The Federal Reserve Signals a Dovish Shift, Set to Cut Rates by Another 25 Basis Points in October

22:41 October 14, 2025 EDT

Key Points:

Federal Reserve Chair Jerome Powell stated at the National Association for Business Economics (NABE) annual meeting that downside risks to U.S. employment have risen significantly, with clear signs of labor market cooling.

Powell also indicated that the Fed’s long-running balance sheet reduction program — known as quantitative tightening (QT) — may be approaching its end.

If the Fed simultaneously cuts interest rates and concludes QT, it would mark a significant shift in its monetary policy stance — from prioritizing inflation control to adopting a more balanced approach toward supporting economic growth.

On October 14 (local time), Federal Reserve Chair Jerome Powell delivered a key speech at the National Association for Business Economics (NABE) annual meeting, explicitly signaling that the Fed could end its balance sheet reduction (QT) program within the coming months. He also reaffirmed the dual trends of a cooling labor market and easing inflation, increasing the likelihood that monetary policy may soon return to a more accommodative trajectory.

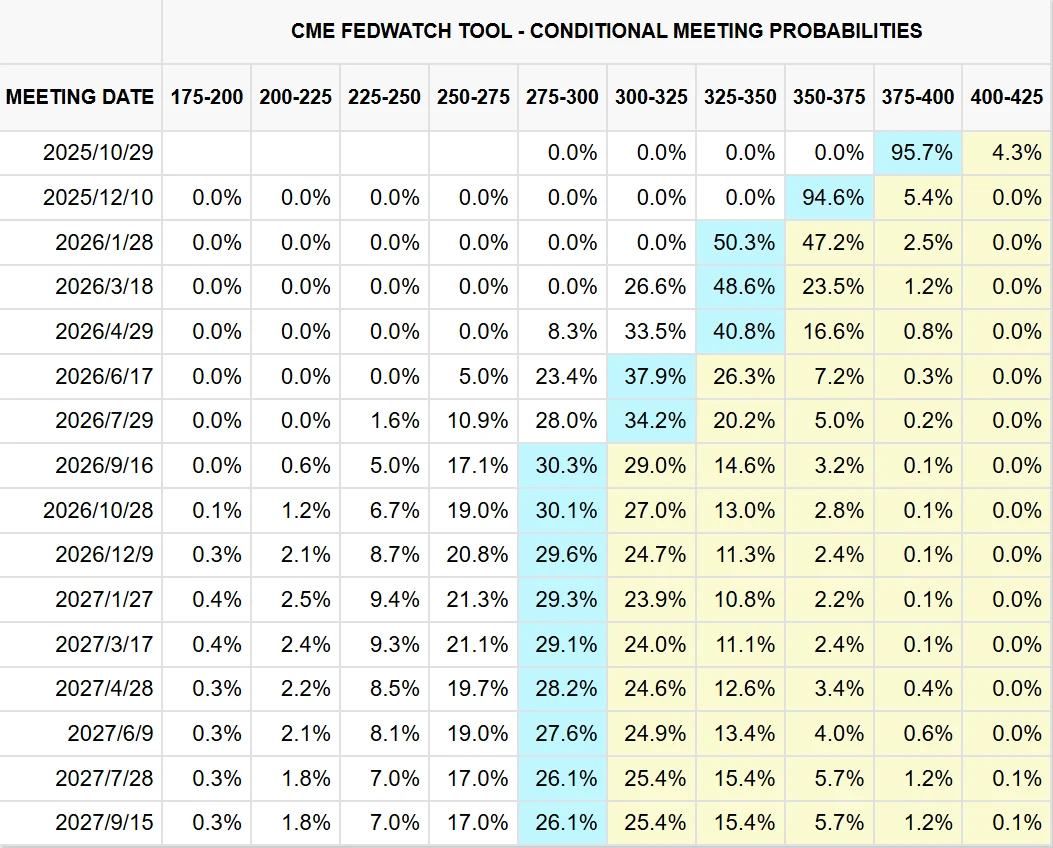

As Powell’s final public appearance before the October 28–29 FOMC meeting, markets interpreted his remarks as a clear signal for another rate cut. According to data from the CME FedWatch Tool, following Powell’s speech, market expectations for a 25-basis-point rate cut in October surged to nearly 100%.

Source: CME Group

Rate Cuts and Balance Sheet Reduction Near Their End

Jerome Powell noted in his speech that since the September FOMC meeting, the outlook for U.S. employment and inflation has “not changed significantly,” but the trend of labor market cooling has become increasingly apparent.

Powell also stated that the Fed’s long-standing plan is to stop balance sheet reduction when the banking system’s reserve levels are slightly above the “adequate” threshold. “At present, it appears we may approach this level in the coming months,” he said.

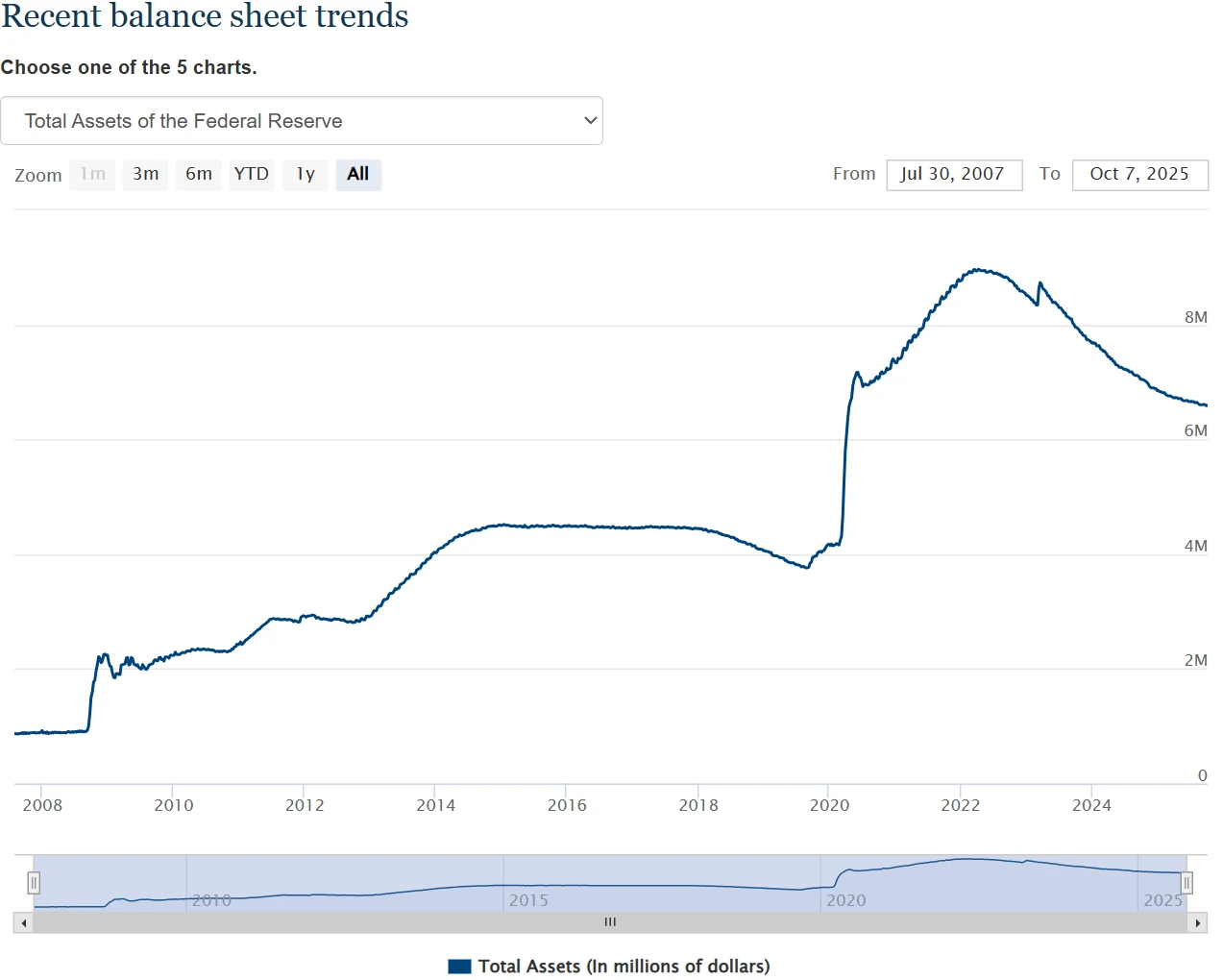

Since the Fed launched quantitative tightening (QT) in mid-2022, its balance sheet has declined from roughly $9 trillion to $6.6 trillion. The reduction has primarily occurred through allowing Treasury securities and mortgage-backed securities (MBS) to mature without reinvestment, reducing assets by approximately $95 billion per month. Market liquidity indicators have shown marginal tightening: the overnight repo rate has risen about 15 basis points above the central benchmark rate, and some short-term funding rates have experienced abnormal volatility on certain settlement dates.

Source: Federal Reserve

Powell specifically emphasized that liquidity in the financial system is “gradually tightening,” but underscored that the Fed will proceed cautiously to avoid a repeat of the September 2019 repo market crisis. At that time, excessive balance sheet reduction left reserves too low, driving overnight funding rates up to 10% and forcing the Fed to urgently restart repo operations. His remarks made it clear that the Fed aims to prevent a similar liquidity shock, often referred to as a “taper tantrum.”

Notably, Powell also defended the Fed’s core monetary policy tools, warning that if the interest payments on excess reserves and reverse repurchase agreements were removed, the Fed would lose control over rates, potentially triggering volatility in financial markets.

Labor Market Weakness Emerges as the Core Trigger for Rate Cuts

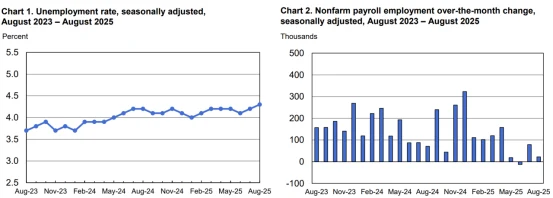

In terms of monetary policy orientation, Powell reiterated that employment risks are becoming a primary consideration. He stated, “The labor market shows signs of softness, with both supply and demand declining, and downside risks to employment appear to have increased.” In August, nonfarm payrolls increased by only 22,000, well below the market expectation of 75,000. The unemployment rate rose to 4.3%, marking a 0.1 percentage point increase for the second consecutive month and reaching the highest level in nearly four years.

Source: U.S. Bureau of Labor Statistics

Powell noted that slower wage growth and constrained labor supply may reflect structural issues. Reduced immigration and a declining labor force participation rate (currently 62.3%) are jointly limiting the potential for employment expansion. He emphasized that one reason the Fed cut rates in September was a shift in the risk balance from inflation toward employment — that is, “slowing rate cuts too much could impose greater losses on the labor market.”

In striking a policy balance, the Fed faces a “dilemma”: cutting rates too quickly could trigger an inflation rebound, while delayed cuts could cause “painful losses” in the labor market. Current data clearly favors the latter — the dual decline in labor supply and demand makes employment support a policy priority.

Meanwhile, Boston Fed President Susan Collins also commented on the same day that further rate cuts this year “would be a prudent course of action.” She indicated that another 25-basis-point reduction could help support the labor market, but policy would remain moderately restrictive to prevent an inflation rebound. Collins projected that the U.S. unemployment rate would rise modestly to around 4.5% by early 2026.

Tariffs Emerge as the Main Driver of Inflation

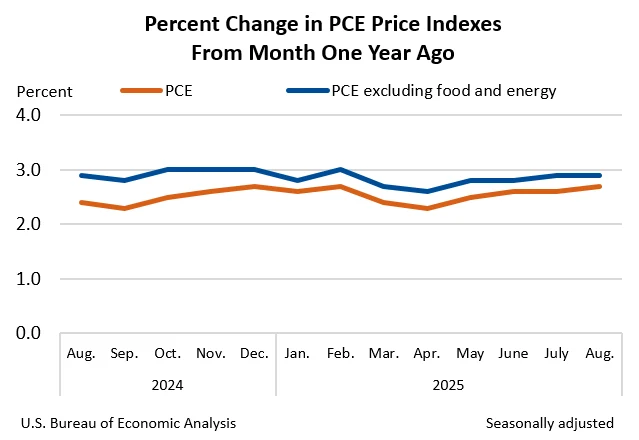

On the inflation front, Powell made it clear that recent price increases have been primarily driven by tariffs rather than broad-based demand-driven inflation. The U.S. core personal consumption expenditures (PCE) price index rose 2.9% year-over-year, still above the Fed’s 2% target, but the upward pressure shows distinct structural characteristics: goods price increases are largely attributable to tariff effects rather than widespread demand-pull inflation.

Source: BEA

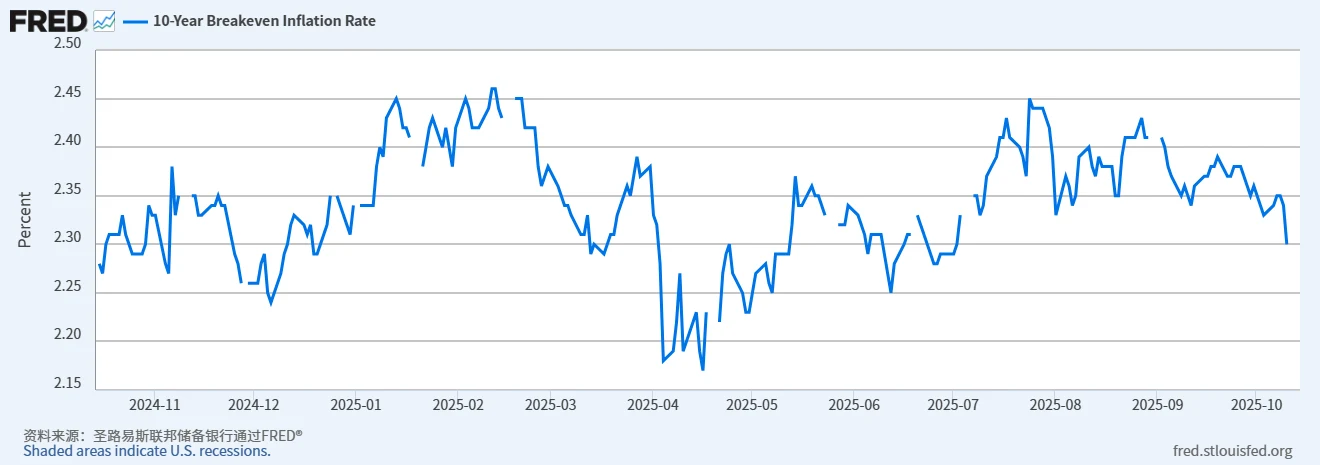

Powell also emphasized that the rise in goods prices “primarily reflects tariff effects,” while service-sector prices and wage growth are declining in tandem. He noted that there is currently no evidence of secondary inflationary pressures forming. Indeed, market-based inflation expectations remain stable — the 10-year breakeven inflation rate stands at approximately 2.3%, near the lowest level of the past 12 months.

Source: FRED

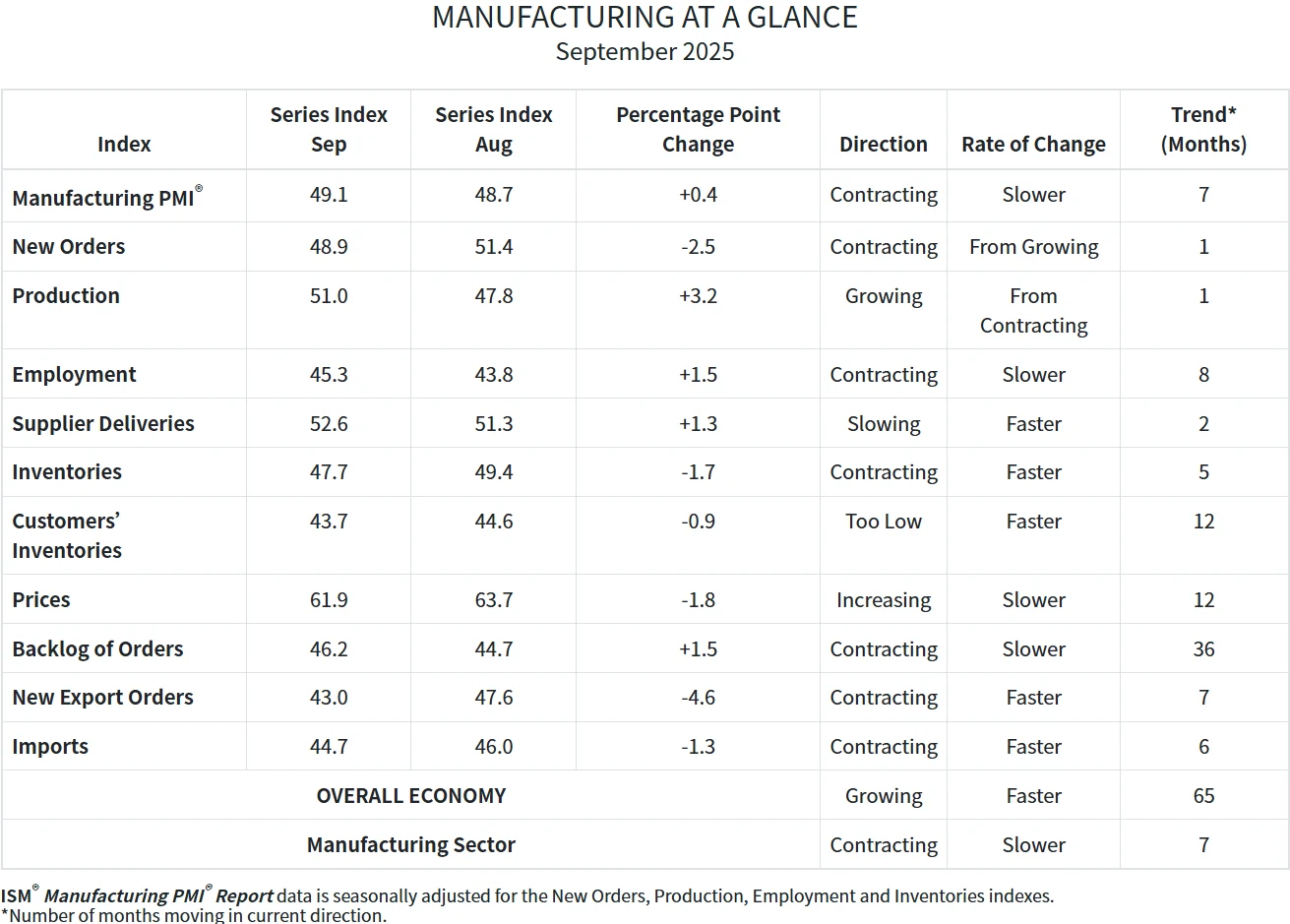

Analysts argue that beyond the short-term imported inflation from tariffs, domestic demand momentum in the U.S. is slowing. Data from the Institute for Supply Management (ISM) shows that the September manufacturing PMI rose slightly to 49.0 from 48.7 in August, modestly above market expectations but still below the expansion threshold of 50.

Source: ISM

Within the PMI components, the production index increased to 51.0, and the employment index rose to 45.3, yet the new orders index fell to 48.9, customer inventories dropped to 43.7, and the order backlog index declined to 46.2, signaling persistently weak demand. The input prices index decreased from 63.7 in August to 61.9 but remains elevated, indicating that cost pressures, although somewhat easing, are still present. Against this backdrop, the Fed is more likely to use rate cuts to address growth risks rather than prolong the tightening cycle.

Government Shutdown Undermines Policy Decision-Making

Powell also addressed a technical but critical issue: the impact of the U.S. government shutdown on Federal Reserve decision-making. Due to the federal funding lapse, the Fed has lost access to a range of key government statistical data, which are typically used to adjust economic outlooks and guide interest rate policy.

Powell noted that state-level employment data and the ADP employment report, often referred to as “small nonfarm payrolls,” cannot replace the “gold standard” of official statistics.

He emphasized that if the government shutdown persists, the Fed will increasingly miss more data, making the situation more challenging. Market observers interpret this as indicating that the Fed may adopt a more cautious approach in the face of data gaps to avoid misjudging risks.

Uncertainty in the Policy Path

Although Powell’s remarks paved the way for potential rate cuts, significant uncertainty remains within the Federal Reserve regarding the policy trajectory. He made it clear that Fed policy is not on a predetermined path and will be determined on a meeting-by-meeting basis.

Some officials have warned that the Trump administration’s new tariff policies could once again push up prices, complicating the path toward disinflation. This divergence may become more pronounced in future interest rate decisions, particularly if economic data send mixed signals.

In addition, Powell devoted considerable attention in his speech to indirectly defending the Fed’s monetary policy actions since the 2020 pandemic.

Recently, several political figures, including Treasury Secretary Janet Yellen’s successor Scott Besent and a number of potential Fed chair candidates, have criticized the Fed’s policy path. Besent previously indicated in media interviews that his team had completed the first round of interviews with 11 potential Fed chair candidates and plans to submit a shortlist of 3–4 individuals to the President in November. Among these candidates, some have publicly questioned whether the Fed has focused excessively on inflation at the expense of economic growth.

Final Thoughts

As the Federal Reserve’s policy meeting on October 28–29 approaches, the market is closely watching for signals regarding the future direction of monetary policy.

Powell’s latest remarks clearly provide the market with an important reference point, and the trajectory of U.S. monetary policy will continue to influence global markets.

Wall Street analysts note that if the Fed simultaneously implements a rate cut and concludes its balance sheet reduction, it would signal a significant shift in its monetary policy stance—from prioritizing inflation control to taking a more balanced approach toward economic growth risks.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates