Nvidia's Stock Price Hits Another Record High as It Cements Dominance in AI Chip Market

22:41 October 9, 2025 EDT

On October 9, 2025 (ET), NVIDIA's stock achieved another breakthrough, surging more than 3% during the session to hit an intraday high of $195.30 per share, pushing its market capitalization past $4.73 trillion. The stock closed at $192.57, up 1.83%, with a final market cap of $4.68 trillion. Trading volume reached $35.349 billion, setting a new historical record.

In after-hours trading on October 9, NVIDIA's momentum continued, with shares climbing as high as $193.24—a 0.34% increase from the closing price of $192.57.

Source: TradingView

As the first publicly traded company to surpass a $4 trillion market capitalization, NVIDIA has seen its stock price appreciate over 1,000% since early 2023, with year-to-date gains exceeding 20% in 2025. Its market value now approaches the scale of Japan’s 2024 GDP, and its weight in the S&P 500 index is nearing a historical peak. Over the past year, NVIDIA has contributed approximately 20% to the index’s total return.

Export License Breakthrough

NVIDIA's recent stock rally received a significant boost in October 2025, when the U.S. Department of Commerce's Bureau of Industry and Security (BIS) granted the company an export license. This license authorizes NVIDIA to ship AI chips worth billions of dollars to the United Arab Emirates (UAE), marking the first concrete step in implementing the bilateral AI agreement signed by the two nations in May 2025 .

This approval activates the core framework of the U.S.-UAE cooperation deal. The United States will support the UAE in building a 5-gigawatt artificial intelligence data center park—the largest of its kind outside the U.S . In return, the UAE has committed to investing up to $1.4 trillion in the United States over the next decade .

Under the specific terms of the agreement, the U.S. plans to approve the export of up to 500,000 advanced AI chips to the UAE annually . One-fifth of this allocation is designated for G42, an AI giant based in Abu Dhabi . The value of the chips exported will be directly tied to the scale of the UAE's investments in the U.S . Although the initial batch of approved shipments does not include the portion allocated for G42 , the market widely interprets this development as a signal of continued access to the Middle Eastern market.

Source: NVIDIA

The Gulf states, with their strong AI demand and substantial financial resources, have become a crucial global technology market and source of capital . NVIDIA's strategic focus on this region effectively hedges against uncertainties in other markets. The formal issuance of the export license has significantly alleviated market concerns about the constraints on its overseas business expansion and has opened the door to the emerging AI market in the Middle East for NVIDIA

Strategic Investment Initiatives

NVIDIA has embarked on a series of strategic investments beyond the approved chip exports to the UAE. Through its venture capital arm NVentures and direct investments, the company is building a comprehensive ecosystem around key segments of the AI产业链, injecting momentum for long-term growth. Since September 2025, its investment activities have accelerated markedly:

The company invested $2 billion in Elon Musk's xAI, as part of xAI's massive funding round totaling $20 billion. NVIDIA CEO Jensen Huang expressed his enthusiasm regarding this investment.

Source: NVIDIA

Even more notably, NVIDIA signed a letter of intent with OpenAI, planning an investment of up to $100 billion to jointly construct large-scale AI data centers. Under the agreement, OpenAI will utilize NVIDIA's systems to build and deploy at least 10 gigawatts (GW) of AI data center capacity, employing millions of NVIDIA GPUs to train and deploy next-generation AI models. Huang revealed that 10 GW is equivalent to 4 to 5 million graphics processing units (GPUs), roughly matching NVIDIA's total shipments for this year and double that of the previous year.

Furthermore, the company injected $5 billion into Intel, subscribing to ordinary shares at $23.28 per share, while reaching a multi-generation custom chip collaboration agreement.

In the field of cutting-edge technology, Nvidia's layout is also in-depth. It participated in PsiQuantum's $1 billion Series E funding round, which valued the company at approximately $7 billion, and the two sides will collaborate on GPU-QPU integration. It invested an additional $600 million in Honeywell subsidiary Quantinuum, at which time the company's pre-money valuation was $10 billion. It also added to its investment in QuEra's Series B round, expanding the total funding round to $230 million.

On the application front, NVIDIA plans to invest $500 million in the autonomous driving company Wayve, having previously participated in its $1.05 billion Series C round. It invested $683 million in energy infrastructure company Nscale and participated in the Series A funding round for embodied AI enterprise Dyna Robotics.

These investments form a "hardware sales + ecosystem dividend" revenue model, accelerating its transition from a chip supplier to an "AI infrastructure platform."

Market Expectations Mount

Capital markets have shifted their valuation perspective on NVIDIA from that of a "hardware manufacturer" to an "AI infrastructure platform," with analyst confidence continuing to strengthen.

As of October 2025, 29 analysts had raised their earnings estimates for the next reporting quarter. Cantor Fitzgerald lifted its price target to $300, while Goldman Sachs set a target of $210, reflecting optimistic expectations for the 2026 shipment of the Rubin chip. Citi revised its EPS estimates upward for fiscal years 2026 and 2027 to $4.58 and $7.00, respectively, exceeding previous forecasts. Analyst Ananda Baruah issued the Street-high target of $250, positing that the industry is entering a "golden wave" of generative AI adoption.

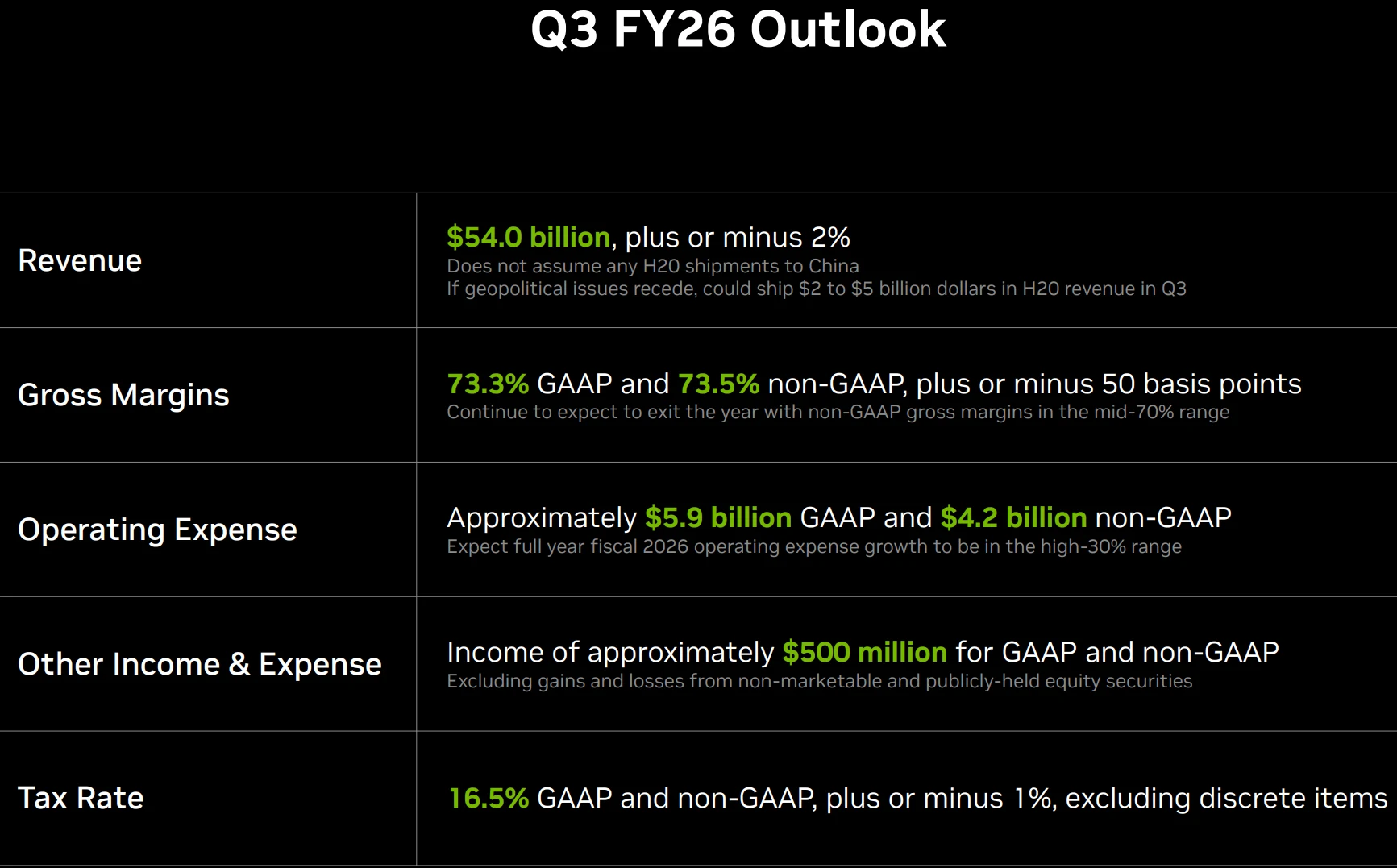

Source: NVIDIA

A large-scale stock buyback program has further bolstered market confidence. In the second quarter of 2025, NVIDIA authorized an additional $50 billion repurchase plan, bringing its cumulative buyback total to over one trillion dollars. These repurchases directly reduce the number of outstanding shares, boosting earnings per share and return on equity, thereby signaling the company's firm belief in its intrinsic value.

Against this backdrop, momentum investors have joined the rally, creating a positive feedback loop: better-than-expected earnings drive share price gains, prompting analysts to raise price targets, which in turn fuels further appreciation—helping to sustain its elevated valuation.

With demand for AI chips continuing to surge, NVIDIA's future growth prospects remain substantial. As Jensen Huang pointed out, the transition from CPUs to GPU-driven generative AI computing "has only just begun."

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates