Will October Repeat April's Market Performance?

01:57 October 13, 2025 EDT

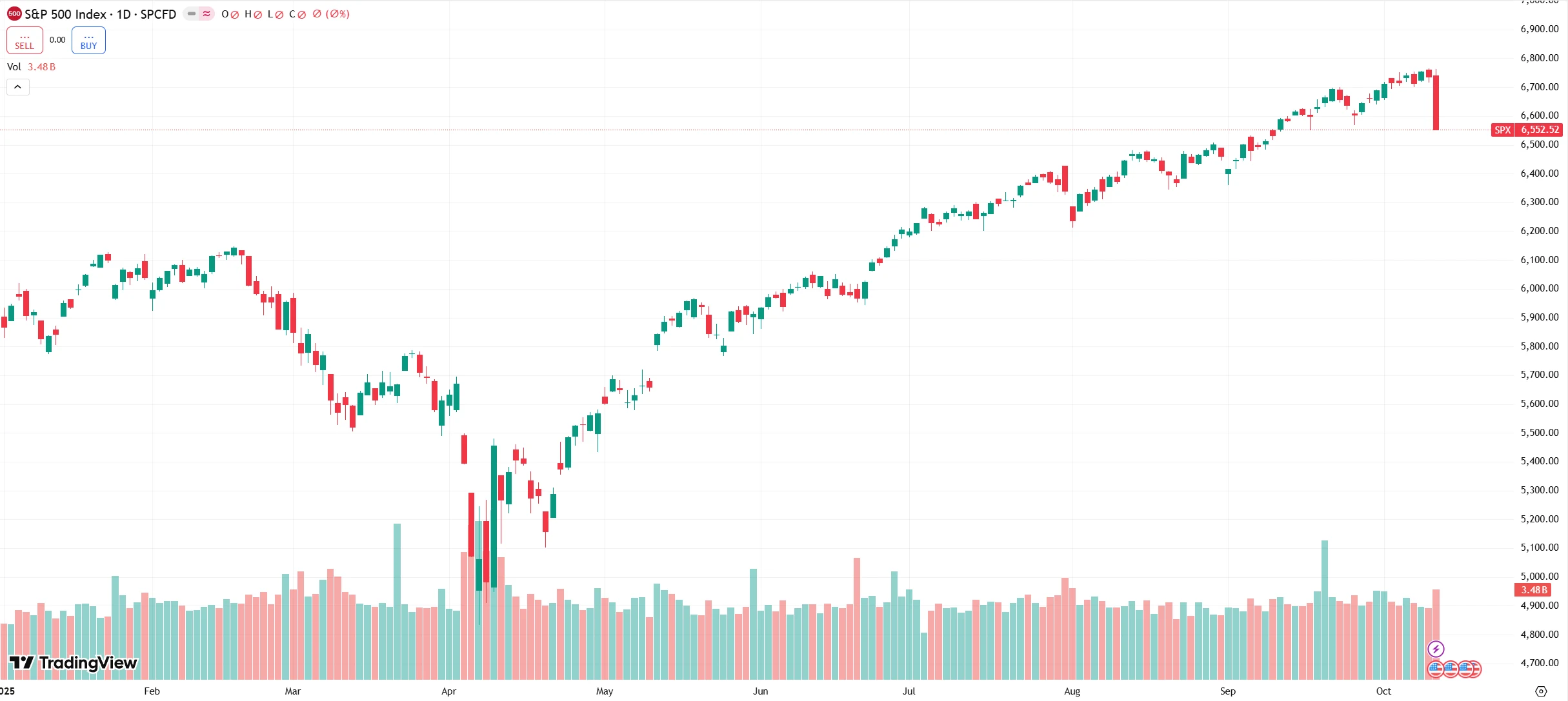

On October 10, U.S. equity markets experienced broad-based declines, with the Dow Jones Industrial Average falling 1.9%, the Nasdaq Composite dropping 3.56%, and the S&P 500 Index declining 2.71%, marking the largest single-day drop since April. Market sentiment deteriorated sharply, and investor risk appetite retreated noticeably.

Source: TradingView

Notably, just the previous day, the Nasdaq had risen 1.12% driven by gains in the artificial intelligence sector, surpassing the 23,000-point level for the first time. The dramatic reversal within just 24 hours highlights the market’s heightened sensitivity to policy uncertainty and recalls the sharp sell-off observed in early April of this year.

U.S. Stocks Rout in "Black Friday” Sell-Off

On October 10, 2025, U.S. equity markets experienced a new round of sharp volatility, primarily triggered by tariff-related announcements from former President Donald Trump on social media. On that day, he declared that, in response to recent measures by China, the United States would impose an additional 100% tariff on all Chinese imports starting November 1, 2025, on top of existing tariffs, and simultaneously implement comprehensive export controls on key software. This decision effectively overturned the tariff consensus reached during the third round of U.S.-China Madrid trade negotiations, pushing markets back into a state of policy uncertainty.

On October 9, China’s Ministry of Commerce announced a “global jurisdiction” export control on the rare earth industry chain: any overseas products produced using Chinese technology, equipment, or raw materials, where the value of key rare earth elements such as samarium or dysprosium exceeds 0.1%, would require Chinese approval for export. Applications for products intended for sub-14nm chip manufacturing or military AI development would be subject to stricter controls. China controls roughly 90% of global rare earth supply and 95% of refining capabilities, meaning this policy directly affects U.S. high-tech and defense industries. On the same day, China also announced a tiered special port fee on U.S.-owned or -operated vessels, further increasing uncertainty in bilateral trade relations.

In response to these policy developments, U.S. equities fell sharply. The three major indices declined collectively, erasing approximately $1.65 trillion in market capitalization in a single day. Investor panic increased significantly, reflected in the VIX index, which surged more than 31%, signaling a rapid rise in demand for hedging and risk-off positioning.

Source: TradingView

Technology stocks were the primary drag on the market, with the semiconductor sector hit hardest. The Philadelphia Semiconductor Index fell 6.32% in a single session, with leading companies broadly declining. Nvidia dropped nearly 5%, wiping out approximately $228.7 billion in market value, as investors worried that software export controls and tariffs could disrupt its supply chain and business expansion. AMD fell nearly 8%, erasing gains from the prior day’s AI-related surge. Broadcom declined nearly 6%, while TSMC ADR and Tesla each fell over 5%; Apple and Meta also dropped more than 3%.

Source: TradingView

It is noteworthy that, prior to this sell-off, market sentiment remained elevated. On October 9, the Nasdaq rose 1.12% on gains in the AI sector, surpassing 23,000 points for the first time, setting a new historical high. Nvidia and AMD increased 1.83% and 11.4%, respectively, reflecting strong investor confidence in tech stocks. The sharp reversal within just 24 hours, from broad optimism to widespread declines, underscores the market’s sensitivity to policy shifts and highlights the fragility underlying the prior sentiment-driven rally.

The impact quickly spread to global markets. In the Asia-Pacific region, FTSE A50 futures closed down 4.26% in overnight trading, the Nasdaq China Golden Dragon Index fell 6.1%, and popular Chinese ADRs such as Pinduoduo and JD.com broadly declined, reflecting concerns over escalating U.S.-China trade tensions. Commodities exhibited clear risk-off behavior: WTI crude fell over 4%, Bitcoin dropped more than 13% intraday, while spot gold rose over 1% to surpass $4,000 per ounce. The U.S. 10-year Treasury yield declined to as low as 4.03%, indicating rapid inflows into safer assets. Major European equity indices also closed lower, showing broad pressure on global risk assets.

Source: TradingView

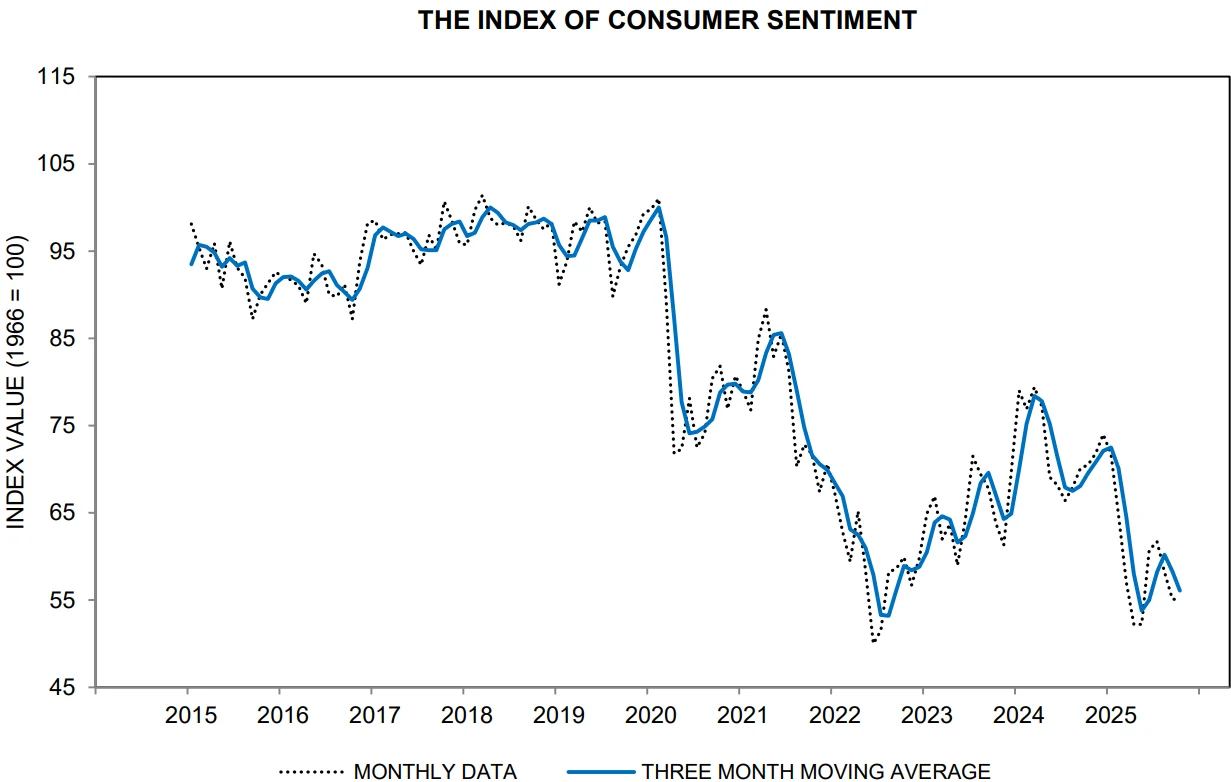

Domestic political and economic factors in the U.S. further amplified market volatility. On that day, the federal government shutdown entered its 10th day, and the White House announced the implementation of permanent federal employee layoffs affecting thousands across nine departments, including the Interior and Treasury Departments, reflecting ongoing partisan fiscal disputes. At the same time, macroeconomic data signaled weakening confidence. The preliminary University of Michigan Consumer Sentiment Index for October fell to 55, the lowest level since May, indicating increased concerns among households about employment and inflation prospects.

Source: University of Michigan

Analysts noted that the U.S. remains heavily dependent on China for rare earths in the short term. Enforcing additional tariffs could push up domestic inflation and compress corporate profit margins. Furthermore, similar tariff measures in April were previously blocked by a federal court on the grounds of executive overreach, indicating ongoing legal uncertainty regarding policy implementation.

Comparative Market Analysis

On the surface, the market decline in October appears similar to the early-April sell-off, but a closer analysis reveals clear structural differences between the two events.

First, the level of panic differs significantly. On April 3, the S&P 500 fell 5.4% in a single day and dropped another 6.0% on April 4. In contrast, the recent decline saw the S&P 500 fall only 2.7%, less than half of the early-April single-day drop, indicating a comparatively smaller price adjustment.

Second, volatility indicators further highlight the divergence in market sentiment. On October 10, the VIX index rose 31.8% to 21.66. Although elevated, this remains far below April levels—on April 7, the VIX surged to 60.13, marking a post-2020-pandemic high. This suggests that the October episode did not trigger panic comparable to early April.

Source: TradingView

Third, trading volume comparisons reinforce this assessment. On October 10, overall U.S. equity volume increased roughly 27% from the previous day, whereas April 3 saw a 51.5% jump, indicating that the selling pressure and market participation were significantly lower in October than during the peak April sell-off.

Source: TradingView

The event’s timeline also differs. Last night’s decline was concentrated within approximately half an hour following Trump’s first Truth Social post, after which selling pressure was gradually absorbed, suggesting that market reactions to this policy shock were more immediate and short-lived rather than prolonged.

Finally, the foreign exchange market reacted relatively mildly, further underscoring the limited scope of the October volatility. Despite Trump’s second post at 16:50 reiterating the additional 100% tariffs, the USD/CNH exchange rate did not materially break prior highs, trading at 7.13658—well below April 8’s 7.4295. The relative stability in FX, combined with trading volume and VIX behavior, indicates that although policy shocks heightened market volatility, overall market sentiment has not fallen into panic levels comparable to early April.

Source: TradingView

Underpinning Drivers

Compared with April, the underlying conditions of the U.S. equity market in October have materially changed, primarily in terms of valuation levels and fundamental expectations.

On the valuation side, the S&P 500 currently trades at a forward price-to-earnings (PE) ratio of 22.2x, corresponding to the 94th percentile of its historical range, higher than 20.3x at the beginning of April. The Nasdaq-100 forward PE stands at 26.6x, also above the 23.5x level in early April. From a global allocation perspective, U.S. equities remain relatively attractive across metrics such as PE/EPS growth and PB/ROE, providing some support for long-term investment positioning.

On the fundamentals side, earnings revisions have stabilized and even rebounded since late June. Currently, the 2025 earnings growth expectations for the S&P 500, Nasdaq-100, and the MAG7 (Apple, Microsoft, Amazon, Google, Tesla, Nvidia, Meta) stand at 9.9%, 20.5%, and 20.6%, respectively. This indicates overall solid corporate profit expectations, with the technology sector showing clear growth potential driven by AI-related capital expenditures (CAPEX).

According to CITIC Securities research, the recent U.S. market pullback is unlikely to repeat the sustained declines and bear market conditions observed from late February to April 8. At that time, the market was pricing in a potential U.S. economic recession, and the Federal Reserve had not yet initiated rate cuts. Currently, the economy demonstrates greater resilience, the Fed has implemented precautionary rate cuts, and strong AI investment trends provide ongoing support for both the technology sector and the broader U.S. equity market.

Could Face Volatility

Looking ahead to the fourth quarter, multiple institutions expect U.S. equities to trade in a relatively range-bound manner, with investors needing to monitor the combined effects of several key factors.

U.S.-China trade relations remain a central market variable. Following market close, former President Trump announced that, starting November 1, the U.S. would impose a 100% additional tariff on all Chinese imports. CITIC Securities noted that Trump later clarified in a White House interview that the APEC meeting with Chinese leaders would not be canceled. Therefore, if U.S.-China tensions do not materially escalate, the U.S. market could still see a temporary rebound.

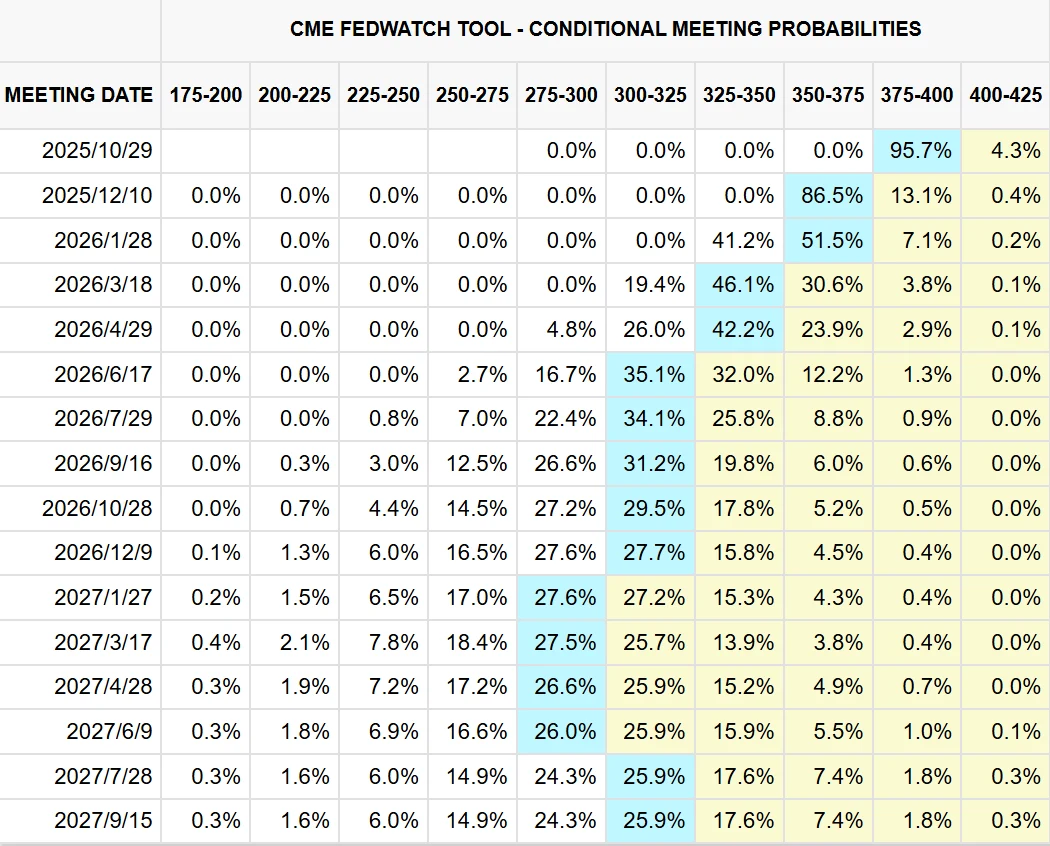

The ongoing U.S. government shutdown further amplifies market uncertainty. Yang Delong, Chief Economist at Qianhai Open Source Fund, highlighted that with no signs of resolution, concerns over a potential economic downturn may persist. To mitigate the potential negative impact of the shutdown on growth and employment, the Federal Reserve is likely to continue cutting rates this month, with an expected 25-basis-point reduction in both October and December.

Source:CME Group

Other policy developments also warrant attention. The gradual implementation of the “One Big Beautiful Bill Act” is projected to reduce Medicaid and Children’s Health Insurance Program (CHIP) expenditures by approximately $1.02 trillion over the next decade, potentially creating notable pressure on the U.S. healthcare sector. Additionally, the removal of the $7,500 electric vehicle (EV) tax credit starting October may further constrain earnings growth for EV manufacturers.

Overall, compared with April, the U.S. equity market in October starts from a different position: valuations are higher, unrealized gains are larger, but market experience is more extensive and the policy environment relatively accommodative.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates