Why is Qualcomm worth investors' attention again?

02:15 October 12, 2025 EDT

The artificial intelligence industry is transforming. Chipmaker Nvidia is undoubtedly the biggest beneficiary of the AI era. Its processors are at the heart of most of the world's AI computing platforms, and AI-related products currently account for the vast majority of Nvidia's sales. As a result, the company's stock price has risen by over 1,200% over the past five years, in line with its revenue growth.

However, the next five years may not be like the past five. The AI industry is maturing, and so are Nvidia's competitors. In fact, even AI data center operators are now looking for solutions tailored to their unique needs. Besides Nvidia, other companies will also benefit from this ongoing transformation.

In this context, it is not just Nvidia. In fact, as an important link in Nvidia's downstream supply chain, Qualcomm and Nvidia's business and capital market development are also positively correlated.

Speaking of Qualcomm, to date, almost all generative AI work, including platforms like OpenAI’s ChatGPT or Google’s Gemini, has been processed remotely in the cloud—most computers and mobile devices can’t handle such energy-intensive, computationally intensive workloads. The exceptions are Apple’s latest iPhones and some of Microsoft’s Surface laptops, which are purpose-built with powerful but expensive processors built in.

However, like most things in tech, time will drive down the cost of AI-enabled mobile processors. It won't be Apple that provides these processors to non-iPhone users, though. Qualcomm supplies chips to consumer tech companies seeking to bring AI capabilities to consumers affordably.

In fact, this is already happening. Qualcomm's Snapdragon® 8 Gen 3 chipset, unveiled in October 2023, is "the first mobile platform designed with generative AI in mind." A year later, even before software leveraging these generative AI capabilities is ready for everyday use, several smartphone manufacturers are already adopting this powerful processor. Notably, Microsoft has chosen to use Qualcomm's latest Snapdragon processors in several of its AI-enabled business laptops.

While this isn't a mainstream market yet, it's gradually becoming one. Qualcomm already has a mature product and a leading position in this field. In the growing mobile/onboard AI processor market, Qualcomm's high-performance mobile processors are expected to occupy a significant position in the large mid-range market.

Break free from the constraints of smartphones and diversify your business

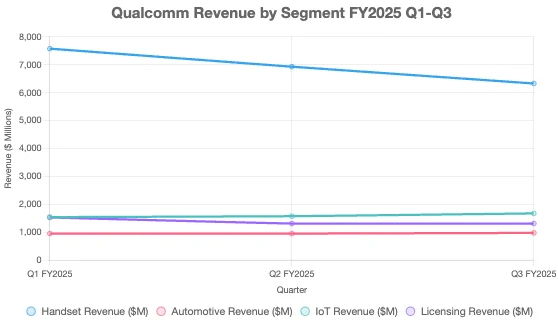

Qualcomm's revenue and profit for the third quarter of fiscal 2025 exceeded analysts' expectations, thanks in part to strong growth outside its core smartphone-related businesses. The company's chips power a significant portion of the world's smartphones, but other revenue streams are growing much faster.

Smartphone-related revenue grew 7% year-over-year to $6.3 billion. Meanwhile, automotive-related revenue soared 21% to $984 million, and IoT-related revenue jumped 24% to $1.7 billion. The company's next-generation augmented reality platform was recently unveiled, powering Meta Platforms' (META 2.16%) AI smart glasses, enabling a billion-parameter AI model to run locally.

Qualcomm is also entering the PC industry, predicting that by the end of 2026, all major PC OEMs will have more than 100 models equipped with the company's Snapdragon X platform.

Technology licensing revenue was $1.32 billion, up 4% year-over-year. Growth across Qualcomm's business units drove its third-quarter adjusted earnings per share up 19% year-over-year.

Despite Qualcomm's strong third-quarter earnings report, which included better-than-expected revenue growth, its stock fell about 5% in after-hours trading on Wednesday. Qualcomm's stock has lagged so far this year, rising just 4% year-to-date as of the release of its third-quarter earnings report.

In addition to using its chips in personal computers and augmented reality devices, Qualcomm is also entering the AI infrastructure market. Qualcomm provides server CPUs and AI inference chips, and announced the acquisition of Alphawave Semi in June. Alphawave specializes in high-speed wired connectivity products, which will help enrich Qualcomm's data center product portfolio as demand for AI infrastructure surges.

Qualcomm is an industry leader in mobile innovation, renowned for its pioneering role in the development of wireless technologies, including the Snapdragon chipset platform and 5G. The company operates through two primary segments: Qualcomm CDMA Technologies (QCT), which develops integrated circuits (ICs), including mobile semiconductors; and Qualcomm Technology Licensing (QTL), which licenses intellectual property critical to wireless communications.

In recent years, Qualcomm has been committed to expanding beyond mobile devices to strengthen its presence in the automotive and IoT sectors. These initiatives have been key to the company's success, enabling it to diversify its revenue streams and reduce its reliance on smartphone-related revenue. This strategic diversification aligns with its mission to capitalize on the burgeoning market for smart cars and connected devices while maintaining its leadership in connectivity.

In its most recent fiscal quarter, Qualcomm achieved outstanding growth across multiple metrics.

Qualcomm CDMA Technologies (QCT), which accounts for a significant portion of Qualcomm's revenue, saw its revenue surge to $10.08 billion, driven by strong performance in the mobile, automotive, and IoT segments. In the mobile segment alone, QCT's revenue grew 13% year-over-year to $7.57 billion, highlighting the continued success of its Snapdragon platform. Meanwhile, QCT's automotive business saw a significant 61% increase in revenue to $961 million, driven by the popularity of the Snapdragon Digital Chassis.

Qualcomm's technology licensing (QTL) division reported revenue of $1.54 billion, a 5% year-over-year increase. Despite this modest increase, the licensing division remains a key contributor to Qualcomm's revenue, thanks to its solid 5G patent portfolio.

This quarter's results were virtually free of one-time events, clearly demonstrating the company's organic growth. Management did not announce any significant dividend adjustments, but solid financial performance may support future shareholder returns. Qualcomm returned $2.7 billion to shareholders, including $942 million in cash dividends and $1.8 billion from share repurchases of 11 million shares.

Try again

Qualcomm launched its first PC CPU based on the Arm architecture last year. Although it did not cause much response due to compatibility issues and other reasons, the PC market based on the Arm architecture is likely to continue. Currently, Qualcomm seems to be seeking to re-enter the server CPU market with new chips.

According to a LinkedIn post, Intel veteran Sailesh Kottapalli, chief architect of the Xeon server processor family, is joining Qualcomm after nearly three decades at Intel. Last December, Qualcomm revealed in a job posting that its data center team is developing server products for data center applications. Kottapalli is expected to lead this work.

While Qualcomm's PC chips have had issues running certain types of applications, especially games, they offer solid performance and efficiency, which could be a strong foundation for Qualcomm's push into the data center market.

Qualcomm's Centriq server CPU had little chance of success in 2018. x86 had too much inertia behind it, and the software ecosystem was centered around the dominant architecture.

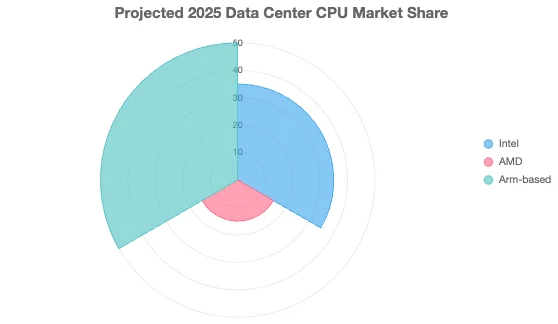

Qualcomm may have better luck this time around, thanks to AI. Tech giants like Microsoft are investing heavily in new AI data centers, and some are even designing their own Arm-based CPUs. The software stack is still evolving, and with Microsoft, Amazon, and others beginning to support Arm-based server CPUs, 2025 is poised to see even more momentum than 2018.

While the environment is more favorable for Qualcomm, the company will face competition from potential customers’ internal chip design efforts and from other companies entering the market. Nvidia already sells its Grace series of data center CPUs based on the Arm architecture, and as Arm gains traction, other companies may follow suit.

If Qualcomm returns to the server CPU market, Intel and AMD will face stiffer competition, but both companies have strong product lineups that are difficult to beat. Intel improved its competitive position last year with the powerful Granite Rapids chip and the efficiency-focused Sierra Forest chip, and this year it plans to use its cutting-edge Intel 18A manufacturing process for the Clearwater Forest chip.

Meanwhile, AMD officially launched its Turin series of server CPUs in October, featuring 192 cores. The series also includes a CPU designed specifically for use as a host node CPU in AI accelerator clusters. AMD's previous generation of server CPUs was a resounding success, and the company is committed to building on this success.

Qualcomm appears to be preparing to re-enter the server CPU market. Due to the more favorable market environment for Arm-based CPUs, this time the progress should be better than last time, but the competition will also be extremely fierce.

Conclusion

Qualcomm Inc. is guiding for revenue in the range of $10.3 billion to $11.2 billion and adjusted earnings per share of $2.70 to $2.90 for the upcoming second quarter. The revised outlook reflects the company's continued expectation of strong demand across diverse markets, despite recognized risks associated with a changing economic landscape and market transitions.

Investors should monitor Qualcomm's continued expansion into the automotive and IoT markets, as these sectors are expected to play a key role in future growth. Management has set a target of $22 billion in non-handset revenue by fiscal 2029. As the company reduces its reliance on handheld devices, monitoring its strategic moves into emerging markets will be crucial to maintaining its continued growth momentum.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates