U.S. Government Shutdown Enters Second Week as Sixth Negotiation Attempt Fails; How Long Will the Stalemate Persist?

02:26 October 10, 2025 EDT

On October 1, 2025, the U.S. federal government officially entered a shutdown after Congress failed to pass the new fiscal year budget or a continuing resolution. As of October 10, the shutdown has lasted nearly ten days, with the Senate holding seven votes on the continuing resolution, all of which failed to reach the 60-vote threshold. As the shutdown drags on, its negative effects on the economy, public services, and market stability continue to mount.

Source: The WHITE HOUSE

This shutdown marks the first federal government closure since 2018–2019 and is the 21st shutdown since the enactment of the Congressional Budget and Impoundment Control Act of 1974.

Root Causes of the Shutdown

The immediate cause of the U.S. government shutdown lies in the failure to complete the budget approval process on time, while the deeper issue stems from structural flaws in the budget system itself and the long-standing accumulation of partisan political divisions. The 2025 shutdown once again highlights the deep-seated conflict between the federal budget process and party politics.

Under the Congressional Budget and Impoundment Control Act of 1974, passing the federal budget requires two key steps. First, Congress must review and approve twelve regular appropriations bills covering all departments—including defense, healthcare, education, and energy—before the start of the new fiscal year on October 1. Second, if the regular appropriations bills are not passed by the deadline, a continuing resolution (CR) is needed to maintain the government’s previous year spending levels, thereby preventing a shutdown.

Two structural features of the system make shutdowns a persistent risk.

First, appropriations bills in the Senate require 60 votes to pass, not a simple majority of 51. This means that any party can block the budget if it chooses not to cooperate. In 2025, the Senate composition is 52 Republicans and 48 Democrats, leaving neither side able to reach the 60-vote threshold on its own, making a legislative stalemate almost inevitable.

Second, the completion rate of regular appropriations bills is extremely low. Over the past 20 years, Congress has only completed all twelve bills in 2018; in other years, it has relied almost entirely on continuing resolutions. From 2020 to 2024, the government operated under continuing resolutions for 78% of the time, demonstrating a long-term “short-termism” in the federal budget process.

The immediate trigger for this shutdown is the dispute over bundling the renewal of Affordable Care Act (ACA) subsidies with the continuing resolution, which ultimately reflects the fundamental differences between the two parties on fiscal priorities and policy objectives.

The Democrats advocate extending ACA subsidies for low- and middle-income individuals. These subsidies are set to expire at the end of 2025, affecting roughly 13 million beneficiaries. According to estimates from the Department of Health and Human Services, if the subsidies are terminated, the average annual premium for beneficiaries would rise from $5,400 in 2025 to $6,500 in 2026, an increase of about 20%. Democrats argue that the extension of these subsidies should be explicitly included in the continuing resolution to prevent policy gaps.

Republicans, on the other hand, insist on the principle of “separating budget from policy,” arguing that healthcare and other policy issues should be addressed through standalone legislation rather than bundled into budget bills. Some Republicans have proposed that the continuing resolution include a 10% cut to non-defense spending in fiscal year 2024 and eliminate aid to Ukraine. These demands were firmly opposed by Democrats, resulting in a stalemate in negotiations.

The Cost of the Shutdown

The impact of the government shutdown on the U.S. economy is not merely a short-term slowdown in production but represents a sustained shock that affects both macroeconomic and microeconomic levels.

From a macroeconomic perspective, the shutdown directly suppresses economic growth. Kevin Hassett, Director of the White House National Economic Council, noted that each week of a shutdown reduces economic output by roughly $15 billion, equivalent to a 0.1 percentage point decline in quarterly GDP. If the shutdown persists for a month, it is projected to result in approximately 43,000 job losses and a $30 billion reduction in consumer spending. This impact not only depresses short-term growth but may also weaken business investment incentives and household confidence, slowing the overall economic recovery process.

Historical experience corroborates these effects. The 35-day shutdown from 2018 to 2019 caused an estimated $11 billion in economic losses, $3 billion of which were considered permanent, illustrating that interruptions in government functions can inflict lasting damage on the economic chain.

At the sector level, the shutdown’s losses are both specific and widespread. The tourism industry is hit first: according to the U.S. Travel Association, weekly losses reach approximately $1 billion. National parks were forced to close, resulting in daily ticket revenue losses of $1 million, while surrounding hospitality and dining services lost about $77 million per day. The aviation sector is also disrupted, with more than 11,000 Federal Aviation Administration (FAA) employees furloughed, causing over a thousand daily flight delays nationwide. Flight scheduling, security checks, and aviation safety all face varying degrees of disruption.

These short-term disruptions create cascading effects on regional economies and employment structures, particularly for local businesses dependent on tourism and government contracts. Even after the shutdown ends, it may take months for operations to return to normal.

More seriously, the shutdown-induced paralysis of public services is spreading to essential areas affecting citizens’ daily lives. Approximately 750,000 federal employees are furloughed without pay, resulting in a daily personnel cost loss of $400 million. The White House has also warned of potential permanent layoffs, putting around 150,000 positions at risk, further exacerbating social uncertainty.

Meanwhile, delays in the release of key economic data are forcing policymakers into reactive positions. The Bureau of Labor Statistics has paused the publication of employment and inflation data. The scheduled October 3 nonfarm payroll report and the October 15 CPI release were postponed, leaving the Federal Reserve to make monetary policy decisions without core information—effectively “driving blind”—and increasing market uncertainty.

The effects on citizens’ welfare are equally significant. The Social Security Administration has a backlog of roughly 30,000 disability benefit applications, the Food and Drug Administration has delayed approvals for cancer treatments, and the National Weather Service saw half its staff furloughed during hurricane season, significantly reducing forecasting and emergency response capabilities.

All these indicators suggest that the government shutdown has evolved from a fiscal dispute into a multifaceted economic and social crisis. While short-term administrative paralysis can be quickly remedied once a political compromise is reached, the erosion of trust, gaps in data, and policy delays will have long-lasting consequences, posing deeper challenges to the stability of the U.S. economy.

Historical Comparison

Since 1976, the U.S. government has experienced more than 20 shutdowns, making them almost a cyclical outcome of political gridlock. A review of past events reveals a consistent pattern: shutdowns often begin with budget disagreements but ultimately evolve into extended political confrontations, with recurring economic losses and social disruption as a result.

The 2013 shutdown originated from disputes over the Obama administration’s healthcare reform, lasting 16 days. Approximately 800,000 federal employees were furloughed, and economic output declined by an amount equivalent to a 0.25 percentage point drop in GDP. This event marked the first time that fiscal negotiations were fully intertwined with healthcare policy, deeply linking the budget process with social policy.

The 2018–2019 shutdown, triggered by the Trump administration’s insistence on funding a U.S.-Mexico border wall, lasted 35 days, making it the longest in history. It caused an estimated $11 billion in economic losses, of which $3 billion were considered irrecoverable. This shutdown highlighted the deadlock between executive and legislative powers and exposed the vulnerability of the budget system under extreme partisanship.

By 2025, the characteristics of shutdowns have intensified. Unlike previous shutdowns triggered passively by budget impasses, the current event shows a “proactive” trend. On October 9, President Trump stated at the White House that, given Congress’s stalemate over reopening the government, he planned to cut certain federal programs favored by Democrats, explicitly indicating that the reductions would be permanent and targeted only at Democratic-supported initiatives.

According to the action plan from the Office of Management and Budget (OMB), multiple funding allocations have already been frozen: $18 billion for key infrastructure projects in New York City, $8 billion in climate-related funding for Democratic-leaning states, $2.1 billion for transportation projects in Chicago, and approximately $7.56 billion in funding for 223 clean energy projects under the Department of Energy. Notably, the frozen funds are concentrated in states controlled by Democrats, whose senators previously opposed the appropriations proposals put forward by Republicans.

Future Outlook

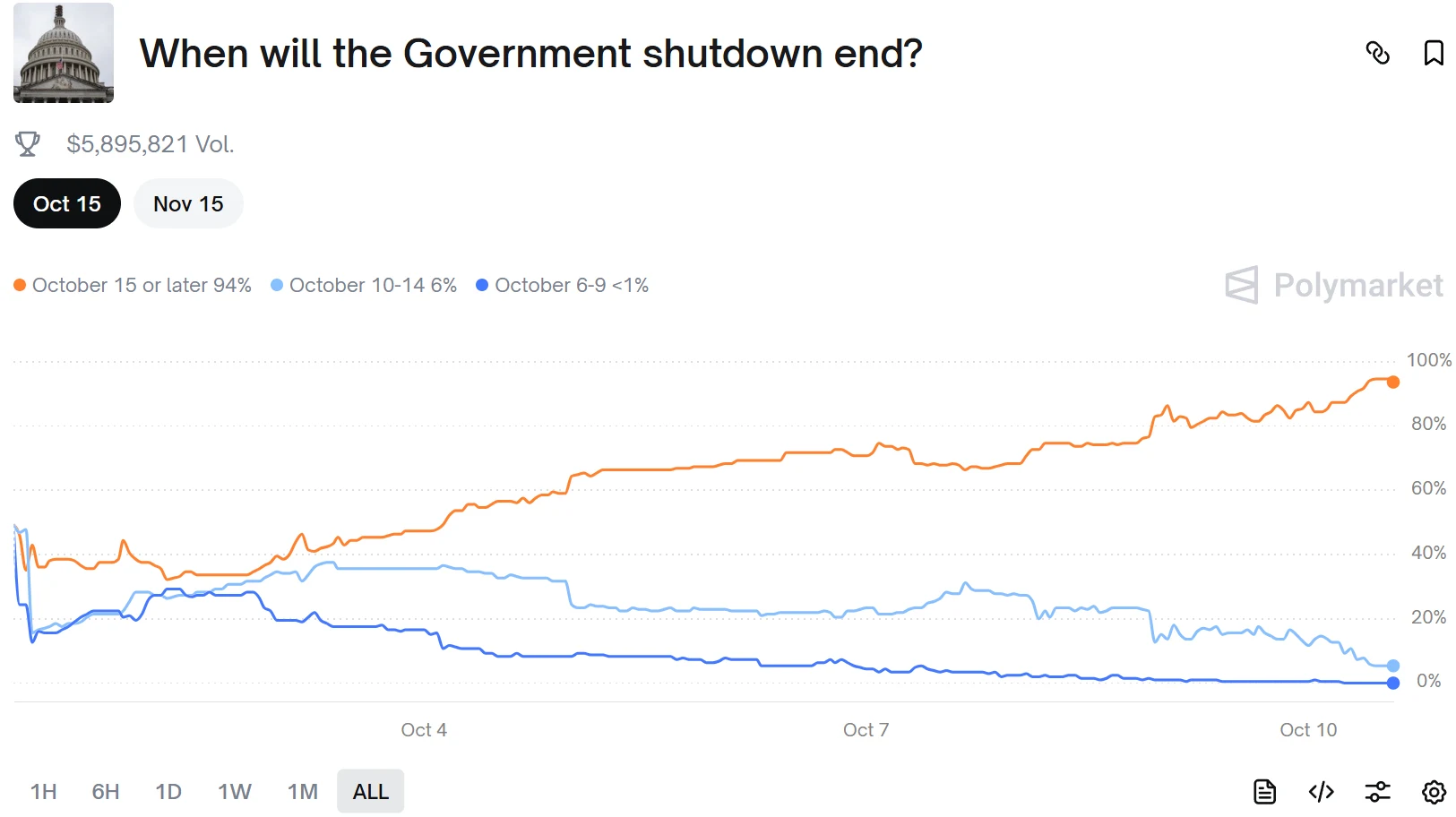

Although historical data show that roughly 80% of U.S. government shutdowns are resolved within two weeks, the negotiations this time are proving more challenging. In the short term, the two parties may still reach limited agreement on healthcare provisions, potentially advancing a continuing resolution to keep the government operating until November 21 and mitigate the impact of the shutdown on public sector operations. However, according to Polymarket’s forecast data, the probability of ending the shutdown before October 14 has fallen below 50%, indicating a marked decline in market expectations for a near-term resolution.

Source: Polymarket

From a medium- to long-term perspective, fiscal pressures in the U.S. remain unresolved. The debt ceiling issue, expanding budget deficits, and disagreements over spending cuts continue to exert strain on policy continuity. The Bipartisan Policy Center notes that disputes over fiscal policy are likely to recur ahead of the 2026 midterm elections, and ongoing deadlock in debt and budget negotiations will continue to weigh on market confidence.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates