Is there more room for Amazon to run?

02:27 May 14, 2025 EDT

After months of escalating global trade tensions, the market is finally seeing signs of relief. Following the U.K.-U.S. trade agreement, the U.S. and China reached a trade consensus in Geneva on Monday, May 12. The U.S. slashed tariffs on Chinese goods from 145% to 30%, while China reciprocated by lowering tariffs on U.S. imports from 125% to 10%. Both sides also agreed to continue trade and economic negotiations over the next 90 days. Investors are increasingly betting that U.S.-China trade relations are unlikely to spiral into extremes. This shift has become a major catalyst for the recent rally in equities—especially tech stocks.

Tariff relief marked a turning point for Amazon (AMZN), one of the Magnificent Seven. The stock surged over 8% on Monday, reclaiming the $200 level for the first time since March. It also fully recovered from the April pullback that saw shares dip to $180, notching a 17.4% rebound. Amazon is now establishing technical support above $200, signaling that further upside may be in store.

Source: TradingView

Tariff Risk Eases

Amazon is highly sensitive to shifts in trade policy. Its retail business, along with a vast third-party seller network—which accounts for 60% of platform-wide sales—relies heavily on imports from China. Previous tariff hikes directly raised costs for both sellers and consumers, significantly compressing profit margins and dampening demand. Since mid-March, Amazon shares had fallen roughly 15% due to tariff concerns and a broader tech pullback.

Source: TradingView

Recently, there have been signs of easing in global trade tensions. On Tuesday, May 13, White House National Economic Council Director Kevin Hassett revealed that President Donald Trump, upon returning from the Middle East, announced a new trade deal. This followed progress in trade talks with both the U.K. and China. China lowered tariffs on U.S. goods from 125% to 10%, while the U.S. cut its tariffs on Chinese goods from 145% to 30%. The two countries also agreed to continue economic and trade negotiations over the next 90 days.

Under the U.K.-U.S. deal, the U.S. maintained a 10% base tariff on British goods, but lowered duties on the first 100,000 U.K. cars exported annually to the U.S. from 25% to 10%.

These agreements have significantly reduced the U.S.’s average effective tariff rate on foreign goods. According to a report released Monday by Yale’s Budget Lab, although the current effective rate stands at 16.4%—the highest since 1934—it marks a notable drop from the 28% projected by the same group just a month earlier.

For Amazon, this shift signals a positive turn for business fundamentals. The tariff adjustments directly impact many of its core retail categories, potentially boosting gross margins in Q2 and offering fundamental support for the stock’s renewed momentum.

AI-driven growth potential

Amazon’s AI initiatives have become a key pillar of its medium- to long-term growth strategy. In 2025, the company plans to allocate the bulk of its $100 billion in capital expenditures toward AI infrastructure. This includes the development of its in-house Trainium3 chip, which delivers 4x the performance of the previous generation, and the Project Rainier compute cluster, built in collaboration with Anthropic, offering over 5x the computing power.

Generative AI applications have already been deployed across more than 1,000 use cases within the company. For instance, the rollout of AI-powered shopping chatbots has boosted conversion rates by 25%, while daily interactions with the upgraded Alexa voice assistant have increased by 30%. This closed-loop integration of technology, commercial applications, and ecosystem advantages is redefining Amazon’s competitive moat.

On May 13, Amazon, along with NVIDIA and Google, announced a partnership with Saudi Arabia’s AI company Humain. As part of this initiative, Amazon Web Services (AWS) and Humain will jointly invest over $5 billion to establish an AI zone in Saudi Arabia. Additionally, Saudi Arabia is building a dedicated AWS infrastructure region, set to go live in 2026—a move expected to strengthen AWS’s market share in the Middle East.

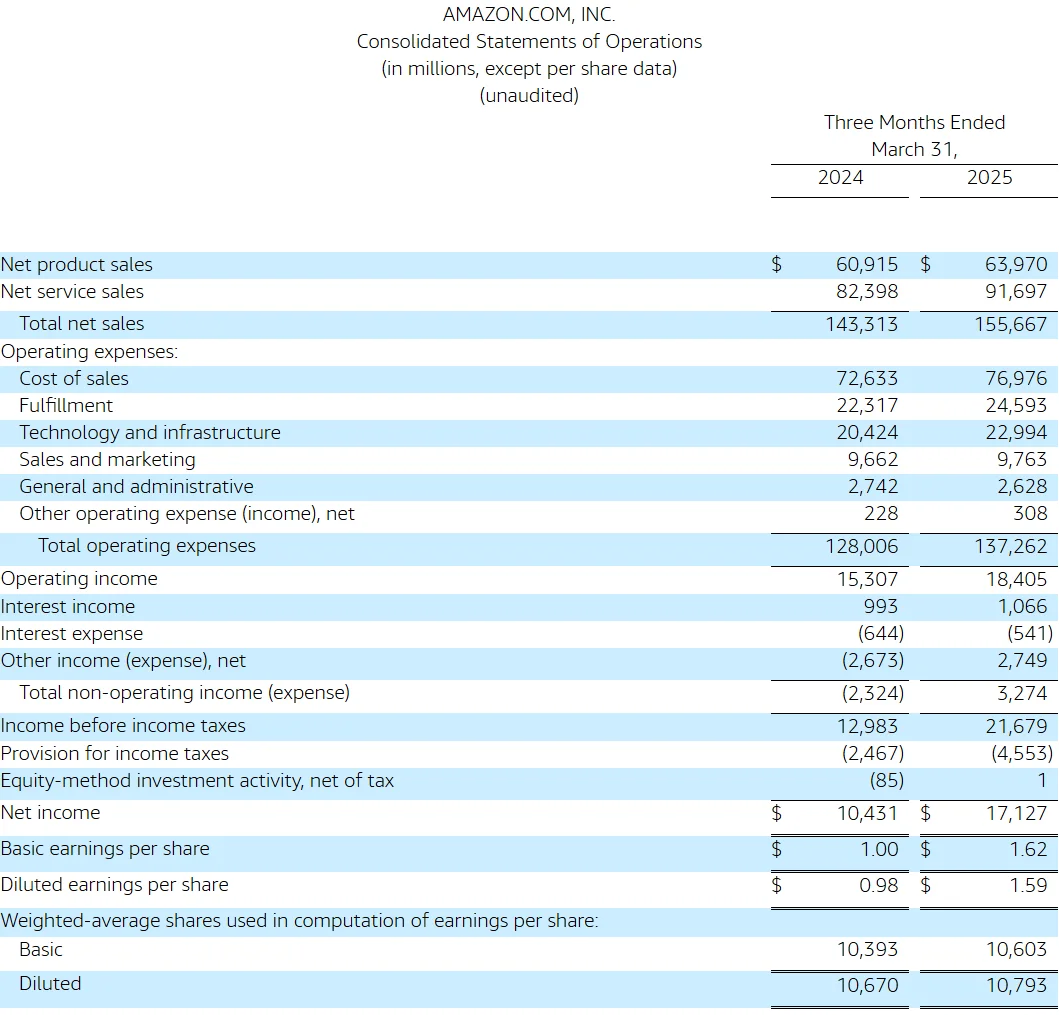

In its Q1 2025 earnings report, Amazon posted net sales of $155.67 billion, up 9% year-over-year. Net income surged 64% to $17.13 billion, while diluted EPS came in at $1.59—up 62% from $0.98 a year earlier.

Source: Amazon

AWS operating margin hit a record high of 39.5%. Meanwhile, Amazon’s advertising segment surpassed $13.9 billion in revenue, outpacing growth at both Meta and Google’s comparable businesses. This highlights Amazon’s increasing monetization power within its e-commerce ecosystem.

Overall, AI is lifting Amazon’s growth curve on both ends—by driving efficiency on the cost side and enabling new products and revenue streams. As its AI capabilities continue to scale, Amazon is well positioned to expand profitability across its three core businesses: cloud computing, e-commerce, and advertising. For Q2 2025, the company expects revenue to come in between $159 billion and $164 billion, representing year-over-year growth of 7% to 11%.

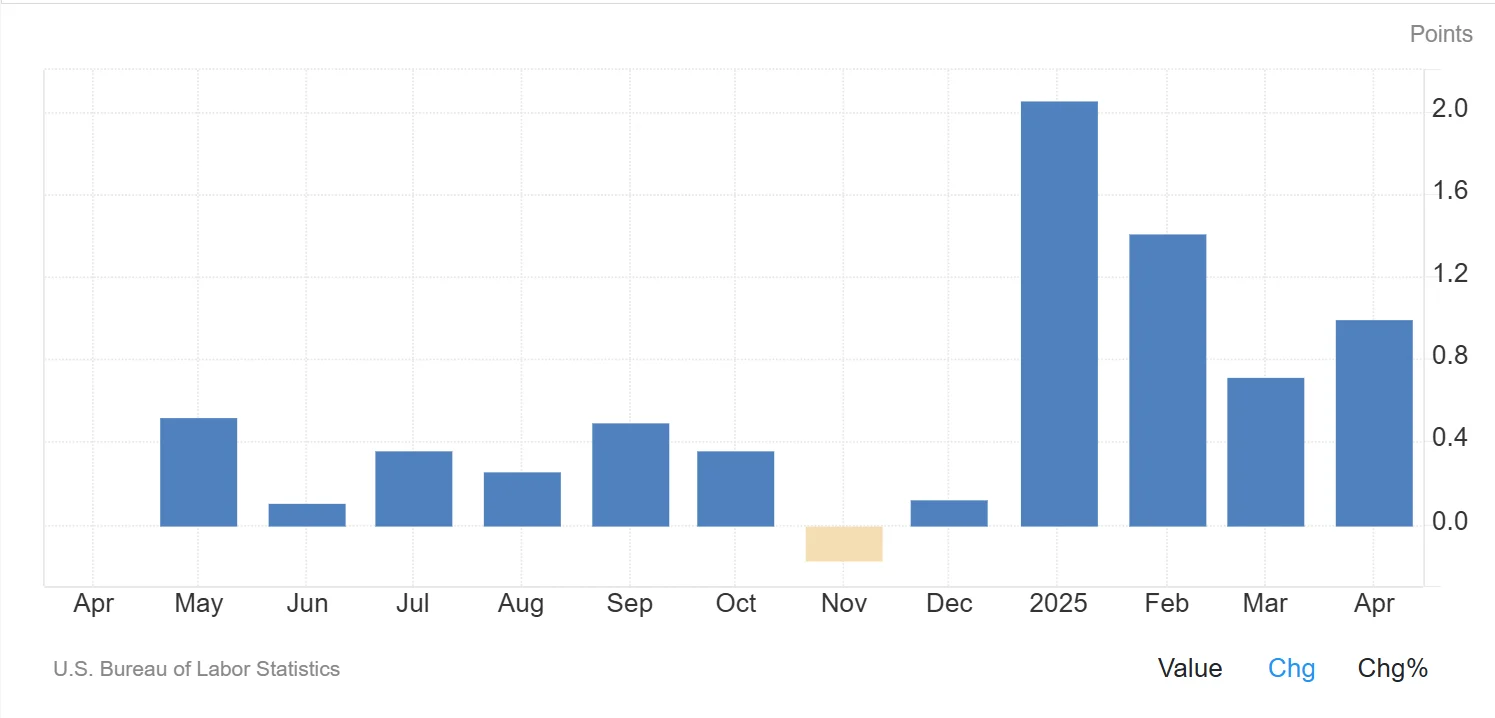

CPI data shows inflation cooling

The CPI data for April provided a positive signal for the market. According to the U.S. Bureau of Labor Statistics, the April CPI rose 2.3% year-over-year, while core CPI increased 2.8%, both marking the lowest levels since 2021.

Source: Trading Economics

The April CPI data indicates that inflationary pressures remain within a manageable range and reinforces the likelihood of rate cuts by the Federal Reserve this year. Traders continue to bet on two rate cuts by the end of 2025, which has helped boost market risk appetite.

Tech growth stocks, in particular, stand to benefit from this shift in rate expectations. In a high-valuation environment, every decline in rates translates to a lower discount rate, directly boosting company valuations. The Nasdaq index rose 1.61% following the CPI data release. Amazon, with its strong cash flow and stable growth, is clearly at the center of this rally.

Importantly, Amazon’s consumer-facing nature gives it built-in cyclical resilience. Amid macroeconomic uncertainty, the platform’s user stickiness and stable consumer demand provide a valuation floor, while a rebound in consumer purchasing power could further stimulate e-commerce demand. In a low-inflation environment with rates peaking, Amazon stands to benefit from both a higher valuation and a rising stock price.

Positive technical signals

From a technical perspective, Amazon's stock price has broken through the key psychological level of $200. The April low of $180 and the May rebound high of $211 form a potential inverse head-and-shoulders pattern, with the neckline at $224. A breakout above this level could target the 52-week high of $242, with further potential to move toward the $260–$280 range.

Source: TradingView

In terms of technical indicators, the 50-day and 200-day moving averages are in a bullish alignment, and the MACD is entering a new upward cycle, indicating that the market is currently in a bullish trend.

Source: TradingView

Market sentiment on Amazon is overwhelmingly bullish. According to TipRanks, the average target price from 47 analysts over the past three months is $239.90, implying a 13.5% upside from the current stock price. Institutions such as Bank of America and Tigress Financial have set their highest target at $305, suggesting a potential upside of over 44%.

Analysts generally believe that Amazon's dominance in AI infrastructure through AWS, the continued expansion of its advertising business, and the benefits of tariff reductions will be key drivers for the stock's upward movement.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates