflation. If core inflation remains elevated, the Federal Reserve’s window for rate cuts this year will narrow further, especially as the stickiness of service prices may become the biggest policy obstacle in the next phase.

However, employment data has yet to show a comprehensive weakening, and the rebound in prices still has structural explanations, which keeps the market’s baseline expectation of one rate cut this year intact. Therefore, the data in July and August will be crucial in determining whether the Fed truly “waits for more information” or is forced by external pressures to take a more proactive approach.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates