Boeing: Commercial aircraft production rebounded, with robust defense business supporting growth

02:15 October 12, 2025 EDT

Boeing is a global aerospace and defense company that designs, manufactures, and maintains commercial and military aircraft, satellites, and related systems. Its operations are organized into three core segments: Commercial Airplanes (passenger and cargo aircraft); Defense, Space & Security (military fighter jets, trainer aircraft, and drones); and Global Services (maintenance, spare parts, and pilot training).

Boeing has recently placed a high priority on improving production line reliability, enhancing product quality, and rebuilding the trust of customers and regulators. Key areas of business success include maintaining competitiveness with other aerospace companies (particularly Airbus and Lockheed Martin), meeting stringent safety and environmental standards, managing a complex global supply chain, and addressing labor and regulatory challenges. Order growth and delivery momentum are seen as key indicators of recovery, as are progress in cash flow and backlogs.

Quarterly Highlights: Financial and Operational Review

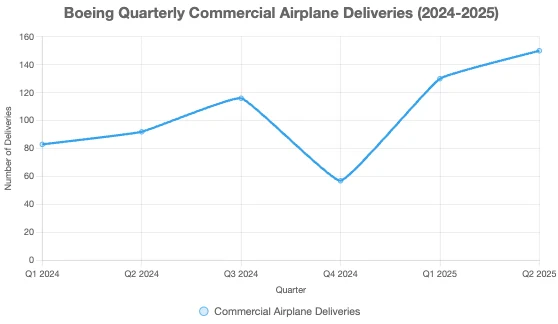

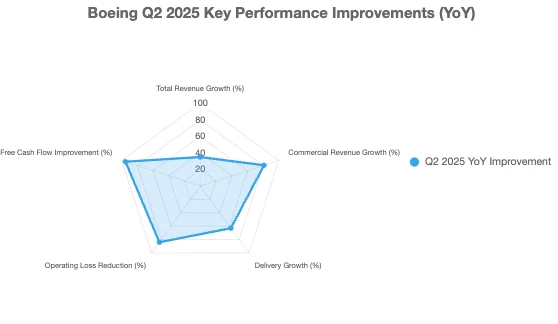

Boeing delivered 150 commercial airplanes in the second quarter of 2025, a 63% year-over-year increase. The increase in deliveries was driven by growth across several product types, including 104 737 narrow-body jets, 24 787 wide-body airplanes, and 22 767 and 777 series airplanes combined. Commercial Airplanes segment revenue increased 81% to $10.9 billion, with the division receiving 455 net orders, including significant new orders for the 787 and 777-9 from Qatar Airways and the 787-10 from British Airways.

Defense, Space & Security segment revenue increased 10% to $6.6 billion. Key program activity during the quarter included the U.S. Air Force's order for T-7A Red Hawk trainer aircraft and continued progress on the MQ-25 Stingray unmanned refueling tanker. Profit margins for this segment have returned to positive territory, moving from a 15.2% loss in the second quarter of 2024 to a 1.7% profit in the second quarter of 2025.

How important is Boeing's defense business?

Historically, commercial aircraft sales have been Boeing's largest revenue source. However, in recent years, a series of quality control lapses and production setbacks—particularly the 737 MAX crisis—have hit Boeing's commercial business hard. As a result, Boeing's Defense, Space, and Security (BDS) segment is projected to become the largest contributor to overall revenue by 2024.

The chart below shows how the BDS segment has become a more important component of Boeing's revenue structure since 2017.

The BDS unit generated $6.6 billion in revenue, or nearly 30% of Boeing's total quarterly revenue, in the second quarter of 2025. However, commercial aircraft sales accounted for 48% of total revenue in the second quarter as Boeing ramped up production of its popular 737 MAX and 787 Dreamliners.

Assuming Boeing continues to make progress in stabilizing its commercial airplane production, the revenue mix going forward should start to look more like 2017 and 2018, when its commercial business carried most of the load.

Despite this, the BeiDou system (BDS) has been a steady contributor and has had some major wins this year. In March, the U.S. Air Force selected Boeing to build its next-generation fighter jet, the F-47. A few weeks ago, the U.S. Space Force awarded Boeing a $2.8 billion contract to develop two satellites for space-based nuclear command, control, and communications.

Boeing is expanding its St. Louis factory to support F-47 production, and the machinists' strike is unlikely to have an impact on the F-47 program because the contract was only signed in March.

strike

Last September, 33,000 IAM union members at Boeing's Seattle-area factories went on strike, halting production of the 737 MAX and 777. The 53-day machinists' strike cost Boeing and its shareholders at least $5.5 billion in lost profits, according to estimates by Anderson Economics Group.

The strike came at an inopportune time. Boeing was still recovering from an Alaska Airlines 737 MAX explosion earlier this year caused by an improperly installed fuselage panel. Given Boeing's history of quality control issues with the 737 MAX, the company could face criminal prosecution over two fatal crashes in 2018 and 2019.

Today, Boeing is in a stronger position. At the end of May, the US Department of Justice reached a non-prosecution agreement with Boeing. Meanwhile, Boeing is ramping up commercial aircraft production. In the second quarter, commercial aircraft deliveries surged 63% compared to the same period last year. Meanwhile, Boeing's balance sheet is becoming healthier, and management expects the company to achieve positive free cash flow in the fourth quarter of this year.

That's perhaps why Boeing CEO Kelly Ortberg didn't seem too concerned when he addressed the strike during the company's second-quarter earnings call. He was quick to point out that "this strike is much smaller than last fall." "I wouldn't be too concerned about the impact of this attack," Ortberg told analysts. "We're going to work through it."

If there's one reason investors shouldn't be overly concerned about the strike's impact, it's the rebound in Boeing's commercial aircraft production. Deliveries of commercial aircraft increased 60% year-over-year through the first half of 2025. Commercial aircraft revenue accounted for 45% of Boeing's total revenue in the first half of the year, while the BDS business accounted for 31%.

If Boeing can continue to increase commercial aircraft production, it should help mitigate the negative impact of the St. Louis machinists' strike. Under the new arrangement, Boeing will regain the ability to issue airworthiness certificates for some 737 MAX and 787 aircraft, with the FAA and Boeing taking turns on a weekly basis. This is a significant shift from the current system, where the FAA directly oversees each aircraft before delivery.

The regulatory changes follow years of increased oversight by the Federal Aviation Administration (FAA) following issues with the 737 MAX, including two fatal crashes in 2018 and 2019 and a cabin door blown out on an Alaska Airlines flight in January 2024. However, the FAA maintained the 38-aircraft production cap per month that was implemented after the Alaska Airlines accident. The partial reinstatement of certification signals growing confidence among regulators in Boeing's safety procedures and quality control measures.

Boeing's ability to resume some self-certification responsibilities could streamline deliveries and reduce bottlenecks that have constrained production output. The aerospace manufacturer has been working to rebuild trust with regulators and customers while managing a large backlog of orders from airlines looking to expand or update their fleets in the post-pandemic recovery.

Business stability

Boeing delivered the most commercial airplanes in the quarter (150) and the most in the first half of the year (280) since 2018. That's why "stabilization" was a common theme in CEO Kelly Ortberg's comments during the second-quarter earnings call — even though he stopped short of saying production had completely stabilized.

The highlight of this event is Boeing's best-selling next-generation aircraft, the 737 MAX. In the second quarter, Boeing achieved its target monthly production of 38 aircraft. "Now we're focused on maintaining stability at that rate," Ortberg said. If 737 MAX production stabilizes at 38 per month, Boeing plans to apply for approval from the Federal Aviation Administration (FAA) to increase monthly production to 42.

Another positive development: Monthly production of the 787 Dreamliner has increased from five to seven. Boeing's production capacity recovery has been matched by a significant increase in sales. Boeing's commercial airplane revenue surged 81% to $10.9 billion in the second quarter. The company's total revenue for the second quarter increased 35% to $22.7 billion.

Second-quarter figures indicate progress in Boeing's return to profitability. Under US Generally Accepted Accounting Principles (GAAP), Boeing reported an operating loss of $176 million, down from a $1.1 billion loss in the same period last year. In the first half of 2025, Boeing's operating profit turned positive, reaching $285 million, a significant improvement from a $1.2 billion loss in the first half of 2024.

Boeing's free cash flow was negative $200 million in the second quarter. However, that was down from negative $4.3 billion in the same period last year. Free cash flow is a measure of profitability that excludes non-cash items such as stock-based compensation, changes in inventory values, and depreciation and amortization.

Management attributed the improved free cash flow in part to above-average 777 deliveries in the quarter. Boeing typically delivers six to seven aircraft per quarter, but in the second quarter, Boeing delivered 13 aircraft, adding $700 million to its positive free cash flow.

Third-quarter free cash flow could be impacted by several factors, including a potential $700 million one-time payment from Boeing's non-prosecution agreement with the Department of Justice. However, Chief Financial Officer Brian West said free cash flow is expected to be positive in the fourth quarter as long as Boeing can continue to increase aircraft production and "global trade conditions remain favorable."

Boeing's backlog totaled $619 billion as of the second quarter, including orders for more than 5,900 aircraft that will take more than seven years to build.

Meanwhile, Boeing and Qatar Airways announced that Qatar Airways will purchase up to 210 Boeing wide-body aircraft, a deal initially valued by the White House at $96 billion. The deal also includes options for 50 additional 787 and 777x aircraft. In May, British Airways' parent company announced an order for 32 Boeing 787-10 aircraft.

While Boeing has struggled to recover from a series of self-inflicted losses over the past few years — most of which stemmed from quality control lapses and other production challenges — it remains one of two companies that dominate the global commercial aircraft market.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates