Apple or Amazon: Which Deserves a Spot in Your Portfolio Today?

05:09 July 1, 2025 EDT

In a market environment marked by high valuations and policy uncertainty, comparing Apple and Amazon—two members of the

“Magnificent Seven”—can help investors identify higher-conviction opportunities within the tech sector.

Both Apple and Amazon are leading players in the technology industry, with significant influence across consumer and tech markets.

However, they differ meaningfully in areas such as artificial intelligence (AI) strategy, capital expenditures, valuation, and stock

performance—differences that shape diverging paths for future returns.

AI Strategy

Amazon has positioned AI as a core engine for its long-term growth and is aggressively expanding its AI capabilities across the board. In Q1

2025, Amazon’s capital expenditures reached $24.3 billion, primarily allocated toward building AI-related computing and storage

infrastructure to support the expansion of its core AWS business. AWS revenue grew 17% year-over-year to $29.3 billion in the quarter,

accounting for the vast majority of the company’s total profit.

At the application level, Amazon is also making broad AI investments. These include upgrades to the Alexa voice assistant, deployment of

750,000 robots for warehouse automation, its self-driving subsidiary Zoox, and more than 1,000 generative AI initiatives—demonstrating its

ability to extend technology horizontally. Company executives have stated that generative AI will reshape nearly every customer experience.

By contrast, Apple’s AI strategy focuses on integration and ecosystem optimization, rather than large-scale infrastructure investment. Apple

has partnered with Google and OpenAI to reduce the cost of AI development. At its Worldwide Developers Conference (WWDC) in June

2025, Apple introduced Apple Intelligence, which includes new features such as real-time translation, an enhanced Siri, and visual search.

However, the market response was muted, with some key features delayed until 2026.

Apple’s progress in AI is widely seen as lagging behind its peers, with limited success in monetizing its AI capabilities.

Nonetheless, Apple’s ecosystem offers structural advantages for AI adoption. In Q1 2025, CEO Tim Cook noted that Apple Intelligence is

driving an iPhone upgrade cycle. LSEG projects iPhone revenue to rebound to $220 billion in 2025. Morgan Stanley has highlighted the

potential for double-digit growth from geographic expansion of Apple Intelligence. Apple is also considering acquiring AI startups to close its

technology gap.

Fundamental performance

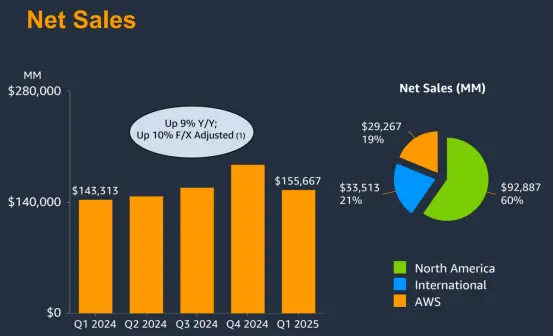

From a financial perspective, Amazon reported $155.7 billion in revenue for Q1 2025, up 9% year-over-year. Its three major segments—cloud

computing, advertising, and e-commerce logistics—continued to show solid growth momentum. The company forecasts double-digit

revenue growth for the full year, with margins continuing to improve on the back of AI-driven efficiencies.

Source: Amazon

In the first half of fiscal 2025, Apple’s business performance was more mixed across segments. iPhone revenue reached $115.94 billion,

down 0.8% in Q1 but up 1.9% in Q2, reflecting slowing growth in the high-end smartphone market. Mac and iPad performed strongly, while

the services segment maintained robust growth, achieving a record-high gross margin of 75.7% in Q2—becoming a key profit driver.

Overall, Apple’s revenue structure remains stable, but its growth flexibility appears more limited compared to Amazon.

Valuation and Analyst Expectations

As of July 1, Apple is trading at a 12-month forward P/E ratio of approximately 31.96x, compared to Amazon’s 35.73x. While both companies

are valued near the higher end of their historical ranges, Amazon’s relatively higher multiple appears more justified given its earnings growth

trajectory and investment pace.

According to TipRanks, 49 analysts have issued 12-month price targets for Amazon over the past three months, with an average target of

$243.24—representing a 10.87% upside from the current price of $219.39. The stock continues to receive a consensus rating of

“Strong Buy.”

In contrast, sentiment around Apple is more divided. Despite a recent rebound driven by AI-related news, the stock remains down nearly

18% year-to-date. Ongoing trade policy uncertainty and slower progress in AI integration have contributed to weaker medium-term

confidence among investors.

Potential Risks

The S&P 500 is currently trading at a 12-month forward P/E ratio of around 21x—near historical highs. Based on the 2025 EPS forecast of

$257, the multiple rises to 24x, trailing only the extreme valuation levels seen during the dot-com bubble of 2000 and the early stages of the

COVID-19 pandemic in 2020. Within the tech sector, the Nasdaq-100's forward P/E stands at 26.8x, reflecting elevated investor expectations

for AI-driven growth—but also highlighting the market’s sensitivity to negative surprises.

On July 9, the 90-day pause on the U.S. administration’s proposed “reciprocal tariffs” is set to expire. Treasury Secretary Bessent has stated

that if negotiations fail, the high tariffs announced in early April could be reinstated. According to JPMorgan Research, a full reinstatement

could push the global recession probability to 40% and lead to an 8%–10% downward revision in S&P 500 earnings.

Against this backdrop, capital expenditure plans, supply chain localization, and the degree of global exposure will directly shape tech

companies’ earnings resilience. Amazon, with a higher share of revenue from domestic e-commerce and AWS, appears relatively insulated.

Apple, on the other hand, remains heavily reliant on China and the broader Asia-Pacific region for its hardware business, making it more

vulnerable to trade-related shocks.

Since the tariff proposal in early April, both Apple and Amazon shares have seen sharp volatility, but their trajectories have since diverged.

Apple dropped nearly 7% in after-hours trading on April 2, followed by a 9.32% decline on April 3, wiping over $500 billion in market value in

just two days. Although the stock rebounded 15.33% on April 9—regaining the world’s largest market cap title—it still fell 7.5% for Q2 and is

down nearly 18% year-to-date.

Source: TradingView

Amazon declined 9.11% between April 2 and 8, but surged 11.98% on April 9 and ended Q2 with a 15.3% gain. As of July 1, the stock closed

at $219.39—slightly below its year-to-date high.

Source: TradingView

Overall, both Apple and Amazon retain long-term value as consumer tech leaders. But in the current environment, Amazon’s strengths are

more pronounced. Apple faces multiple headwinds, including slowing growth, lagging AI deployment, and high sensitivity to trade policy. If

its upcoming AI features fail to meaningfully drive user adoption or spark a hardware upgrade cycle, valuation support may come under

pressure.

In a high-volatility, high-valuation market phase, selective allocation matters more than passive exposure. From today’s standpoint, Amazon

stands out as a more compelling mid- to long-term investment in the AI growth narrative.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates