Gold Keeps Rising

22:29 October 13, 2025 EDT

Key Points:

So far this year, international gold prices have surged 58%, making gold one of the best-performing major assets globally. The World Gold Council noted that 2025 could mark the strongest annual gain in gold prices since 1979.

At this stage, selling gold has become a high-risk move, for a simple reason: market conviction in gold’s upside remains exceptionally strong. Gold has evolved from merely a “safe haven during uncertainty” into a “belief trade.”

The medium- to long-term outlook for gold remains positive, though short-term volatility risks at elevated levels should not be overlooked.

Gold prices continue their relentless climb, as global markets witness the strongest rally in the yellow metal since 1979. On October 13, spot gold broke above the $4,100 per ounce level, hitting an intraday high of $4,149.87 per ounce, a new all-time record. As of press time, spot gold traded at $4,141.72 per ounce, up 58% year-to-date, cementing its status as one of the world’s top-performing assets.

Source: TradingView

The World Gold Council projects that 2025 could be the biggest year for gold gains since 1979. In its latest report, Bank of America sharply raised its medium-term outlook for precious metals, lifting its 2026 gold price target to $5,000 per ounce.

Safe-Haven Demand Surges

The growing complexity of global geopolitical and policy dynamics has significantly boosted demand for gold as a safe-haven asset.

First, U.S.-China trade tensions have once again flared up. On October 13, China’s General Administration of Customs stated that U.S. measures over port service fees were “unilateral actions,” and described China’s countermeasures as “necessary defensive responses.” The statement underscored the persistent divide between the two nations on trade and economic issues.

At the same time, political gridlock in the United States is worsening. The government shutdown has entered its 13th day, and the Trump administration’s policy direction has raised concerns about the stability of U.S. economic governance—further strengthening gold’s safe-haven appeal.

Uncertainty surrounding U.S. fiscal and monetary policy has also been a major driver. Bank of America noted that under the White House’s “nontraditional policy framework,” the widening fiscal deficit, rising debt levels, and efforts to reduce the current account imbalance all represent long-term tailwinds for gold. This policy uncertainty has fueled a wave of “devaluation trades,” as investors, worried about the credibility of the U.S. dollar, increasingly turn to hard assets such as gold.

On the capital side, global gold ETFs saw net inflows of 473.1 tons in 2025—the first annual net increase since 2021. In September alone, gold ETF holdings rose by 3.6 million ounces, up 17% year-to-date, reaching 97.2 million ounces—the highest level since September 2022.

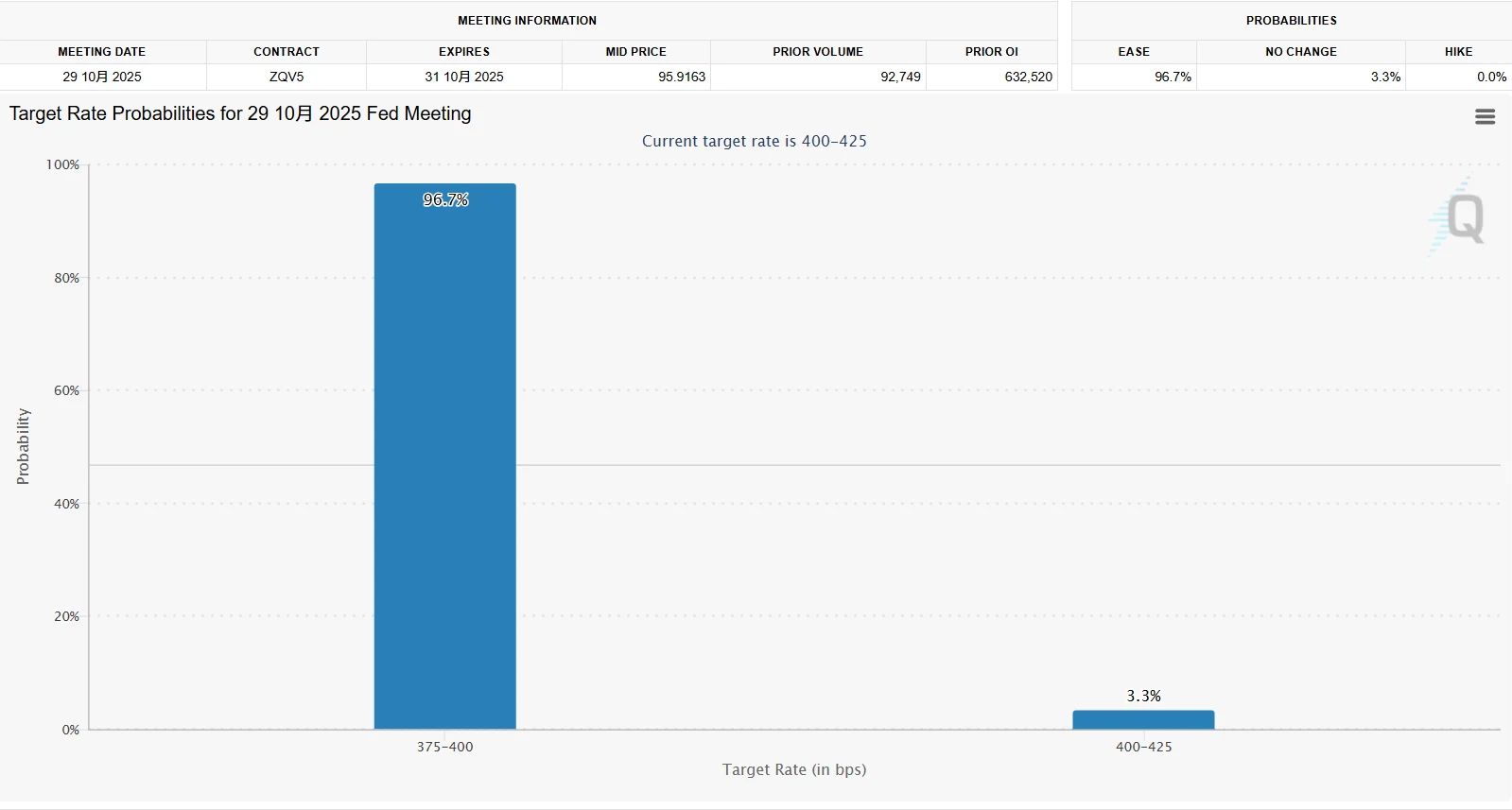

Meanwhile, market expectations for Federal Reserve rate cuts have become overwhelmingly strong. According to CME’s FedWatch tool, there is a 96% probability that the Fed will cut rates by 25 basis points at its October 29 meeting. Markets also anticipate another 25-basis-point cut in December, with the probability of a total 75-basis-point reduction by year-end nearing 100%.

Source: CME Group

Falling interest rates directly reduce the opportunity cost of holding gold—as a non-yielding asset, gold becomes significantly more attractive in a low-rate environment. Rate-cut expectations have also put pressure on both U.S. Treasury yields and the dollar index, further widening the upside potential for gold prices.

Pepperstone analyst Ahmad Assiri commented that selling gold at this stage has become a high-risk move for a simple reason: market conviction in gold’s upside remains exceptionally strong. Gold has evolved from a “safe-haven asset during uncertainty” into a “belief trade,” reflecting growing skepticism toward policy credibility and the unpredictability of fiscal decision-making.

Silver Follows Higher

While gold has been soaring, the silver market has experienced even sharper price swings. Bank of America also holds a bullish view on silver, projecting prices to reach $65 per ounce by 2026.

Although the bank expects global silver demand to decline by 11% in 2026, largely due to reduced usage in the solar photovoltaic sector, it notes that mine supply remains insufficient to meet demand, keeping the market in a fifth consecutive year of deficit.

The silver market is facing an even more severe physical supply shortage. According to Bank of America, “Anticipation of upcoming tariffs led to a large amount of silver being transferred to New York, causing a sharp drawdown in London inventories, a surge in lease rates, and notable disruption in market operations.” Last week, London silver lease rates spiked, signaling tightening physical availability.

This extreme imbalance between supply and demand has driven silver prices to a record high of $52.96 per ounce, while also reigniting investor enthusiasm for gold and other precious metals.

Source: TradingView

Wall Street’s Bullish Consensus Strengthens

While gold has been soaring, the silver market has experienced even sharper price swings. Bank of America also holds a bullish view on silver, projecting prices to reach $65 per ounce by 2026.

Although the bank expects global silver demand to decline by 11% in 2026, largely due to reduced usage in the solar photovoltaic sector, it notes that mine supply remains insufficient to meet demand, keeping the market in a fifth consecutive year of deficit.

The silver market is facing an even more severe physical supply shortage. According to Bank of America, “Anticipation of upcoming tariffs led to a large amount of silver being transferred to New York, causing a sharp drawdown in London inventories, a surge in lease rates, and notable disruption in market operations.” Last week, London silver lease rates spiked, signaling tightening physical availability.

This extreme imbalance between supply and demand has driven silver prices to a record high of $52.96 per ounce, while also reigniting investor enthusiasm for gold and other precious metals.

Source: TradingView

Invest Rationally in the Gold Market

As gold prices continue to climb, the market is displaying characteristics typical of investment-driven demand. Opinions on the appropriate allocation of gold within an investment portfolio vary among institutions.

Ray Dalio, founder of Bridgewater Associates, suggests a reasonable allocation of 15%, noting that the current economic environment—marked by high inflation and elevated government debt—bears similarities to the 1970s. In such a context, holding cash and bonds may not serve as effective stores of wealth, whereas gold acts as a safe-haven asset independent of the credit system. Guosen Securities, on the other hand, recommends a gold allocation of 2–10% for household portfolios from a risk diversification perspective, while institutional asset management products could reasonably increase allocations to above 10%.

The medium- to long-term outlook for gold remains positive, making it difficult to declare a peak. However, high-level volatility risks should not be ignored.

First, technical overbought pressure is evident. The current gold Relative Strength Index (RSI) remains above 80, within the overbought zone. Historical data indicate that such readings often signal an overstretched uptrend, suggesting the potential for a short-term technical pullback. Should daily prices close below $4,100, gold may enter a range-bound phase, with support levels at $4,059, $4,000, and $3,895.

Source: TradingView

Second, policy expectation adjustments pose a risk. If upcoming U.S. economic data show a rebound—such as stronger-than-expected nonfarm payroll growth or faster-than-anticipated inflation easing—the market may scale back its rate-cut expectations, potentially triggering a gold price correction.

Finally, marginal liquidity shifts could weigh on gold. A rebound in the U.S. dollar index, driven by more aggressive easing in other major economies, or a global risk-on shift causing funds to exit safe-haven assets, could put additional pressure on gold prices.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates