Fed Doesn’t Rule Out Rate Cut in July

22:38 July 1, 2025 EDT

Key Points:

1. Fed Chair Jerome Powell stated that if summer employment data weakens and inflation comes in below expectations, it may be enough to trigger a rate cut.

2. Powell noted that if not for concerns that tariffs could disrupt the progress the Fed has made in bringing inflation under control in recent years, the central bank might have already continued its gradual rate-cutting cycle in 2025.

At the European Central Bank Forum held in Portugal on July 1, 2025, Federal Reserve Chair Jerome Powell once again struck a flexible tone,

leaving the door open for a possible rate cut in July. He emphasized that under current conditions, the Fed is “keeping all options on the

table.”

Powell’s remarks addressed market uncertainty about the policy outlook and highlighted the Fed’s ongoing balancing act between

maintaining price stability and supporting economic growth.

Tariffs Slow the Fed’s Rate Cut Path

Jerome Powell emphasized that the Federal Reserve will maintain a data-dependent approach at the upcoming Federal Open Market

Committee (FOMC) meeting in July 2025. He made it clear that the Fed will not pre-commit to any specific policy action, and that future

economic data will determine the course of monetary policy.

Powell pointed out that if not for concerns that tariffs could disrupt the progress the Fed has made in curbing inflation in recent years, the

central bank might have already continued its gradual rate-cutting path in 2025. This remark underscores that the Fed’s current cautious

stance is not due to economic strength, but rather reflects heightened uncertainty about the potential impact of tariffs.

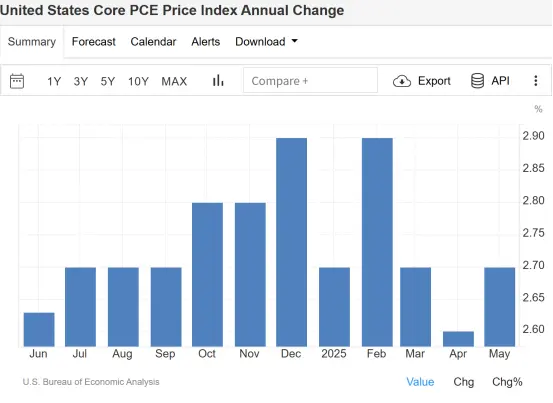

According to the Fed’s preferred inflation gauge—the Personal Consumption Expenditures (PCE) Price Index—core inflation (excluding food

and energy) stood at 2.7% in May 2025. While this remains above the 2% target, it marks a significant decline from the peak levels seen in

2022, indicating continued progress in controlling inflation.

Source: Trading Economics

Powell expects the impact of tariffs to gradually surface in the inflation data over the coming months, but he also acknowledged uncertainty

around the magnitude and persistence of those effects. Some analysts believe tariffs may result in a one-off increase in prices rather than

sustained inflation. Institutions like Goldman Sachs further argue that tariffs could squeeze corporate profit margins, slow economic activity,

and increase unemployment risk—factors that may lead the Fed to cut rates sooner to support growth.

At present, the Fed appears inclined to wait for more data to ensure the timing and magnitude of any policy shift is justified. Cutting rates too

early could undermine the Fed’s final push to bring inflation under control.

Jobs and Spending Both Slow

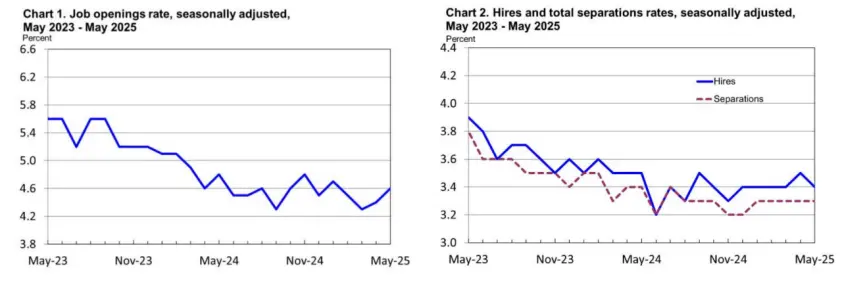

Recent data suggests growing signs of weakness in the U.S. labor market. The May 2025 Job Openings and Labor Turnover Survey (JOLTS)

showed that job openings unexpectedly rose by 374,000 to 7.769 million, but the number of hires declined to 5.503 million.

Source: BLS

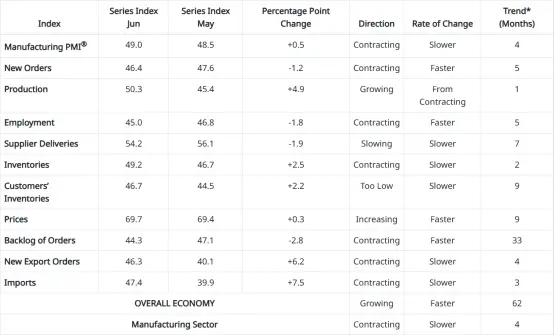

Meanwhile, the Institute for Supply Management (ISM) Manufacturing Purchasing Managers' Index (PMI) edged up slightly from 48.5 in May

to 49.0 in June. However, it remains below the 50 threshold that separates expansion from contraction, indicating that manufacturing

activity continues to shrink. Business responses revealed that tariffs are negatively impacting economic activity.

Source: ISM

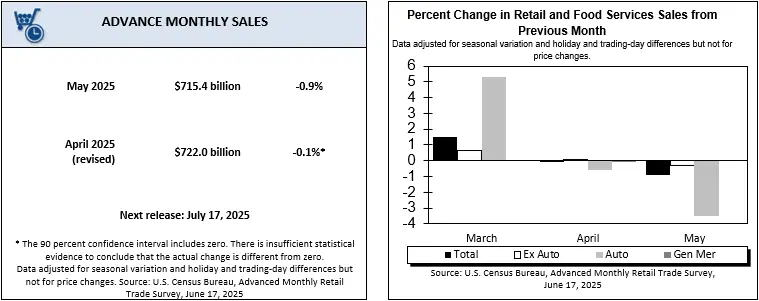

Consumer spending, a critical engine of U.S. economic growth, also showed signs of slowing. According to the U.S. Department of

Commerce, retail sales fell 0.9% month-over-month in May 2025. Notably, spending at restaurants and bars dropped 0.9%—the largest

decline since early 2023. This suggests consumers are pulling back on discretionary spending in the face of high prices and economic

uncertainty, which could ease inflationary pressures going forward.

Source: U.S. Census Bureau

Markets Shift Focus to September

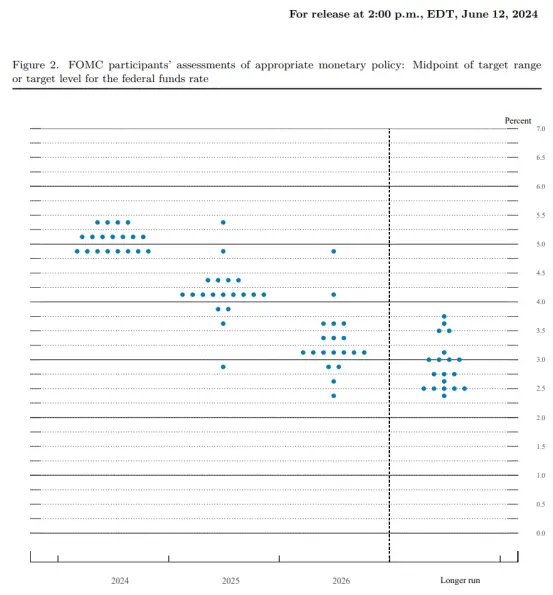

At the June FOMC meeting, the Federal Reserve kept interest rates unchanged, but internal views on the pace of rate cuts showed

significant divergence. Ten officials forecast at least two rate cuts this year, two supported only one cut, while seven expected no cuts

throughout 2025.

Source: Federal Reserve

Fed Governor Michelle Bowman and Vice Chair Christopher Waller supported the possibility of a rate cut as early as July, citing that

tariff-driven price increases may be temporary. In contrast, Philadelphia Fed President Patrick Harker advocated a more cautious approach,

emphasizing the need to monitor summer data.

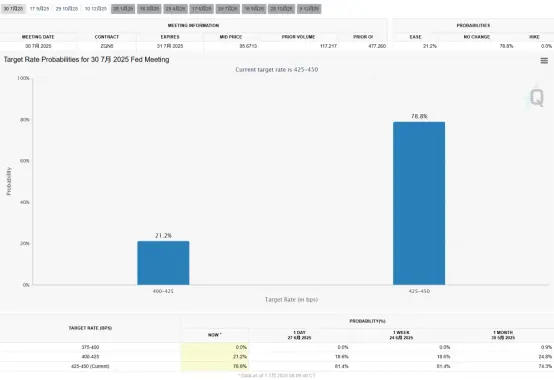

Market expectations for rate cuts are also shifting. The CME FedWatch tool indicates a 78.8% probability of rates remaining unchanged at

the July meeting, but the odds of a cut in September continue to rise.

Source: CME

Goldman Sachs has moved forward its initial rate cut forecast from December to September, expecting three consecutive cuts in the second

half of the year, with the year-end policy rate landing between 3.0% and 3.25%. Citi also anticipates the first cut in September but notes that

if economic data deteriorates further, a July cut becomes more likely.

The Fed Faces a Test of Its Independence

On June 30, Trump once again posted that “Mr. Too Late” Powell and the entire committee should be ashamed for not cutting rates, arguing

that if the Fed did its job properly, the U.S. could save trillions in interest costs. On the same day, White House Press Secretary Karine

Jean-Pierre publicly read a handwritten letter from Trump to Powell, emphasizing the need for significant rate cuts. Meanwhile, Treasury

Secretary Janet Yellen likened the Fed to “an elderly person scarred by high inflation,” implying excessive caution in policy.

In response, Powell stated at the ECB forum that Fed rate decisions are not influenced by politics; the focus remains on controlling inflation

and maintaining a healthy labor market. He emphasized the Fed’s commitment to fulfilling its dual mandate of maximum employment and

price stability.

Although Powell’s term as Fed Chair runs through May next year, Yellen has indicated that the White House may nominate a successor as

early as October or November to fill a board vacancy expected in February.

Nick Timiraos, a prominent financial journalist dubbed the “new Fed correspondent,” commented that Powell’s recent remarks—including

those on Tuesday—demonstrate his effort to maintain broad policy flexibility in the coming months. This suggests a possible shift in the

Fed’s rate-cutting strategy—especially if the eventual tariff increases fall short of the levels Trump announced in April.

The Bottom Line

From a market perspective, Powell’s remarks reaffirm that the conditions for a policy shift are beginning to take shape. Core inflation and

nonfarm payroll data over the next two months will be key variables influencing the September policy decision. If inflation remains moderate

and employment continues to cool, the Fed is likely to initiate a rate-cutting cycle this fall.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates