Weekly Wrap-Up: U.S. Market Trends and Turbulence

16:59 June 27, 2025 EDT

Over the past week, the U.S. stock market staged a strong rebound, driven by multiple positive catalysts. The S&P 500 index approached its

all-time high, while the Dow also recorded solid gains, signaling that bullish momentum remains intact.

A ceasefire agreement between Israel and Iran eased geopolitical tensions significantly. At the same time, news of a tariff exemption

extension helped alleviate concerns about escalating trade frictions, serving as a key catalyst for the recovery in risk assets. Signs of a

more dovish shift in Federal Reserve policy expectations further boosted market risk appetite.

In addition, optimism surrounding U.S.-India trade negotiations has sharply reduced market fears over the potential reimplementation of

“reciprocal tariffs” on July 9. Overall sentiment turned notably more positive, and the market appears to be positioning for a potential next

leg of the rally.

Market Overview

A series of positive developments supported market sentiment this week. The temporary ceasefire between Israel and Iran remains in place,

and on June 23, former President Donald Trump announced that U.S. and Iranian officials are set to meet next week, further easing

geopolitical risk. Brent crude briefly surged to $80 per barrel early in the week but later pulled back nearly 16% to around $67, reflecting

reduced concerns over supply disruptions.

Source: TradingView

Gold prices retreated from $3,368 to around $3,285 per ounce, pressured by a stronger U.S. dollar and rising interest rate expectations.

Source: TradingView

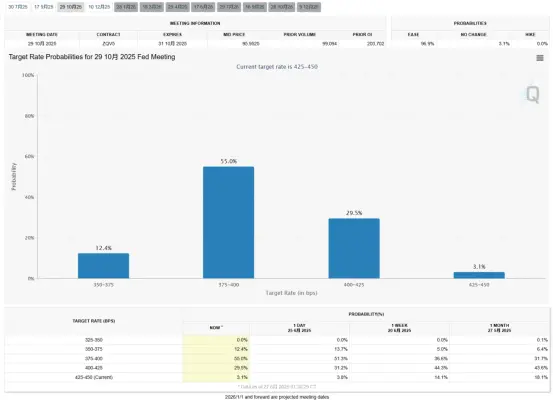

On June 24, Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee, stating that the federal funds

rate remains at 4.25%–4.5% primarily due to the anticipated inflationary impact of 2025 tariffs. He acknowledged uncertainty over how

tariffs will affect consumer prices, suggesting that if inflation rises less than expected, the Fed could consider cutting rates as early as July

2025. He emphasized that “multiple paths are possible,” reaffirming the Fed’s data-dependent approach.

Powell noted that data from June and July will be critical in assessing the tariff impact. While some cost pressures may be passed on to

consumers, the extent remains unclear. According to the CME FedWatch Tool, markets currently price in a 55% probability of a 50-basis-

point rate cut in September. Traders have fully priced in a rate cut at the September FOMC meeting.

Source: CME

Importantly, on June 26, White House Press Secretary Olivia Levitt said the July 9 “reciprocal tariff” suspension could be extended, easing

fears of an imminent escalation in trade tensions. U.S. Commerce Secretary Ruthnick added that trade talks with India, the EU, and other

partners are close to final agreement, and several deals may be announced in the coming weeks. He reiterated that July 9 is the deadline to

“reach a deal or face tariffs,” but expressed openness to extending talks if needed.

However, despite assurances from National Economic Council Director Kevin Hassett that multiple agreements are near completion, so far

only a deal with the UK has been reached—one that appears more like a framework for ongoing negotiations than a finalized trade pact.

Market Performance

All three major U.S. stock indexes posted solid gains this week. By Thursday’s close, the S&P 500 rose 48.86 points, or 0.80%, to 6,141.02—

just shy of its intraday all-time high of 6,147.43.

Source: TradingView

Sector performance was notably mixed. Technology led the gains, with the S&P 500 tech sector up 2.8%, driven by strength in AI-related

stocks. Financials rose 2.1%, supported by expectations of looser regulations after the White House proposed easing leverage rules for big

banks. Northern Trust (NTRS) surged 8.0% amid reports of a potential merger proposal from Bank of New York Mellon (BK).

Copper prices on the London Metal Exchange climbed to $9,800/ton, a three-month high. The rally in copper helped lift resource stocks by

1.9%. Meanwhile, energy stocks fell 0.7% as oil prices retreated.

The VIX volatility index spiked to 22.51 early in the week before falling to 16.59 by the weekend, reflecting improved market sentiment.

Source: TradingView

On the earnings front, Nike (NKE) reported its fiscal Q4 2025 results, with revenue of $11.1 billion and EPS of $0.14, both beating

expectations. The stock rose 1.2% to $62.54, though management warned of an additional $1 billion in tariff costs in FY2026, which capped

the upside.

Source: TradingView

The ceasefire agreement between Israel and Iran helped reduce volatility in oil prices, benefiting airline stocks. United Airlines (UAL) gained

2.3%. Energy stocks were mixed—Occidental Petroleum (OXY) slipped 1.2%.

AI-related stocks remained strong performers. Nvidia (NVDA) jumped 4.33% on the day of its 2025 Annual Shareholders Meeting, closing

at $154.31 and reclaiming the title of the world’s most valuable company with a market cap of $3.77 trillion—surpassing both Microsoft and

Apple.

Source: TradingView

Micron Technology (MU) reported better-than-expected results for fiscal Q3 2025, driven by stronger demand from data centers, sending

shares higher.

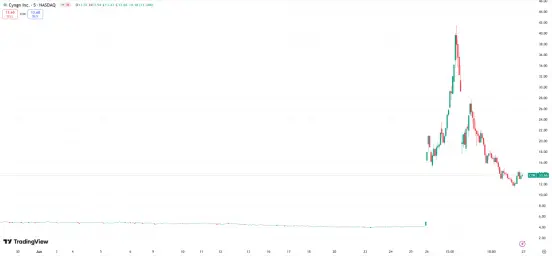

Small-cap autonomous vehicle firm Cyngn soared 171% in a single session after being mentioned in an Nvidia blog post highlighting its

technology application.

Source: TradingView

Next Week’s Key Events

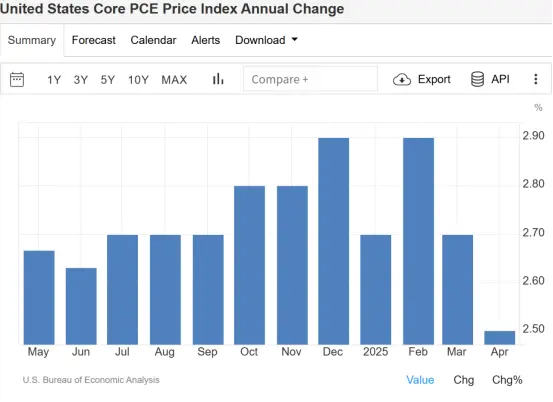

On June 30, the U.S. will release May’s Personal Consumption Expenditures (PCE) inflation data. Core PCE is expected to rise to 2.6%. A

downside surprise could strengthen expectations for a Fed rate cut in July and put downward pressure on the 10-year Treasury yield,

currently around 4.25%.

Source: TradingEconomics

Other key data releases include consumer confidence (June 30), new home sales (July 1), and durable goods orders (July 2), which will

help gauge the resilience of the U.S. economy.

Geopolitical developments remain a critical driver of market sentiment. Although a ceasefire agreement between Israel and Iran is nominally

in place, the reality on the ground tells a different story. Shortly after the truce was enacted, Israeli forces detected ballistic missile launches

from Iran and responded with an airstrike on a radar facility near Tehran—highlighting the fragility of the ceasefire and persistent distrust

between the two sides.

The current situation resembles a “ceasefire in name, confrontation in practice,” leading investors to remain highly cautious. A renewed

flare-up could trigger a flight to safe-haven assets. In the event of an escalation into a broader regional conflict, Brent crude may swiftly

return to $80 per barrel or higher as markets reprice in a “war premium.” Gold could surge toward $3,400/oz, reaffirming its role as a haven

for risk-averse capital.

Trade negotiations between the U.S. and major partners such as India and the EU are also under close watch. U.S. Commerce Secretary

Rutnik signaled that multiple deals could be announced within the next one to two weeks. However, if the July 9 tariff exemption deadline is

not extended, countries like India could face a 5%–10% increase in selective tariffs, posing economic and market risks.

Overall, markets remain delicately balanced between “cautious optimism” and “a turn on a dime.” Expectations for a tariff exemption

extension and a temporary de-escalation in the Middle East have eased two major systemic risks and supported appetite for risk assets.

However, inflationary pressures persist, and the July 9 tariff deadline remains a potential trigger for renewed volatility.

The S&P 500 is expected to remain in a consolidation range between 6,000 and 6,200, though further upside will require stronger support

from fundamentals. On the macro front, the U.S. Dollar Index is likely to trade within the 97–100 range in the near term, driven by a mix of

Treasury yields and safe-haven flows. Gold is caught in a tug-of-war—on one hand, high interest rates suppress holding costs; on the other,

geopolitical uncertainty and safe-haven demand offer support. The metal may continue to trade in a narrow range between $3,300 and

$3,400 per ounce.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates