The Federal Reserve’s Potential for an Early Rate Cut

22:52 June 24, 2025 EDT

Key Points:

1. Fed Chair Jerome Powell signaled the possibility of an early rate cut during a congressional hearing, emphasizing that well-contained

inflation would prompt the Fed to act sooner rather than later.

2. If incoming data show that the impact of tariffs is less severe than expected, a rate cut could come as early as July 2025.

At a June 24 hearing before the House Financial Services Committee, Federal Reserve Chair Jerome Powell signaled that the Fed may

consider cutting interest rates earlier than previously expected, citing evidence that the inflationary shock from tariffs may not be as strong

as markets had initially feared.

Powell’s latest remarks reflect a critical shift in the Fed’s policy stance: if inflation unexpectedly softens, the central bank would be more

inclined to start the rate-cutting cycle sooner rather than later, rather than delaying action.

Fed Begins to Open the Door Technically to a July Rate Cut

Fed Chair Jerome Powell emphasized that the central bank’s decision to hold rates steady is primarily based on expectations that the 2025

tariffs will add upward pressure to inflation. However, he acknowledged uncertainty surrounding the extent to which tariffs will impact

consumer prices. If the inflationary effect proves weaker than anticipated, the Fed may consider cutting rates earlier, potentially as soon as

July 2025. “Multiple paths are possible,” Powell stated, highlighting the Fed’s data-dependent approach to policy.

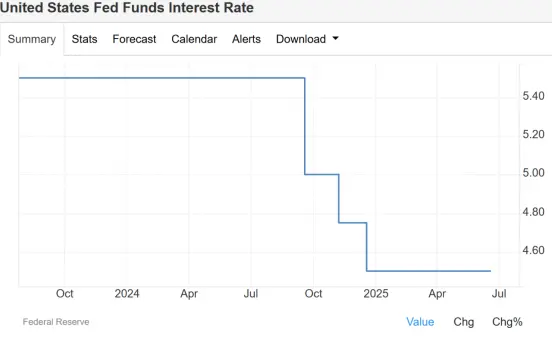

The current federal funds rate target range of 4.25%–4.50% remains “modestly restrictive,” according to the Fed, aimed at controlling

inflation without significantly hindering economic growth. Powell noted that June and July data will be critical in assessing the true impact of

tariffs. While he conceded that some of the tariff costs may be passed on to consumers, the degree of pass-through remains uncertain.

Source: Trading Economics

Powell also addressed labor market conditions, stating there is no sign of weakness. The unemployment rate held at 4.2% in April 2025, and

the resilience of the labor market supports the Fed’s cautious stance. A strong job market allows the Fed to wait and observe inflation

trends without needing to rush into rate cuts.

However, if inflation reaccelerates alongside continued labor market strength, the timing of the first rate cut may be pushed back beyond

September 2025. Conversely, a cooldown in inflation or labor market deterioration could prompt the Fed to act sooner.

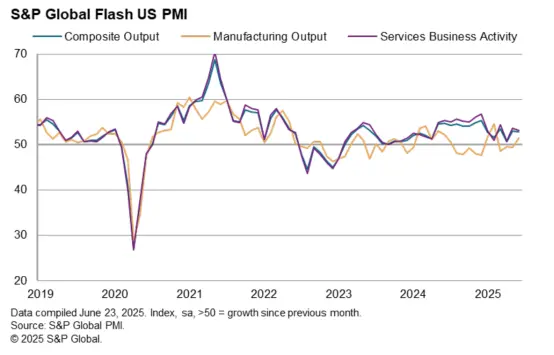

Recent data have also reinforced the Fed’s caution. The S&P Global U.S. Manufacturing PMI held steady at 52 in June 2025, matching May’s

15-month high and beating expectations of 51. Robust growth in new orders and employment drove factory output to a four-month high.

However, input and output prices rose to their highest levels since July 2022, reflecting tariff-related cost pressures—a key concern

highlighted by Powell.

Source: S&P Global

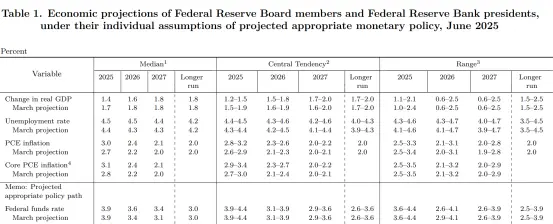

At its June meeting, the Fed left interest rates unchanged at 4.25%–4.50%. The updated dot plot reaffirmed expectations for two

25-basis-point cuts in 2025. However, changes in projections—inflation revised up from 2.7% to 3.0%, unemployment from 4.4% to 4.5%,

and GDP growth down from 1.7% to 1.4%—signal rising stagflation risk. The Fed remains caught between the goals of taming inflation and

supporting economic growth.

Source: Federal Reserve

Tariff Impact May Be Overestimated

Over the past few months, the Federal Reserve has held off on cutting interest rates, primarily due to a rebound in inflation data and the

Biden administration’s large-scale tariff initiatives. However, during his latest congressional testimony, Fed Chair Jerome Powell made it clear

that the upward revision in inflation forecasts by most FOMC members was “primarily driven by tariff expectations.” If future data shows that

the impact of tariffs is less severe than anticipated, the Fed's policy path “will adjust accordingly.”

Powell even stated that the Fed is “completely open” to a scenario where tariff-related inflation proves mild, and that upcoming data in June

and July will be crucial in shaping that judgment. In other words, tariffs have emerged as the central variable in determining the timing of the

Fed’s policy shift—and the true extent of their impact remains highly uncertain.

This uncertainty has been reflected in rising market expectations for a policy pivot. On June 24, U.S. Treasury yields declined, with the

10-year yield dropping over 5 basis points to briefly fall below 4.30%.

Source: TradingView

Corporate behavior will be a key lens for assessing how tariff-driven cost pressures are passed through to consumer prices. Powell noted:

“Many firms are still working through inventory built up in February, but we expect to see more noticeable tariff pressures beginning in the

third quarter.” This inventory buffer helps explain why imports surged 42.6% in Q1, while May’s 2.6% year-over-year increase in core PCE

has yet to fully capture the inflationary effects of tariffs.

Is Rate Cut Just a Matter of Time?

Powell’s balanced remarks, particularly his openness to an earlier rate cut, have reinforced market expectations for greater policy flexibility.

Wall Street Journal reporter Nick Timiraos noted that while Powell did not rule out a July 2025 rate cut, September remains the more likely

starting point for easing, allowing time to assess the full impact of tariffs.

Investors have begun to reassess the probabilities of rate cuts in July and September. According to the CME FedWatch Tool, traders

currently assign just an 18.6% probability to a rate cut in July, while the likelihood of a cut in September exceeds 70%.

Source: CME Group

The Fed’s data-dependent stance means upcoming releases—including May’s PCE report, June CPI, and labor market data—will be critical.

Inflation readings that persist above the 2% target could delay rate cuts, while softer data may accelerate the shift toward easing.

However, stagflation risks remain a key concern—particularly if tariffs heighten price pressures at the same time that economic growth slows.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates