Oil Prices Hit Five-Month Low, Likely to Extend Short-Term Decline

05:41 October 13, 2025 EDT

Key Points:

Although oil prices saw a slight rebound in early Monday trading, market confidence remains fragile. The recent plunge in crude prices was driven by a combination of factors — concerns over weaker demand amid renewed U.S.–China trade tensions sparked by the Trump administration’s tariff threats, fears of oversupply due to continued OPEC+ production increases, and the fading of risk premiums as Middle East geopolitical tensions eased.

The recent de-escalation in the Middle East has significantly reduced the geopolitical risk premium tied to potential supply disruptions, prompting a rapid unwinding of safe-haven demand in the oil market.

With the onset of the Northern Hemisphere’s winter demand lull and the continuation of OPEC+’s output expansion, oil prices face further downside pressure in the near term. If Brent crude breaks below the key $60 support level, the next downside target could shift toward $55 per barrel.

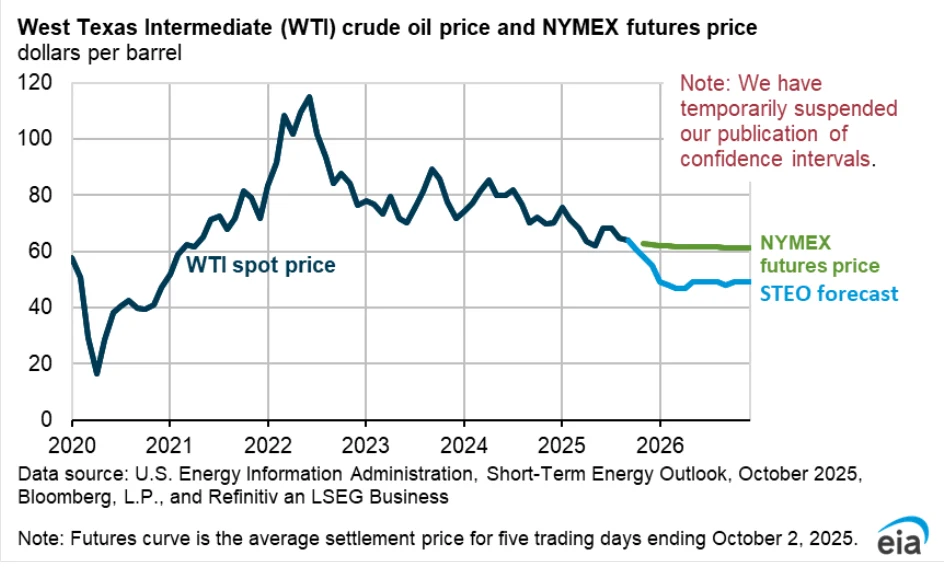

Global oil prices fell sharply over the past week, hitting a five-month low. On Friday, November-dated West Texas Intermediate (WTI) crude futures on the New York Mercantile Exchange (NYMEX) dropped $2.61, or 4.24%, to close at $58.90 per barrel. December Brent crude futures on the Intercontinental Exchange (ICE) fell $2.49, or 3.82%, to $62.73 per barrel — both marking their lowest levels since early May.

Following the selloff, crude prices saw a modest recovery during Asian trading on October 13: WTI hovered near $60 per barrel, while Brent climbed above $63. However, sentiment remained fragile.

Source: TradingView

Technical indicators reveal that support remains weak: WTI has yet to decisively break above the $60 resistance level, while the RSI has only rebounded to around 45 — still within bearish territory. Key support lies in the $58.50–$59.30 range.

Source: TradingView

Haris Khurshid, Chief Investment Officer at Chicago-based Karobaar Capital LP, echoed this view, noting that the rebound reflects a short-term correction from excessive pessimism rather than a sign of a sustained trend reversal.

Rising Trade Tensions Deepen Demand Concerns

On October 10 local time, U.S. President Donald Trump announced via social media that, starting November 1, an additional 100% tariff would be imposed on all Chinese imports to the United States. The move sparked concerns over a potential escalation in global trade tensions.

John Kilduff, founding partner at Again Capital LLC, commented: “If Trump implements the latest tariff threat, it would have negative economic consequences and weigh on crude oil and refined product demand.”

The tariff threat has stoked fears that a trade war could severely impact global economic growth and energy demand. S&P Global had previously warned in its “Cambridge Energy Week” report that the energy sector is at a “crossroads of uncertainty,” and a tariff escalation would push that uncertainty to its extreme.

Analysts note that Trump’s threat casts a shadow over oil demand expectations, prompting investors to shift toward safe-haven assets.

Trade tensions have directly weighed on demand projections. As a classic event-driven shock, the escalation in trade friction triggered a sharp market reaction, reflecting sudden shifts in sentiment and a reassessment of trading expectations.

Over the past few months, the oil market appeared to have developed a certain “immunity” to global trade frictions. However, this latest escalation has exceeded the market’s psychological tolerance in both magnitude and timing: a 100% tariff hike is more than double the previous maximum level and coincides with the critical window since April when OPEC+ began rolling back production cuts and global crude supply has been steadily increasing. The International Energy Agency has already warned that large surpluses could emerge later in 2025, and demand contraction triggered by tariffs may bring forward and intensify this oversupply.

Supply Glut

Amid the sharp drop in oil prices, OPEC+’s production increase plan continues to advance steadily. On October 5, OPEC+—comprising the Organization of the Petroleum Exporting Countries (OPEC) and non-OPEC producers including Russia—officially announced an additional 137,000 barrels per day of crude output for November, in line with October’s increase.

This decision represents a continuation of the “production ramp-up” plan launched in March. Reviewing OPEC+’s capacity release trajectory this year, the pace has followed a clear “initiation—acceleration—stabilization” pattern.

April, as the first month of the strategic shift, saw OPEC+ cancel 1.2 million barrels per day of previous production cuts. From May through July, supported by the Northern Hemisphere’s summer energy demand, monthly production increases accelerated to 411,000 barrels per day. In August and September, buoyed by a short-term rebound in global energy demand, the monthly increase further climbed to 547,000 barrels per day.

Data shows that OPEC+’s share of global oil supply has fallen from 50% in 2022 to 45% in 2025, while U.S. shale oil production has grown rapidly during the same period, squeezing OPEC+ members’ market share. In the current environment of declining oil prices, OPEC+’s continued output growth helps maintain its market presence and, by stabilizing the supply rhythm, reduces the risk of competitors disrupting oil prices.

Risk Premium Fades

Beyond supply and demand fundamentals, the notable easing of geopolitical tensions in the Middle East has become a key factor in the decline of oil’s risk premium. As the world’s core oil supply region, the Middle East accounts for roughly 35% of global crude production, and historical volatility in the region has often driven oil prices higher. For example, during the 2023 escalation of the Israel-Palestine conflict, Brent crude jumped 5.8% in a single day due to “supply disruption concerns,” with the geopolitical risk premium once reaching $8–10 per barrel. Recently, as the conflict shifted toward a ceasefire, this portion of the premium quickly dissipated, accelerating the downward pressure on oil prices.

On October 9 local time, mediators announced that a Gaza ceasefire negotiation had reached an agreement covering all terms and implementation mechanisms for the first phase of the truce. Israel’s Prime Minister’s office stated that the ceasefire would take effect once formally approved in a cabinet meeting that evening.

On October 10, the Israeli Defense Forces (IDF) confirmed that the first-phase Gaza ceasefire agreement officially went into effect at 12:00 p.m., and troops began deploying along the revised lines to implement the truce and prepare for the return of detained personnel. Senior Hamas officials stated that aid and other essential goods would begin entering Gaza freely on October 11. Under the agreement, the Rafah crossing was to open within 72 hours of the ceasefire taking effect. On October 12, Egyptian officials confirmed the Rafah crossing was officially open, with the first batch of aid delivered into Gaza.

Although differences remain between Israel and Palestine on core issues such as Jerusalem’s status and national borders, and long-term enforcement of the ceasefire remains uncertain, the short-term truce has significantly eased tensions in the Middle East. This both reduces the risk of the conflict spreading to Lebanon and Syria and lowers security risks along key oil transport routes such as the Strait of Hormuz, while also creating conditions for Saudi Arabia, the UAE, and other regional players to resume energy cooperation—further diminishing risk-driven pressure on oil markets.

Oil Prices Likely to Remain Under Pressure in the Near Term

Facing the current oil market backdrop, multiple authoritative institutions have issued relatively bearish forecasts, indicating that the global crude market remains under pressure in the near term.

The International Energy Agency (IEA) in its latest report lowered the global oil demand growth forecast for 2026 from 1.4% to 1.1%, while revising up the 2025 global supply growth projection to 2.5 million barrels per day. This signals that the market’s short-term supply-demand balance remains tilted toward oversupply. The IEA expects global crude inventories in Q1 2026 to rise by 15 million barrels sequentially, with WTI averaging $55–60 per barrel for the year.

Source: IEA

Goldman Sachs’ latest research aligns with the IEA’s outlook, lowering its 2026 Brent crude target from $75 to $62 per barrel. Goldman emphasizes that the oil market is currently facing “supply-side pressure”—driven by gradual OPEC+ production increases, a rebound in U.S. shale output, and new capacity coming online in Brazil and Canada. If daily supply surplus reaches 1.2 million barrels in 2026, oil prices could even test an extreme low near $50 per barrel.

UBS analysts offered a more detailed trajectory, projecting a “dip then rebound” pattern for international oil prices over the next 1–2 years. They expect supply surpluses of roughly 1.2 million barrels per day in 2025 and 1.5 million barrels per day in 2026, largely driven by OPEC+ production. The supply-demand imbalance is projected to peak in the first half of 2026, with oversupply potentially reaching 2.3 million barrels per day. As the market gradually absorbs the excess capacity, surplus is expected to decline to around 1 million barrels per day in the second half of 2026, providing potential support for a price rebound.

Is the Era of Peak Oil Demand Arriving?

Beyond short-term volatility, the global oil market is undergoing a structural transformation. According to the report Global Oil Market 2025: Outlook and Forecast through 2030, the pace of global oil demand growth is expected to continue slowing, with demand peaking around 2030 and stabilizing thereafter.

On the demand side, oil consumption in the transportation and power generation sectors could peak as early as 2027. This shift is primarily driven by three factors: the accelerated adoption of electric vehicles, energy transitions in the power sector, and rapid growth in petrochemical feedstock demand.

Meanwhile, oil demand is showing clear regional divergence. Emerging economies are expected to drive the bulk of demand growth, while demand in developed economies continues to decline. In China, rapid EV adoption has led to a downward revision of oil demand growth expectations, whereas in the U.S., lower gasoline prices and a slower EV rollout have slightly lifted demand forecasts.

On the supply side, structural changes are also evident. Natural gas liquids (NGLs) are set to become the main source of incremental supply, projected to contribute nearly 50% of global oil capacity growth by 2030.

Taken together, these developments signal a deep, qualitative transformation in the global oil market, shifting from growth in volume to structural rebalancing and composition changes.

Conclusion

As the Northern Hemisphere enters the seasonal winter demand lull, combined with the continued OPEC+ production increases, oil prices face further downside risk in the near term. Several analysts have pointed out that if Brent crude breaks the key $60 support level, the next target could be around $55 per barrel.

However, falling oil prices are not entirely negative. For central banks and consumers grappling with inflationary pressures, lower energy costs ease inflation and boost purchasing power. This effect is particularly evident in the U.S. market—declining oil prices directly increase households’ real income while creating room for a more accommodative monetary policy, which could collectively help support a soft landing for the economy.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates