Why did Xiaomi's stock price soar?

02:41 March 19, 2025 EDT

On the evening of March 18, Xiaomi released its 2024 financial report. Lei Jun, chairman of Xiaomi Group, posted on social media that this was Xiaomi's "strongest annual report in history."

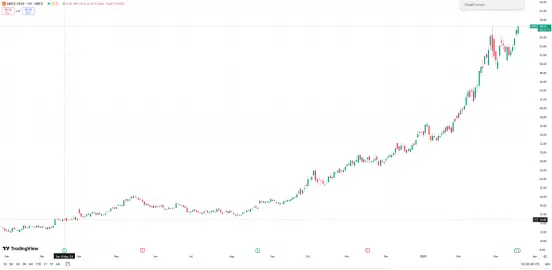

The impressive performance in the financial report boosted the market's confidence in Xiaomi's prospects, directly stimulating the stock price to climb by more than 3% to HK$57.65 per share, with a market value approaching HK$1.5 trillion, almost four times the stock price (HK$14.86) on the date the 2023 financial report was released (March 19, 2024).

Image source: Tading View

The strongest annual report in history

Financial report data shows that Xiaomi Group's total revenue for the whole year of 2024 was 365.906 billion yuan, a year-on-year increase of 35%, a record high; adjusted net profit was 27.2 billion yuan, a year-on-year increase of 41.3%, also setting a historical record. Among them, Xiaomi's quarterly revenue exceeded 100 billion for the first time, reaching 109 billion yuan in Q4 of 2024, a year-on-year increase of 48.8%; adjusted net profit was 8.3 billion yuan, a year-on-year increase of 69.4%. This is the fastest year-on-year growth quarter for Xiaomi since Q4 of 2021, setting a new record for single-quarter performance.

In terms of business, Xiaomi achieved synergistic growth in multiple business segments, with breakthroughs in smartphones, IoT and electric vehicles. The revenue of smartphone × AIoT business was 333.2 billion yuan, a year-on-year increase of 22.9%; the revenue of innovative businesses such as smart electric vehicles was 32.8 billion yuan, of which smart electric vehicles had a revenue of 32.1 billion yuan, and the adjusted net loss for the full year was 6.2 billion yuan.

Image source: Xiaomi official website

Mobile phones are Xiaomi's core business, with annual revenue of 191.8 billion yuan, a year-on-year increase of 21.8%, and are gradually narrowing the gap with Apple and Samsung. According to Canalys data, Xiaomi's global smartphone shipments reached 169 million units in 2024, accounting for 13.8% of the global market share, ranking among the top three in the world for 18 consecutive quarters.

At the same time, Xiaomi's high-end results are remarkable, with its market share in the 4,000-5,000 yuan price segment rising to 24.3%, and its market share in the 5,000-6,000 yuan price segment reaching 9.7%. The sales growth of high-end models pushed the average selling price (ASP) up 5.2% year-on-year to RMB 1,138.2. Thanks to technological innovations such as AI imaging and voice interaction, Xiaomi's mobile phone competitiveness in the high-end market continues to improve, providing stable support for revenue growth.

At the same time, 2024 is also the year when Xiaomi’s “full ecosystem of people, cars and homes” strategy will be fully implemented. As of December 2024, Xiaomi's global monthly active users exceeded 700 million, and the number of IoT devices connected to the AIoT platform (excluding smartphones, tablets and laptops) increased to more than 900 million, a significant year-on-year increase, once again demonstrating its continued deep cultivation and ecological advantages in the Internet of Things field.

The automotive business becomes a core catalyst

As the "second growth curve", Xiaomi Auto's market performance that exceeded expectations directly prompted investors to reassess its valuation, especially in terms of its competitiveness in the smart electric vehicle track.

For example, the SU7 Ultra, which was first launched in February 2025, received over 19,000 orders in three days, with over 10,000 valid orders. This explosive effect allowed the market to see Xiaomi's growth potential in the smart electric vehicle sector and became the core catalyst for its stock price increase.

Although the automotive business is still in a loss-making state, its revenue scale and growth momentum offset the market's concerns about short-term losses. In 2024, the first model SU7 delivered 136,900 units, far exceeding expectations, and its high gross profit margin (18.5%) further improved the quality of revenue.

Regarding the profit expectations of the automotive business, Xiaomi Group President Lu Weibing stated in the earnings call that the automotive business is currently still focused on key areas such as core technology research and development, multi-model development, factory construction and intelligent driving technology investment. The group has not yet put forward rigid requirements on the time of profitability, but will continue to work hard to improve profitability.

The operating performance of the automotive business in Q4 2024 has shown positive signs. The gross profit margin of the automotive business increased to 20.4% and the net loss narrowed to 700 million yuan, showing the initial results of cost control and product structure optimization. In 2025, Xiaomi will increase its delivery target to 350,000 vehicles to improve profitability through economies of scale. As the delivery volume increases, economies of scale may gradually emerge, and the market expects that future losses will narrow and profitability will increase.

Xiaomi's automotive business does not stop there. In mid-2025, Xiaomi will officially launch its first pure electric SUV, Xiaomi YU7. Xiaomi YU7 is positioned as a medium-to-large pure electric SUV, directly targeting Tesla Model Y. Its starting price is expected to be around 230,000 yuan, and the high-end four-wheel drive version may be between 280,000 and 300,000 yuan. With core technology selling points such as intelligent ecological interconnection, high-efficiency three-electric system, and intelligent driving assistance, as well as professional moat building advantages such as full industry chain integration, user big data and AI technology, Xiaomi YU7 is expected to occupy a place in the 200,000-300,000 new energy SUV market competition, and may become another milestone in the growth of Xiaomi's automotive business.

Image source: Xiaomi official website

It is worth noting that the success of Xiaomi Motors has also made Xiaomi's market value among the top three global automakers, second only to Tesla and Toyota. This improvement in industry status has led the market to re-evaluate Xiaomi's value and compare it with giants such as Tesla and Toyota. At the same time, Xiaomi Motors has once again strengthened its "full ecosystem of people, cars and homes": the automotive business is used to attract offline channels, and high-end mobile phones and IoT products lay the brand foundation for the automotive business. The three work together to enhance user stickiness and ecological value. The imagination space of this closed ecological loop makes the market full of confidence in Xiaomi's future.

Boosted by multiple positive factors, institutions are optimistic about the long-term performance of the stock

such as the double increase in revenue and profit, the increase in the proportion of automotive business revenue, the intensity of R&D investment ( 30 billion yuan in 2025 ) and AI strategy have strengthened the market's recognition of Xiaomi's long-term value.

The current market sentiment for the stock is positive. It broke through the key resistance level of HK$40 in February 2025, forming an upward channel, and the stock price showed a strong upward trend. Since the end of 2024, Xiaomi's stock price has increased by more than 80%.

Institutions are generally optimistic about Xiaomi's future performance. After Xiaomi's financial report was released, Citi raised Xiaomi's target price to HK$73.5 and maintained a buy rating. The institution is optimistic about the profitability of Xiaomi's core business and pointed out that Xiaomi's upcoming AI smart glasses, new MIX series mobile phones, and YU7 models will become key factors in driving the stock price up in the short term.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates