Should You Buy Nvidia Stock Before TSMC Reports Earnings?

04:02 October 14, 2025 EDT

On October 16, 2025, TSMC is set to release its fiscal Q3 earnings. The results are widely viewed as a key indicator for assessing AI chip demand and will also serve as a pivotal reference point for investment decisions on Nvidia stock.

As TSMC’s largest customer for advanced process nodes, Nvidia’s share price has shown a notable correlation with TSMC’s performance. As of October 14, Nvidia’s stock closed at $188.32, giving it a market capitalization of $4.58 trillion — about 3.8% below its all-time high of $195.62 reached on October 10. Investors may look to TSMC’s earnings signals as a valuation anchor to determine whether a short-term buying window for Nvidia is emerging.

Key Metrics for October 16

As the world’s leading semiconductor manufacturer, TSMC’s performance not only serves as a barometer for the broader chip industry but also offers investors key insights into the strength of semiconductor demand.

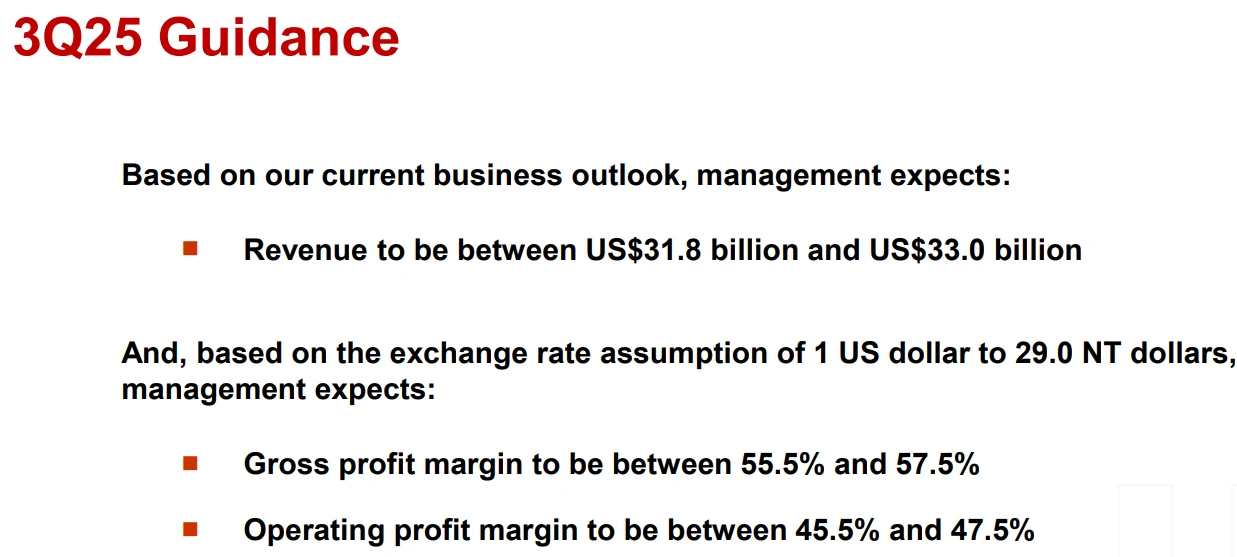

It is worth noting that TSMC’s third-quarter results already show clear signs of growth, with the core driver pointing directly to surging demand in the AI chip sector. According to LSEG SmartEstimate, the company’s quarterly net profit is projected to reach NT$415.4 billion (approximately US$13.55 billion), up 28% year over year; revenue is estimated at NT$989.92 billion (US$32.47 billion), an increase of 30% YoY, landing near the midpoint of TSMC’s guidance range of US$31.8–33.0 billion. If net profit exceeds NT$398.3 billion (the record set in Q2 2025), it would mark the seventh consecutive quarter of growth.

Source: TSMC

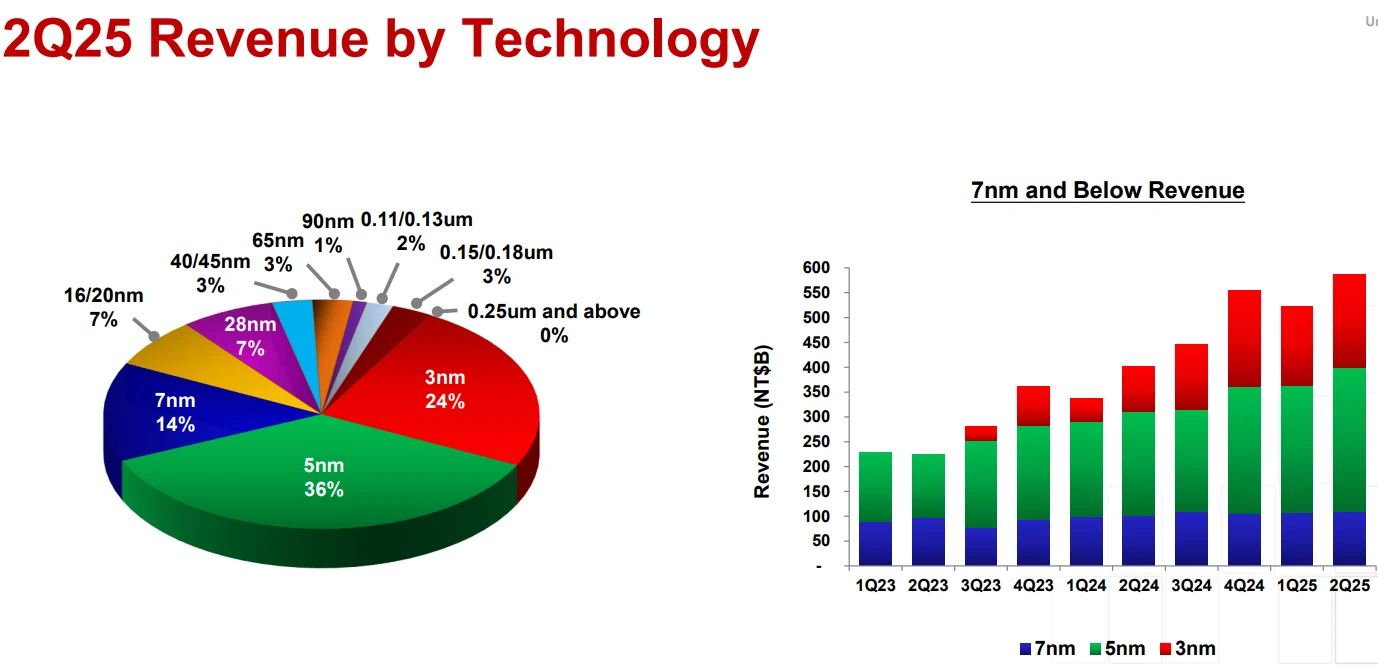

In Q2 2025, advanced process technologies of 7nm and below accounted for 74% of TSMC’s revenue, with 5nm contributing 36% and 3nm contributing 24%. Industry estimates suggest the 3nm share will further increase to 26–28% in Q3, with most of the incremental capacity dedicated to NVIDIA’s Blackwell GPU orders. From a technology cycle perspective, the expansion of TSMC’s advanced nodes is directly aligned with the rising demand for NVIDIA’s high-end AI chips.

Source: TSMC

Developments in advanced packaging further validate the sustained strength of AI chip demand. TSMC Chairman C.C. Wei has repeatedly emphasized that demand for CoWoS advanced packaging continues to outstrip supply by more than twofold. To address this, the company plans to double CoWoS capacity to 8 million units per year by 2025 and add eight new CoWoS facilities (six in the Southern Taiwan Science Park and two in the ChiaYi Science Park), with total investment exceeding NT$200 billion.

From a structural demand perspective, industry estimates indicate that NVIDIA accounts for 63% of global CoWoS demand, far ahead of Broadcom and AMD. TSMC’s capacity expansion plan essentially serves as a direct endorsement of NVIDIA’s robust order outlook. Earlier market rumors suggesting that NVIDIA was cutting CoWoS orders were later dismissed by CEO Jensen Huang, who clarified that the adjustments were related to the transition from the B200 series to the B300 series and a shift toward the Blackwell platform using CoWoS-L technology, rather than a demand contraction. This clarification helped stabilize investor sentiment ahead of TSMC’s earnings release.

Wei also noted during previous earnings calls that the outlook for AI chip demand remains highly optimistic, with customer demand for CoWoS packaging far exceeding TSMC’s supply capacity—a critical factor for NVIDIA’s Blackwell AI GPUs and other AI-related semiconductors. As NVIDIA’s most important manufacturing partner, nearly every major NVIDIA chip architecture has been built upon TSMC’s process technologies.

If TSMC delivers another strong earnings report, it could trigger a positive reaction across all AI hardware-related stocks, making NVIDIA one of the top names to watch—and potentially accumulate—before October 16.

Historical Correlation

The transmission effect of TSMC’s earnings on NVIDIA’s stock performance has been clearly validated by historical data, and this correlation appears to be strengthening under current market conditions.

On October 17, 2024, after TSMC reported a robust 54% year-over-year increase in Q3 net profit, NVIDIA’s share price surged more than 3.1% intraday to a new all-time high, posting a cumulative gain of 5.8% over the following three trading sessions. Similarly, on July 17, 2025, when TSMC announced a stronger-than-expected 61% YoY rise in Q2 net profit, NVIDIA’s shares climbed 0.95% to $173 on the day, extended gains by another 3.3% in premarket trading the next day, and rose a total of 4.2% for the week.

Source: TradingView

The underlying logic of this correlation lies in the fact that TSMC’s financial results serve as a direct indicator of real-time AI chip demand. According to a Morgan Stanley report published on October 10, TSMC’s advanced-node capacity utilization remains at 100%, underscoring the strength of orders from major clients such as NVIDIA. Meanwhile, the expansion of CoWoS packaging capacity helps alleviate concerns over NVIDIA’s GPU delivery bottlenecks, further reinforcing expectations for the company’s revenue growth.

Relatively Fairly Valued Tech Giants

NVIDIA continues to maintain a dominant position in the AI computing sector, with its advanced Hopper and Blackwell GPU architectures setting the industry benchmark. Even amid competition from AMD and Broadcom, NVIDIA’s market leadership and valuation advantages remain intact.

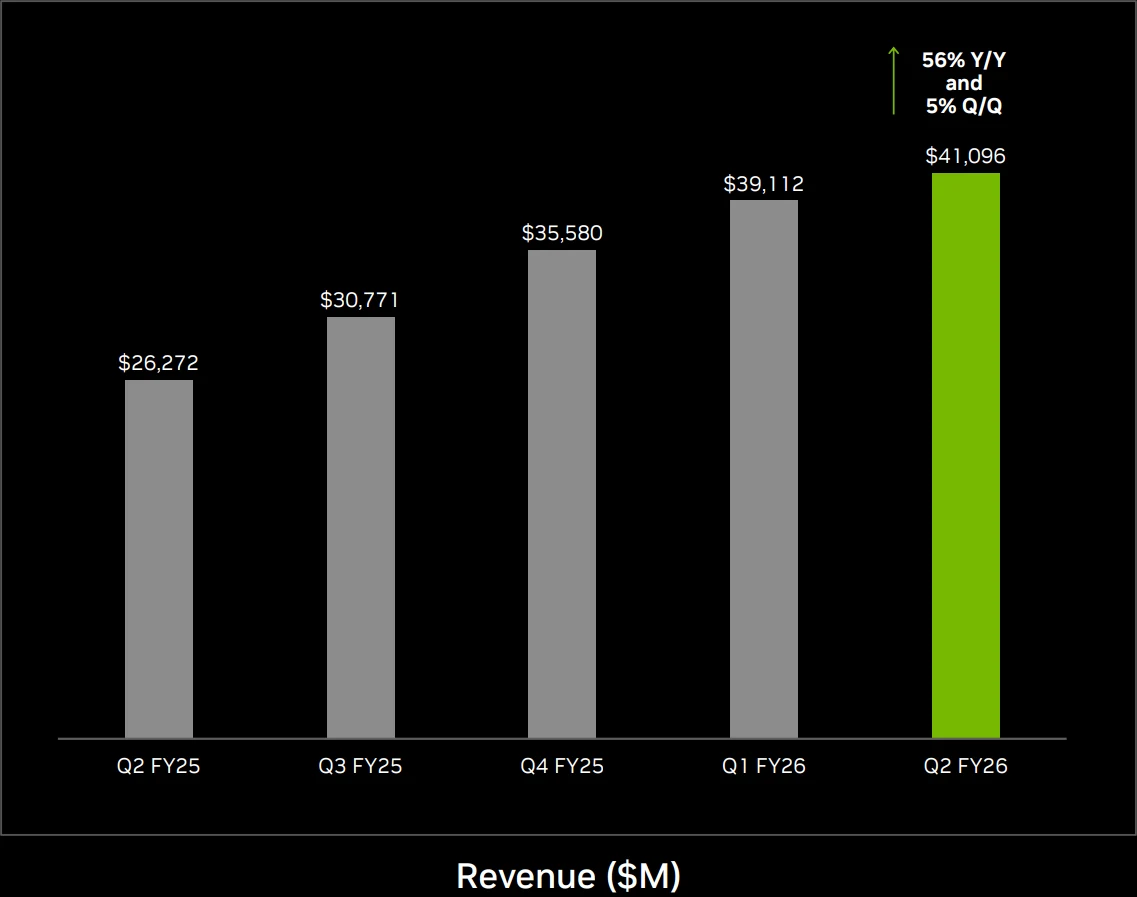

In terms of market scale, despite AMD’s $34 billion collaboration with OpenAI and Broadcom securing a $10 billion order, NVIDIA’s Q2 FY2026 data center revenue reached $41.1 billion in a single quarter, far exceeding the combined value of these two deals.

Source: NVIDIA

From a product and ecosystem standpoint, Blackwell GPUs have seen quarterly sales growth of 17% since beginning mass production in Q2 2025. NVIDIA founder and CEO Jensen Huang stated during a conference call that demand for the Blackwell platform, tailored for enterprise-level and custom AI designs, is “exceptionally strong,” and shipments have already started to major clients including Disney, Foxconn, Hitachi, and Hyundai Motor Group, among other large-scale customers.

From a valuation perspective, NVIDIA also holds relative advantages: as of October 2025, the company’s trailing P/E ratio stands at approximately 53.65, with a forward P/E of around 32.16, levels that are attractive relative to both its historical averages and industry benchmarks.

Meanwhile, Wall Street analysts maintain an average rating of “Strong Buy” for NVIDIA, with a 12-month price target of $221.25, representing an upside potential of 17.49% from the current price of $188.32. This target suggests that despite the company’s substantial market capitalization, analysts remain bullish on its future trajectory.

Conclusion

TSMC’s earnings data will serve as a key indicator for gauging AI chip demand and is likely to influence the performance of the entire sector. If TSMC reports strong results, NVIDIA, as a leading AI chip player, could see a new wave of upside momentum.

Investors may consider positioning in NVIDIA shares ahead of October 16 to capture potential gains. At the same time, they should closely monitor TSMC’s earnings guidance and shifts in AI market demand, while setting appropriate stop-loss levels to manage risk.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates