Core Logic of the Iron Condor Strategy: Volatility Arbitrage and Risk Control Framework

11:59 June 26, 2025 EDT

In the universe of options strategies, the Iron Condor stands out as an advanced trading tool thanks to its distinctive risk-reward profile. This

strategy involves simultaneously buying and selling call and put options at different strike prices, creating a market-neutral position designed

to generate relatively stable returns.

The core logic of the strategy begins with its direction-neutral nature. Investors are not required to accurately predict the market’s

directional movement. As long as the underlying asset’s price remains within a predetermined range, the strategy can generate profits. This

greatly reduces directional risk during execution, shifting the trading focus toward range-bound price behavior.

Secondly, the Iron Condor systematically capitalizes on the time decay of options (the Theta effect), gradually profiting from the erosion of

premium value as time passes. This time-based value capture mechanism is a fundamental component of the strategy’s return generation.

Lastly, to manage potential downside, the Iron Condor incorporates protective options that strictly cap maximum losses within a predefined

range. This quantifiable risk feature not only enhances the strategy’s margin of safety but also improves transparency and effectiveness in

risk management, contributing to its overall robustness.

Standardized Strategy Construction Process

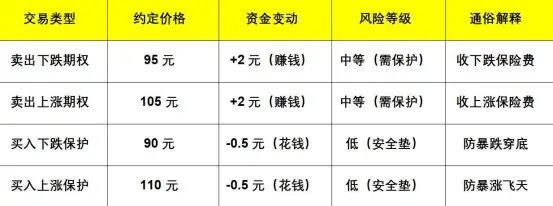

The following framework provides a clear understanding of how the Iron Condor strategy operates. Using an example where the underlying

asset is priced at 100 yuan, the strategy balances return and risk through four specific steps.

First, a put option with a 95 yuan strike price is sold, generating 2 yuan in premium income. Simultaneously, a call option with a 105 yuan

strike price is sold, earning an additional 2 yuan in premium.

To limit potential risk, two protective options are purchased: a put with a 90 yuan strike price, costing 0.5 yuan, and a call with a 110 yuan

strike price, also costing 0.5 yuan. By combining options with different strike prices, the strategy creates a market-neutral position with

capped risk.

From a price range perspective, the optimal profit zone is between 95 and 105 yuan. If the underlying ends up within this range at expiration,

both short options expire worthless, allowing the strategy to capture maximum profit.

If the price approaches the outer edges—between 90 to 95 yuan or 105 to 110 yuan—the profit gradually decreases but does not yet trigger

actual losses, forming a buffer zone.

When the price drops below 90 yuan or rises above 110 yuan, the protective options are activated, strictly capping the maximum potential

loss within a predefined threshold.

This mechanism effectively manages downside risk and allows the Iron Condor to maintain strong risk-reward characteristics in range-

bound or low-volatility markets, making it a stable and balanced options strategy.

Quantitative Analysis of the Profit and Loss Structure

Understanding the profit and loss characteristics of a strategy is the cornerstone of effective risk management. For investors, this clarity is

essential in evaluating the Iron Condor’s payoff profile.

From a return perspective, the Iron Condor strategy offers a maximum profit of 3 yuan. This comes from the total premium income of 4 yuan

earned by selling two options, minus the 1 yuan cost of purchasing two protective options. This maximum return is realized only if the

underlying asset’s price remains within the 95 to 105 yuan range through expiration.

On the risk side, the downside maximum loss is calculated by taking the difference between the 95 yuan strike of the short put and the 90

yuan strike of the long protective put, then subtracting the 3 yuan net premium received—resulting in a maximum loss of 2 yuan. Similarly,

the upside maximum loss is the difference between the 110 yuan strike of the long call and the 105 yuan strike of the short call, also minus

the 3 yuan net premium, again totaling 2 yuan. This symmetrical loss profile ensures that the strategy’s downside is capped, regardless of

whether the price breaks above or below the protection zone.

Additionally, the breakeven points are clearly defined at 92 yuan (95 minus the 3 yuan net credit) and 108 yuan (105 plus 3 yuan). These

levels offer investors a well-defined reference range for potential profit and loss. By quantifying the strategy’s payoff structure, investors can

approach position sizing and risk management in a more disciplined and systematic manner.

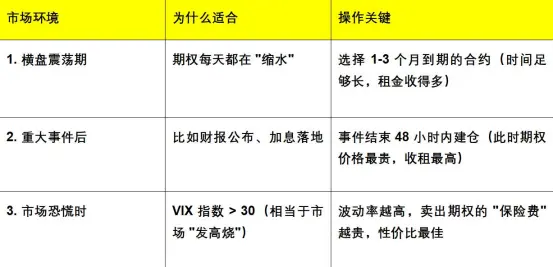

Practical Use Cases and Timing Criteria

Effective implementation of the Iron Condor strategy requires identifying key market windows.

In practice, the optimal time to initiate this strategy is when implied volatility (IV) is above the 90th percentile of its past-year range. During

such periods, option premiums are significantly elevated, creating a favorable environment for selling options and capturing higher income.

At the same time, the underlying asset should be trading within a defined range—often during a policy lull or a technical consolidation

phase—offering a stable price environment where the asset is likely to stay within the targeted bounds.

Take, for example, an ETF currently priced at 100 yuan. An investor can sell a 95-yuan strike put and a 105-yuan strike call, earning 2 yuan

in premium from each. Simultaneously, the investor buys a 90-yuan protective put and a 110-yuan protective call, each costing 0.5 yuan.

This creates a symmetric risk-reward structure with a maximum profit of 3 yuan and a capped maximum loss of 2 yuan. This practical setup

highlights how the Iron Condor strategy can effectively capitalize on elevated volatility and range-bound markets—capturing time decay

while maintaining tight risk control through precise timing and structure.

Dynamic Risk Management Guidelines

This set of core disciplines is crucial to ensuring the Iron Condor strategy’s robust performance, requiring strict adherence to three key rules.

First, in terms of strike price selection, the distance between the short strikes must be no less than 10% of the underlying’s current price. For

example, with a 100 yuan underlying, there should be at least a 10 yuan gap to maintain a reasonable risk exposure.

Second, the volatility filter mandates initiating positions only when implied volatility (IV) exceeds the 50th percentile of its historical range.

This criterion helps avoid taking on excessive risk in low-volatility environments.

Third, the protective options’ strikes must maintain at least a 5% spread relative to the corresponding short strikes. For instance, when

selling a 95 yuan put, the protective long put should be at 90 yuan to ensure a sufficiently deep risk buffer.

The core advantage of this strategy lies in its negative vega exposure—meaning that it profits as volatility decreases. This characteristic

makes it a strong complement to traditional trend-following strategies. Additionally, the pre-locked maximum loss mechanism caps downside

risk at the time of position initiation, effectively mitigating tail risk.

Importantly, the strategy leverages the statistical reality that markets spend roughly 70% of the time in a trading range. By capitalizing on

this probabilistic edge, it achieves positive expected returns and embodies a robust, systematic approach to risk management.

The Essence of Volatility Arbitrage

The Iron Condor strategy fundamentally integrates time decay and volatility premium capture into a sophisticated financial engineering

framework. Its stable returns rest on three core pillars:

First, strict adherence to volatility timing discipline ensures positions are opened when implied volatility is reasonably elevated. Second,

maintaining a 5% to 10% spread between strike prices enforces effective risk limits and caps potential losses. Finally, the strategy leverages

the nonlinear payoff profile of options to build multi-layered risk barriers.

Anchored in statistical market behavior, this approach offers investors a quantifiable, low-correlation return stream, fulfilling the goal of

robust volatility arbitrage.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates