Wall Street Banks Beat Expectations, But Warning Signs Emerge

04:30 October 15, 2025 EDT

On October 14 local time, major Wall Street financial institutions — including JPMorgan Chase, Goldman Sachs, Citigroup, and Wells Fargo — released their financial results for the third quarter of 2025, officially kicking off a new U.S. earnings season.

Against the backdrop of a federal government shutdown that has disrupted the release of official economic data, these banking giants’ earnings reports have become one of the key windows into the state of the U.S. economy. While the banks delivered strong performances in trading and investment banking, their executives issued cautious warnings about the economic outlook and potential risks — reflecting a mix of solid results and restrained optimism.

Multiple Performance Metrics Exceed Expectations

From core profitability metrics, major Wall Street banks that have reported earnings so far all posted year-over-year revenue growth, with most exceeding analyst expectations.

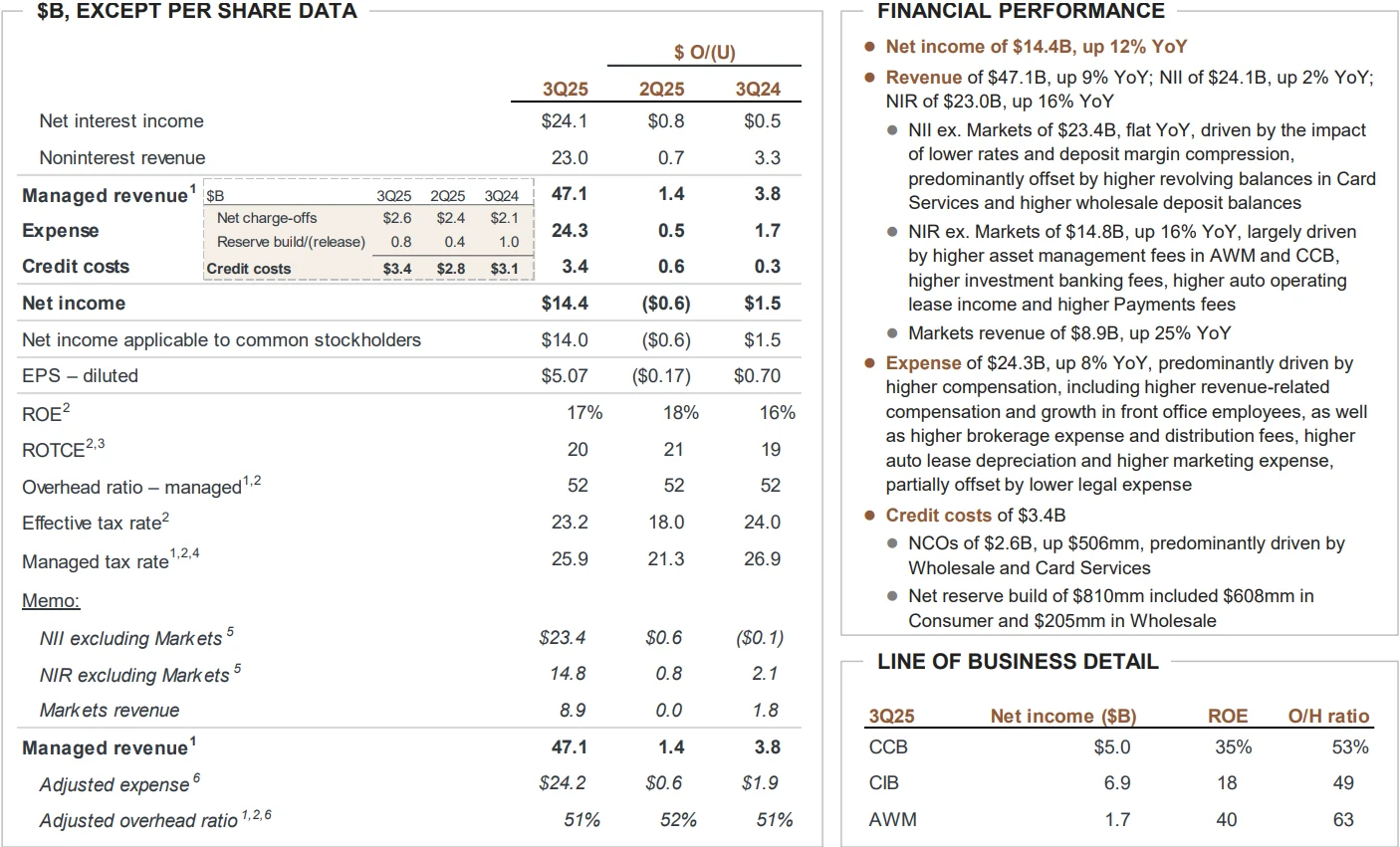

JPMorgan Chase led the pack with revenue of $47.1 billion, up 9% year over year and $1.72 billion above market expectations of $45.4 billion. Net income reached $14.4 billion, or $5.07 per share, representing a 12% increase in profit.

Source: JPMorgan Chase

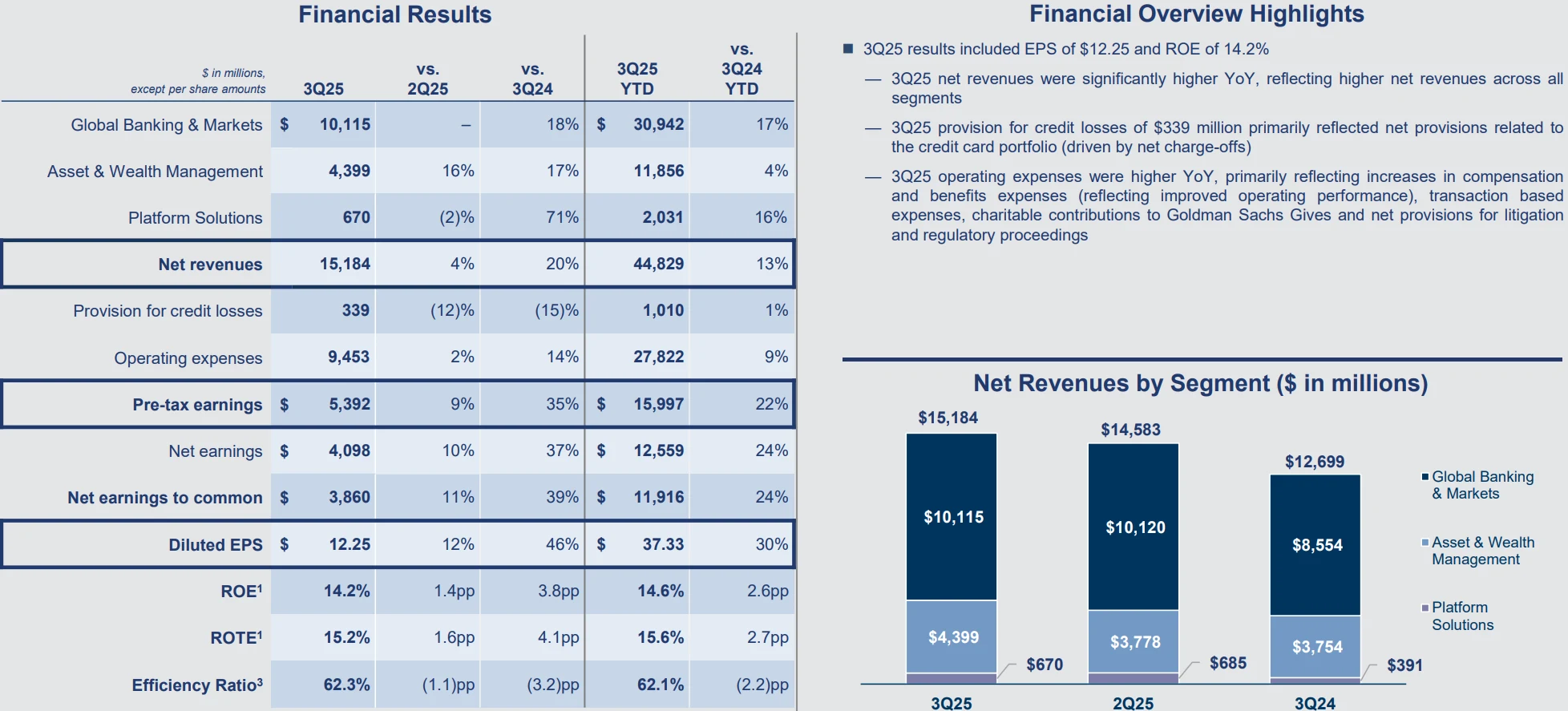

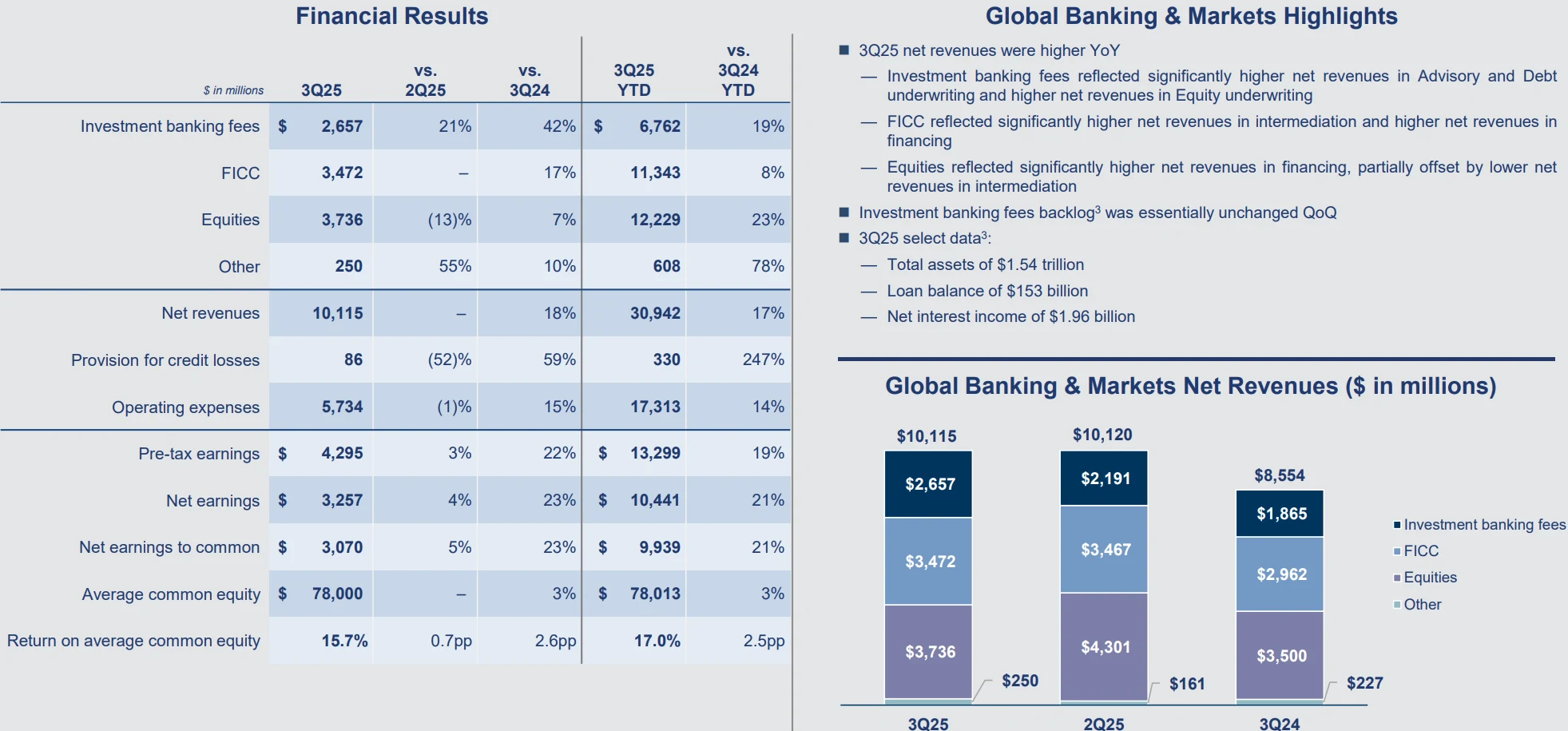

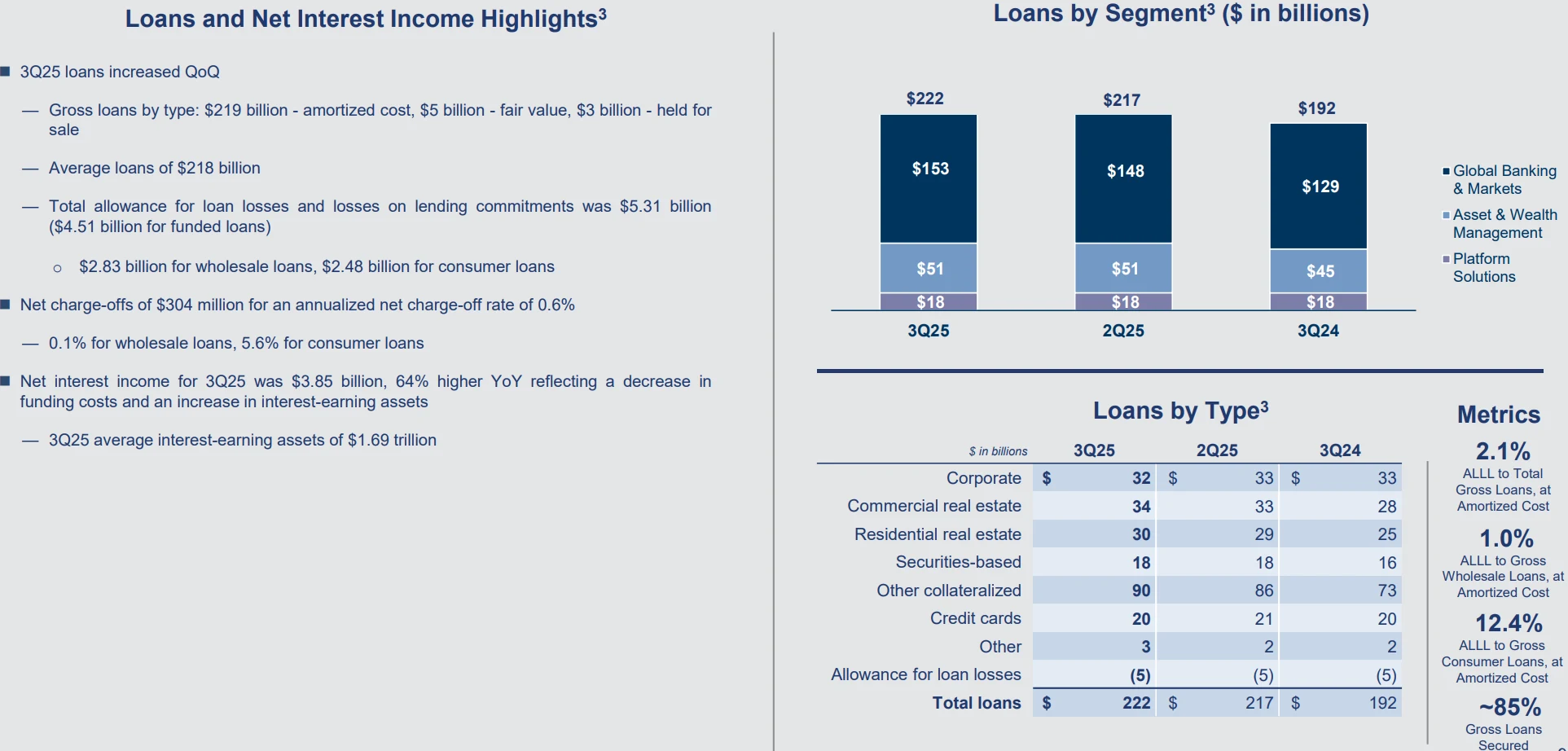

Goldman Sachs delivered an even stronger performance, reporting revenue of $15.2 billion, up 20% from a year earlier and well above the $14.1 billion consensus estimate. Net income surged 37% year over year to $4.1 billion, with earnings per share of $12.25, marking a record high for the period.

Source: Goldman Sachs

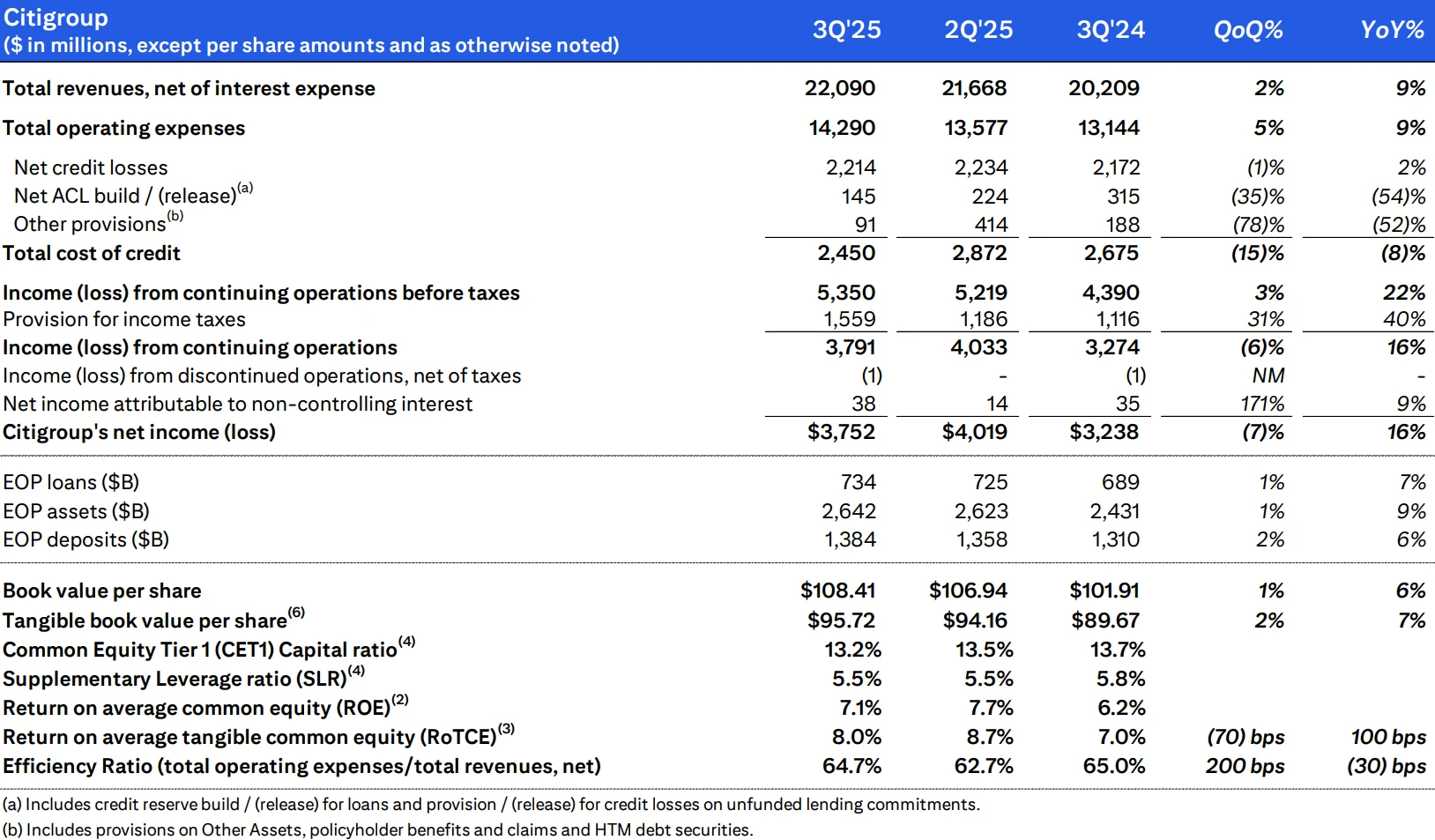

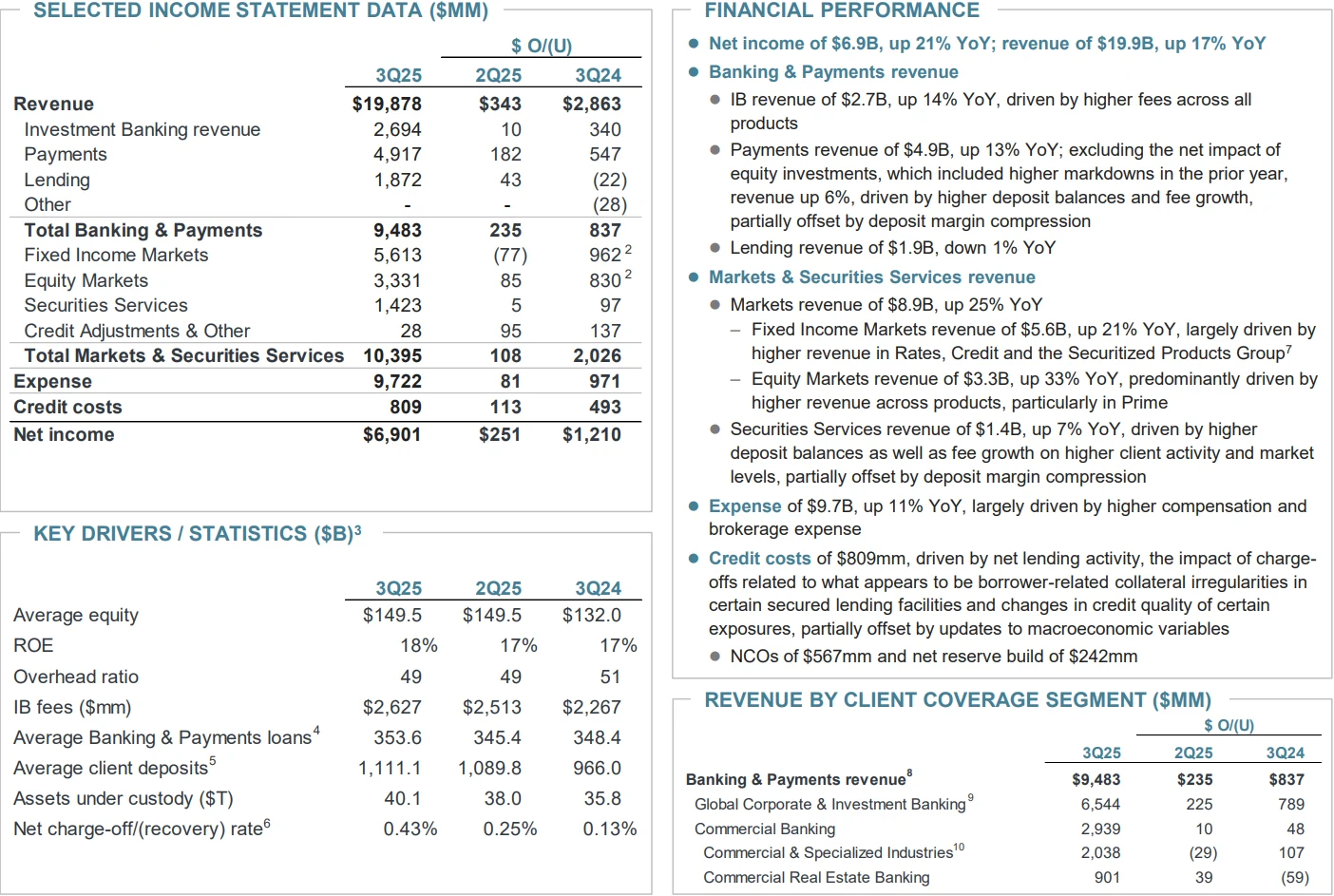

Citigroup and Wells Fargo recorded more moderate yet steady growth. Citigroup’s third-quarter revenue rose 9% year over year. Excluding one-time items such as goodwill impairment related to the sale of its Banamex unit, adjusted EPS came in at $2.24, significantly higher than the reported $1.86 per share.

Source: Citigroup

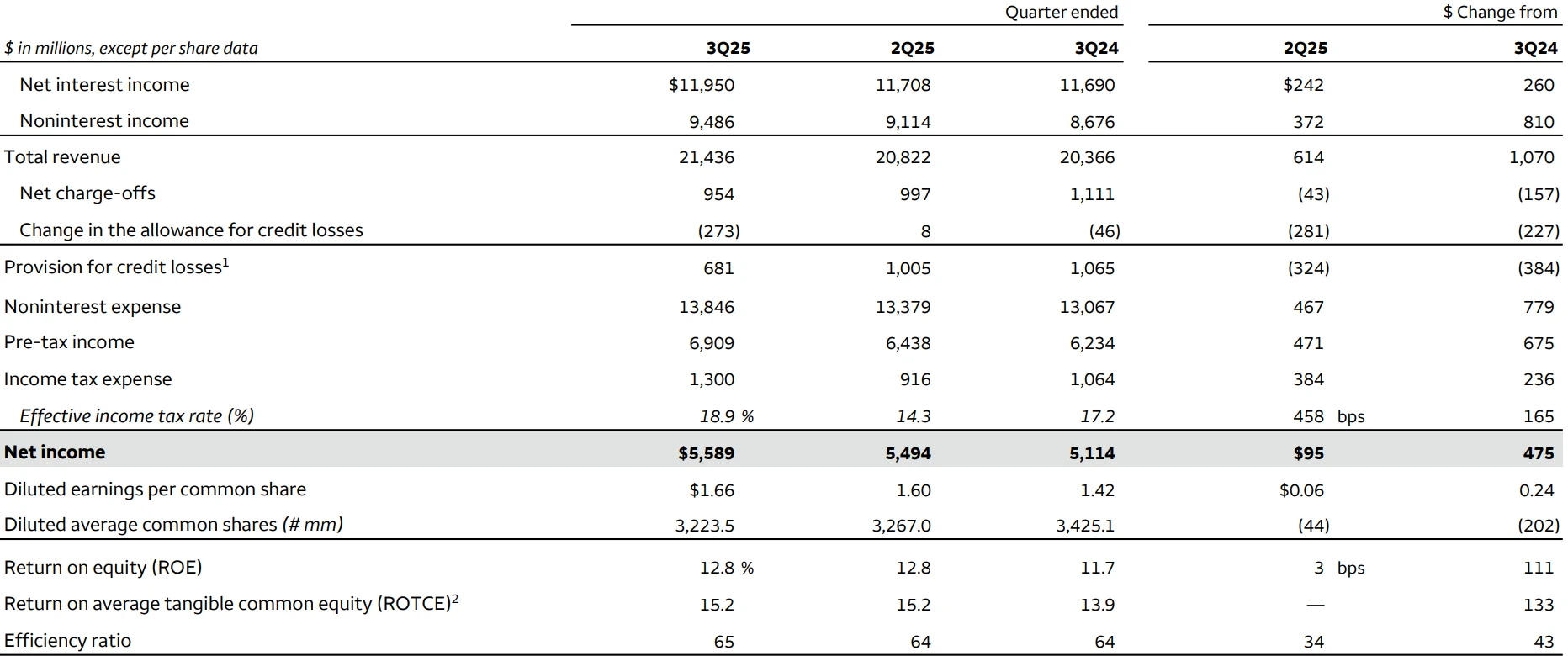

Wells Fargo’s revenue grew 5% to $5.6 billion, with diluted earnings per share of $1.66. Although net income declined 11% from the prior year, results still came in well above the market estimate of $1.28 per share.

Source: Wells Fargo

Trading and Investment Banking Drive Growth

The strong performance of Wall Street banks this quarter was primarily driven by robust growth in investment banking and trading activities.

Goldman Sachs generated $2.66 billion in investment banking fees, up 42% year over year and well above market expectations. Advisory revenue came in at $1.4 billion, marking a 60% increase from the same period last year. Equity underwriting revenue rose 21% to $465 million, while debt underwriting jumped 30% to $788 million. The bank has advised on over $1 trillion worth of announced M&A deals so far this year, maintaining its leading position in global merger advisory.

Source: Goldman Sachs

This rebound was supported by a global M&A volume exceeding $1 trillion in Q3 — only the second time in history the threshold has been surpassed. Meanwhile, the IPO market saw its busiest quarter since 2021, as companies such as Klarna and Lendbuzz went public, reigniting capital-raising activity.

JPMorgan Chase also posted solid results, with investment banking revenue reaching $2.6 billion, up 16% from a year earlier. The firm ranked first globally in investment banking fees, with a market share of 8.7%. The rebound in debt underwriting and M&A advisory activity was a key contributor to the increase.

Source: JPMorgan Chase

In trading, JPMorgan recorded revenue of $8.9 billion, surging 25% year over year to set a record for third-quarter performance. Fixed-income trading rose 21%, while equity trading surged 33%. Goldman Sachs’ fixed income, currency, and commodities (FICC) trading revenue also climbed 17% to $3.47 billion, exceeding market expectations. This performance was closely tied to midyear volatility in U.S. equity markets, as frequent portfolio reallocations by investors boosted banks’ trading commissions.

Rising Credit Costs and Higher Loan Loss Provisions

Despite strong earnings, credit cost pressures are rising across several banks, signaling potential risks to the economic outlook.

JPMorgan Chase recorded $3.4 billion in provisions for credit losses in Q3, with net charge-offs of $2.6 billion. The bank’s net reserves increased by $810 million, primarily concentrated in consumer lending. Notably, the net charge-off rate on credit cards rose to 3.15%, indicating potential marginal deterioration in consumer credit quality.

Goldman Sachs set aside $339 million for credit loss provisions, down from $397 million in the same quarter last year, but still at an elevated level.

JPMorgan CEO Jamie Dimon confirmed that the bank incurred $170 million in losses related to the bankruptcy of auto lender Tricolor, highlighting that risks are concentrated among highly leveraged companies and lower-income consumers.

During the earnings call, Dimon noted, “When economic conditions worsen, the pain may be greater than usual. I would expect that in a downturn, certain categories of credit losses could exceed normal levels.”

Citigroup and Wells Fargo also faced pressure in their lending operations. Citigroup’s adjusted expenses rose 3%, while Wells Fargo’s noninterest expenses increased 6% year over year, primarily due to restructuring costs.

Potential Bubble

One notable trend this earnings season is that an increasing number of major banks are shifting toward providing financing to nonbank lending institutions and asset management companies.

Goldman Sachs’ results offer some insight—its prime brokerage stock-lending division saw revenue rise roughly one-third year over year, setting a single-quarter record for the business.

Source: Goldman Sachs

Recent Federal Reserve data show that all of this year’s loan growth in the U.S. banking sector has come from lending to nonbank institutions, which now account for 13% of total outstanding bank loans.

JPMorgan CEO Jamie Dimon has been repeatedly asked about the risks associated with lending to nonbank entities. He highlighted that this space spans high-risk subprime loans and high-yield private credit, loans secured by investment-grade assets, and financing activities for asset managers overseeing trillions of dollars, each carrying different risk profiles.

Dimon warned, “There is a significant amount of regulatory arbitrage outside the banking system, and when the economy turns down, problem loans will be exposed. We have been operating in a relatively loose credit environment for too long. I believe that in a downturn, the quality of credit outside the banking system could deteriorate more than most people expect.”

Market Reaction

Despite strong financial performance, shares of major Wall Street banks broadly declined, reflecting investor caution. On the day of the earnings releases, JPMorgan’s stock fell 1.91%, while Goldman Sachs shares dropped approximately 2.04%. This market reaction likely signals broader economic uncertainty as well as investor concerns over potential regulatory changes and credit risks within the banking sector.

Source: TradingView

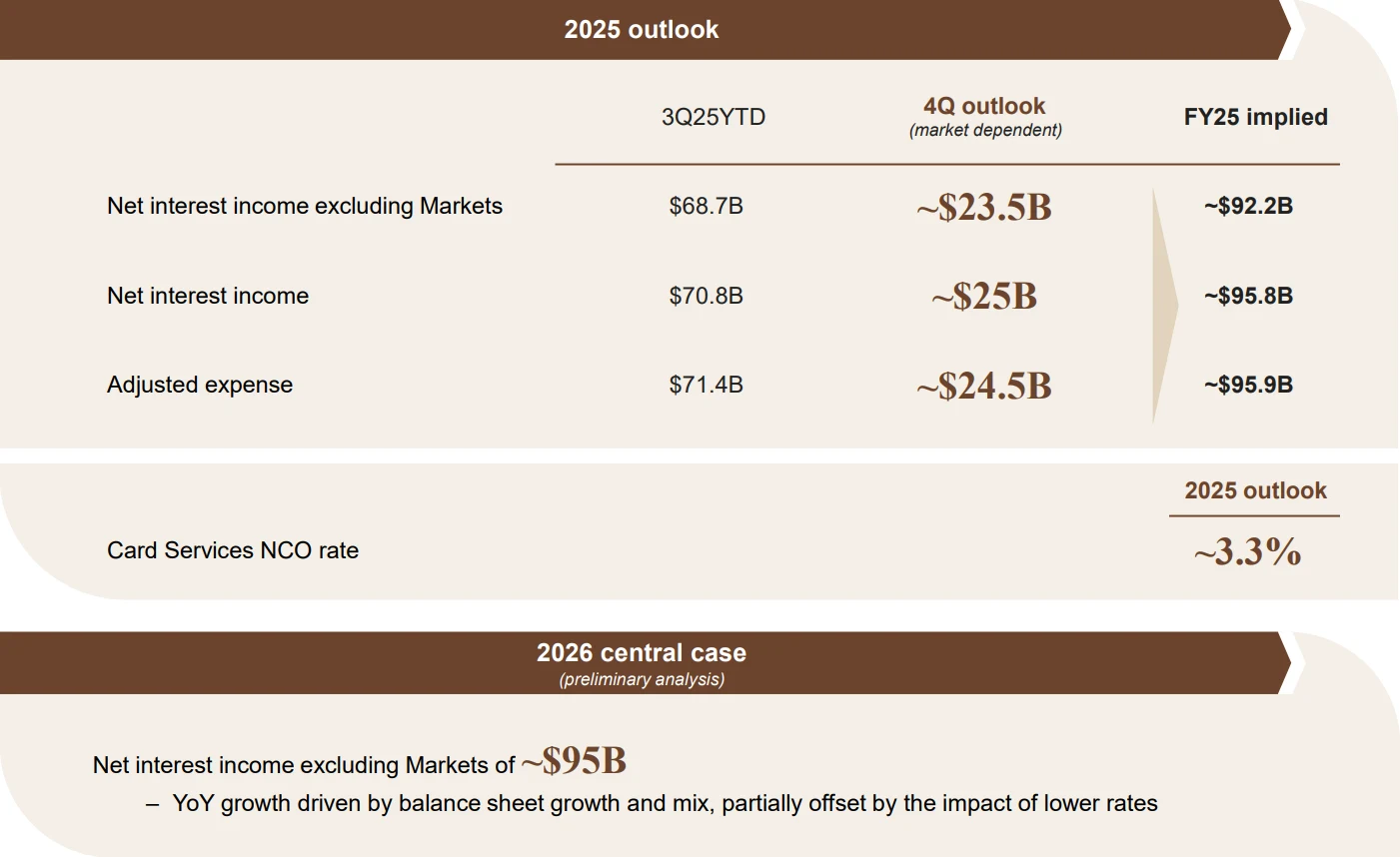

Nonetheless, JPMorgan provided an optimistic outlook for the remainder of 2025 and into 2026. For 2025, the bank expects net interest income excluding market-related businesses to reach approximately $92.2 billion, with total net interest income around $95.8 billion. Looking ahead to 2026, JPMorgan’s baseline case projects net interest income excluding market businesses of roughly $95 billion.

Source: JPMorgan

Goldman Sachs is advancing its AI-driven, more centralized operating model, known as “Goldman 3.0,” a multi-year strategic initiative aimed at optimizing client onboarding, enhancing business profitability, and improving operational efficiency.

While the better-than-expected Q3 results and positive guidance demonstrate the profitability of Wall Street banks amid market volatility, executives’ cautious tone casts a shadow over the outlook. As the earnings season progresses, markets will closely monitor other sectors’ performance to gauge the underlying health of the U.S. economy.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates