Fed Chair Selection Enters Critical Phase: Implications of Leadership Transition for Monetary Policy

02:19 October 11, 2025 EDT

Key Points:

Preliminary interviews led by U.S. Treasury Secretary Scott Bassett have narrowed the pool of Fed Chair candidates from 11 to 5, with the final recommendation expected to be submitted to President Trump after Thanksgiving (November 27).

The policy stance of the eventual appointee could serve as a key gauge of whether the Federal Reserve will maintain its independence and credibility under political pressure.

Federal Reserve policy decisions ultimately need to be anchored in economic fundamentals, but the current U.S. economic landscape—characterized by strong growth alongside weak employment, and high inflation paired with low expectations—creates significant constraints on candidates’ policy choices.

On October 10, U.S. Eastern Time, the Treasury Department announced that the list of Fed Chair candidates had been reduced from 11 to 5. The final nominee is expected to be appointed as a Federal Reserve Governor in January 2026, and subsequently succeed Jerome Powell as Fed Chair.

The selection takes place against a backdrop of sticky inflation, a bifurcated labor market, and mounting political pressures. Its outcome will have profound implications for the Fed’s future policy independence and market expectations.

Backgrounds of the Five Candidates

The selection process for the Federal Reserve Chair has entered a critical phase. Preliminary interviews led by U.S. Treasury Secretary Scott Bassett have narrowed the candidate pool from 11 to 5, with the final recommendation expected to be submitted to President Trump after Thanksgiving (November 27).

The five candidates advancing to the final evaluation stage form a diverse lineup: current Fed Vice Chair for Supervision Michelle Bowman, Fed Governor Christopher Waller, White House National Economic Council Director Kevin Hassett, former Fed Governor Kevin Warsh, and BlackRock Global Chief Investment Officer for Fixed Income Rick Rieder.

Rieder is the only candidate without prior Fed experience. His extensive Wall Street background and hands-on asset management expertise are seen as a potential “outside-the-system advantage.” Treasury officials noted that Rieder made a “particularly strong impression” during his interview with Bassett.

Regarding selection criteria and timeline, Bassett has emphasized that the next Fed Chair should possess expertise in economics, monetary policy, banking supervision, and management, while also being open to reforms of the Fed’s structure and operations. He has publicly criticized the Fed for being “overly large” with “mission creep,” potentially signaling support for scaling back central bank functions and limiting quantitative easing.

In terms of policy stance, the five candidates span a spectrum from hawkish to dovish, reflecting differing monetary policy orientations.

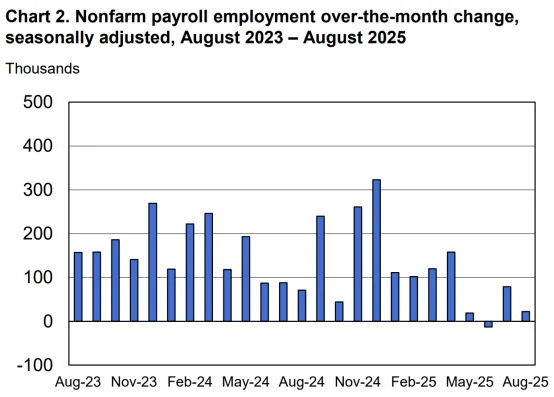

Bowman, as the current Vice Chair for Supervision, leans dovish. She noted that, since April, U.S. monthly job gains have averaged only about 25,000, far below roughly 150,000 per month earlier in the year, indicating that the labor market is “more fragile than expected.” She also believes inflation is “sufficiently close” to the 2% target and therefore stated that “the Committee should take decisive, proactive action.”

Source: U.S. Bureau of Labor Statistics

Waller also belongs to the dovish camp but advocates a measured policy pace. In August, he supported a 50 basis-point rate cut in September, stressing the necessity of easing while opposing “aggressive and rapid moves.” In interviews, Waller emphasized Fed independence, noting that discussions should be “entirely focused on policy, not politics.”

Hassett, a long-time economic advisor to Trump, prioritizes stimulating growth through rate cuts. Despite a strong academic background, he has repeatedly supported Trump’s easing initiatives. Recently, he publicly stated that the Fed should “remain fully independent,” while simultaneously calling for a “comprehensive review” of its operations—a stance viewed by some as contradictory.

Warsh represents the hawkish wing, consistently adhering to a monetarist framework and criticizing the Fed’s expansionary policies for driving inflation out of control. He calls for a “thorough reform” of the Fed, questions Powell’s policy credibility, and advocates for monetary policy to be more closely coordinated with fiscal policy.

Potential Threats to Federal Reserve Independence

Behind the divergence in candidates’ policy stances lies the most serious test of Federal Reserve independence in nearly a century. Since the Trump administration returned to office in January 2025, the White House has expressed dissatisfaction with Fed policy through public commentary, personnel changes, and legal channels.

The market has widely interpreted these actions as a challenge to the central bank’s independence, sparking debate over the boundaries between policy autonomy and political accountability, while raising international concerns about the long-term stability of the U.S. dollar system.

Public criticism and personnel maneuvers have become focal points. Trump has repeatedly pointed out in public that the Fed’s pace of rate cuts has been too slow and could hinder economic growth, while questioning its internal management efficiency. Although the president lacks direct authority to remove the Fed chair, the intensity of public scrutiny has heightened market uncertainty. Some analysts suggest that the Fed’s rate cut in September partially reflected a response to external pressure, while Powell’s subsequent statement that policy was “not on a preset path” was seen as a signal of the central bank’s effort to maintain independence.

Personnel appointments have also attracted close market attention. In August 2025, the White House dismissed Fed Governor Lisa Cook citing a “compliance investigation,” triggering widespread legal and academic debate. Under the Federal Reserve Act, governors serve 14-year terms and can only be removed for “cause” through formal legal procedures. The case is currently under judicial review. Legal experts note that the final ruling could set an important precedent for defining the boundaries between presidential appointment powers and central bank independence. Markets worry that if the White House gains greater appointment authority, the Fed’s decision-making structure could tilt in the long term.

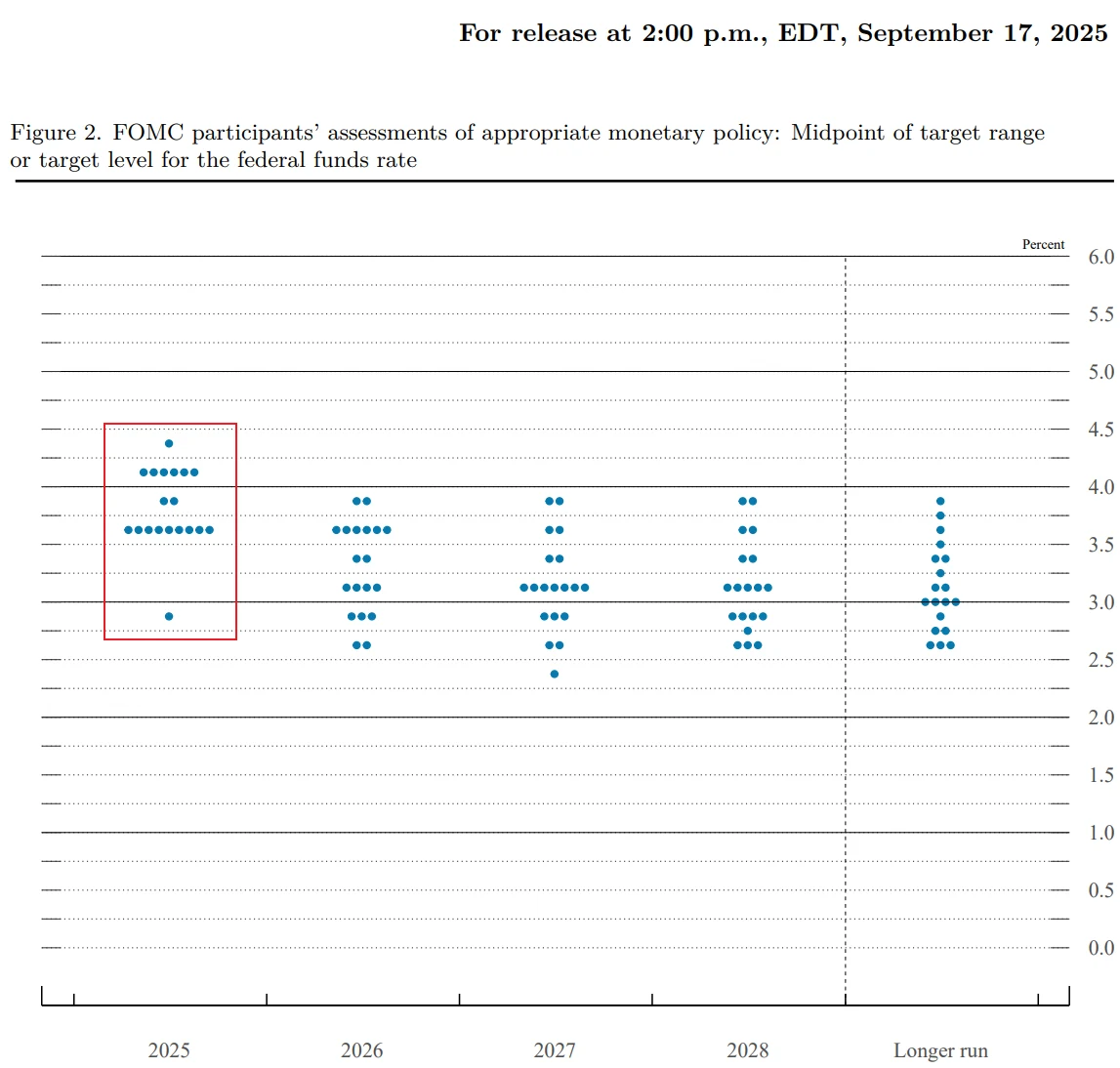

Meanwhile, White House economic advisor Stephen Milan has been confirmed by the Senate as a Fed governor. Milan cast the sole dissenting vote at the September FOMC meeting, advocating for a more aggressive rate-cutting pace aligned with the administration’s growth-oriented policy agenda.

Source: Federal Reserve

Barclays analysts note that while Milan is unlikely to dominate policy in the short term, his vote could have marginal influence under conditions of diverging economic data, increasing the risk of political factors affecting monetary policy decisions.

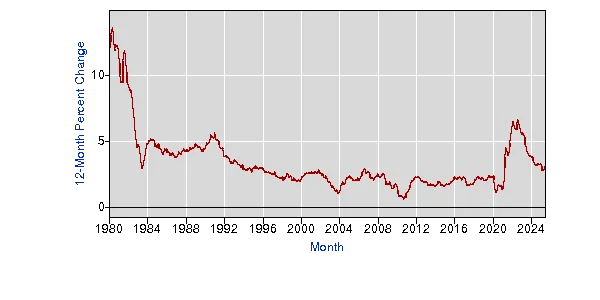

Historical experience shows that excessive political pressure on monetary policy can have long-term negative consequences. In the early 1970s, policy easing contributed to a period of stagflation in the U.S., with inflation exceeding 13%. Although current inflation has fallen significantly from its peak, core PCE remains above the long-term 2% target, and recent tariff policies have pushed up the prices of certain imported goods. Any renewed deviation from data-driven monetary policy could elevate the risk of resurgent inflation.

Source: U.S. Bureau of Labor Statistics

International markets are also closely monitoring how changes in Fed independence may affect global capital flows, with heightened volatility in emerging markets being a key concern.

Against this backdrop, candidates’ attitudes toward independence have become a critical reference point for market assessment. Waller has repeatedly emphasized that the Fed should “base decisions on data and economic fundamentals,” representing a strong commitment to policy autonomy. Hassett, while expressing support for central bank independence, also advocates reviewing its decision-making processes. Warsh proposes the concept of “limited independence,” arguing for professional policy execution while strengthening coordination with fiscal policy. The eventual choice of Fed chair could serve as a key indicator of whether the central bank will maintain its independence and credibility under political pressure.

Expectations for Interest Rate Cuts

Federal Reserve policy decisions ultimately need to anchor on economic fundamentals, yet the current U.S. economy presents a complex landscape of strong growth alongside weak employment and high inflation with low expectations, imposing significant constraints on candidates’ policy choices. Economic data released intensively since September 2025 have simultaneously reduced the urgency for near-term rate cuts while highlighting the necessity for long-term accommodation, amplifying the divergence in policy expectations.

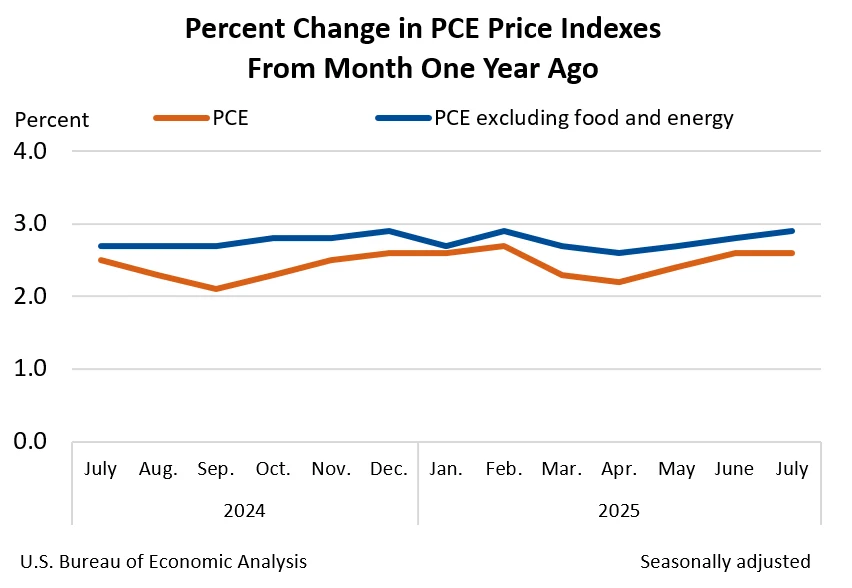

Specifically, one of the Fed’s core metrics, the U.S. second-quarter core PCE price index, was revised up to an annualized quarterly rate of 2.6%, exceeding both expectations and the prior reading of 2.5%.

Source: BEA

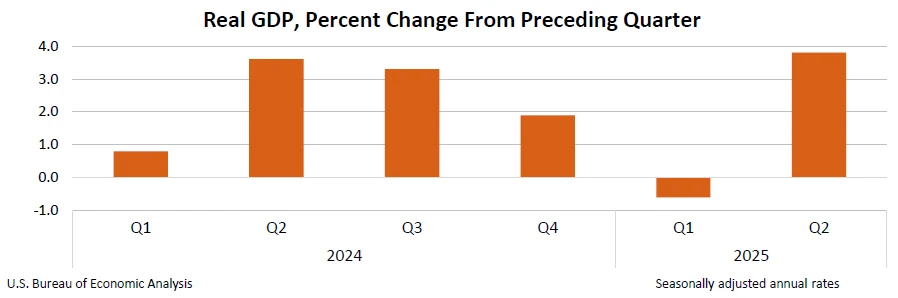

Meanwhile, second-quarter real GDP annualized quarterly growth was sharply revised up to 3.8%, well above the expected 3.3% and prior 3.3%, marking the strongest performance since Q3 2023.

Source: BEA

The Fed is currently awaiting key data such as the September nonfarm payroll report. However, due to the U.S. government shutdown, the Labor Department’s planned October 3 release of September employment data was delayed. The Labor Secretary stated that the September employment report would be released immediately once the government reopens.

Similar situations have occurred historically—for example, during the 2013 government shutdown, employment reports were delayed, leaving markets and policy makers without up-to-date data. A prolonged shutdown could result in continued gaps in critical economic indicators, adding uncertainty to the Fed’s policy path.

Moreover, there is no consensus within the Fed on the future policy trajectory. Chicago Fed President Charles Evans has not ruled out rate cuts entirely but cautions that “acting too aggressively on rate reductions based solely on slowing employment data carries risks,” and argues that action should await clear evidence of inflation retreating toward the 2% target path. He also notes that the current environment shows signs of “stagflationary pressures.”

Vice Chair Michelle Bowman and newly appointed governor Stephen Milan, meanwhile, focus more on labor market fragility. Milan’s stance is more aggressive—as the sole dissenting vote at the September FOMC meeting, he advocates for rapid cuts of “50 basis points at a time, totaling 150-200 basis points” to bring rates back to neutral.

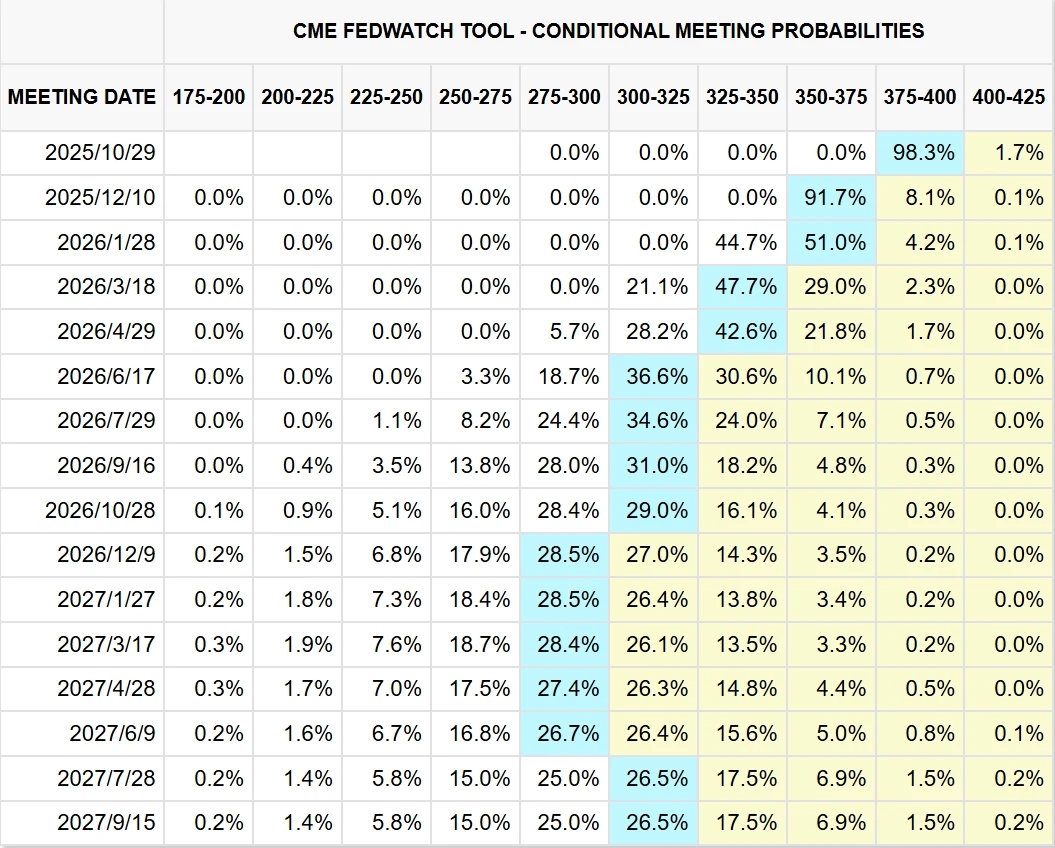

As the Fed’s next policy meeting approaches, market expectations for additional rate cuts continue to rise. According to CME FedWatch data, the probability of a 25-basis-point cut at the October meeting has climbed to 98.3%, while expectations for cumulative easing by year-end have strengthened, with the likelihood of a total 50-basis-point cut by December rising to 91.7%.

Source: CME Group

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates