AI to Humanoid Robots: How Investors Can Tap Into the Next Tech Wave

03:25 July 2, 2025 EDT

Over the past two years, the explosive growth of the artificial intelligence industry chain has driven a valuation reshaping of major U.S. tech

giants like NVIDIA, Palantir, and Microsoft, while also making global investors realize that AI is no longer just a single technological

breakthrough but a long-term theme fiercely pursued by the capital markets. As large language models transition from the infrastructure-

building phase into practical application, the AI investment frenzy in 2024 has gradually cooled, and market focus has begun to shift from

the “invisible” algorithmic capabilities to the “visible” physical carriers.

In 2025, embodied intelligence (Embodied AI) has become the new focal point for both technology and capital. The software-side dividends

of AI are entering a stage of diminishing marginal returns, while intelligent hardware with real physical interaction capabilities—especially

humanoid robots—is emerging as the critical bridge connecting virtual models to the real world. Through humanoid robots, AI’s perception,

understanding, and execution abilities are being integrated and realized in physical form for the first time, providing a technical pathway for

AI to extend to frontline production and everyday life scenarios.

The year 2025 is gradually becoming the “year of mass production for humanoid robots.” Tesla’s Optimus has already begun internal factory

deployment, entering pilot commercialization. Figure AI has completed over $1 billion in funding, with Microsoft and OpenAI jointly betting on

the space. Boston Dynamics unveiled a new version of Atlas featuring agile movements and language interaction capabilities. Chinese

company Yush Robotics even appeared on the CCTV Spring Festival Gala, stunning the public with humanoid robot dance performances.

Source: Yush Robotics

Unlike previous industrial automation or service robots, humanoid robots possess characteristics of “universality, multimodality, and strong

learning ability,” fitting a broad range of scenarios including manufacturing, logistics, housekeeping, retail, and even healthcare. For the

capital markets, this signifies a potentially trillion-dollar opportunity that could replicate the explosive growth path of electric vehicles, as

well as the starting point for a new round of valuation re-ratings.

The Real-World Platform for Embodied AI

Compared to traditional abstract software systems or non-interactive embedded AI, humanoid robots are regarded as one of the “ultimate

forms of AI.” They integrate human-like perception, semantic understanding, logical reasoning, and physical execution capabilities, enabling

them to perform complex tasks in real-world environments in a “humanized” manner.

This involves a comprehensive fusion of core AI algorithms such as language models, computer vision, and reinforcement learning, while

also relying on highly integrated hardware systems including robotic operating systems, sensing devices, energy management, and

actuation structures.

It can be said that following smartphones and electric vehicles, humanoid robots are becoming the next super terminal driving the deep

integration of “hardware + AI.” This trend explains why tech giants like Tesla, Microsoft, and NVIDIA are actively investing in this space.

With these leading companies’ involvement, humanoid robots are moving from laboratory research toward early-stage industrialization. They

represent a technological breakthrough in combining perception and execution for artificial intelligence, and are also driving the entire AI

industry chain to extend and transform from cloud applications to edge intelligence and terminal devices.

Development Timeline

Humanoid robots are not a new concept. Since the 1960s, when Waseda University in Japan developed the first prototype robot, engineers

worldwide have been exploring how to make robots not only look human but also “think and act like humans.” However, for a long time, this

technology remained confined to research labs or exhibition stages, limited by AI computing power, energy density, and cost structures.

It was only in the past three years that humanoid robots began transitioning from “demonstration-level” to “commercial-grade,” driven by

breakthroughs in large language models, the deployment of “AI chips + edge computing,” and the accelerated domestic substitution of

high-precision mechanical components.

Policy support has further accelerated this process. In 2023, China’s Ministry of Industry and Information Technology identified humanoid

robots as a key next-generation disruptive technology for focused cultivation. In 2025, the founder of UBTech Robotics was invited to

participate in private enterprise forums and deliver industry insights, signaling the national strategic emphasis on this sector.

In the U.S., emerging companies like Figure AI have received joint funding from AI alliances including Microsoft, OpenAI, NVIDIA, and

Amazon, with their product Figure 02 being hailed as “the most advanced AI hardware on Earth.”

Tesla has also clearly stated plans to deliver small-scale production of its Optimus humanoid robot in 2025, aiming for mass production and

export by 2026. Elon Musk has gone so far as to say that “future demand for robots may far exceed that for electric vehicles.”

Source: Tesla

Market Potential

As the humanoid robot industry gradually transitions from experimental validation to commercial deployment, capital market focus has

shifted from the technology itself to its underlying economic potential. This sector represents far more than technical ideals and engineering

exploration—it is a key growth driver for future industrial transformation and productivity upgrades.

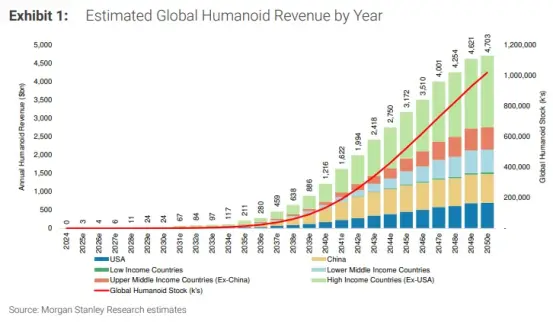

Goldman Sachs forecasts that by 2035, the global humanoid robot market will reach $38 billion in size, with shipments exceeding 1.4 million

units, marking its official move from an early trial phase to large-scale application. Citibank projects that by 2050, the global installed base

of humanoid robots will reach 640 million units, with a market size approaching $7 trillion—an economic impact comparable to the

combined value of today’s two largest global automotive industries.

Morgan Stanley’s research further highlights that humanoid robots could potentially cover up to 75% of employment scenarios in the future,

affecting more than $3 trillion in labor cost expenditures. This “labor substitution” capability positions humanoid robots as a critical fulcrum

in the next wave of production efficiency revolutions.

Source: Morgan Stanley, “Top 100 Humanoid Robots”

The core logic behind these growth expectations lies in their broad application scenarios. Whether in flexible automation within industrial

manufacturing and logistics, or in healthcare, domestic care, retail services, security patrol, and even defense, humanoid robots

demonstrate clear demand drivers and cost advantages across many industries. Especially in labor-intensive, highly repetitive tasks

requiring enhanced human-machine collaboration, their ability to substitute human labor promises ongoing marginal value release.

With increasing technological maturity and declining mass production costs, humanoid robots are evolving from small-scale functional

deployments toward large-scale, generalized industrial adoption.

Industry Chain Overview

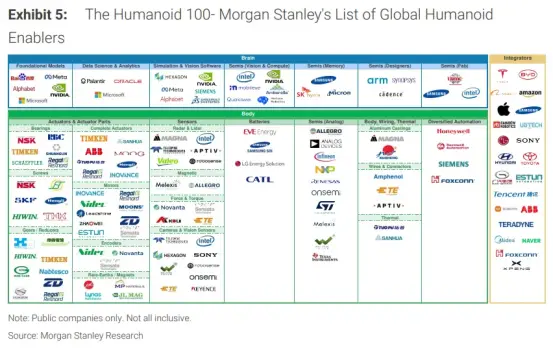

In its report “Top 100 Humanoid Robots,” Morgan Stanley divides the entire humanoid robot industry chain into three core tiers, forming a

complete ecosystem architecture spanning foundational chips and algorithms, hardware components, and full-system integration.

Source: Morgan Stanley, “Top 100 Humanoid Robots”

First, the “Brain Layer” focuses on AI chips and software platforms, serving as the central nervous system of robotic intelligence. This layer

encompasses core elements such as chip computing power, data training, and model inference and decision-making.

NVIDIA, leveraging its GPU computing advantage, has long held a leadership position in AI chips and acts as a key compute supplier to

robot manufacturers like Figure AI and UBTECH Robotics. Meanwhile, Intel, Qualcomm, and Ambarella are actively developing edge

computing chips to meet the real-time processing demands of robots on-site.

On the software side, Microsoft, Google, and Meta leverage their large-scale models and compute infrastructure to advance multimodal

perception and natural language interaction technologies. Palantir penetrates the enterprise segment with its data platforms and intelligent

decision systems, enhancing robots’ decision-making effectiveness in practical applications.

Additionally, EDA design tool and IP providers such as Synopsys and Arm safeguard chip R&D, underpinning innovation throughout the brain

layer.

Second, the “Torso Layer” centers on the hardware fundamentals of robot movement and perception, including actuators, sensors, and

energy systems.

Companies like Japan’s Harmonic Drive and China’s Green Harmonic supply high-precision servo motors and reducers that ensure

movement stability and flexibility. Perception capabilities rely on high-precision radars and sensors developed by Hesai Technology,

RoboSense, and others, which enhance robots’ spatial recognition and path-planning abilities.

On the energy supply front, lithium battery manufacturers CATL and EVE Energy focus on developing compact, high-power battery solutions

to meet the demands of prolonged, intensive robot operation. At the same time, Texas Instruments and Analog Devices excel in low-power

analog chips and power management technologies, ensuring reliable hardware operation at the torso level.

Finally, the “Full-System Layer” sits at the top of the industry chain, integrating system design, software control, and commercialization

deployment. This is the critical link to bring robot products to market.

Tesla’s Optimus project leads the way with small-scale pilot production, with Elon Musk projecting initial mass production by 2025. Figure

AI’s Figure 02 robot, celebrated for its highly humanoid design, has been dubbed the “iPhone of robots” and secured joint investments from

OpenAI and Microsoft. Chinese domestic players such as UBTECH and Unitree Robotics leverage full-stack independent R&D capabilities

and policy support to push commercial deployment of robots in low- to mid-speed applications, gradually building regional competitive

advantages.

Overall, China dominates the supply chain: 56% of the companies on Morgan Stanley’s “Humanoid 100” list are Chinese, benefiting from

cost advantages and rapid responsiveness. The U.S. leads in AI ecosystems, with NVIDIA and Figure AI excelling in software-hardware

integration.

Investment Prospects

The humanoid robot sector presents significant investment opportunities, especially for companies with advantages in technology and

supply chains. Below are the key stocks highlighted by FoolBull for 2025 so far:

NVIDIA: The computing core of humanoid robots and a primary partner of Figure AI. Also a leading provider of compute power for large-

scale model training.

Tesla: Possesses vertically integrated capabilities spanning full systems, AI, and chips, with strong potential to replicate its electric vehicle

success in the robotics domain.

Amazon: Deploys its Digit robot in warehousing and plans to extend use into last-mile delivery. Its investment in Figure AI further strengthens

its industrial robotics presence. The robotics business is boosting logistics efficiency and supporting stable stock growth.

Palantir: Deeply embedded in defense and government sectors, with huge potential if it expands into humanoid robot decision-making and

scheduling systems.

Xiaomi Group: Has invested in nearly 50 robotics companies, including Unitree Robotics, and launched the CyberOne humanoid robot. Its

supply chain and consumer electronics ecosystem offer competitive advantages. Following Unitree Robotics’ high-profile debut in 2025,

Xiaomi’s stock price rose alongside the robotics sector.

Analog Devices (ADI) & Texas Instruments (TI): Providers of analog chips and power management components, essential to the midstream

of the robotics supply chain, and positioned to continue benefiting.

CATL & EVE Energy: Battery manufacturers critical to endurance performance. Their ongoing R&D in miniaturization and high energy

density will form key competitive moats.

UBTECH & Unitree Robotics: With domestic substitution capabilities and policy support, these companies may become China’s answer to

Figure AI and are worthy of medium- to long-term attention.

Final Thoughts

Humanoid robots are not the future—they are becoming reality. Although commercialization is still in its early stages, much like Tesla a

decade ago or ChatGPT five years ago, the inflection point of this technological revolution may already be upon us.

For investors, understanding the composition of this industry chain, evaluating the feasibility of its technology and commercialization

pathways, and capturing the strategic moves of key players will be critical to participating in the next wave of AI-driven growth.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates