Is Now the Time to Buy This Stock After Its 50% Drop from the Peak?

04:49 October 10, 2025 EDT

When Sezzle’s stock price reached 182.16 dollars in early July 2025, the “buy now, pay later” (BNPL) company appeared to be experiencing rapid growth—rising nearly 300% from around 45 dollars at the beginning of the year to its mid-year high. It quickly became one of the standout performers in the broader fintech sector. However, just three months later, the stock had fallen 41% from pre-earnings levels and nearly halved from its peak, bringing a sharp dose of reality to an overheated market.

Source: TradingView

Behind this sharp valuation correction lies a key question for investors: is Sezzle’s story still one of sustained growth, or are the underlying risks beginning to surface? In the BNPL landscape, investors must take a closer look at the company’s core growth drivers and the emerging sources of risk shaping its outlook.

The Growth Dividend and Credit Risk of BNPL

Sezzle’s business performance is closely tied to the broader trajectory of the “buy now, pay later” (BNPL) industry. The BNPL model, which offers consumers the ability to make purchases with zero down payment and installment payments, continues to gain traction. The U.S. BNPL market is projected to reach 116.7 billion dollars in 2025, with the small and medium-sized business segment growing at over 35%. Globally, the BNPL platform market is expected to record a compound annual growth rate (CAGR) of 22.5% between 2025 and 2032, underscoring the sector’s strong long-term growth potential.

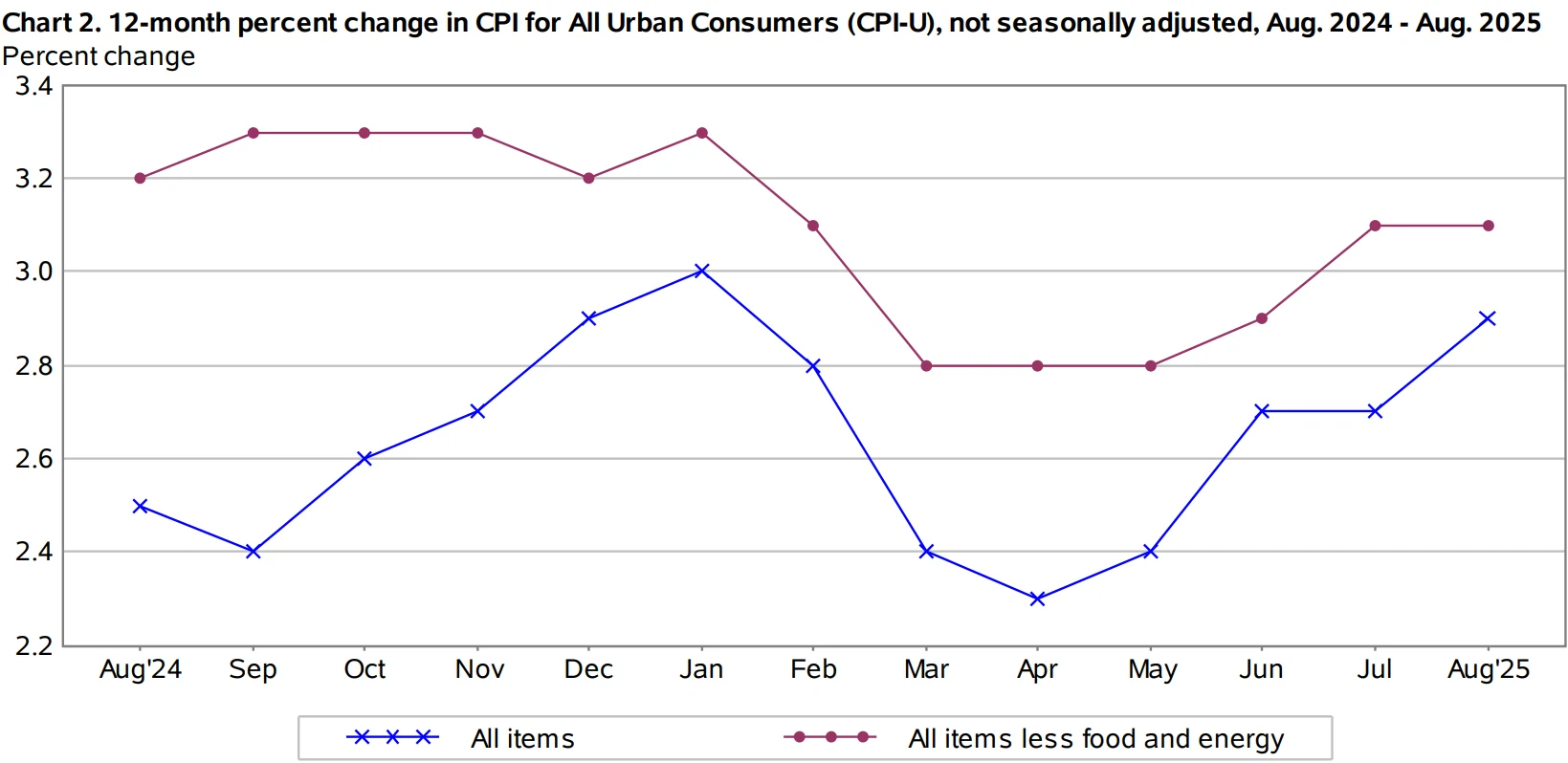

The macroeconomic backdrop is also fueling demand. In August 2025, U.S. core CPI stood at 3.1%, and Goldman Sachs forecasts it may ease to 2.8% by year-end, though inflation remains sticky. Real disposable income growth has been under pressure, declining 0.4% year-on-year in May 2025 and rising only 0.1% in August — a sluggish recovery. Meanwhile, the average credit card interest rate has climbed to 20.8%, pushing consumers toward BNPL solutions as a flexible alternative to traditional credit products.

Source: U.S. Bureau of Labor Statistics

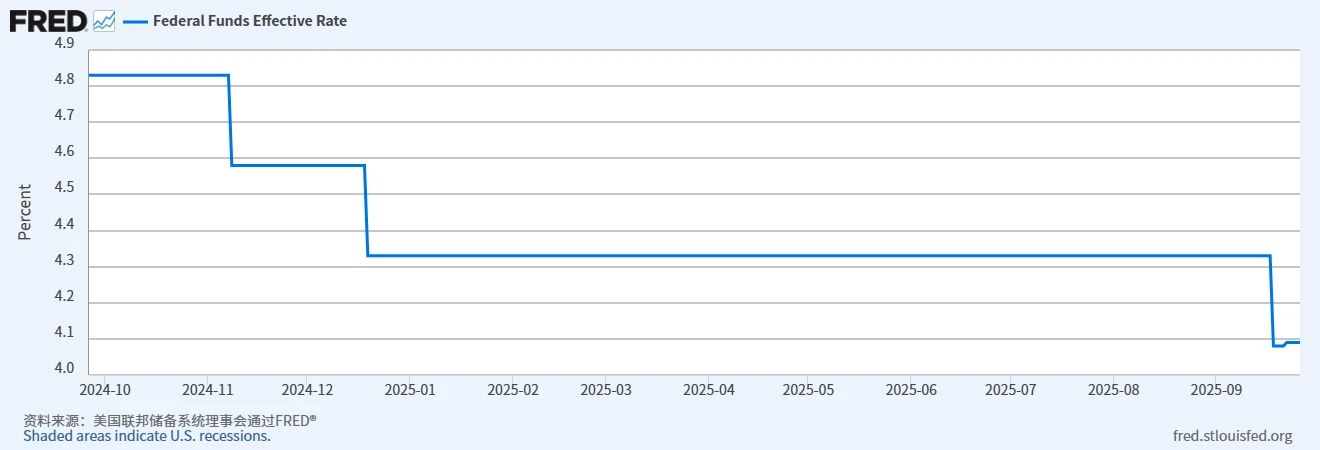

However, the industry’s rapid expansion has come with growing risks. According to a LendingTree survey, about 41% of BNPL users have experienced payment delinquencies — up 7 percentage points from 34% a year earlier — highlighting the persistent exposure to credit risk. On the policy front, the Federal Reserve’s September 2025 rate cut to 4.00%–4.25% has slightly eased BNPL financing costs, but regulatory scrutiny is intensifying. The European Union is advancing a unified BNPL regulatory framework, while several U.S. states are considering new compliance requirements that could reshape the industry’s current operating model.

Source: FRED

Sezzle’s Growth Mechanism

Sezzle’s growth momentum stems from the strong alignment between its product design and market positioning. The company has built a streamlined onboarding process for merchants and integrated deeply with e-commerce platforms such as Shopify, allowing for low-cost customer acquisition. During the 2021 BNPL boom, roughly 90% of customer inquiries came through organic traffic, indicating that early-stage growth was almost entirely driven by natural demand. Once onboard, merchants experienced tangible business benefits — average order values rose by up to 57%, while return rates declined significantly — reinforcing Sezzle’s competitive edge within the ecosystem.

At the same time, Sezzle’s membership system has become a key pillar of its growth strategy. By the first quarter of 2025, the company had reached 480,000 paying members. Through subscription offerings such as the “Super Member” plan (priced between $12.99 and $17.99 per month) and the OnDemand payment solution developed in partnership with WebBank, subscription revenue has grown steadily. Membership-related revenue now exceeds $6.23 million per month, with paying users showing materially higher transaction frequency than non-members — positioning them as the core driver of transaction growth.

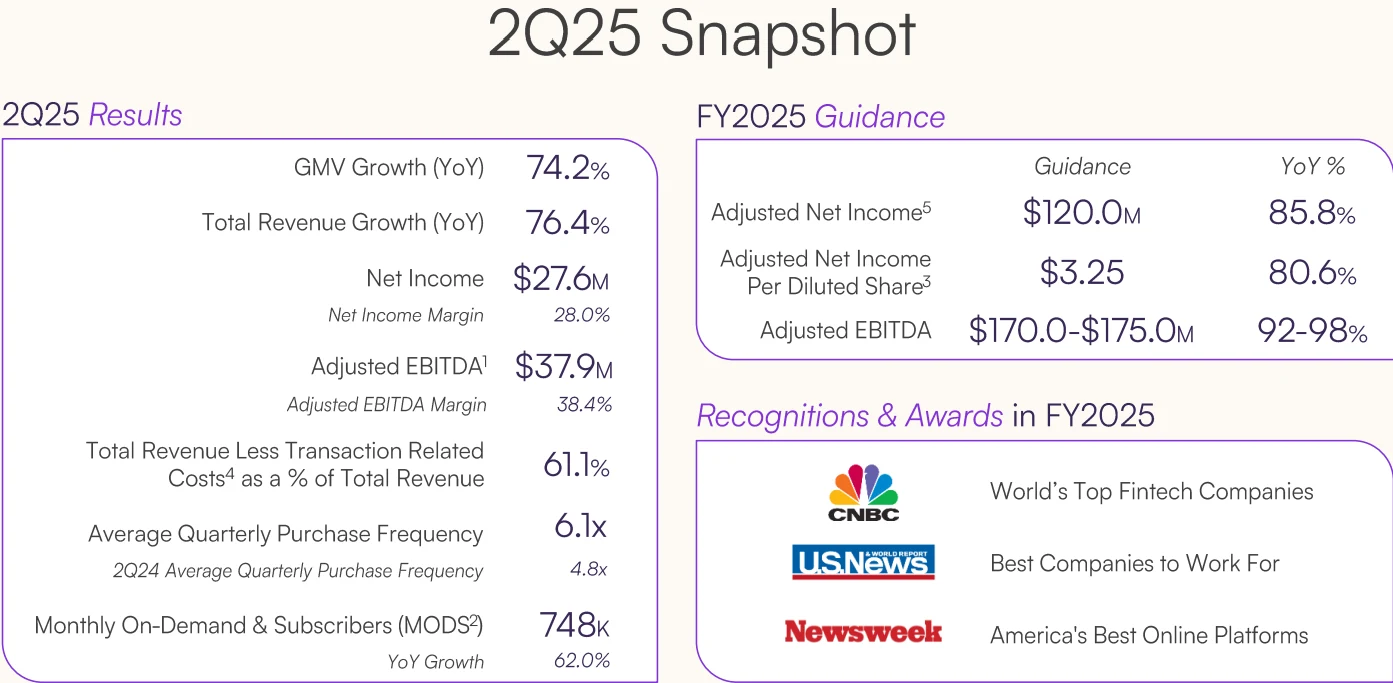

Financial performance further underscores the sustainability of this momentum. In the first half of 2025, Sezzle generated total revenue of $204 million, with $105 million in Q1 — up 123% year-over-year and well above market expectations — and $99 million in Q2, representing 76.35% year-over-year growth. The company maintained a gross margin of around 65% and an operating margin of approximately 35%, ranking among the most stable players in the BNPL sector.

Source: Sezzle

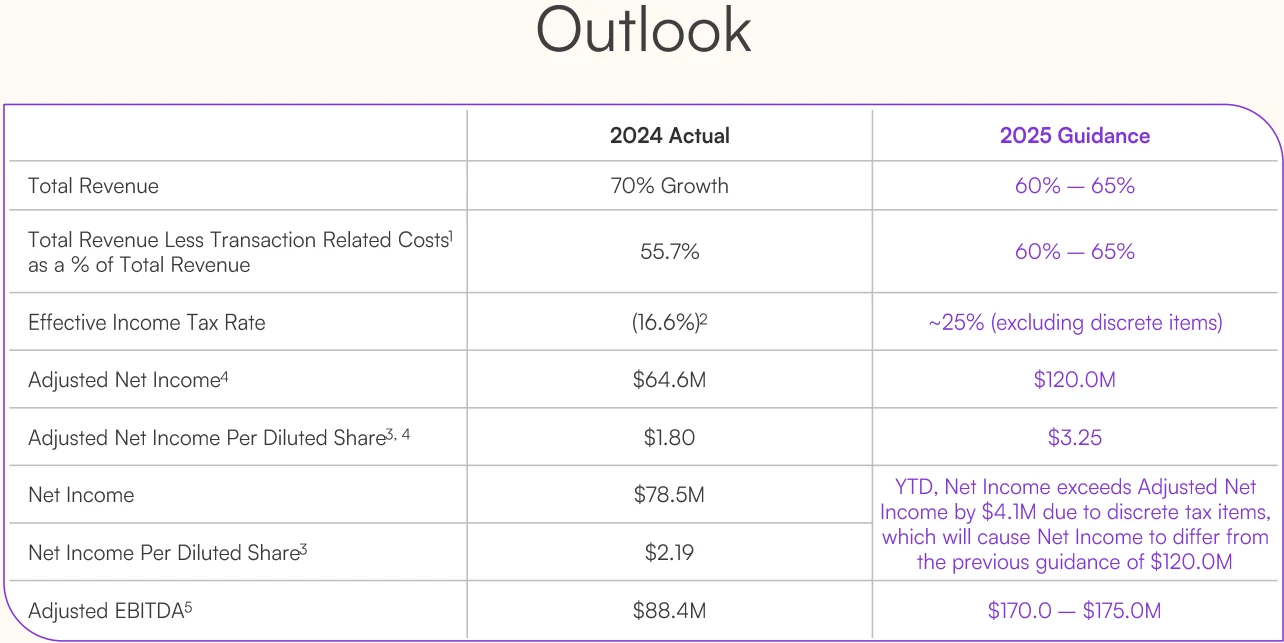

Supported by continuous product innovation and steady paid user expansion, management has raised its full-year 2025 revenue growth guidance to 60%–65%, with a midpoint of 62.5%, signaling strong growth visibility and long-term sustainability.

Source: Sezzle

Valuation Analysis

The sharp swings in Sezzle’s stock price fundamentally reflect a market recalibration of its valuation narrative. Prior to the decline, the market assigned the company a forward sales multiple of 5.5x based on 2025 projected revenue — a 63% premium over the BNPL sector average of roughly 3.37x. This valuation premium was underpinned by high growth expectations, as management projected full-year revenue growth of 60%–65% in 2025, far exceeding industry leaders such as Affirm and PayPal.

From a profitability perspective, however, a different picture emerges. As of October 8, 2025, Sezzle’s trailing twelve-month (TTM) price-to-earnings ratio stood at 27.8x, substantially lower than Affirm’s 516.4x TTM. Compared with more traditional fintech peers, Sezzle’s TTM P/E was slightly higher than PayPal (16.22x) and Bread Financial (9.56x), yet its corresponding revenue growth outpaced both, preserving a measurable growth premium.

This divergence in valuation reflects the market’s recognition of Sezzle’s rare “high growth plus profitability” profile — in the BNPL sector, few companies achieve over 70% revenue growth while remaining net profitable.

Nonetheless, InvestingPro’s fair value model offered a contrasting view. On July 4, 2025, the platform flagged Sezzle as “significantly overvalued,” suggesting that the stock price had already priced in three years of flawless growth assumptions (assuming annual growth above 60% without any credit risk shocks). In the subsequent two months, the stock fell 51%, partially validating this assessment.

The core divergence lies in risk pricing: whether the market has fully accounted for the sector-wide challenges of deteriorating credit quality and intensifying competition. When the Q2 2025 report revealed that revenue growth, although still robust at 76.35%, had slowed considerably from Q1’s 123%, the market recognized a marginal weakening in growth expectations, triggering a reevaluation of Sezzle’s valuation framework.

Credit, Insider Selling, and Competitive Pressure

Sezzle’s recent stock pullback reflects the concentrated exposure of multiple risk factors rather than a simple market sentiment shift. In late 2024, short-seller Blue Orca Capital highlighted significant structural risks in the company’s business model: Sezzle finances itself through asset-backed securities (ABS) at a high interest rate of 12.65%, then extends loans to subprime customers with low credit scores who struggle to access traditional credit cards. This combination of high-cost financing and high-risk assets was seen as potentially precarious, and the report triggered an 18% one-day decline in the stock.

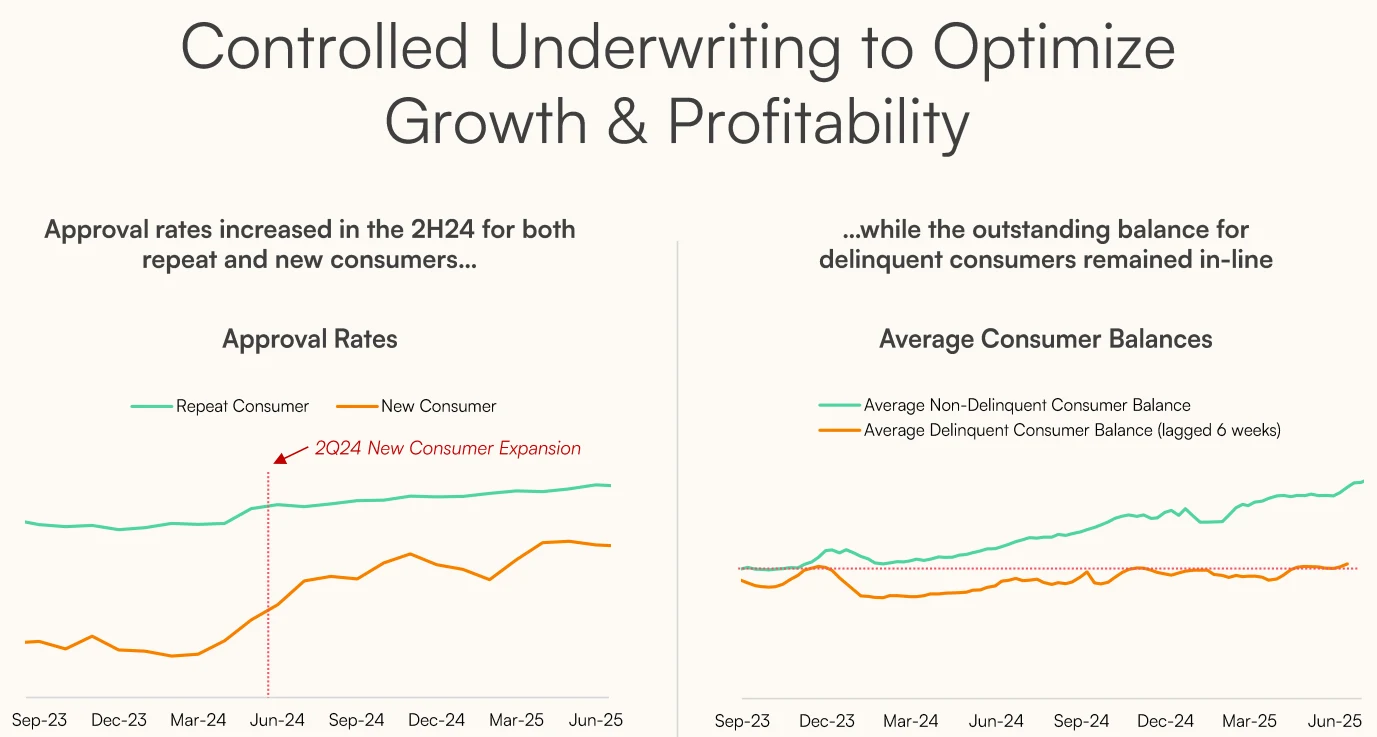

Financial metrics further underscore the growing risk. In Q2 2025, Sezzle’s credit loss provisions increased 130% year-over-year to $62 million, while loan balances only grew 6% (approximately $480 million). This implies that for every $1 of new loans, risk provisions rose by 117%, indicating a widening credit risk exposure. At the same time, 52% of the company’s revenue comes from transaction commissions and merchant services tied to loan volume. With delinquency rates rising 7 percentage points YoY, this revenue segment faces downside pressure; if lending is tightened to control risk, core revenue could decline concurrently.

Source: Sezzle

Internal share sales have amplified market concerns. In 2024, insiders sold approximately $21 million in stock, with the CFO accounting for over 40% of the total. Ahead of and following the Q2 2025 earnings release, the board, CEO, and current CFO collectively sold $1.6 million, all non-restricted shares immediately after vesting, interpreted by the market as caution regarding short-term prospects. Additionally, CEO Charlie Youakim pledged 30% of his holdings as margin collateral, representing 8.5% of total shares. While margin calls have not yet been triggered, a 40% decline from the pledged share price could force involuntary sales, adding further volatility risk.

Competition and regulatory pressures remain key considerations. In the small- and medium-sized business (SMB) segment, PayPal leverages 380 million active users and a zero-fee integration strategy, expanding SMB merchant adoption by 52% YoY in H1 2025, constraining Sezzle’s addressable market. In the premium segment, Affirm’s exclusive partnerships with Amazon dominate, with high-end customer transactions exceeding 60% of Sezzle’s total. Moreover, Sezzle terminated partnerships with 12 merchants, including Lamps Plus and Bellacor, who switched to Affirm or PayPal, highlighting challenges in merchant revenue sharing and technical integration.

On the regulatory front, the U.S. Consumer Financial Protection Bureau (CFPB) released a draft BNPL Credit Reporting Guidance in September 2025, proposing the inclusion of BNPL installment transactions in consumer credit reports. If implemented in 2026, Sezzle’s target demographic—subprime borrowers with credit scores below 620—could face higher default costs, potentially increasing delinquency rates by 5–8 percentage points.

Wall Street Perspective

Wall Street analysts hold markedly divergent views on Sezzle, offering a key reference point for assessing its fair valuation. As of October 2025, four firms issued ratings over the past three months, with two maintaining a “Buy” stance and two assigning “Hold.” While the median rating has slightly declined compared to Q2, the overall sentiment remains positive. Notably, Northland Securities analyst Michael Grondahl continues to maintain a bullish outlook on SEZL, assigning a “Buy” rating with a $150 price target.

Some analysts caution that Sezzle’s competitive edge relies more on operational execution—specifically, the rapid onboarding of SMB merchants—rather than structural moats such as technology barriers or user stickiness. Against the backdrop of PayPal’s increased SMB incentives and tightening CFPB regulations, the company’s margin for error has narrowed significantly. In the short term, a “wait-and-see” approach may be warranted, pending clearer data on credit risk.

From a valuation anchor perspective, Sezzle’s current share price of approximately $82 as of October 15 still implies around 34.45% upside relative to the analysts’ average target of $110.25.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates