Gold Breaks Through the $4,000 Barrier: Signaling a Shift in the Global Monetary Credit System

22:52 October 8, 2025 EDT

Key Points:

Gold has achieved a cumulative gain of 148% over the past three years, significantly outperforming major global equity and bond indices during the same period.

From U.S. government shutdown risks to escalating global geopolitical tensions and the Federal Reserve’s policy shift, each factor has eroded the appeal of risk assets while reinforcing gold’s role as a store of value.

Regardless of market fluctuations, gold’s independence and stability as a cross-cycle and cross-system store of value remain one of the most universally recognized convictions among global investors.

On October 8, 2025, London spot gold prices broke above the psychological threshold of $4,000 per ounce for the first time, setting a new all-time high and briefly reaching $4,059.25 per ounce intraday. As of this writing, spot gold trades at $4,014 per ounce. In just over six months, gold has surged from $3,000 to $4,000, marking a gain of more than 50% year-to-date and making it one of the best-performing major assets of 2025.

Notably, from $1,614 per ounce in 2022 to $4,000 per ounce in 2025, gold has posted a cumulative gain of 148% over three years—an extraordinary rally rarely seen in the history of gold trading.

Source: TradingView

Catalysts Behind the Breakthrough

The surge in gold prices past the $4,000 threshold reflects a broad market rebalancing of the relationship between risk and safe-haven assets amid a series of global shocks. From the U.S. government shutdown to escalating geopolitical tensions and the Federal Reserve’s policy pivot, each development has eroded the appeal of risk assets while reinforcing gold’s role as a store of value.

The immediate catalyst for the breakout was the sharp rise in U.S. political and fiscal uncertainty. At the end of September 2025, the U.S. Congress failed to reach an agreement on budget appropriations, triggering a partial federal government shutdown on October 1. This standoff raised doubts about Washington’s fiscal governance and deprived investors of key economic indicators needed to assess growth prospects. With key agencies such as the Labor Department and the Commerce Department ceasing operations, major releases—including nonfarm payrolls and CPI data—were delayed, leaving markets in an “information vacuum.”

Panic quickly spread across financial markets. The U.S. sovereign credit default swap (CDS) spread surged 18 basis points in just three days to 65 basis points, its highest level since the 2008 financial crisis. At the same time, the steepening of the short end of the yield curve reflected investors’ reassessment of “technical default” risks. In such an environment, demand for safe-haven assets surged—and gold became the natural refuge.

Beyond U.S. political turmoil, synchronized instability across global regions further amplified safe-haven demand. In Europe, the sudden resignation of France’s prime minister derailed fiscal consolidation plans and revived concerns about sovereign debt risks in the eurozone. In Japan, an increasingly contested Liberal Democratic Party leadership race heightened uncertainty over fiscal and monetary policy, making it difficult for markets to gauge the future path of interest rates and public debt.

Meanwhile, the Russia-Ukraine conflict entered its 33rd month. A renewed attack on Black Sea ports pushed up agricultural and energy prices, reigniting inflation expectations. In the Middle East, tensions remained high: mere weeks after the reopening of the Red Sea shipping route, an oil tanker was again struck by a Houthi missile, reigniting fears of supply chain disruptions. The combination of political and security risks across Europe, Asia, and the Middle East drove global risk aversion to new highs, prompting a revaluation of gold’s traditional role in portfolios.

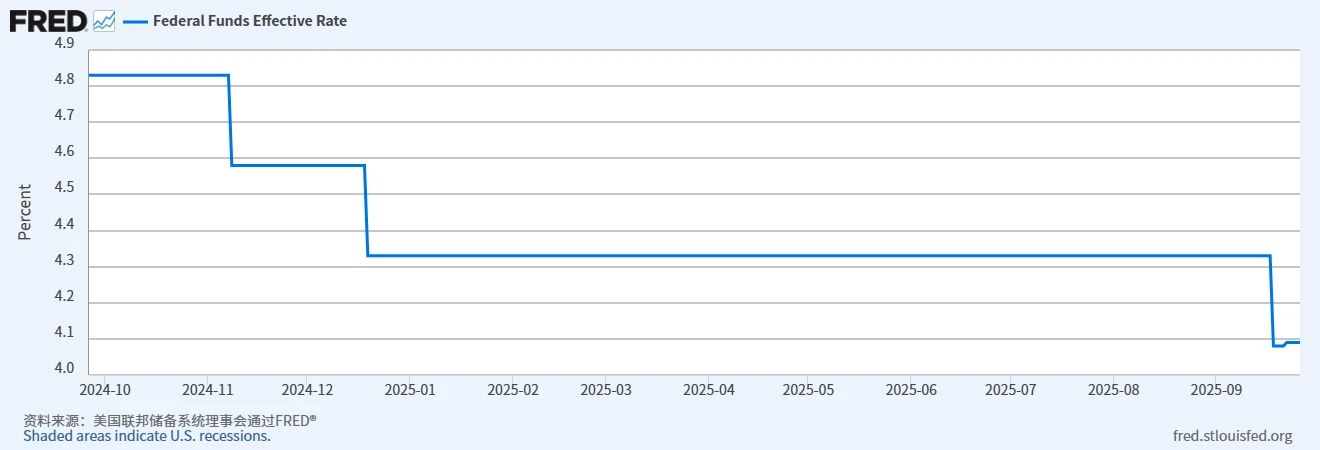

Against this backdrop of geopolitical uncertainty, the Federal Reserve’s policy shift provided a key catalyst for gold’s sustained rally. In September 2025, the Federal Open Market Committee (FOMC) voted 11–1 to cut the federal funds rate by 25 basis points to a range of 4.00%–4.25%, marking its first rate reduction of the year. While some officials argued for a larger move, meeting minutes indicated that “downside risks to the labor market are rising” and “upward inflation pressures are easing,” suggesting that further policy easing remains possible.

Source: FRED

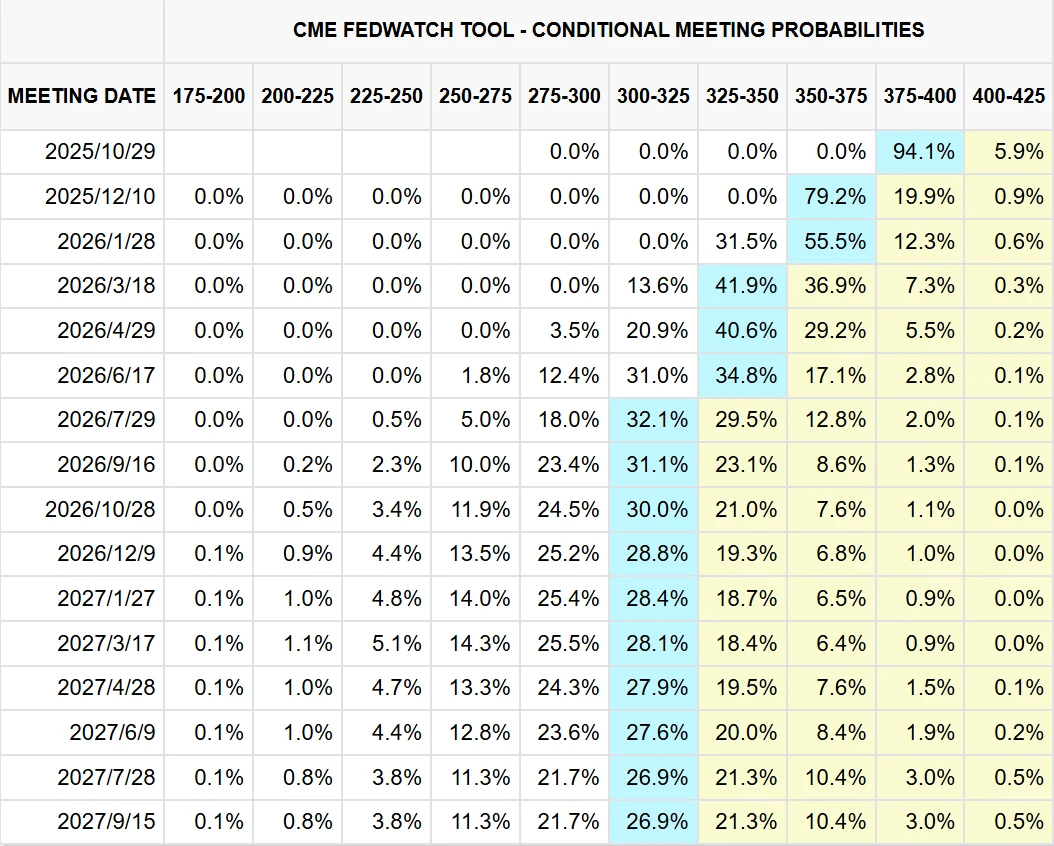

Following the decision, U.S. real interest rates fell rapidly to 1.2%, reducing the opportunity cost of holding non-yielding assets. Market pricing implied two additional 25-basis-point rate cuts in October and December, expectations that directly supported higher gold valuations.

Source: CME Group

Meanwhile, the U.S. dollar index declined to 96.2, more than 7% below its yearly peak. Given the inverse correlation between the dollar and gold, dollar weakness provided another strong tailwind for bullion.

Source: TradingView

Finally, liquidity dynamics delivered the “final push” behind gold’s breakout. Since mid-2024, gold ETF inflows have rebounded significantly as institutional investors shifted from a cautious to an active allocation stance. By October 2025, global gold ETFs had recorded cumulative inflows of more than 16 million ounces—equivalent to roughly 322 tons and about $30 billion in new investment during the first half of the year alone. This marked the strongest start since 2020, underscoring a structural return of capital into gold.

Although total holdings remain below pandemic-era peaks, the continued trend of net inflows suggests that the renewed demand for gold is not a temporary reaction but a strategic response to a long-term reassessment of global risk.

The Foundation of the Bull Market

If short-term turmoil served as the catalyst for gold’s surge past $4,000, the true foundation of this three-year bull market lies in the profound transformation of the global monetary system, reserve structures, and economic governance framework. The sustained rally in gold prices reflects a broad revaluation by global capital of the existing financial order—and an ongoing shift in asset allocation strategies.

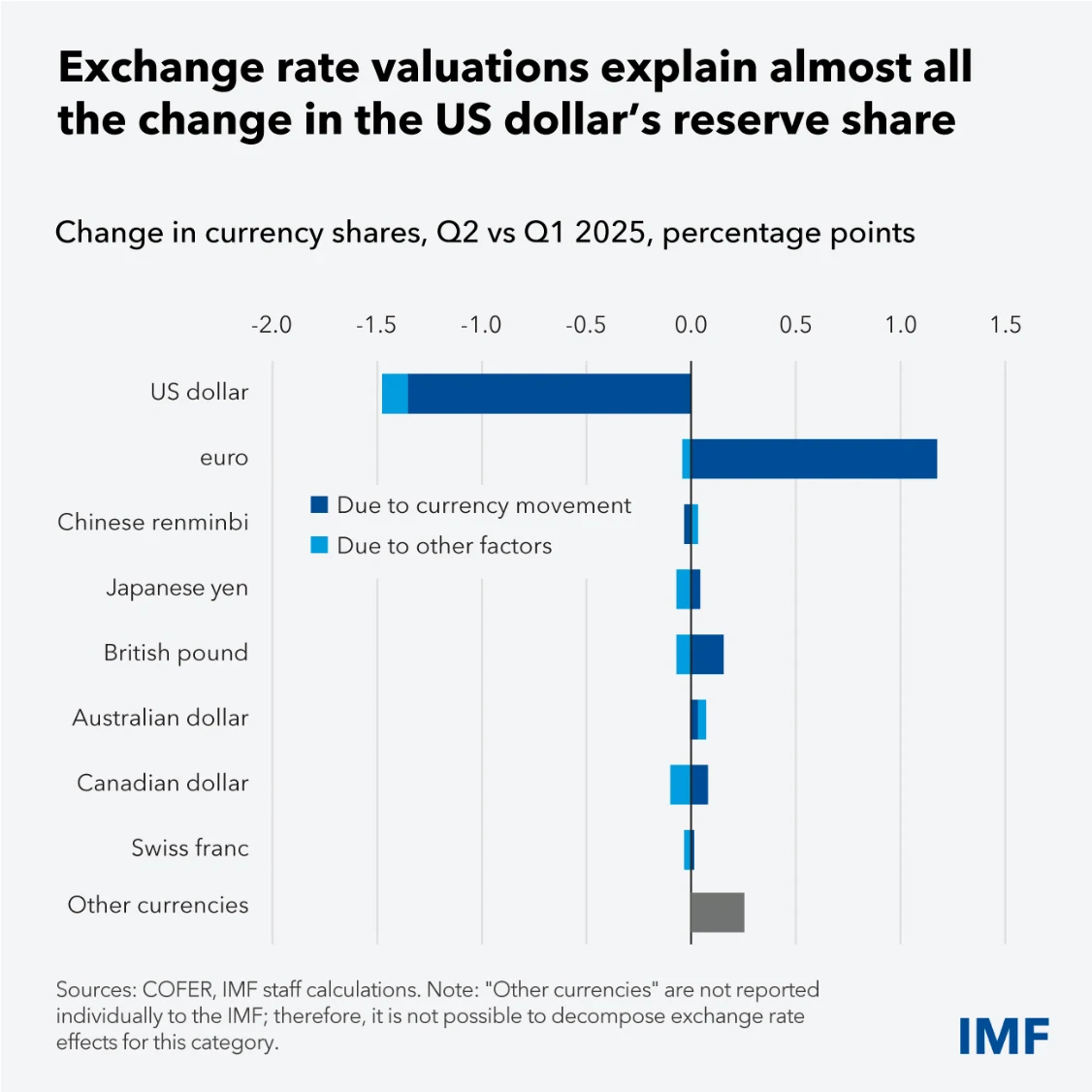

The accelerating wave of de-dollarization has become the central backdrop behind gold’s rising prominence. Since the freezing of Russia’s foreign reserves in 2022, many countries have grown increasingly wary of the political risks attached to dollar-denominated assets, prompting a concerted effort to diversify their foreign exchange reserves. According to IMF data, the U.S. dollar’s share of global reserves fell to 56.3% in the second quarter of 2025—a 30-year low and down 15 percentage points from 72% in 2000.

Source: IMF

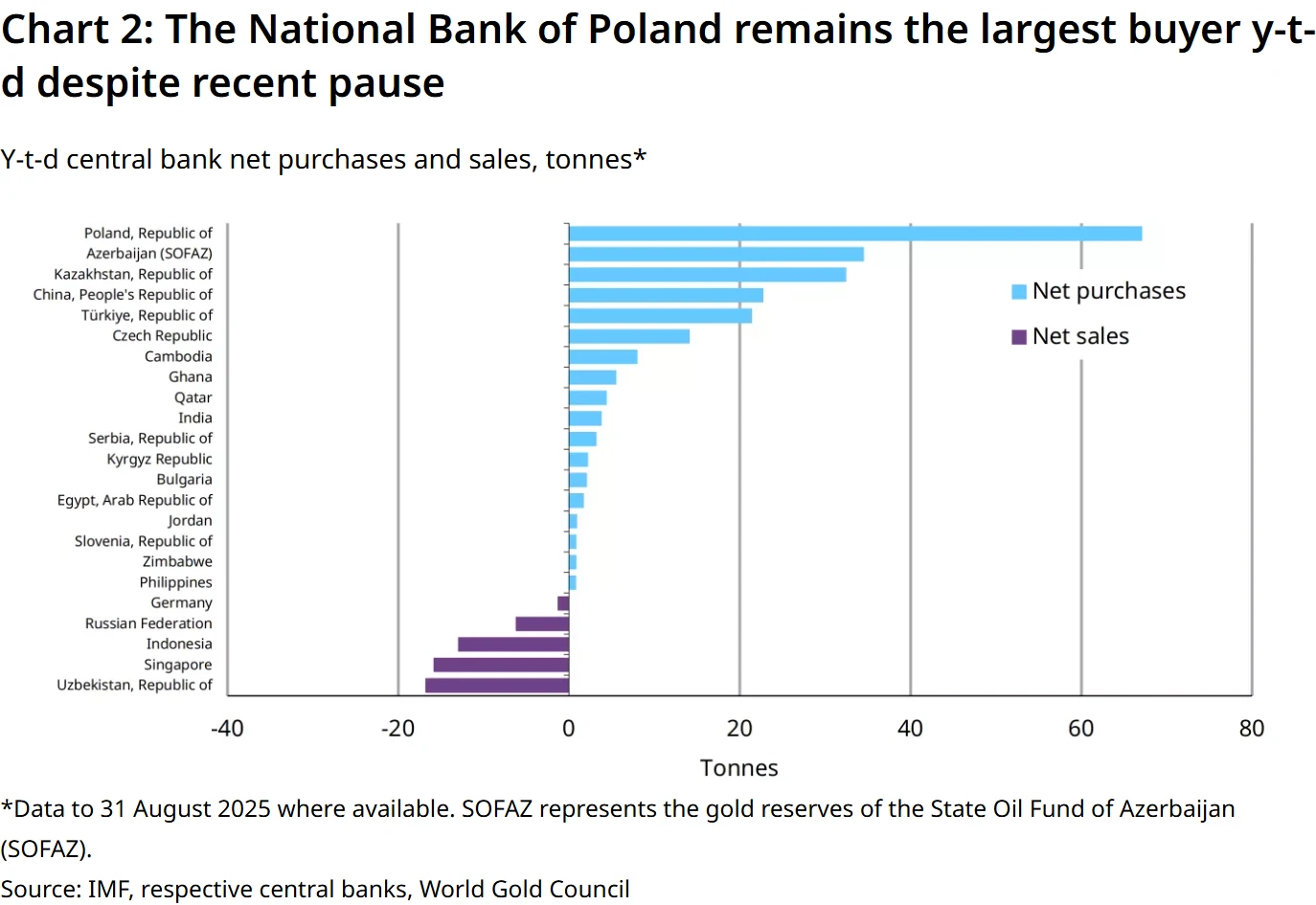

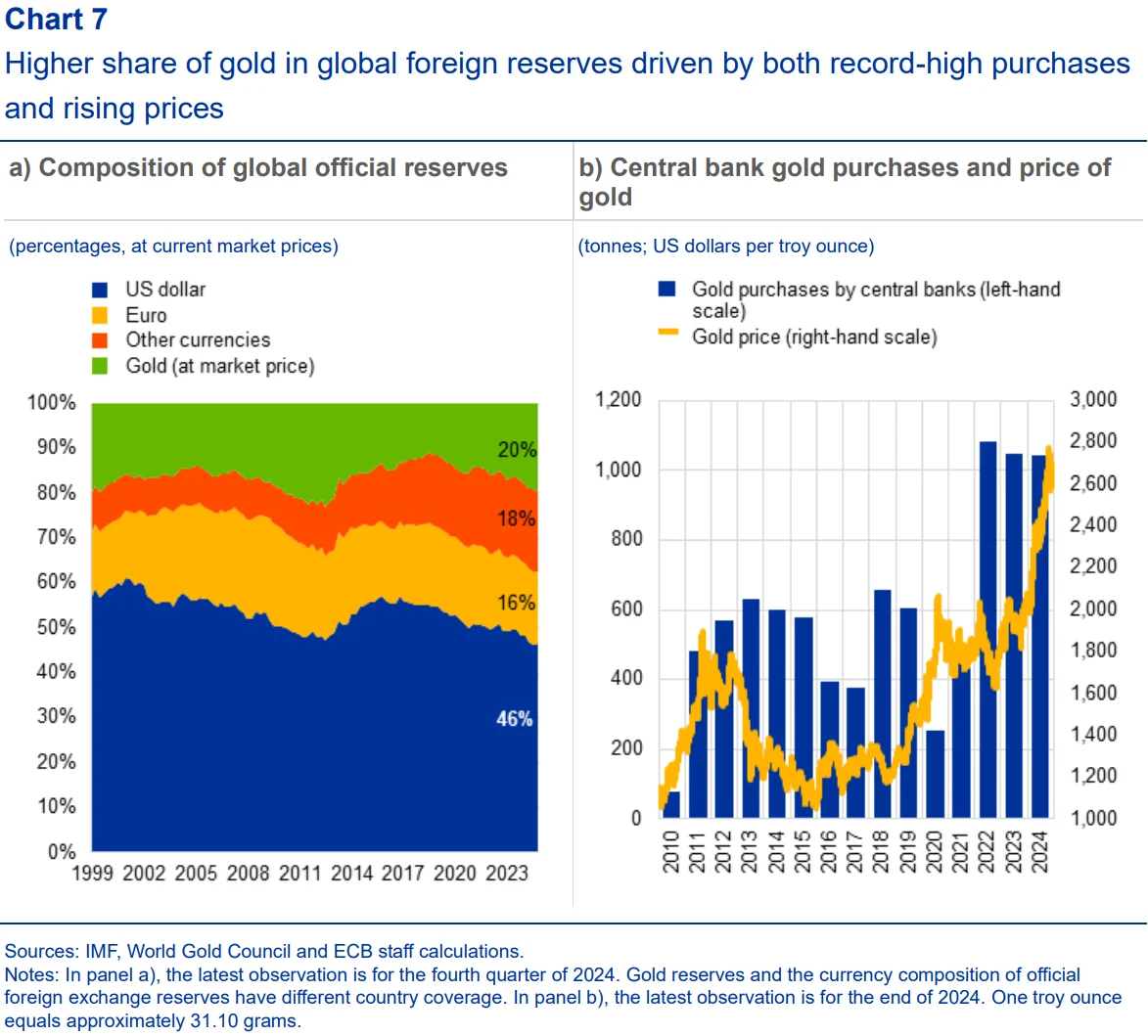

In stark contrast, data from the World Gold Council (WGC) show that gold’s share of official reserve assets has risen to 20%, surpassing the euro’s 16%, making it the world’s second-largest reserve asset after the U.S. dollar. This shift is clearly reflected in central bank purchasing behavior: in the first quarter of 2025, global central banks added 244 tons of gold—well above the five-year quarterly average. By the end of the second quarter, total official gold reserves reached a record 36,300 tons, with emerging markets such as China, Poland, and Turkey accounting for more than half of the net additions.

Source: World Gold Council

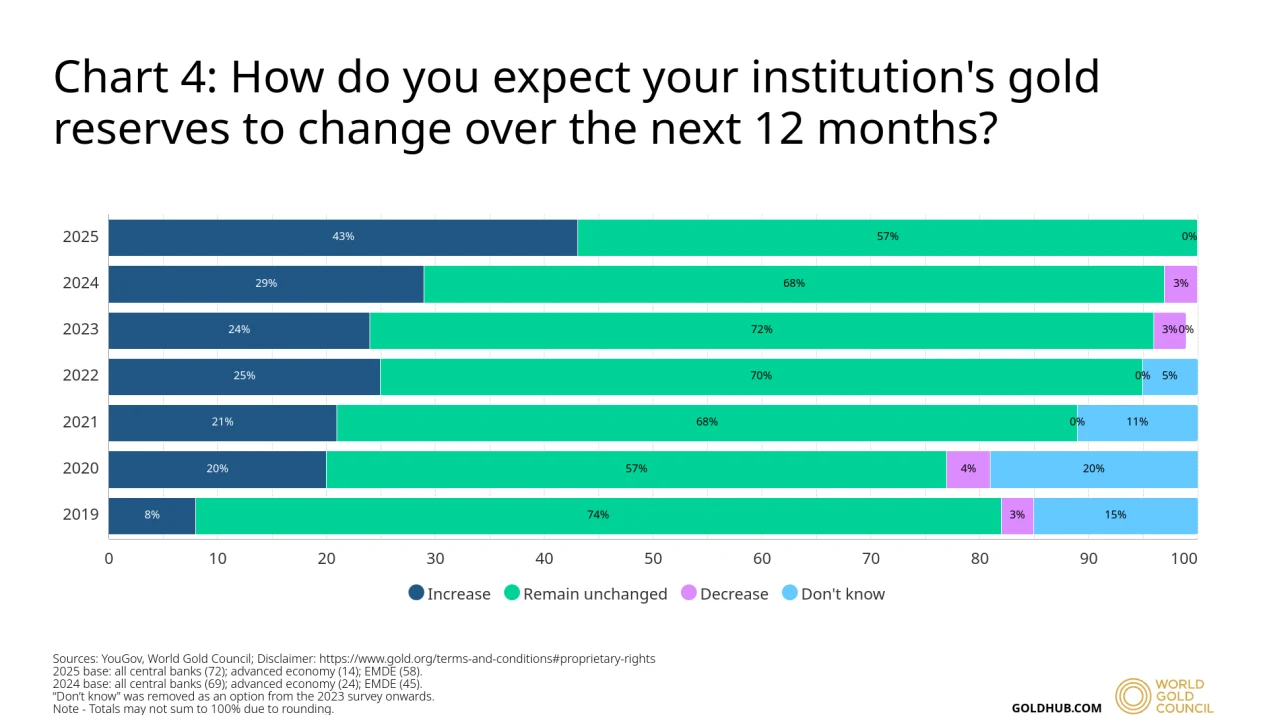

Survey data further confirm that this trend is set to continue. According to the WGC’s latest poll of 73 central banks, 76% plan to increase gold holdings over the next five years, and 43% intend to do so within the next 12 months—up sharply from 46% and 25%, respectively, in 2022.

Source: World Gold Council

Moreover, 45% of central banks plan to reduce their U.S. dollar holdings, while roughly 70% have already begun implementing diversification measures. BRICS economies are taking the most aggressive stance: alongside promoting local-currency settlements in rubles, rupees, and renminbi, they are accelerating efforts to build a cross-border payment network independent of SWIFT and exploring the use of gold as a settlement and reserve foundation. Reports suggest that the People’s Bank of China may assume a custodial role for foreign gold reserves—an initiative widely viewed as a key step in deepening BRICS monetary cooperation. This underscores gold’s unique status as a “stateless asset” and its growing importance in the reconstruction of the global reserve system.

At a deeper level, the imbalance in global economic governance and the erosion of major currencies’ credibility have strengthened gold’s intrinsic value. Public debt levels in advanced economies continue to climb—the U.S. federal debt is now approaching $39 trillion, exceeding 120% of GDP. Although global inflation has moderated from its post-pandemic highs, it still stood at 6.8% in 2024, well above the long-term pre-pandemic average. Structural cost pressures from energy transition and geopolitical tensions have made inflation increasingly sticky.

Faced with high debt burdens, central banks have been forced to maintain accommodative policies, heightening the long-term risk of currency debasement. In real purchasing power terms, gold’s 1980 peak of $850 per ounce is equivalent to roughly $3,500 per ounce today. Thus, the October 2025 price breakout above $4,000 means gold has now surpassed its inflation-adjusted peak from the last great stagflation era—signaling that market fears of fiat currency devaluation are deeply embedded in prices.

More importantly, gold’s investment dynamics have undergone a structural shift. Whereas its value once depended primarily on central bank reserves, jewelry demand, and industrial use, investment demand has now become the dominant driver. Beyond sustained ETF inflows, long-term institutional investors—including sovereign wealth funds and pension funds—are increasingly incorporating gold into their core portfolios to hedge against de-dollarization and geopolitical financial fragmentation.

Ole Hansen, Head of Commodity Strategy at Saxo Bank, noted that the rally in gold “reflects a fundamental shift in investor psychology and capital flows—sanctions, asset freezes, and rising debt burdens are forcing institutional investors to move part of their wealth outside the traditional financial system into tangible assets.”

Long-term trend

Gold’s breakout above the $4,000 mark represents more than just a market milestone—it is a collective vote of confidence (or skepticism) by global capital toward the existing financial order, and a defining moment in gold’s evolving role within the modern monetary system. From being the “dollar’s anchor” under the Bretton Woods framework, to serving as a “safe-haven asset” after the Jamaica system, and now emerging as the “core instrument of reserve diversification,” gold’s value logic has continued to evolve and deepen over the past half-century of financial transformation.

This bull market is not a revival of the gold standard, but rather a structural correction to the flaws of the current monetary system. Against the backdrop of a “weaponized” dollar, soaring sovereign debt, and persistent inflation, gold’s non-sovereign nature, scarcity, and inflation-hedging properties have reestablished it as a key “store of value” amid systemic risk. As noted in the European Central Bank’s latest report, the rising share of gold in global reserves reflects not only central bank purchases and price appreciation, but also a broader shift—“a reflection of the global financial system’s gradual reorientation toward diversification and de-dollarization.”

Source: European Central Bank

For global markets, gold’s resurgence presents both challenges and opportunities. The long-standing dollar-centric pricing and reserve structure is being tested, potentially introducing phases of volatility in capital flows. Yet this evolution also opens the door to a more resilient, multipolar financial architecture—one that reduces systemic vulnerabilities inherent in a single-currency framework. The $4,000 milestone is not the end of a cycle, but the beginning of gold’s redefinition within the global financial order.

Looking ahead, as de-dollarization deepens, geopolitical power structures shift, and the framework of global economic governance continues to evolve, gold’s price volatility may intensify. Nevertheless, its enduring role as a cross-cycle, cross-system store of value—anchored by independence and stability—will remain one of the strongest and most universal convictions among global investors.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates