Can artificial intelligence continue to advance the bull market?

05:12 October 12, 2025 EDT

During the dot-com bubble of the 1990s, the stock market experienced "irrational exuberance." Now, driven by the surge in artificial intelligence (AI), the S&P 500 index reached a new all-time high yesterday. At the current rate of appreciation, could an AI asset bubble similar to the 2000 dot-com bubble be brewing? Could this happen?

There are some discouraging aspects of the economy today, such as rising loan delinquencies, a stagnant labor market, stubbornly high inflation, and a persistently weak manufacturing sector. However, these developments are not uncommon for a mid-cycle slowdown. From an investment perspective, it's crucial to consider all the data in context, which still suggests that the current economic situation presents more encouraging than discouraging aspects, and therefore, investors should remain optimistic about the year ahead.

We have economic growth well above trend, double-digit corporate earnings growth, fiscal stimulus measures like tax cuts and deregulation on the horizon, and the Federal Reserve easing monetary policy. Whether or not you support the current administration's policies, these constitute a powerful tailwind that should sustain a bull market for the coming year. That said, signs of a bubble are emerging. For a bubble to form, high-frequency economic statistics must still show a negative rate of change, to the point where all data points to a downturn. Isn't that the case with today's numbers? A key reason is the projected increase in AI capital spending, exceeding $400 billion by 2026.

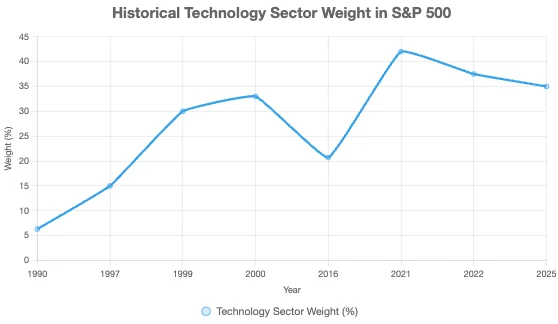

Bears focus on the fact that the tech sector now accounts for 35% of the S&P 500, compared to 33% at the peak of the dot-com bubble, though similarities have diminished since then. Concentration risk is real, but valuations are vastly different. While some stocks may trade at similar price-to-earnings ratios, profit margins are nearly double today, supporting higher multiples.

Another area of concern is the ongoing investment cycle among today's largest and most important AI players. In the late 1990s, this circular investment took the form of vendor financing, where one company loaned money to another to purchase its hardware and then provided services to the borrower. The difference today is that most of these investments are being made with cash rather than debt. The tech giants are generating astonishing levels of free cash flow, which is precisely what will fuel their capital expenditures exceeding $400 billion next year. If there is any concern about speculative frenzy, it is directed at the middlemen and smaller companies that provide services to the giants, but these companies will not pose any substantial drag on the broader market.

The bottom line is that the AI investment cycle is far better capitalized than the dot-com investment cycle of the late 1990s. It's also generating profits at a much faster pace, though there are legitimate questions about how much profit will be generated in the coming years to justify these investments. I'm not worried about that in 2026, but I'm definitely concerned about 2027 and beyond.

Besides impressive profit margins (which AI is expected to boost, supporting higher price-to-earnings multiples), this market has another advantage that makes it more affordable than it was during the dot-com era: free cash flow. A company's free cash flow (FCF) is calculated by subtracting capital expenditures from its total cash flow. We can calculate a company's free cash flow yield by dividing its free cash flow generation by its market capitalization. Today, the median S&P 500 stock's free cash flow yield is almost three times what it was in 2000. Note that I said "median," not "average"; this is an important distinction.

This highlights that when we look beyond the tech sector, there are still significant value propositions in today's market. As the economic expansion progresses, we should see a continued extension of the bull market and a shift in industry leadership. Increasing exposure to sectors outside of tech and the AI investment theme is a prudent way to mitigate risk while capitalizing on the benefits that today's AI investments should bring to the broader economy.

S&P 500 growth

The S&P 500 has significantly outperformed the dividend stock sector since the AI craze took off in early 2023. This can be seen by comparing the performance of SPY with the Charles Schwab U.S. Dividend Stock ETF over the same period.

The reason is simple – leading AI stocks like Meta Platforms, NVIDIA, and Palantir Technologies have seen significant gains.

There are two main reasons for the excellent performance: first, the artificial intelligence boom has stimulated great optimism in the market about the future profitability of artificial intelligence, prompting investors to give high evaluations to leading artificial intelligence companies; second, the sharp rise in interest rates, continued high inflation, increased economic uncertainty and the tariff policy proposed by President Trump have made the market cautious about dividend stocks.

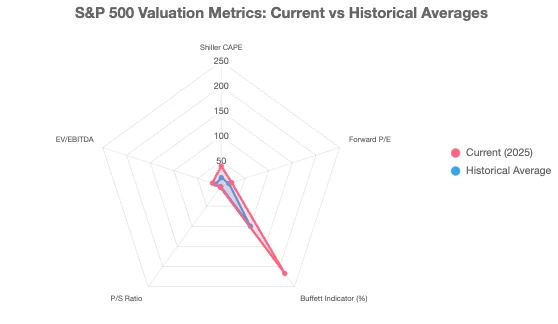

However, many macro indicators suggest that the S&P 500 is currently overvalued. By almost any major market valuation metric, the S&P 500 currently looks overvalued, whether it's the Shiller CAPE exceeding 40 (one of the highest readings in decades), the S&P 500 forward P/E ratio of approximately 23 (well above long-term norms), or even other metrics such as the Buffett Indicator, the price-to-sales model, or the EBITDA version. All of these indicators suggest the market is currently significantly overvalued. Furthermore, these market valuations occur despite the fact that long-term US interest rates (IEF) remain elevated relative to recent history. Typically, rising long-term interest rates push up discount rates, thereby depressing stock valuations.

Furthermore, as I recently detailed, there's growing evidence that AI stocks are facing a potential bubble. Leading investors warn that AI stocks are investing hundreds of billions of dollars in AI infrastructure, even though the actual returns on investment are far from certain. Furthermore, early indicators suggest that companies have had mixed experiences with initial returns on AI projects, and even supporting the computing power required by leading large-cap tech stocks to achieve their AI missions will be difficult due to power constraints, technological barriers, and the need to continue raising and deploying massive amounts of capital.

At the same time, it's far from certain that the Fed's rate cuts will lower long-term interest rates, as inflation remains stubbornly high and the US government deficit remains elevated despite Trump's tariffs. This has put significant pressure on the bond market (AGG), as the US government's continued massive bond issuance has created an imbalance in the bond market, pushing up long-term interest rates. This dynamic has been exacerbated by central banks' shift away from the US dollar and toward alternative assets like gold (GLD).

Will the bull market continue?

One of the strongest supportive factors for the bull market is the expectation that the Federal Reserve will continue to cut interest rates in the coming months. Recent Fed statements and market movements suggest that the Fed believes there is enough slack or risk in the economy to warrant considering further easing.

Lower interest rates reduce the discount rate for future earnings, helping to justify currently stretched valuations. They also allow companies with leverage or capital expenditure needs to borrow more cheaply. Lower interest rates help stimulate consumption and real estate market activity. If the Federal Reserve can achieve a smooth transition without triggering a burst of inflation or financial instability, this could open a favorable window for the stock market.

Second, even if investors believe a market rebound can be driven by earnings, the market won't rebound. So far, large-cap technology stocks and AI application companies have seen strong revenue growth, profit margin expansion, and forward guidance that suggests continued investment demand. Oracle's recent surge, fueled by AI contracts, is a case in point.

For investors, third-quarter earnings expectations have been lowered, but as the "millennial earnings season" begins in October, we are expected to see quite high earnings expectations and optimistic forward guidance. These reports should help support the market and ease current valuation concerns, especially in the artificial intelligence and technology sectors.

However, earnings optimism is currently extremely high through 2026, and we expect these expectations to decline over the next few quarters. The deviation from the long-term earnings growth trend is currently the largest on record.

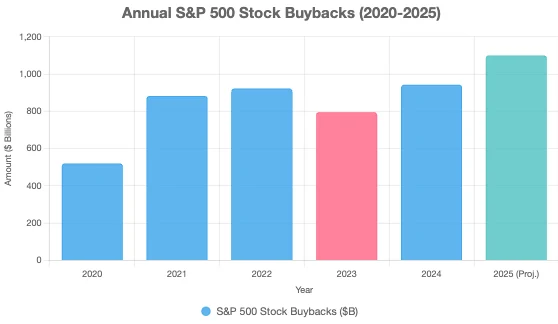

Third, corporate stock buybacks, which have accounted for nearly 100% of all net stock purchases since the beginning of the century, resumed in late October as earnings season drew to a close.

In other words, without buybacks, the stock market would be trading about 40% lower than it is today. With buybacks projected to exceed $1 trillion by 2025 and currently growing at a record pace, the bullish case remains strong.

Finally, retail investors are pouring into the market. Inflows into technology and growth sectors remain substantial, with funds chasing the strongest performing sectors. ETF and mutual fund flows show capital chasing technology, artificial intelligence, and innovative sectors, while Morgan Stanley data indicates that retail participation will reach a record high in 2025, a stark contrast to the average monthly growth rate over the past five years.

While the bull market outlook is strongly supported, several threats could derail it. If these factors materialize, losses could be swift and severe. Therefore, even if you're extremely bullish on the stock market, it's worth considering.

First, as mentioned above, valuations are stretched. The S&P 500 trades at 22.5 times forward earnings and 25 times trailing earnings. UBS notes that this valuation places it in the top 5% since 1985.

High valuations imply high expectations, reflecting investor sentiment. However, if earnings disappoint, forward valuations (expectations) must be recalculated, and currently, the margin for error is minimal. Notably, given that earnings are derived from real economic activity, the current gap between the annual change in earnings and GDP is significant.

The long historical correlation between the two suggests investors may be facing higher risks than they realize.

Furthermore, cracks have appeared in the earnings of mid- and small-cap companies, as these companies are more sensitive to tightening financial conditions, supply chain disruptions, and weak demand. The situation where only a few large technology companies lead the market remains a risk and could leave them vulnerable to sector rotation and valuation contraction.

Finally, external macroeconomic risks remain, including trade policy, geopolitical turmoil, fiscal policy uncertainty, global supply chain disruptions, and potential shocks from China or other major economies. These risks are difficult to predict but crucial, often triggering market adjustments or risk-averse swings.

As investors piled into the stock market, fund flow data showed a surge in new money into technology and growth funds, leading to a broadening of sentiment and momentum indicators. Put/call indicators and volatility indicators suggest investor complacency, while systematic flows (ETFs, quantitative funds, passive funds) can exacerbate drawdowns when they reverse. Commentary from Scott Rubner at Citadel suggests hedging strategies are becoming more cautious.

Investors need to choose the right asset allocation

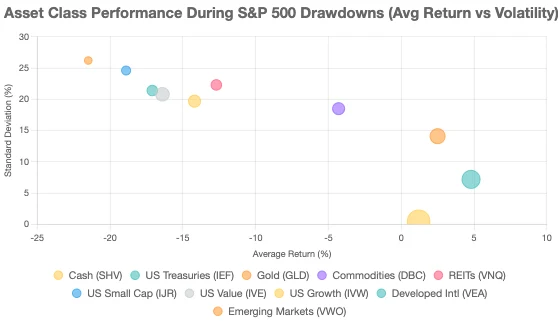

Given the current surging stock market and slow economic growth, diversification across asset classes can minimize the impact of a potential plunge in the US stock market.

However, this also depends on the specific period of the market decline. The diversification alpha of different asset classes also varies considerably. In some cases, losses in a particular asset class are even greater than the decline in the US stock market. However, in other cases, gains are quite substantial.

To get a preliminary understanding of how asset allocations perform during U.S. stock market declines, TMC Research reviewed the performance of the five largest drawdowns in the S&P 500 since 2007. We used a panel of ETFs as a proxy for the asset class. Why was 2007 chosen as the inception date? This is the earliest common inception date for these funds, allowing us to demonstrate actual performance based on publicly traded portfolios.

during each of the five S&P 500 declines. While history can be a guide, these results should be viewed with caution, as each pullback is unique and likely influenced by a unique set of risk factors. In short, the future remains uncertain.

Therefore, diversification across asset classes remains persuasive as a first line of defense in risk management, for the simple reason that it will never be obvious which market (or markets) will provide the stabilizing factor during the next major decline in US equities.

Also keep in mind that the benefits of asset allocation sometimes extend beyond managing drawdowns; if a portfolio is less diversified, drawdowns can be greater. It's also possible to achieve higher returns through a globally diversified strategy, at least during certain periods. For example, foreign stocks and gold have significantly outperformed the U.S. stock market so far this year.

Ultimately, no one knows when a particular asset class will outperform or underperform the US stock market, nor how long this divergence in returns will persist. This provides a strategic foundation for maintaining a globally diversified portfolio, helping to mitigate the challenges of future uncertainty and, at times, potentially even improving the odds of outperforming more concentrated strategies.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates