MAGY's covered call strategy and a viable income portfolio

08:15 October 3, 2025 EDT

Roundhill Investments, an investment firm that launched a series of niche income funds, such as zero-day maturity ETFs, is now a familiar name to most ETF investors. Of particular interest to investors is the Roundhill Magnificent Seven ETF; not the fund itself, which is more of a price-capture ETF; but another particularly interesting fund, the Roundhill Magnificent Seven Covered Call ETF, holds MAGS shares and utilizes a covered call option strategy to generate weekly returns for investors.

The topic we are discussing today is related to this.

MAGY Basics

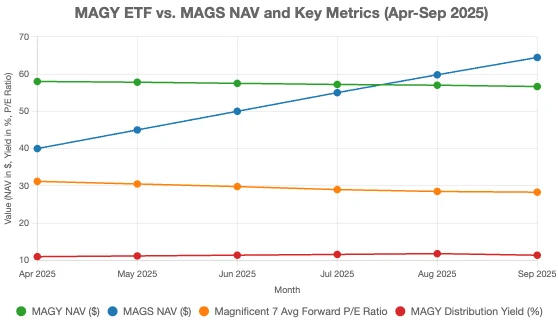

Let me first briefly cover the basics. This ETF is quite new, having been established on April 22, 2025. Its underlying asset, MAGS, predates MAGY by more than two years, giving fund managers a wealth of historical data to draw upon. That said, keep in mind that MAGY only displays approximately five months of performance data. Ironically, this should provide a better understanding of the market, as it eliminates much of the noise that contributed to the April market trough.

Why is this important? Primarily, the strong rebound in the Big Seven's share prices since the Liberation Day tariff scare triggered a stock market plunge provides us with valuable data on the resilience of these companies' undeniably high valuations. Here's a simple example.

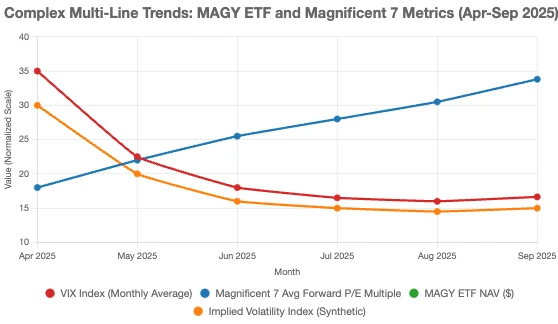

An important ancillary lesson here is that valuation multiples for these companies have expanded by 88%, with even the worst-performing companies enjoying a 24% surge in valuations.

During periods of TTM sales multiple expansion, investors tend to focus on lagging indicators. While the sales index appears to be slowing in the context of the expected price-to-sales multiple evolution over the same period, this can only be attributed to the market pricing in higher, albeit cautious, expectations. This is understandable given the current market dynamism and volatility, which is well below average.

So why are Wall Street's expectations so low? Low volatility may signal a bright future for the stock market, but it's important to remember that volatility tends to fluctuate wildly when it rises and is much more gradual when it falls. Investors are often like a cat on a hot stove. They need time to be confident that the stove has truly cooled. But when it heats up again, they're ready to jump in, causing a sharp spike in volatility.

Back to the specifics of MAGY, because the fund overlays a covered call strategy on its core MAGS assets, it benefits from volatility. More on that later.

Because the fund is still in its early stages, its AUM hasn't yet fully matured to the point where it can be called a stablecoin ETF. With approximately $107 million in assets, it may be relatively small, but it boasts a strong yield of 12.7%.

The ETF's expense ratio is 0.99%, which is reasonable for a fund that pays a weekly dividend and still requires active management. It's important to note that this is only the net expense ratio; the gross expense ratio is 1.28% and is in effect until at least April 30, 2028. There's no need to worry right now, and it's likely that extending the fee waiver and reimbursement beyond April 30, 2028, will reduce the expense ratio to its current level. It all depends on the fund's performance, its popularity (or lack thereof) over time, the competitive landscape in the niche investing space, and a variety of other factors.

On the risk front, we must consider the cap imposed by options strategies, which I'll discuss in detail in the next section. However, in my view, this isn't so much a risk as a trade-off for capturing weekly returns from the price fluctuations of the Big Seven. The real risk lies in the lack of downside protection. However, at these yield levels, most investors would consider this a cost of doing business. Several other options strategies can be used to provide downside protection, but it's important to note that MAGY itself does not offer this protection.

Next, we'll try to understand how this ETF generates its weekly distribution.

Covered Call Option Strategy Explained

Covered call options strategies are becoming increasingly popular among retail investors because they offer a steady income stream. While not necessarily a steady income, or even guaranteed, it does give the average investor the assurance that their investment will yield tangible returns, even if only through historical performance.

While rising prices look good on paper, investors often want to receive actual paper (i.e., cash) that they can spend or reinvest elsewhere. This strategy promises to provide that return.

We talked about AUM growth, so we should look at how the fund has grown over the past five months given its attractive yield.

We can confirm that AUM growth is strong, which is crucial because it reflects the growth and stability of the ETF despite its relatively small size. This growth is driven by the fund's performance in terms of price and yield.

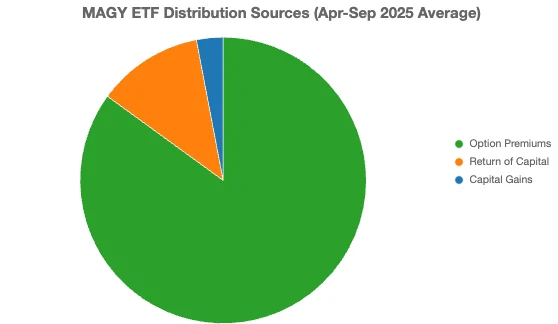

These allocations are generated by selling covered call contracts, which is what we will explore next.

The covered call strategy is a simple but clever way to make money with assets you already own, but it doesn't generate any returns other than paper gains. It involves selling an out-of-the-money (OTM) call option contract (on the underlying asset).

How much out-of-the-money is it? Most funds don't discuss out-of-the-money, as it's often part of a proprietary trading model and can be quite dynamic. What we do know is that these contracts have expiration dates of up to one week. Funds typically hold these contracts until expiration, and they are European-style FLEX options.

Because holding periods are typically one week, the risk of losing excessive upside due to limits (exceeding the strike price of these contracts) is somewhat reduced, which does pose a significant risk during periods of price increases. While volatility favors option sellers, this risk should not be ignored. The gain in the option premium could be completely offset by missing out on upside. Keep in mind that if the Big Seven's stock price surges above the strike price, the underlying MAGS shares will be redeemed in a strong rally, and their value will be lost forever.

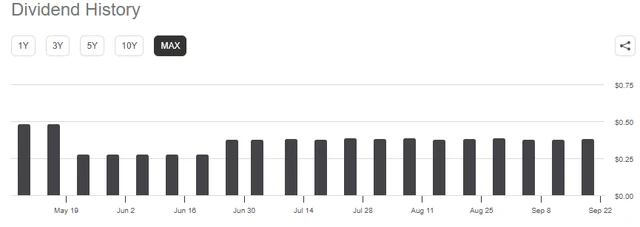

Despite the risks, the one-week-ahead strategy has performed quite well so far, as evidenced by the returns. The weekly payouts indicate that the fund manager is conservative in choosing strike prices, which has resulted in surprisingly stable payouts.

How has MAGY performed since its inception?

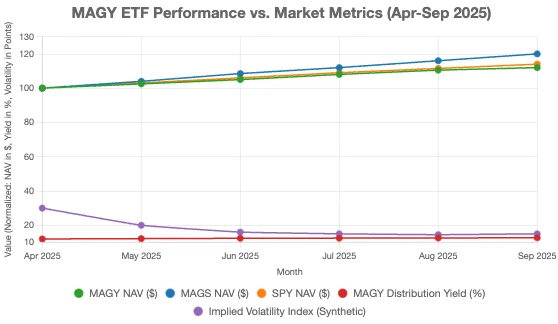

The idea is simple. MAGY holds MAGS shares and writes a layer of call options weekly. Because these contracts are out-of-the-money (OTM), there's some price capture. However, the fund's price returns are also, understandably, lower than those of the underlying assets. This makes sense, as shares will at least sometimes be redeemed, and any new blocks of shares created to replace them will be more expensive because MAGS's underlying stocks have collectively appreciated, limiting net asset value growth.

The purpose of investing in covered calls or long-term buy-sell strategies isn't price capture. Plain and simple. The key is to create an active income stream from a volatile asset. Now, if that income stream isn't achieved at the expense of capital erosion, I believe it's "achieved." As the chart above shows, MAGY's net asset value (as represented by the market price) hasn't shrunk in the five months since its launch. In fact, it has already captured some upside, indicating that these contracts are sufficiently out-of-the-money.

Some analysts also equate the performance of such funds with total returns and compare them to the underlying asset or benchmark. I also don't believe this is the right approach, and my reasoning is equally simple: investors don't expect to earn alpha this way; rather, they want the regular cash flows that the options strategy promises. We'll examine MAGY's total returns in this context.

Unsurprisingly, these funds have achieved double-digit returns, as that's how they're designed. When run well, they don't lose net asset value and instead generate ample funds for distributions from the premiums they collect. They do lose shares of the underlying assets from time to time, resulting in highly volatile AUM fluctuations as premiums are added to AUM, redemptions are recovered, and distributions are made.

Does this mean there's no risk? Of course not. Every investment carries risk, and covered call ETFs are no exception. These funds can perform quite well in rising or sideways markets, but because there's little downside protection beyond the premium (which is distributed anyway), there are times when these funds fail to maintain their net asset value. Even then, drawdowns are typically not as severe as those in the underlying asset itself.

In the timeline above, from January 1st to the April trough, the entire market experienced a sharp decline. SPY performed surprisingly well, but investors should note how covered call ETFs limited their NAV losses. Furthermore, these losses were organic losses in NAV due to falling asset prices, not necessarily due to the options strategies employed by these funds. While it's relatively easy to show investors how their performance compares to the underlying asset, this isn't the primary purpose of funds like MAGY:

MAGY currently has a projected annualized dividend yield of 34.67%, paid every Monday. This weekly payout frequency means income investors can receive a steady stream of income, like a paycheck, which is highly beneficial for those who rely on portfolio income for their livelihoods. However, this income-focused approach also comes with some significant pros and cons, as well as risks, that investors should be aware of before entering the market. Therefore, let's first determine which types of investors are best suited for funds like MAGY, and which investors should avoid investing in such funds.

Fund Strategy

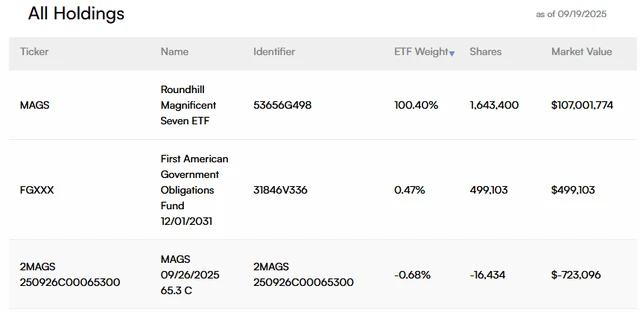

It's important to note that MAGY doesn't actually hold the common stock of the Big Seven companies. Instead, MAGY holds almost exclusively Roundhill's own ETF, the Roundhill Magnificent Seven ETF. Looking at the holdings breakdown below, we see that MAGY only holds MAGS and First American Government Obligations, a fund that simply holds money market securities.

To better understand the fund's internal structure, the prospectus outlines the structure of the options strategy. The fund's primary objective is to provide current returns by selling out-of-the-money (OTM) call options on MAGS, thereby generating weekly current returns. It's important to note that MAGY does not actually sell options on individual companies within the Big Seven.

The main trade-off is that including options means MAGY's upside potential is limited to the chosen strike price. To simplify the process, let's understand how it works. MAGS's current share price is approximately $65 per share, so MAGY can write an out-of-the-money (OTM) call option with a strike price of $70 per share. In exchange, MAGY collects the option premium, but the price increase is limited to the strike price. Therefore, if MAGS rises to $75 per share, MAGY will only realize the upside potential up to the $70 strike price.

The main problem with this option selling strategy is that MAGY's price growth is likely to underperform the Big 7 over an extended period. Since growth is constrained, we can expect this underperformance to persist, and if these companies continue to grow, the earnings gap could widen further.

Another weakness of the fund is that while upside price gains are limited, downside risk is not. Therefore, investors effectively only partially participate in rising markets while still bearing the full weight of falling markets. While higher yields can offset the impact of sideways market movements, the fund's downside protection remains very limited. Because MAGY prioritizes shareholder returns, the fund could even face a situation where it pays out more than its actual premium income, exacerbating downside risks.

A prolonged decline can make it difficult for a fund to recover its share price over time. Although MAGY doesn't use a synthetic structure like some of Roundhill's other funds, it's still susceptible to declines in net asset value due to its high dividend yield. This is one of the most common issues with option ETFs offering large dividend yields. For example, Roundhill offers two different ETFs tracking the S&P 500 and Nasdaq. While these indices have risen over time, these ETFs failed to recover from the market decline earlier this year.

Due to MAGY's short operating history, we cannot yet accurately assess its performance during significant corrections. Such corrections could make it difficult for the stock price to recover and, as the ETF's net asset value declines, could negatively impact dividend payouts. Furthermore, MAGY's focus on seven major technology companies presents potential concentration risk. For example, if AI growth slows or optimism about the sector fades, the tech market could experience a correction.

MAGY Dividend Structure

As of the latest weekly dividend payment of $0.379943 per share, the estimated annual payout ratio is approximately 34.67%. MAGY has maintained a relatively stable dividend over the past few months. This consistency has been more readily achieved given the market's upward trend over the past few months. A shift in market momentum could always lead to a dividend reduction, but management has done a good job of keeping the dividend stable thus far.

One of the fund's most unique aspects is its emphasis on return of capital distributions, which limits the overall tax burden on income received. Return of capital distributions are not considered income and, therefore, are not taxable. Instead, they reduce investors' cost basis and allow for the deferral of tax until the time of sale.

Therefore, it's technically possible to hold on long enough until your cost basis drops to $0 per share. At that point, all distributions received will be classified as long-term capital gains, which is also a tax-efficient option for investors. If you're a buy-and-hold investor, MAGY can be an excellent addition to your income-seeking portfolio.

Who is MAGY best suited for?

In short, MAGY is best suited for investors who prioritize income generation over capital appreciation. While a focus on income may result in lower long-term returns, some investors may accept this trade-off due to various personal circumstances and needs. Tech stocks aren't typically known for offering high dividend yields, so MAGY aims to address this issue for investors.

MAGY is a good fit for investors looking to diversify their income streams beyond the low dividend yields of traditional blue-chip stocks. Even when considering other asset classes like real estate investment trusts (REITs), business development companies (BDCs), or closed-end funds, MAGY's high dividend yield offers superior options. Because of its focus on a few select holdings, MAGY is well-suited for investors who want to maintain exposure to the Mag 7 companies. If you're at a stage in your investing journey where income generation is more important than growth and you're looking for a high dividend yield with tax-efficient income, you can be a believer in it. Many investors may find MAGY unattractive. I think it ultimately depends on your investment goals and whether you need to focus on income generation at this stage in your life. You should focus on whether you prefer total returns over income generation. If you're uncomfortable with the concentrated risk of the Mag 7 companies and want a very low-cost ETF that tracks the market over time, it offers a capped upside potential during a bull market.

Disclaimer: The content of this article does not constitute a recommendation or investment advice for any financial products.

Email Subscription

Subscribe to our email service to receive the latest updates