U.S. Q3 Earnings Season Kicks Off: Bank Results to Lead Insights on Consumer and Corporate Health

02:21 October 14, 2025 EDT

Starting October 14, major U.S. banks including JPMorgan Chase, Goldman Sachs, Citi, Wells Fargo, Bank of America, and Morgan Stanley will begin releasing their third-quarter 2025 earnings reports.

These reports are regarded as key indicators of the health of the U.S. economy. Against the backdrop of a U.S. government shutdown delaying the release of critical economic data, bank earnings have become a primary reference for assessing consumer resilience, corporate conditions, and trends in the lending market.

Market expectations point to continued strength in the banking sector. Analysts forecast that JPMorgan Chase will report Q3 revenue of $45.57 billion and earnings per share of $4.87, representing year-over-year growth of 6% and 11%, respectively. Goldman Sachs is expected to post revenue of $14.13 billion and EPS of $11.10, corresponding to year-over-year increases of 11% and 32%.

Alternative Economic Indicators During Data Blackout Periods

The U.S. federal government shutdown has already lasted more than two weeks, affecting the routine operations of federal agencies and causing interruptions in the release of key economic data—core reports originally scheduled for early October, including the September nonfarm payrolls, Consumer Price Index (CPI), and retail sales, have been postponed due to furloughs of staff at the Bureau of Labor Statistics, the Department of Commerce, and other departments. The absence of these data has created an information gap for investors in assessing the current economic fundamentals, intensifying short-term market volatility.

In this context, the upcoming U.S. third-quarter bank earnings reports have become an important alternative indicator for observing economic conditions. Compared with the delayed official data, bank earnings follow public company disclosure rules and will be released on schedule throughout mid- to late October, providing the market with a relatively timely window for economic observation.

Bank earnings as a proxy for economic health have unique value. As financial hubs, banks are deeply linked with household consumption, corporate operations, and the real estate market: credit card loan delinquency rates and mortgage issuance can reflect residents’ debt repayment ability and consumer confidence; corporate lending volumes and commercial real estate loan delinquency rates reflect business pressures and investment intentions; changes in investment banking revenue can indicate financial market activity and the corporate financing environment. If earnings show tighter lending standards for small and medium-sized enterprises or rising delinquency rates, it may signal economic downside pressure.

Market attention to bank earnings has increased significantly. UBS analyst Erica Najarian pointed out that the banking sector faces “enormous expectations.” Every single piece of data may be interpreted by the market as a signal of economic direction.

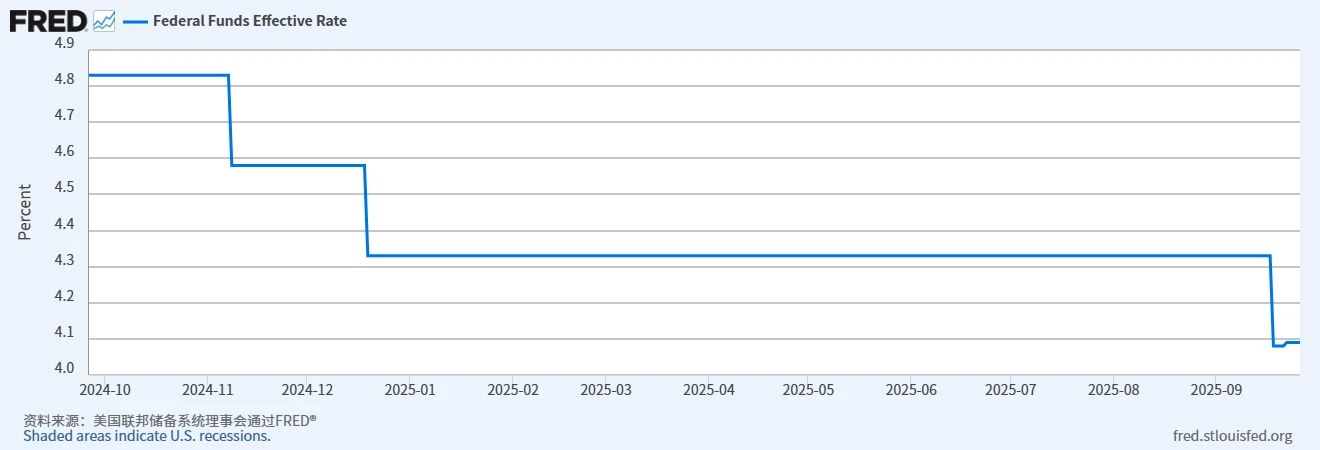

Changes in the interest rate environment also provide context for earnings analysis. The Federal Reserve cut rates by 25 basis points in September to 4.00%-4.25% and indicated the possibility of further cuts of 50 basis points within the year. Rate cuts may compress banks’ net interest margins, but they also stimulate loan demand and push up bond prices, partially compensating for the impact on bank profitability. The market is focusing on indicators such as net interest margin, loan growth, and bond investment income to assess how interest rate changes affect performance.

Source: FRED

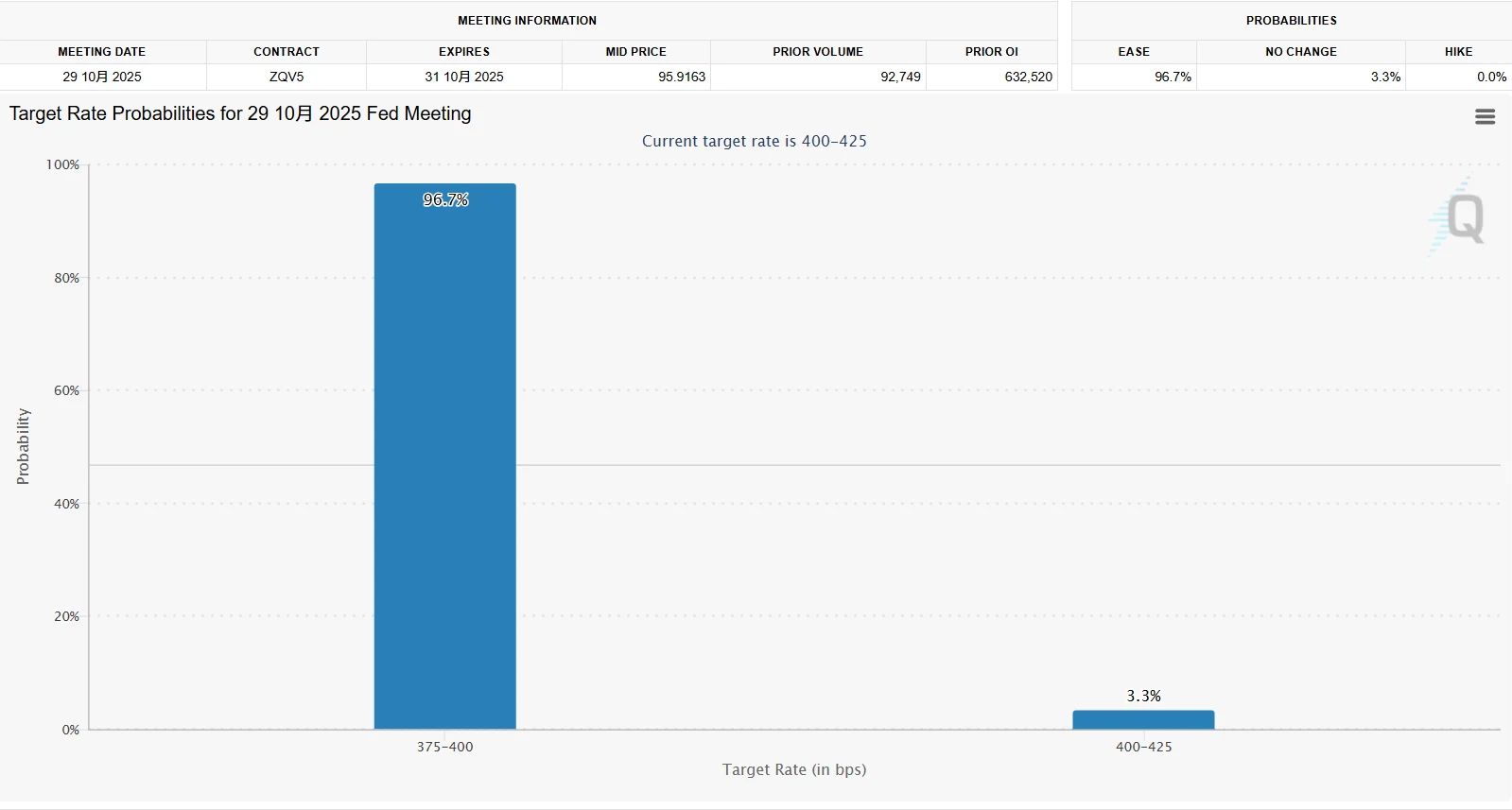

According to the CME FedWatch Tool, the probability of a 25-basis-point cut at the Fed meeting on October 29 exceeds 96%, and the market also predicts another 25-basis-point cut in December, with the probability of a cumulative 75-basis-point reduction this year approaching 100%. This expectation is reflected in falling U.S. Treasury yields, while investors will pay attention to bank management commentary on future interest rates, credit policies, and risk management to assess economic policy and economic trends.

Source: CME Group

Investment Banking Drives Growth, Net Interest Margin Pressure Persists

As the U.S. third-quarter earnings season enters its core disclosure period, the market holds clear expectations for the performance of large U.S. banks. Although net interest margin (NIM) pressure persists, the strong rebound in investment banking has become the key driver of earnings growth. Coupled with the support for credit demand from the resilience of the U.S. economy, mainstream Wall Street institutions generally expect the earnings of leading banks to exceed mid-year projections.

Based on market consensus and institutional views, the “growth engine” for large U.S. banks in Q3 is clearly pointing to investment banking. In its latest sector report, Morgan Stanley expressed a “cautiously optimistic” stance on North American large banks, particularly favoring money-center banks such as JPMorgan and Goldman Sachs. These institutions’ investment banking and trading revenues exhibit stronger recovery elasticity, providing an effective hedge against pressures on traditional interest income.

Specifically, the recovery in investment banking shows a trend of “full-chain rebound,” with growth across multiple segments exceeding market expectations.

M&A market activity has rebounded significantly. As a bellwether of investment banking, the global M&A market in 2025 is emerging from a downturn, with corporate restructuring and industry consolidation demands being released in concentration. Morgan Stanley projects that Q3 North American M&A advisory fees will increase by 30% year-over-year, well above the market expectation of 11%, marking the highest quarterly level since 2023. This suggests that investment banks’ revenue contribution from M&A could potentially multiply.

Capital markets financing activity is improving in parallel. Both equity capital markets (ECM) and debt capital markets (DCM) are performing strongly. Benefiting from a recovery in the U.S. IPO market and rising corporate refinancing needs, ECM fees are expected to increase 41% year-over-year, with technology and clean energy IPOs serving as key drivers. In DCM, although interest rate volatility poses some constraints, issuance of high-grade corporate bonds and municipal bonds remains stable, expected to grow approximately 4% year-over-year, providing a steady income source for investment banking.

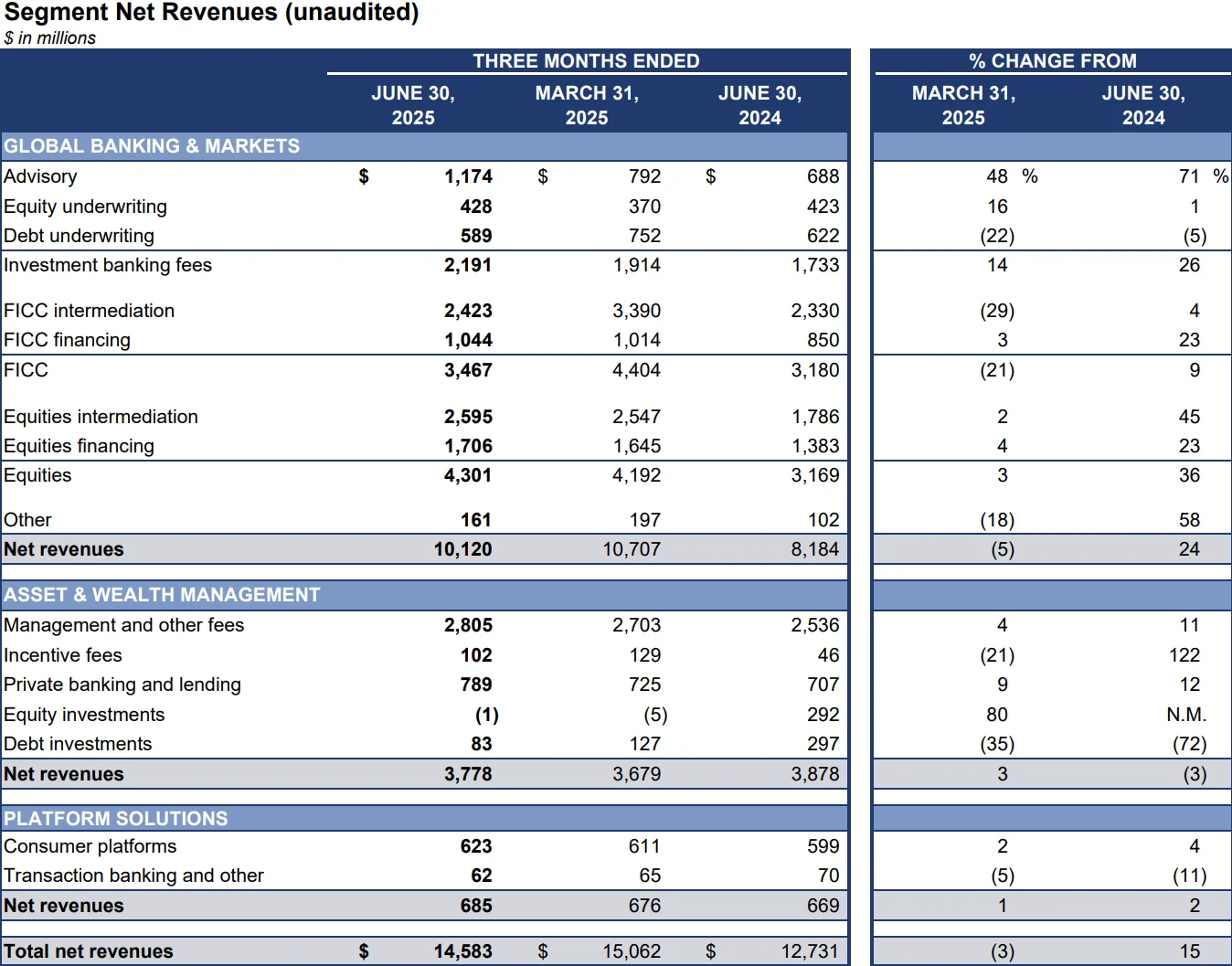

This comprehensive recovery trend is particularly favorable for leading institutions with an “investment banking DNA,” such as Goldman Sachs and JPMorgan. For example, at Goldman Sachs, investment banking revenue accounts for more than 30% of total revenue, and the dual growth of M&A advisory and capital markets businesses is expected to drive the segment’s revenue up over 35% year-over-year, becoming the primary support for Q3 earnings growth.

Source: Goldman Sachs

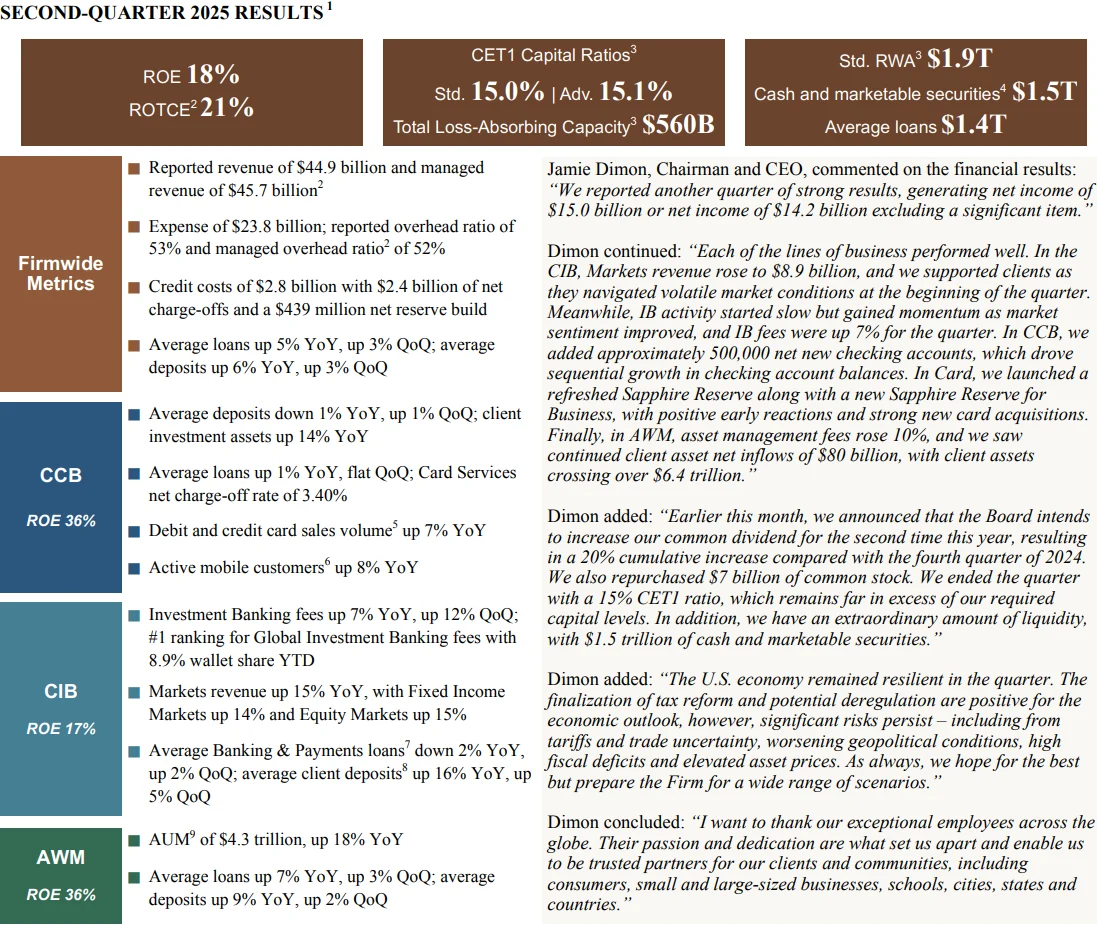

JPMorgan, with its dual “commercial banking + investment banking” model, not only benefits from growth in investment banking revenue but also maintains steady expansion in lending through its large client base, demonstrating stronger earnings resilience.

Source: JPMorgan

However, while investment banking drives earnings growth, NIM compression remains the core challenge for the banking sector, particularly affecting institutions with a higher proportion of retail banking. Bank of America serves as a typical example.

From a logical perspective, NIM pressure mainly stems from the Fed’s rate-cut cycle. Since September 2025, the Federal Reserve has cut rates by 25 basis points, and the downward move directly compresses banks’ lending yields—corporate loans and residential mortgages have been lowered in tandem, reducing interest income from traditional lending.

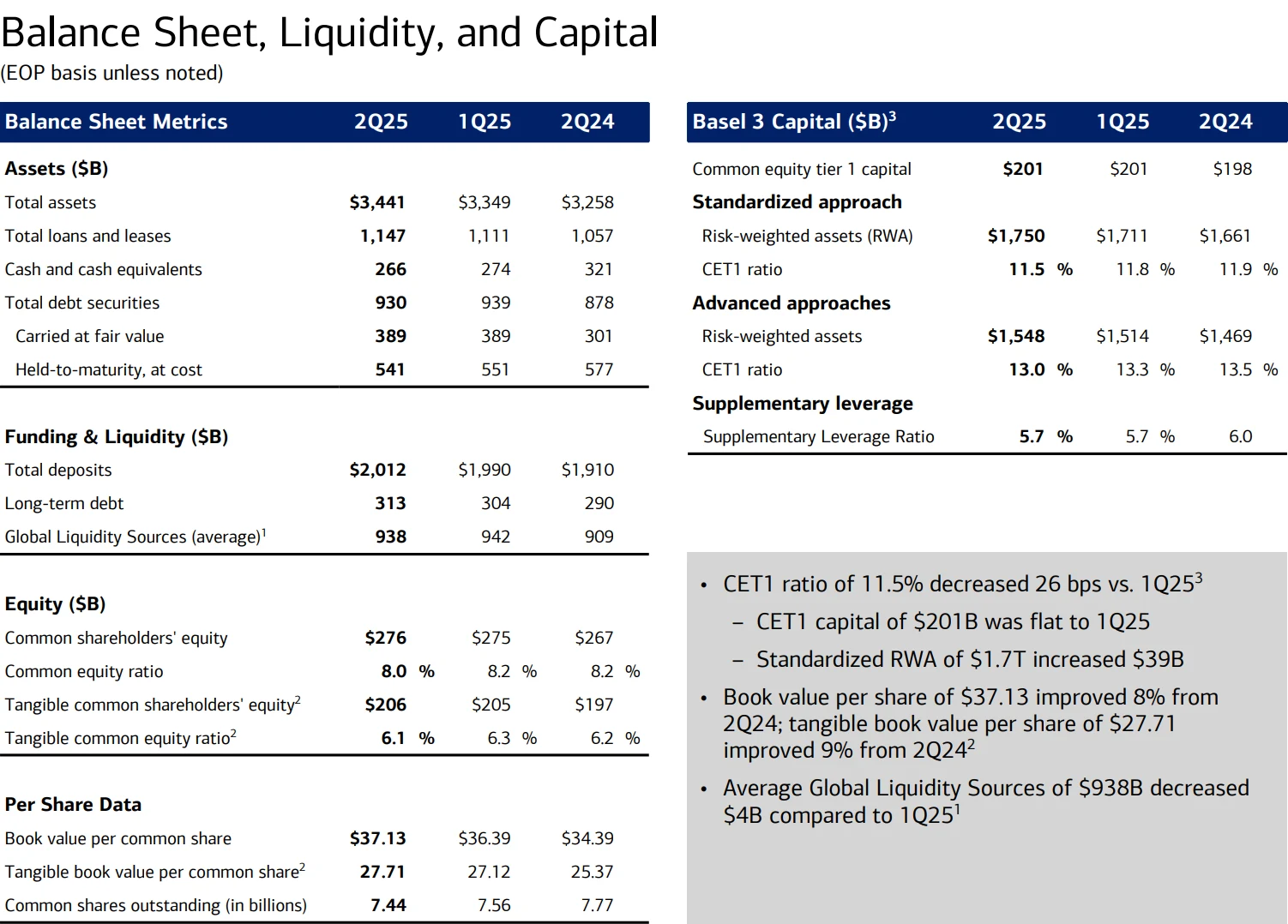

Some banks are attempting to mitigate the pressure through deposit cost management, but the effect remains to be seen. Bank of America, for instance, holds over $2 trillion in customer deposits, one of the largest retail deposit bases in the U.S., theoretically able to offset yield compression with low-cost funds. However, Morgan Stanley data show that the proportion of non-interest-bearing deposits at Bank of America continues to decline, projected to fall to 26% in Q3 2025, down from 26.7% a year ago; meanwhile, the average cost of interest-bearing deposits has decreased from 2.61% in 2024 to 2.23%, but the decline still lags the contraction in loan yields. The market expects Bank of America’s Q3 NIM to narrow to 2.65%, five basis points lower than the previous quarter.

Source: Bank of America

The key focus of the Q3 earnings season is expected to center on whether “investment banking growth can offset NIM compression.” If investment banking revenue growth exceeds expectations and deposit cost management proves effective, leading banks’ overall earnings could outperform consensus; conversely, if margin compression is too severe, banks reliant on traditional lending may face profit pressures. In the upcoming earnings calls, management commentary on “business structure adjustments under the rate-cut cycle,” “deposit cost strategy,” and “loan demand outlook” will serve as important references for the market in assessing the long-term profitability of the banking sector.

Consumer Resilience

The performance of the U.S. consumer and corporate sectors is a key focus for this earnings season. Beyond the rebound in investment banking and the compression of net interest margins, resilient consumer spending and healthy corporate cash flows are supporting banks’ loan growth and asset quality, reinforcing market optimism for this earnings cycle.

Consumer side: High-income households underpin spending, credit card risk recedes

Bank of America CFO Alastair Borthwick recently noted that U.S. consumers continue to demonstrate strong resilience, with both spending and debt-servicing capacity remaining robust. High-income households (annual income above $150,000) are the primary drivers of consumption, particularly in travel, high-end dining, and healthcare services. Data show that in Q3, major banks’ credit card transaction volumes grew 5%-7% year-over-year, with high-income clients contributing over 60% of the growth.

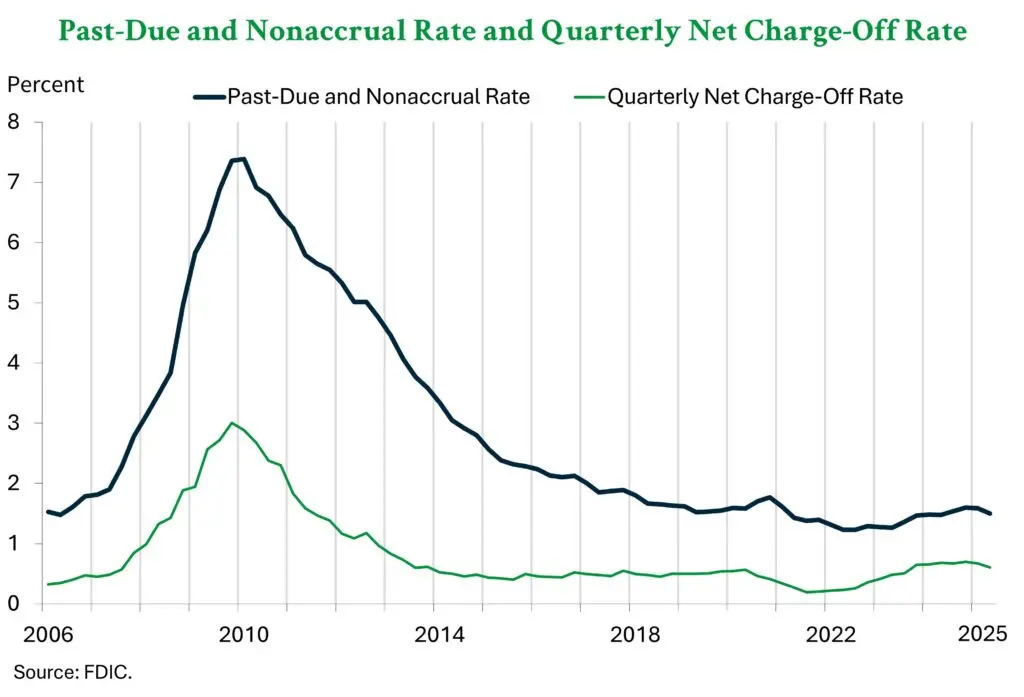

Credit quality has also continued to improve. Delinquency rates on major banks’ credit cards have fallen for six consecutive quarters to 2.8%-3.0%, approaching pre-pandemic levels, significantly easing charge-off pressures. According to FDIC data, the overall loan charge-off rate in the U.S. banking system stands at approximately 0.60%. While higher than pandemic-era lows, it remains below the 2019 average and far below the peak during the 2008 financial crisis, indicating that consumer credit risk is generally manageable.

Source: FDIC

Corporate side: Strong cash flows support loan expansion in key sectors

The resilience of the corporate sector also underpins bank profitability. Executives at JPMorgan and Wells Fargo have noted that corporate cash flows and debt-servicing capacity remain stable. Despite slower overall economic growth, demand for commercial loans remains supported, particularly in high-growth sectors such as data centers, renewable energy, and semiconductor manufacturing, with loan applications rising 10%-15% year-over-year. Loans related to data centers, for example, grew approximately 12% in Q3 on a year-over-year basis, with risk well-controlled.

Non-financial U.S. companies maintain a cash-flow coverage ratio above 1.8x, higher than the pre-pandemic 1.5x level; corporate leverage has fallen below 65%, and non-performing loan ratios are expected to remain in the 0.4%-0.5% range, near a ten-year low. The combination of robust cash flows and deleveraging trends strengthens corporate credit quality.

Overall, the “dual resilience” of the consumer and corporate sectors is supporting bank performance from both the demand and risk sides: the former drives credit card revenue growth, while the latter stabilizes loan asset quality, with declining non-performing rates further alleviating provisioning pressures.

For the market, upcoming bank earnings reports will place particular focus on indicators such as “consumer credit balance growth,” “credit card delinquency rates,” and “corporate loan non-performing ratios.” These metrics will serve as key data points to validate resilience and further influence market assessments of the banking sector and the broader U.S. economic fundamentals.

Economic Turning Point and Government Shutdown

Despite an overall optimistic outlook, the banking sector still faces multiple risk factors. Analysts note that if the economy were to take a downturn, current optimism could quickly dissipate.

First, the risk of a government shutdown remains the most uncertain short-term variable. If a federal government closure is prolonged, economic activity could be constrained. While banks typically provide temporary relief measures to affected clients, furloughed government employees may cut back on spending, weighing on retail consumption.

In addition, a shutdown of the Small Business Administration (SBA) and the Department of Housing and Urban Development (HUD) could delay loan approvals and disbursements, suppressing demand for certain corporate and real estate credit.

Should the shutdown extend beyond expectations, market volatility could rise, and the primary driver of banks’ current earnings recovery—the rebound in investment banking—could slow as a result.

At the same time, while credit quality remains generally healthy, certain segments still require close monitoring. In particular, office mortgage loans continue to face the dual pressures of high interest rates and the normalization of remote work. Refinancing risks for some commercial real estate projects have increased, and ongoing asset valuation adjustments could continue to weigh on banks’ balance sheet quality.

However, analysts generally believe that these pressures are already widely recognized by the market and have been largely priced in. Most banks have increased reserve coverage for these types of loans in previous reporting periods, keeping potential losses manageable. In other words, while these risks have not disappeared, their marginal impact on overall profitability is diminishing.

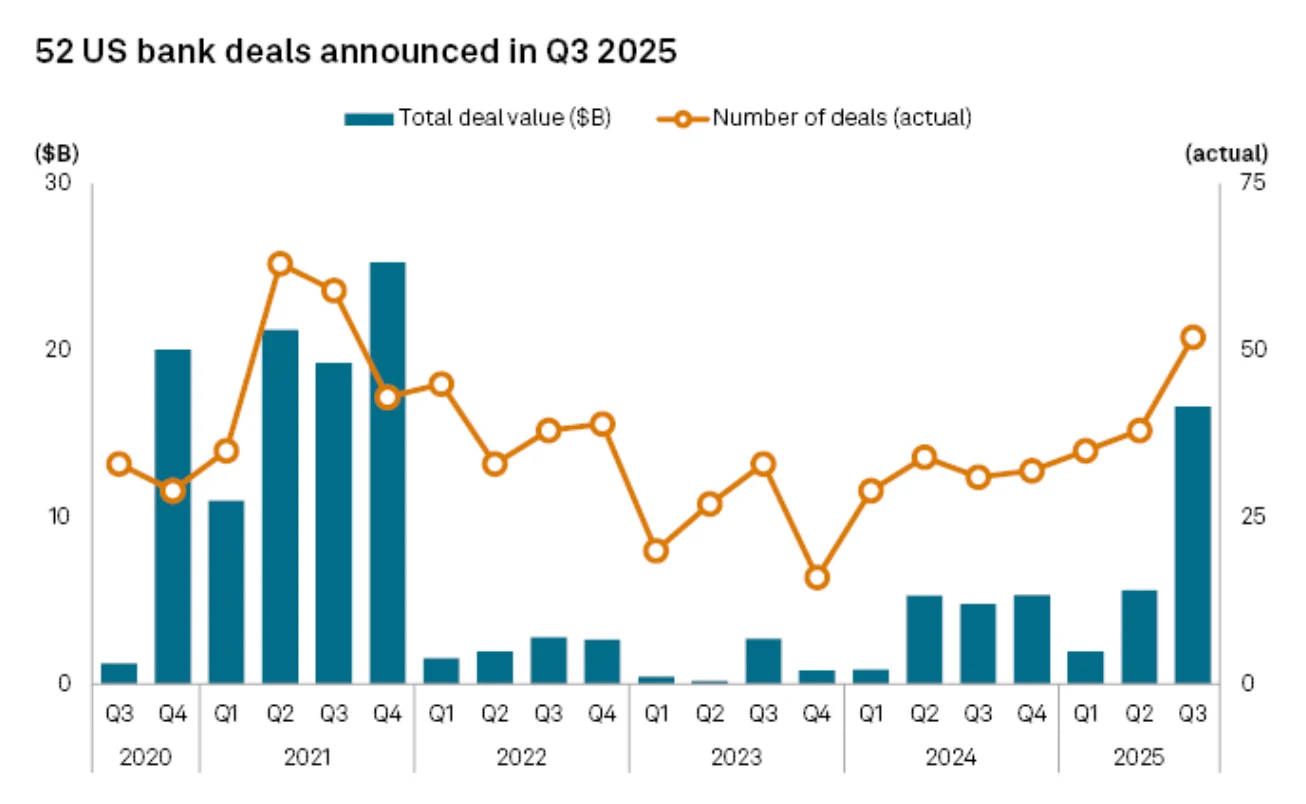

Beyond macroeconomic and policy influences, the sector’s own development trends also warrant attention. The latest data indicate that industry consolidation is accelerating. According to S&P Global Market Intelligence, U.S. banks announced 52 merger and acquisition deals in the past quarter—the highest in nearly four years—signaling a shift from defensive contraction toward a strategic expansion cycle.

Source: S&P Global Market Intelligence

Recently, several high-profile deals have drawn market attention. Last month, PNC Financial announced the acquisition of FirstBank, a regional bank headquartered in Colorado, further expanding its retail footprint in the Midwest. Shortly thereafter, Fifth Third Bank, based in Ohio, announced the acquisition of Comerica Bank in Dallas, marking a new phase in competition among regional banks.

Piper Sandler banking analyst Scott Siefers noted, “The question is no longer whether M&A will continue, but whether other large regional banks will be compelled to take action in response to competitive pressures.” The market broadly expects that the current interest rate easing cycle could act as a catalyst for the next wave of regional bank consolidation.

Against this backdrop of M&A and consolidation, the sustainability of bank earnings remains the core concern for investors. For example, Bank of America has exceeded market expectations in each of the past four quarters, reflecting resilience in both retail and corporate lending. In the latest quarter, the bank reported actual EPS of $0.89, compared with a consensus estimate of $0.86, representing an upside of approximately 3.5%.

However, analysts caution that earnings figures alone are not the sole determinant of stock price movements. Some banks may see their shares pressured even when reporting above expectations due to net interest margin compression, rising regulatory costs, or macroeconomic risks; conversely, certain institutions could outperform thanks to capital allocation optimization or asset sales delivering unexpected upside.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates