This Undervalued AI Giant Deserves Attention

05:02 September 30, 2025 EDT

Although high-profile companies in the artificial intelligence sector attract significant attention, some established tech giants with mature business models may still be undervalued.

Alphabet, the parent company of Google, operates core businesses including search, advertising, cloud computing, and other innovative ventures. As a leading global technology enterprise, Alphabet demonstrates a dual advantage in its core operations and AI deployment, leveraging AI to enhance efficiency in existing businesses while capturing emerging demand through cloud services and infrastructure expansion.

As of the time of writing, Alphabet’s market capitalization stands at approximately $3 trillion, ranking it among the largest companies worldwide. Considering its leading position in artificial intelligence, solid financial performance, and market opportunities, this stock is positioned to deliver significant value appreciation over the next five years.

Financial Performance

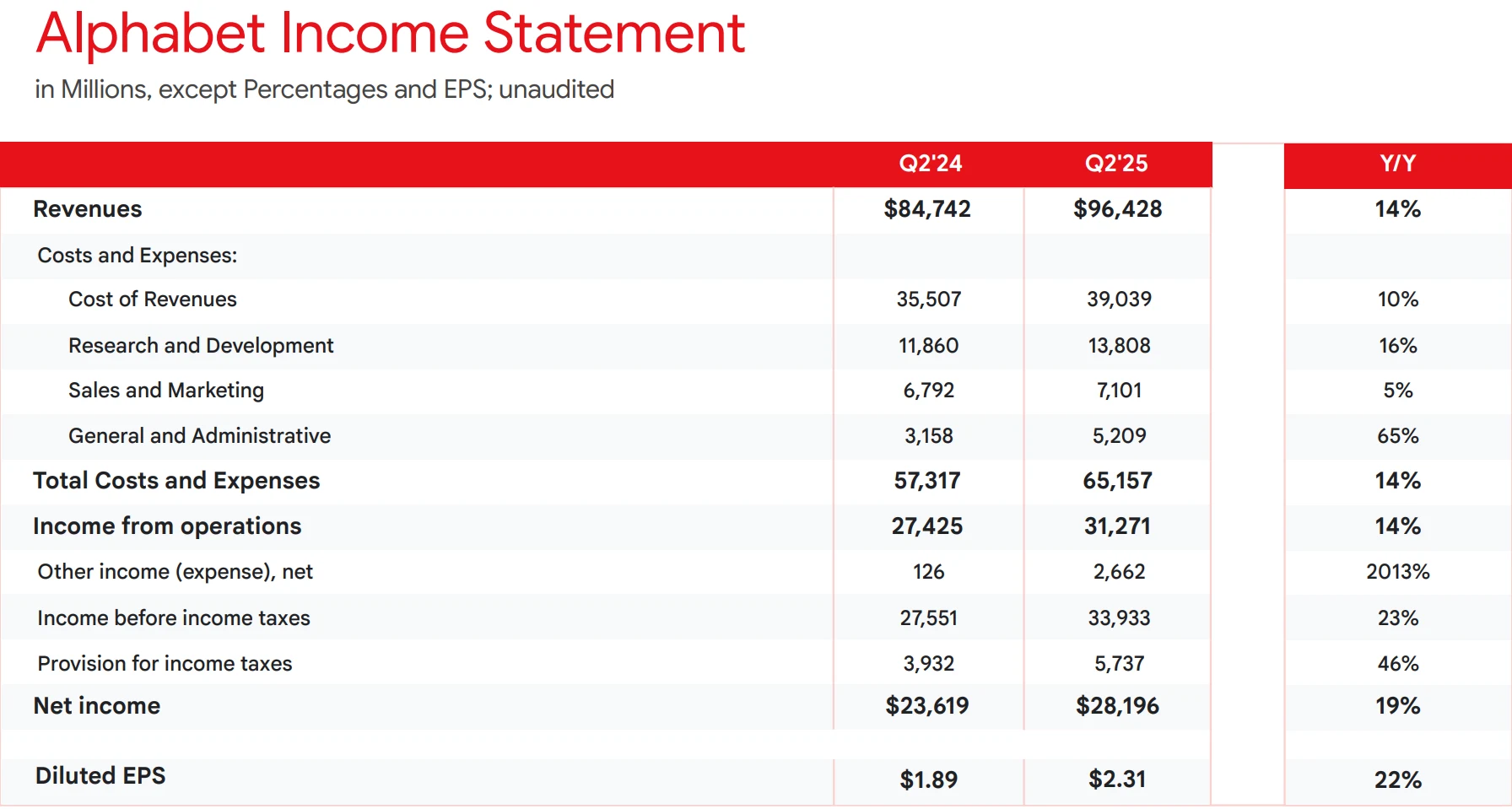

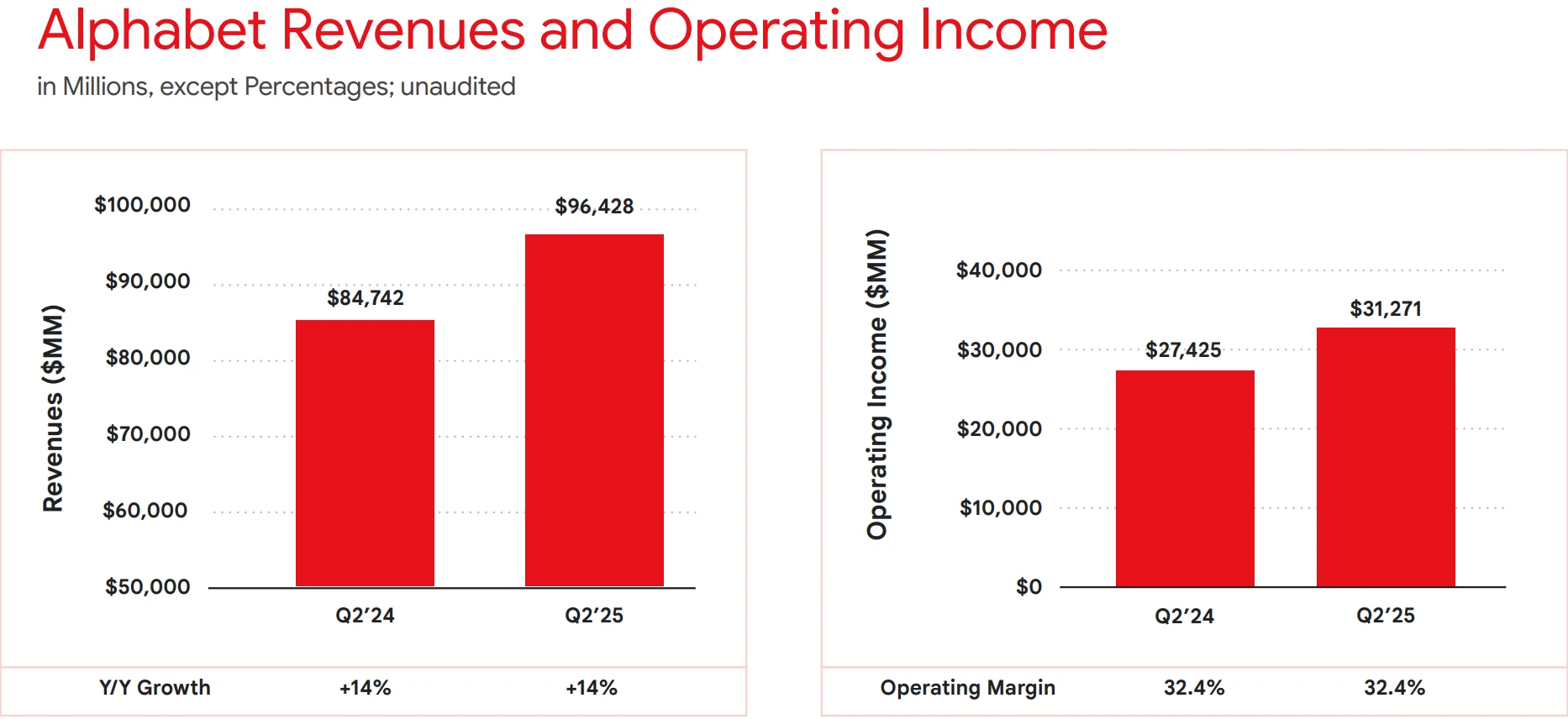

Alphabet’s revenue primarily comes from Google Services, including Search, YouTube, and Android, as well as from Google Cloud and other strategic investments. In the second quarter of 2025, the company reported total revenue of $96.4 billion, up 14% year-over-year, or 13% on a constant-currency basis.

Source: Alphabet

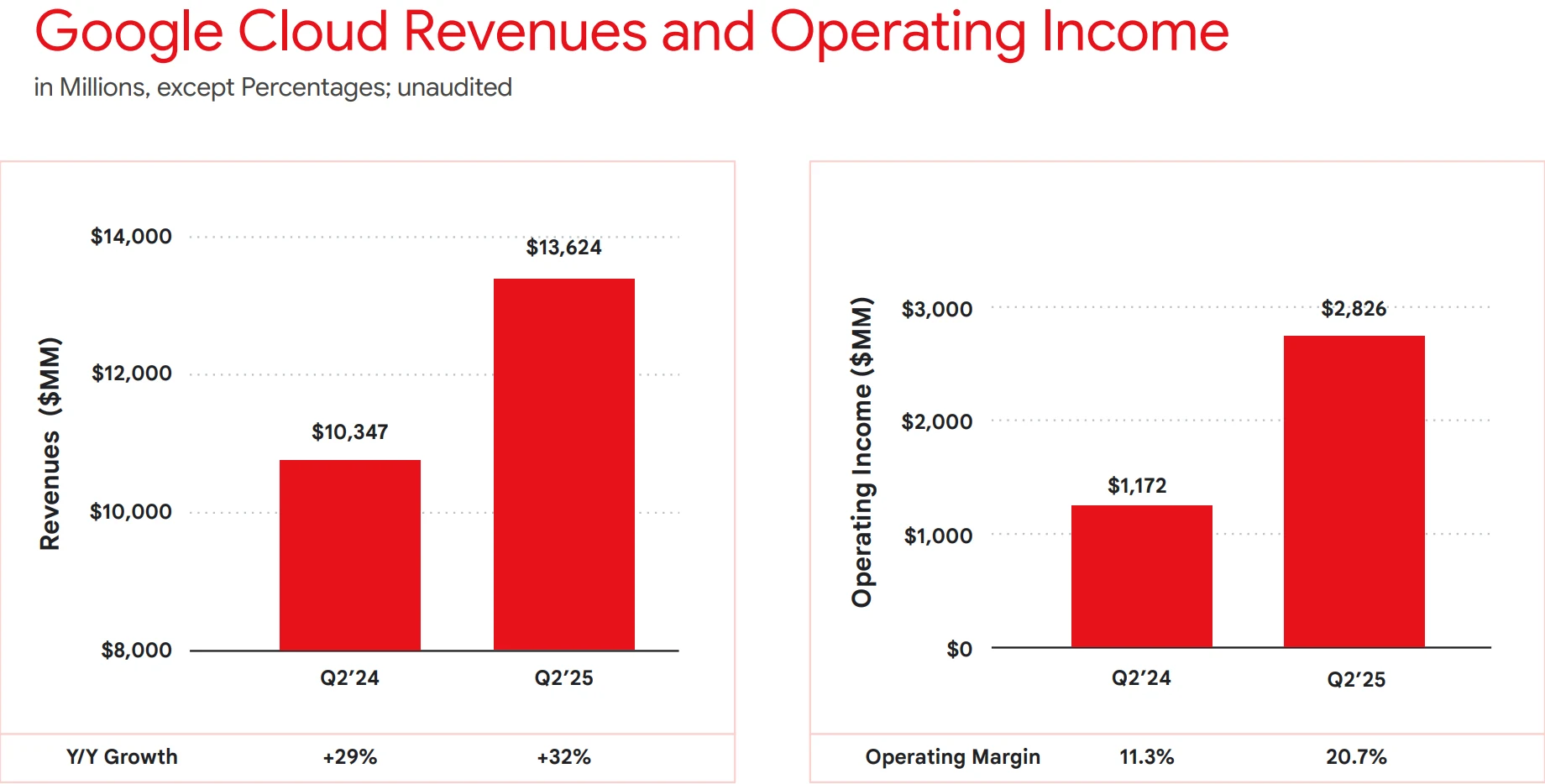

Google advertising remains the primary revenue driver, accounting for more than 60% of total income, while Google Cloud contributed approximately $13.6 billion, up 32% year-over-year, supported by core product expansion and sustained demand for AI infrastructure. For the first half of 2025, total revenue reached $186.7 billion, a 13% increase compared with the same period in 2024, reflecting stable revenue growth momentum.

Source: Alphabet

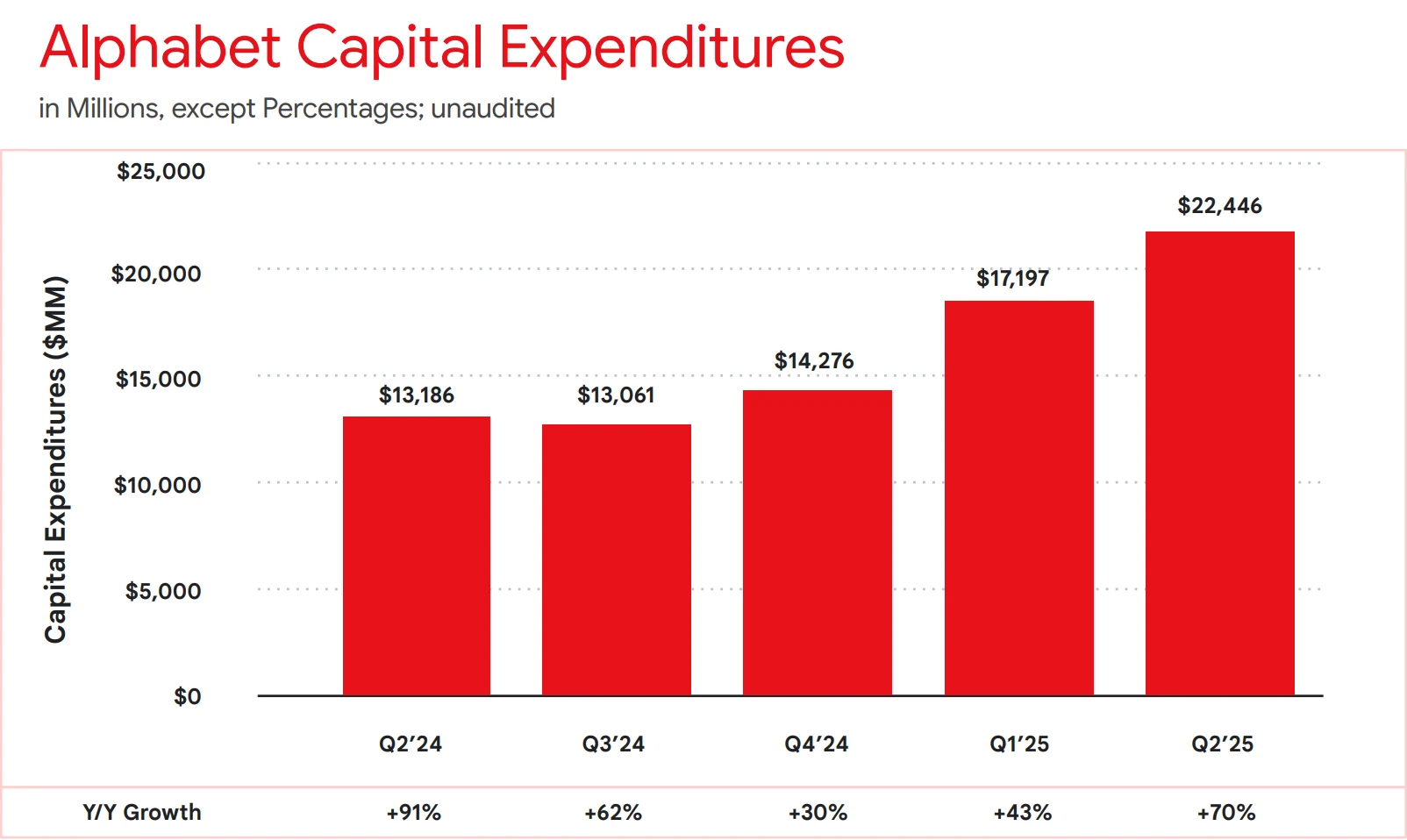

On the profitability side, although operating income is not disclosed in every quarterly report, historical trends show that advertising maintains high margins, while cloud profitability is steadily improving, indicating early returns on AI and cloud infrastructure investments. Capital expenditures remain elevated, with full-year 2025 expected to reach around $85 billion, primarily supporting AI-related data centers and infrastructure, laying the foundation for future growth.

Source: Alphabet

As of September 29, 2025, Alphabet shares (GOOGL) closed at approximately $244, with trailing twelve-month earnings per share of $9.39. Analysts forecast 2025 EPS of $8.89, rising to $10.23 in 2026, corresponding to a growth rate of about 15.1%. Based on these figures, the current P/E ratio is 26.02x, with a forward P/E of 23.42x, indicating a relatively reasonable valuation while reflecting market recognition of its AI growth potential.

In terms of stock performance, Alphabet has risen roughly 30% in 2025, benefiting from advancements in AI technology and favorable antitrust rulings. However, compared with some peers in the “Magnificent Seven”—Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla—its stock gains have been slightly lagging. This suggests that, despite solid fundamentals and long-term growth potential, short-term market sentiment and industry competition continue to influence share price performance.

Source: TradingView

Overall, Alphabet’s revenue structure, profitability, capital investments, and market valuation form an interlinked logic chain: advertising provides cash flow and high-margin support, cloud and AI infrastructure investments drive future growth, and stable financial performance offers investors a relatively predictable return profile.

Integration of AI into Core Business

Alphabet has deeply integrated artificial intelligence into its core operations to enhance efficiency and create new revenue streams. In search and advertising, the company leverages the Gemini large language model to optimize query results and ad delivery. This integration improves ad targeting while enhancing user experience, supporting sustained growth in advertising revenue. For instance, Gemini provides advertisers with advanced data analytics, boosting the efficiency and effectiveness of their campaigns.

In cloud operations, Google Cloud offers a range of AI products, with Vertex AI serving as a managed platform for developing and deploying complex models. Google Cloud’s AI infrastructure was a key driver behind its 32% revenue growth in the second quarter of 2025. Recently, Google Cloud signed a six-year, $10 billion cloud services agreement with Meta, highlighting its critical role in supporting large-scale AI workloads.

Source: Alphabet

Alphabet’s AI strategy extends across a broad ecosystem, leveraging subsidiaries and investments to advance technology adoption. Subsidiaries such as DeepMind, Waymo, and Nest focus on cutting-edge innovation, while Alphabet has invested in 38 AI-related companies spanning autonomous driving, smart home technologies, and other emerging applications.

These initiatives align closely with broader industry trends. Second-quarter 2025 results demonstrate that Alphabet maintains a competitive edge by embedding AI functionality into core products and monetizing new capabilities. Analyst reports suggest that technological progress in multimodal search and cloud AI could position Alphabet ahead of peers and potentially enable it to become the world’s most valuable company. AI is driving short-term financial growth while laying the foundation for long-term market leadership.

Competitive Advantages in the Industry

The global artificial intelligence market provides a strong growth tailwind for Alphabet. In 2025, the market size is estimated between $244 billion and $371 billion. Forecasts indicate that by 2030, it could expand to $827 billion, representing a compound annual growth rate of approximately 29.2%, and reach $2.4 trillion by 2032. More aggressive projections suggest a 25-fold increase from $189 billion in 2023, reaching $4.8 trillion by 2033. This growth is primarily driven by AI adoption in sectors such as healthcare, finance, and manufacturing, where AI workloads place high demands on cloud infrastructure.

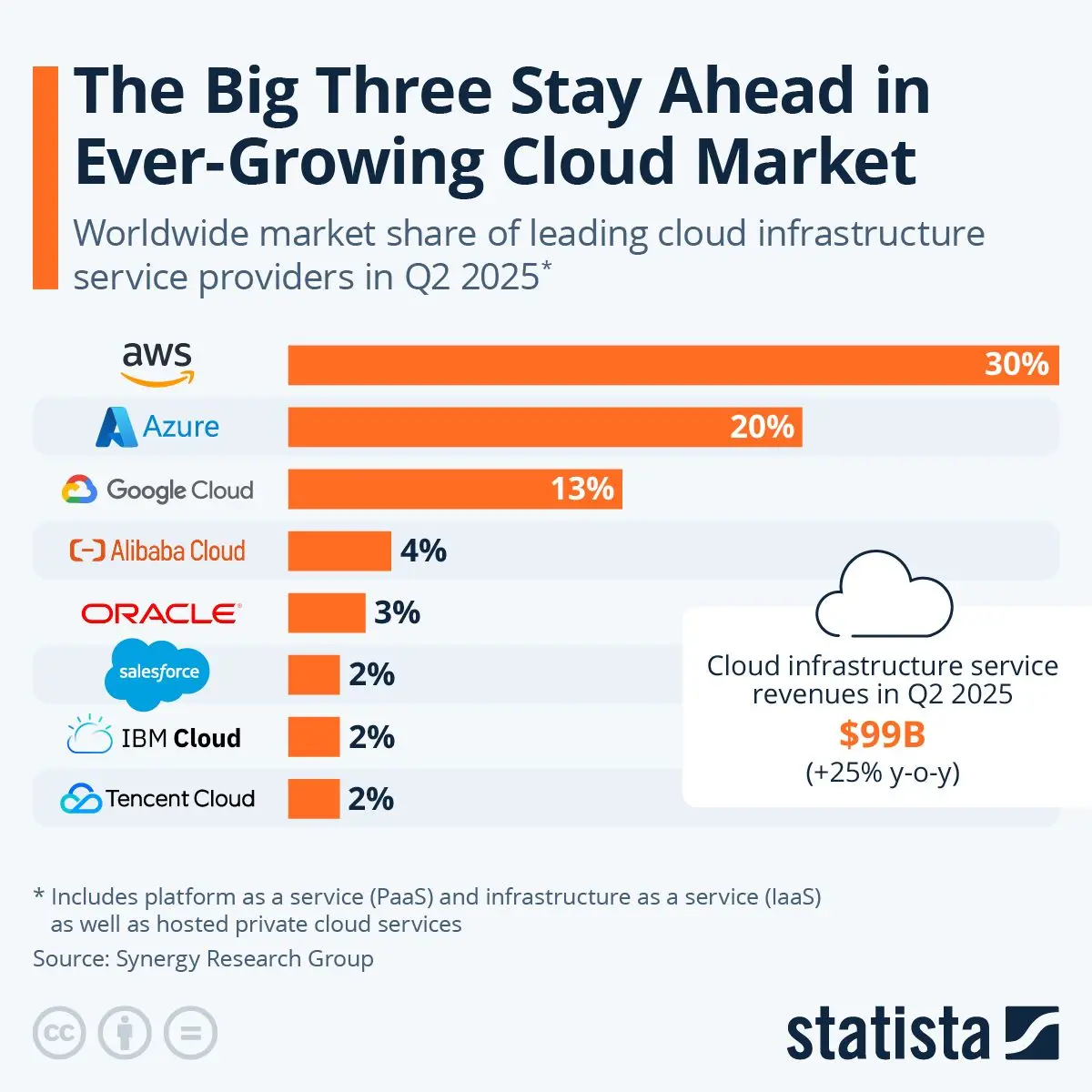

In the cloud computing market, Google Cloud held a 12% to 13% share in the second quarter of 2025, trailing Amazon Web Services (AWS) at 29% to 30% and Microsoft Azure at 20% to 22%. Nevertheless, Google Cloud has gained roughly 6.4 percentage points in market share since Q1 2022, reaching 25.5% on certain metrics, thanks to AI-driven products and services. The overall public cloud market is estimated at $943 billion to $980 billion in 2025 and is projected to grow to $2 trillion to $2.2 trillion by 2030.

Source: Statista

With its existing customer base and continuously expanding infrastructure, Alphabet is well-positioned to capture the accelerating demand for AI and strengthen its competitiveness in the global cloud market, laying a solid foundation for future revenue growth and long-term value creation.

Valuation Reasonableness

Financial analysis and valuation comparisons indicate that Alphabet’s current valuation is reasonable relative to its peers. As of 2025, the company’s trailing P/E stands at 26.02x, with a forward P/E of 23.42x, below the levels of most of the “Magnificent Seven” tech giants. For example, by mid-2025, Alphabet showed relative discounts across key metrics such as P/E, P/S, and price-to-free-cash-flow ratios. In June 2025, the stock traded at approximately 18x expected 2025 earnings, offering a valuation advantage compared with higher-multiple peers like Microsoft.

Historically, Alphabet’s stock has gained more than 140% over the past three years, though its 2025 performance is broadly in line with the S&P 500. Within the “Magnificent Seven,” earnings growth is expected to slow in 2025 relative to 2024, while broader market expansion could accelerate. Alphabet’s P/S ratio of 8.20x reflects the company’s solid revenue-generating capability.

Source: TradingView

Regarding the notion of a tenfold increase—from the current market capitalization of roughly $3 trillion to $30 trillion by 2030—this scenario is highly improbable given global economic constraints and historical precedent, as no company has ever reached such a scale. A more realistic growth trajectory would involve a doubling or tripling of market value to $6 trillion–$9 trillion, supported by the expanding artificial intelligence market.

For instance, if Alphabet captures additional market share in cloud services and maintains roughly 15% annual EPS growth while its valuation multiple expands to 30x, a 2-3x increase in stock price is achievable. Analyst consensus suggests that with AI applications increasingly driving business value, Alphabet is well-positioned to strengthen its standing among global tech companies and potentially become the largest company by market capitalization.

Future Outlook

However, despite the strong growth prospects, several risks could constrain Alphabet’s stock performance and profitability. In terms of market competition, AWS and Azure continue to hold larger shares in the cloud computing and AI sectors, with Google Cloud accounting for only 12%–13% of the market, compared with AWS at 29%–30% and Azure at 20%–22%. This indicates that Alphabet’s expansion still faces intense competitive pressure.

Regulatory risks are also present. Global antitrust investigations, data privacy regulations, and potential policy interventions could impact both advertising and cloud businesses. Although recent rulings have been favorable, future regulatory uncertainty remains a key concern. Macro-economic shifts could also exert pressure, as a potential economic downturn may reduce advertising spend. Advertising revenue, expected to account for approximately 65%–70% of total revenue in 2025, would have a significant impact on profitability.

Additionally, Alphabet anticipates capital expenditures of up to $85 billion in 2025, primarily directed toward AI infrastructure. Should the returns on these projects lag, short-term profit margins could be affected. Its international operations also face challenges, as global market uncertainties—including tensions between the U.S. and China and evolving data privacy requirements—may impact overseas operations and revenue growth.

Overall, however, Alphabet’s technological capabilities, strong cash flow, and ecosystem synergies provide a relatively high degree of confidence that the company could achieve 3- to 5-fold market capitalization growth over the next five years. The current valuation reflects a somewhat cautious outlook for its advertising business, while the growth potential driven by AI-powered cloud services and hardware is not yet fully priced in.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates